7 Mistakes Accredited Investors Make with Portfolio Diversification (And How to Fix Them)

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 18

- 5 min read

You've done well. You've built wealth, crossed the accredited investor threshold, and now have access to opportunities that most people only read about. Private equity deals. Real estate syndications. Hedge fund allocations. Institutional-grade crypto strategies.

But here's the thing: having access to more options doesn't automatically mean better outcomes. In fact, it often leads to a whole new category of mistakes.

At Mogul Strategies, we've seen sophisticated investors stumble in surprisingly predictable ways when it comes to portfolio diversification. The good news? These mistakes are entirely fixable once you know what to look for.

Let's break down the seven most common diversification errors, and more importantly, how to correct them.

Mistake #1: Flying Blind Without Clear Investment Goals

It sounds basic, but you'd be surprised how many accredited investors skip this step entirely. They jump straight into exciting deals without first asking: What am I actually trying to accomplish?

Without defined goals, every shiny opportunity looks appealing. A private equity fund here. A crypto allocation there. Before you know it, you've got a portfolio that resembles a junk drawer rather than a strategic wealth-building machine.

The Fix: Before making any investment decision, establish clear, written objectives. Define your expected returns, time horizons, liquidity needs, and risk tolerance. Then, and this is the crucial part, evaluate every opportunity against these criteria.

Not every great investment is a great investment for you. A 10-year lockup in a private equity fund might be perfect for one investor and completely wrong for another. Your goals are the filter that separates the two.

Mistake #2: Confusing Risk Tolerance with Risk Capacity

These two concepts sound similar, but they're fundamentally different, and mixing them up can wreck your portfolio.

Risk tolerance is emotional. It's how much volatility you can stomach without panic-selling at the worst possible moment.

Risk capacity is mathematical. It's how much risk your financial situation can actually absorb based on your timeline, income, and obligations.

Here's where it gets tricky: a young investor with high risk capacity might invest too conservatively because they feel uncomfortable with volatility. Meanwhile, someone approaching retirement might chase aggressive returns with money they'll need in three years.

The Fix: Separate the emotional from the analytical. Work with professionals who can objectively assess both dimensions and help you find the sweet spot where your psychology and your finances align.

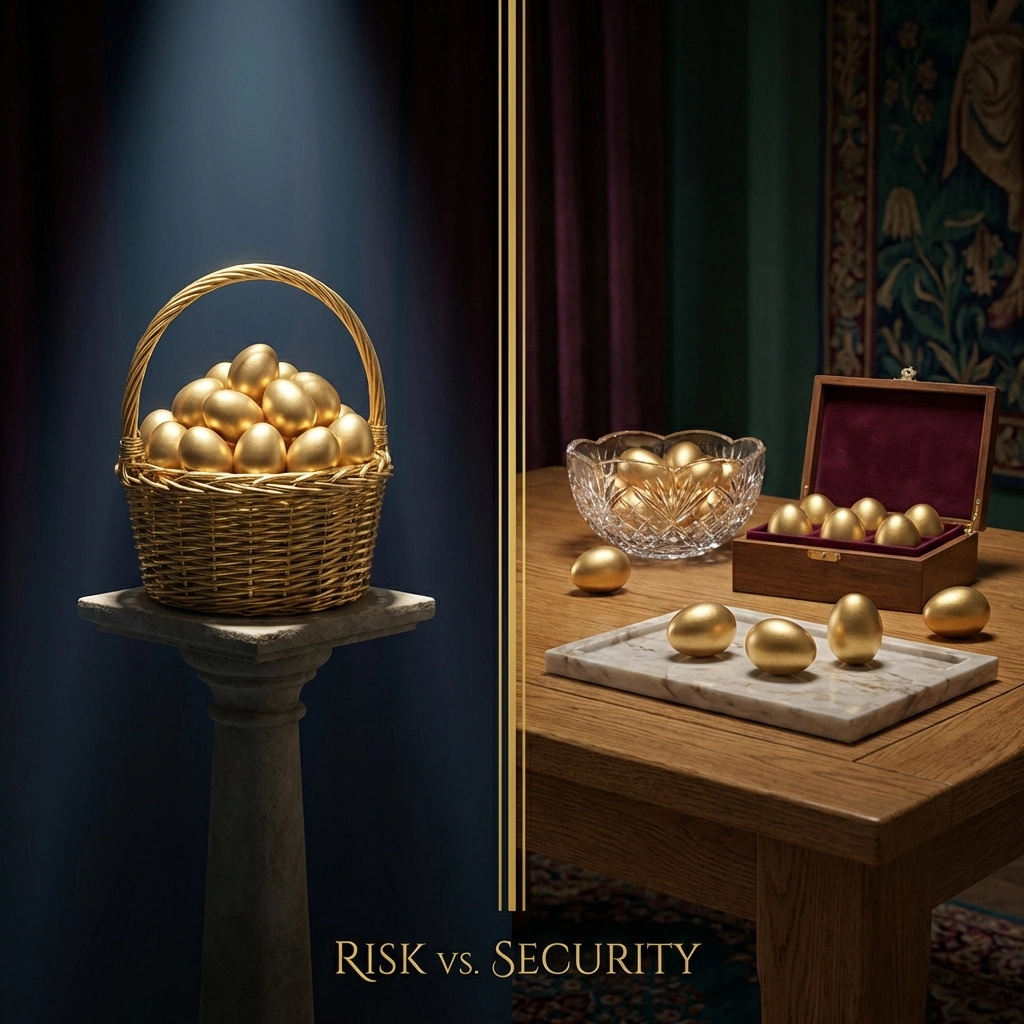

Mistake #3: Under-Diversification (The Concentration Trap)

