7 Hedge Fund Risk Mitigation Mistakes Accredited Investors Make (And How to Fix Them)

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 24

- 5 min read

Look, nobody invests in hedge funds expecting to lose money. Yet between 1983 and 2003, half of all hedge fund failures were caused by operational risk alone: not market conditions, not bad bets, but preventable operational issues.

That's a sobering stat for anyone writing seven-figure checks.

As accredited investors, you've already cleared the financial bar. But qualifying financially and navigating hedge fund risks successfully are two very different games. I've seen plenty of sophisticated investors stumble into the same pitfalls, often because conventional wisdom skips the nuances.

Let's break down the seven most common risk mitigation mistakes: and more importantly, how to fix them.

Mistake #1: Focusing Only on Investment Risk (While Ignoring Operational Risk)

Here's the thing: most investors obsess over market risk. Will the strategy perform? What's the drawdown potential? How does it correlate with my other holdings?

These are valid questions. But they're only half the picture.

Operational risk: the stuff happening behind the scenes: accounts for a massive chunk of hedge fund failures. We're talking about internal controls, compliance procedures, trade settlement, and basic administrative functions. The unsexy stuff that doesn't make it into pitch decks.

How to fix it: Before you commit capital, dig into the operational infrastructure. Ask about:

Internal control frameworks and audit procedures

Staff expertise in compliance and risk management

Third-party service providers (administrators, custodians, auditors)

Background checks on fund principals

If a fund manager gets defensive about these questions, consider that a red flag.

Mistake #2: Cutting Corners on Due Diligence

I get it. Due diligence takes time. And when a fund has impressive returns and a compelling narrative, it's tempting to fast-track the process.

Don't.

Many high-profile hedge fund implosions could have been avoided with thorough due diligence. Investors would have uncovered falsified credentials, legal issues with fund managers, or accounting firms that existed only on paper.

How to fix it: Treat due diligence like you're buying a company, not a product. This means:

Verifying credentials independently (don't just trust the marketing materials)

Researching the fund manager's track record across previous positions

Checking for any regulatory actions or legal proceedings

Speaking with existing investors if possible

Reviewing audited financial statements: and actually reading them

Startup and emerging funds deserve extra scrutiny. They may have talented managers but lack the operational infrastructure to handle compliance, reporting, and risk management at scale.

