7 Mistakes Accredited Investors Make With Portfolio Diversification (And How to Fix Them)

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 19

- 5 min read

Look, you didn't get to accredited investor status by making rookie mistakes. But here's the thing, when it comes to portfolio diversification, even the smartest investors fall into traps that quietly erode their wealth.

I've seen it countless times. Sophisticated investors who crush it in their primary business or career somehow end up with portfolios that are either dangerously concentrated or so scattered they might as well be throwing darts blindfolded.

The good news? These mistakes are fixable. Let's break down the seven most common diversification blunders and, more importantly, how to course-correct.

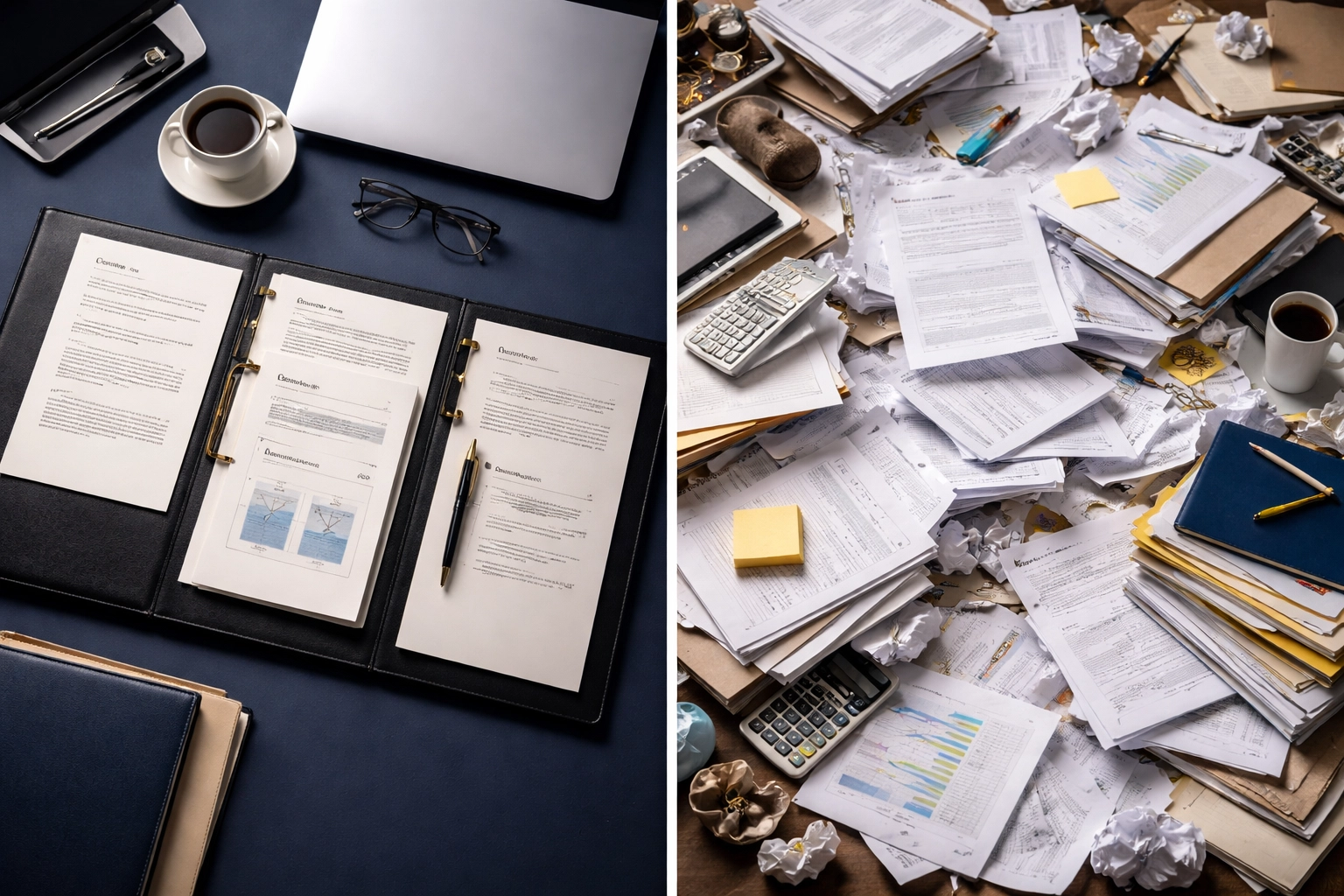

Mistake #1: Under-Diversification

This is the classic "all eggs in one basket" problem. And it's surprisingly common among high-net-worth individuals.

Maybe you made your wealth in tech, so your portfolio is heavy on tech stocks. Perhaps you inherited a concentrated position in a single company. Or you're convinced that one particular sector is going to outperform everything else.

Here's the reality: concentrated positions are how fortunes are made, and lost. When that single holding tanks, your entire financial picture changes overnight.

The Fix: Spread your investments across genuinely different asset classes. We're talking stocks, bonds, real estate, private equity, and yes, even institutional-grade digital assets like Bitcoin. The key word here is "genuinely different." More on that in a moment.

Mistake #2: Over-Diversification (The "Diworsification" Trap)

Peter Lynch coined the term "diworsification" for a reason. It's the opposite extreme, owning so many positions that you've essentially created an expensive index fund with none of the benefits.