This one's classic. An investor makes money in tech stocks, so they double down. And triple down. Before long, 60% of their portfolio is tied to a handful of companies in one sector.

When things go well, concentration feels like genius. When things go wrong, and eventually, something always does, it feels like disaster.

The Fix: Spread your investments across multiple asset classes, industries, and geographies. For accredited investors, this means looking beyond public equities to include:

Private equity and venture capital

Real estate syndications

Hedge fund strategies

Institutional-grade digital assets

Fixed income and alternative credit

True diversification means your portfolio doesn't live or die by the performance of any single holding.

Mistake #4: Over-Diversification (Yes, This Is a Thing)

Here's the counterintuitive twist: you can also diversify too much.

We call this "diworsification": owning so many investments that you dilute your returns without meaningfully reducing your risk. It often happens when investors spread small amounts across every available option without a coherent strategy.

The result? A portfolio that performs roughly like the market average, minus all the fees you're paying for "active management."

The Fix: Adopt a core-satellite approach. Build the core of your portfolio with broad, efficient exposures: index funds, diversified alternatives, or a well-structured hedge fund. Then use smaller satellite positions for targeted opportunities where you have conviction or access to genuine alpha.

One study showed that consolidating from 20 scattered funds to 5-7 carefully selected positions actually improved returns while reducing costs. More isn't always better.

Mistake #5: The Illusion of Diversification (Overlapping Holdings)

This one's sneaky. You think you're diversified because you own five different funds. But when you look under the hood, they all hold the same underlying stocks.

Your S&P 500 index fund, large-cap growth ETF, and technology sector fund might all be heavily weighted toward Apple, Microsoft, Amazon, and Nvidia. That's not diversification: that's concentration wearing a disguise.

The Fix: Conduct a thorough holdings analysis across your entire portfolio. Many custodians and portfolio management tools can show you your true exposure by underlying security.

At Mogul Strategies, we use advanced portfolio analytics to ensure that each position genuinely behaves differently across market conditions. If two investments move in lockstep, you're not getting the diversification benefits you think you are.

Mistake #6: Sticking to What You Know

It's human nature to invest in what's familiar. Tech executives load up on tech stocks. Real estate developers buy more real estate. Finance professionals overweight financial services.

The problem? Your career and your portfolio become correlated. If your industry hits a rough patch, you could lose your job and watch your investments tank simultaneously.

The Fix: Deliberately seek exposure to sectors and strategies outside your expertise. This is where working with experienced asset managers becomes valuable: they can identify opportunities you might never encounter in your professional network.

Consider international markets operating on different economic cycles. Explore asset classes like commodities, infrastructure, or institutional digital assets that march to their own beat. The goal is building a portfolio that doesn't all move in the same direction at the same time.

Mistake #7: All Stocks, All the Time

Even well-diversified equity portfolios share one fundamental flaw: they're all equities. When markets crash, correlations spike, and suddenly your "diversified" stock portfolio drops 30% in unison.

Accredited investors have access to asset classes that can genuinely zig when stocks zag. Ignoring them is leaving risk-adjusted returns on the table.

The Fix: Think beyond traditional stocks and bonds. Consider:

Private real estate syndications that generate income regardless of daily market fluctuations

Hedge fund strategies designed to profit in both up and down markets

Institutional Bitcoin and crypto allocations as a non-correlated alternative asset

Private credit and direct lending for yield uncorrelated to public markets

The 40/30/30 model: 40% traditional assets, 30% alternatives, 30% innovative digital strategies: represents one framework for blending these asset classes effectively.

The Bottom Line

Strategic diversification isn't about owning a lot of stuff. It's about owning the right stuff: assets that work together to optimize your risk-adjusted returns over time.

For accredited investors, this means taking full advantage of the expanded opportunity set available to you. Private equity. Real estate syndications. Hedge funds. Digital assets. These aren't exotic distractions: they're essential tools for building truly resilient wealth.

The mistakes we've covered are common, but they're not inevitable. With clear goals, honest risk assessment, and a disciplined approach to portfolio construction, you can build a diversified portfolio that actually works.

At Mogul Strategies, we specialize in helping accredited investors navigate these complexities. We blend traditional assets with innovative digital strategies to create portfolios designed for long-term wealth preservation and growth.

Because in the end, diversification isn't just about avoiding mistakes: it's about positioning yourself to capture opportunity wherever it appears.

Comments