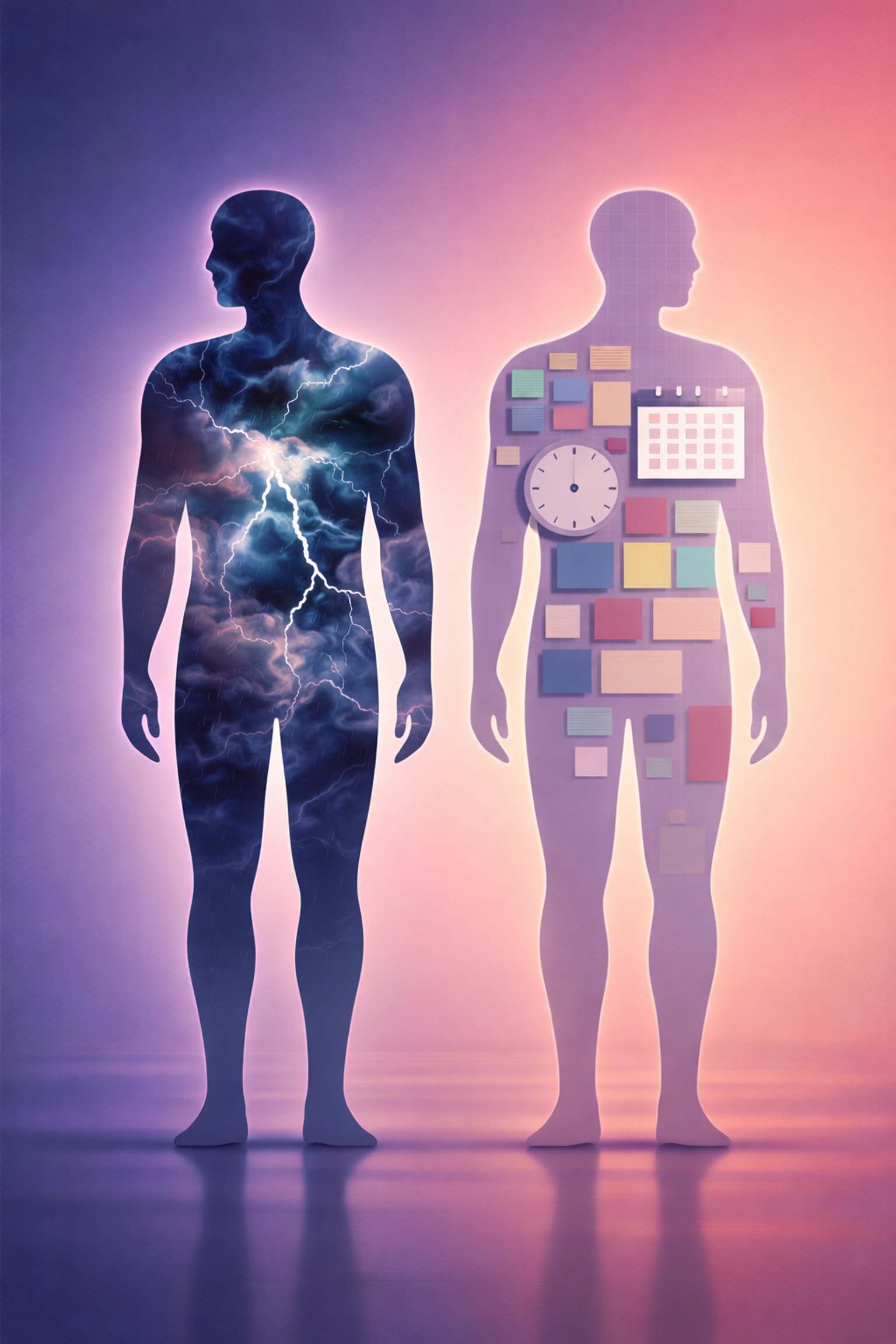

Mistake #3: Misjudging Your Risk Tolerance vs. Risk Capacity

These two concepts sound similar but they're fundamentally different: and confusing them can wreck your financial plans.

Risk tolerance is psychological. It's how much volatility you can stomach without panic-selling at the worst possible moment.

Risk capacity is practical. It's how much risk you can actually afford to take given your financial situation and goals.

I've seen accredited investors with high risk tolerance (they love the action) but low risk capacity (they need that capital for a specific purpose in three years). They invest in an aggressive hedge fund strategy, it hits a rough patch, and suddenly they're liquidating at a loss to meet their original obligation.

How to fix it: Be brutally honest with yourself about both dimensions. Map your hedge fund allocations against your actual timeline and liquidity needs: not your ideal scenario where everything goes perfectly.

Mistake #4: Not Truly Understanding the Fund's Strategy

Hedge fund strategies can range from straightforward to mind-bendingly complex. And here's the uncomfortable truth: some funds prefer it that way.

Complexity can mask risk. Leverage effects, exposure to illiquid assets, derivative positions: these elements might not be obvious from the surface-level explanation. If you don't understand how a fund makes money (and loses money), you can't accurately assess its risk profile.

How to fix it: Keep asking questions until the strategy makes sense. If a fund manager can't explain their approach in relatively plain terms, that's concerning. You should understand:

The core thesis driving returns

How leverage is employed (and what the maximum leverage looks like)

Where illiquidity exists in the portfolio

What market conditions would cause significant losses

How the strategy performed during past stress periods (2008, March 2020, etc.)

No strategy is right for everyone. But every strategy should be understandable to the people investing in it.

Mistake #5: Underestimating Liquidity Constraints

Hedge funds aren't ETFs. You can't just click a button and cash out tomorrow.

Lock-up periods can prevent withdrawals for years. And even after the lock-up ends, redemption restrictions often continue: think quarterly redemption windows with 60-90 day notice requirements. Some funds also reserve the right to gate redemptions during market stress.

This catches investors off guard, especially during financial emergencies or when portfolio rebalancing becomes necessary.

How to fix it: Model your liquidity realistically. Before investing, ask:

What's the initial lock-up period?

After lock-up, how frequently can I redeem?

What notice period is required?

Are there any gate provisions?

Has the fund ever suspended redemptions?

Then stress-test your portfolio. If you needed liquidity across all your holdings simultaneously during a crisis, what would actually be accessible?

Mistake #6: Neglecting Proper Insurance Coverage

This one's often overlooked because it feels like someone else's problem. But inadequate insurance at the fund level directly affects your capital.

Asset managers face increasing regulatory scrutiny and litigation risk. Without proper Directors and Officers (D&O) and Errors and Omissions (E&O) liability insurance, a single lawsuit or regulatory action could devastate fund assets.

How to fix it: During due diligence, ask about the fund's insurance coverage. Specifically:

D&O liability limits and coverage scope

E&O insurance for professional negligence

Fidelity bonds for employee dishonesty

Cyber liability coverage (increasingly important)

A well-managed fund will have robust coverage and won't hesitate to discuss it.

Mistake #7: Ignoring Correlation in Your Broader Portfolio

Here's a mistake I see constantly: investors add hedge funds for "diversification" without actually analyzing how the fund correlates with their existing holdings.

The whole point of alternative investments is to provide returns that don't move in lockstep with traditional assets. But many hedge fund strategies: particularly long/short equity or event-driven approaches: maintain meaningful correlation to equity markets.

Add several "diversifying" alternatives that are secretly correlated with each other and with your core portfolio, and you've created concentration risk wearing a diversification costume.

How to fix it: Request historical performance data and run actual correlation analysis against your portfolio. Look at performance during specific stress periods, not just aggregate numbers. A fund that performs well overall but tanks whenever equities tank isn't providing the diversification you think it is.

Consider how hedge fund allocations fit within a broader framework. At Mogul Strategies, we think about this in terms of balancing traditional assets with genuinely uncorrelated alternatives: including digital asset strategies that behave differently than conventional approaches.

The Bottom Line

Hedge funds can absolutely play a valuable role in a sophisticated portfolio. They offer access to strategies, managers, and return profiles that aren't available through traditional vehicles.

But the accreditation threshold doesn't come with a playbook. The mistakes outlined above trip up experienced investors all the time: not because they're careless, but because the industry doesn't always make risk factors obvious.

Do the work upfront. Ask uncomfortable questions. Verify independently. And make sure your hedge fund allocation actually fits your portfolio construction goals rather than just adding complexity for complexity's sake.

Your capital deserves that level of diligence.

Comments