I've reviewed portfolios with 50, 60, even 100+ individual holdings. The investor thought they were being prudent. In reality, they were diluting their returns, paying excessive fees, and making their portfolio nearly impossible to manage.

When everything averages out, you get... average returns. Minus all those management fees.

The Fix: Adopt a core-satellite approach. Your "core" should be broad market exposure, maybe 60-70% of your portfolio in diversified, low-cost positions. Your "satellites" are smaller, strategic allocations to opportunities with higher return potential: private equity, hedge fund strategies, real estate syndications, or emerging asset classes.

This gives you diversification where it matters while preserving the ability to outperform.

Mistake #3: Overlapping Holdings

This one's sneaky. You think you're diversified because you own five different funds. But when you look under the hood, they all hold the same stocks.

Your S&P 500 index fund? Heavy on Apple, Microsoft, Nvidia, Amazon. Your large-cap growth ETF? Same names. Your technology fund? You guessed it.

You're paying multiple expense ratios to essentially own the same companies three times over.

The Fix: Actually dig into your holdings. Most fund companies publish their top holdings and sector breakdowns. Map them out. You might be shocked at how much overlap exists. Then consolidate into a cleaner structure that provides genuine diversification, not the illusion of it.

Mistake #4: Geographic and Sector Tunnel Vision

Home country bias is real. U.S. investors tend to over-allocate to U.S. markets because they're familiar. It feels safer.

But the U.S. represents only about 60% of global market capitalization. By ignoring international markets, you're missing exposure to different economic cycles, demographic trends, and growth engines.

The same applies to sectors. If you made your money in healthcare, your portfolio probably leans healthcare. If you're in real estate, you likely own too much real estate. We gravitate toward what we know.

The Fix: Force yourself to look beyond your comfort zone. International developed markets, emerging markets, and sectors outside your expertise all deserve consideration. This doesn't mean equal weighting, it means intentional exposure to reduce correlation risk.

Mistake #5: Lack of Asset Class Variety

Here's a mistake that even "diversified" stock investors make: owning nothing but equities.

Sure, you might own U.S. stocks, international stocks, large-cap, small-cap, growth, and value. That's sector diversification within a single asset class. When the stock market drops, it all drops together.

True diversification means owning assets that behave differently from each other. Bonds typically hold value or appreciate when stocks fall. Real estate provides income and appreciation on a different cycle. Commodities can hedge against inflation. And increasingly, institutional investors are recognizing that Bitcoin and select digital assets offer correlation benefits traditional portfolios lack.

The Fix: Think beyond stocks. A model like 40/30/30: roughly 40% traditional equities, 30% alternative investments (private equity, hedge funds, real estate syndications), and 30% fixed income and other stabilizers: can provide genuine portfolio resilience. The exact allocation depends on your situation, but the principle holds: asset class variety matters.

Mistake #6: Portfolio Complexity You Can't Actually Manage

Over-diversification creates a second problem beyond diluted returns: you literally can't keep track of it all.

When you own 40 different positions across multiple accounts, rebalancing becomes a nightmare. Tax-loss harvesting opportunities slip through the cracks. You miss dividend reinvestment deadlines. Worst of all, you lose the ability to make informed decisions because you can't see the forest for the trees.

The Fix: Simplify ruthlessly. A carefully constructed portfolio of 8-12 positions can provide excellent diversification while remaining manageable. Or work with a manager who can handle the complexity for you: but make sure you understand the overall strategy, not just the individual pieces.

Regular portfolio reviews matter here. Quarterly check-ins to rebalance, assess performance, and adjust for life changes should be non-negotiable.

Mistake #7: Misaligned Risk Assessment

This might be the most expensive mistake of all.

Some investors are too conservative for their time horizon. They're 45 with 20+ years until retirement, sitting in bond-heavy portfolios that won't keep pace with inflation. Their "safety" is actually guaranteeing they'll fall short of their goals.

Others swing the opposite direction: taking inappropriate risks with money they can't afford to lose. They're chasing returns without stress-testing what happens when correlations spike during a crisis.

Here's the uncomfortable truth: diversification benefits can disappear exactly when you need them most. In 2008, almost everything fell together. Traditional correlation assumptions broke down.

The Fix: Start with honest self-assessment. What's your actual time horizon? What's your true risk tolerance (not what you say in good times, but how you'll behave when markets drop 30%)? What's your risk capacity: how much can you afford to lose without derailing your life?

Then stress-test your assumptions. Don't rely solely on historical correlations. Model what happens to your portfolio in various crisis scenarios. This is where alternative assets: particularly those with genuinely different return drivers: can provide meaningful protection.

Bringing It All Together

Portfolio diversification isn't just about spreading money around. It's about intentional construction: owning assets that serve different purposes in different market environments.

The accredited investors who get this right share a few traits:

They think in terms of asset classes, not just individual holdings

They accept complexity only when it serves a purpose

They regularly review and rebalance

They're honest about their risk tolerance

They stay curious about emerging opportunities (like institutional-grade digital assets) without chasing every shiny object

At Mogul Strategies, we help high-net-worth investors build portfolios that blend traditional assets with innovative strategies: private equity, real estate syndication, hedge fund approaches, and carefully integrated digital asset exposure.

Because true diversification isn't about owning more. It's about owning smarter.

Comments