7 Mistakes High-Net-Worth Investors Make with Diversified Portfolios (And How Institutional-Grade Strategies Fix Them)

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 4 days ago

- 5 min read

You've built wealth. You've diversified your portfolio. You're playing by the rules everyone says high-net-worth investors should follow.

So why does something still feel off?

Here's the truth: Having a diversified portfolio and having an optimized diversified portfolio are two completely different things. Most investors stop at diversification without realizing they're still making costly mistakes that eat into their returns, expose them to unnecessary taxes, and create risk concentrations they don't even see.

Let's break down the seven most common mistakes we see high-net-worth investors make: and more importantly, how institutional-grade strategies fix them.

Mistake #1: Making Emotional Decisions During Market Volatility

You've been there. Markets tank, headlines scream apocalypse, and suddenly that carefully constructed diversified portfolio feels like a sinking ship.

The knee-jerk reaction? Sell. Get to safety. Wait for things to "settle down."

Here's what happened in 2008: Investors with diversified portfolios panic-sold at massive losses, then sat on the sidelines while markets recovered. They locked in losses and missed the bounce.

The Institutional Fix: Automated rebalancing protocols and predetermined investment policies that remove emotion from the equation entirely. When markets drop, institutional strategies systematically buy the dip according to preset rules: no gut feelings, no CNN watching, no panic.

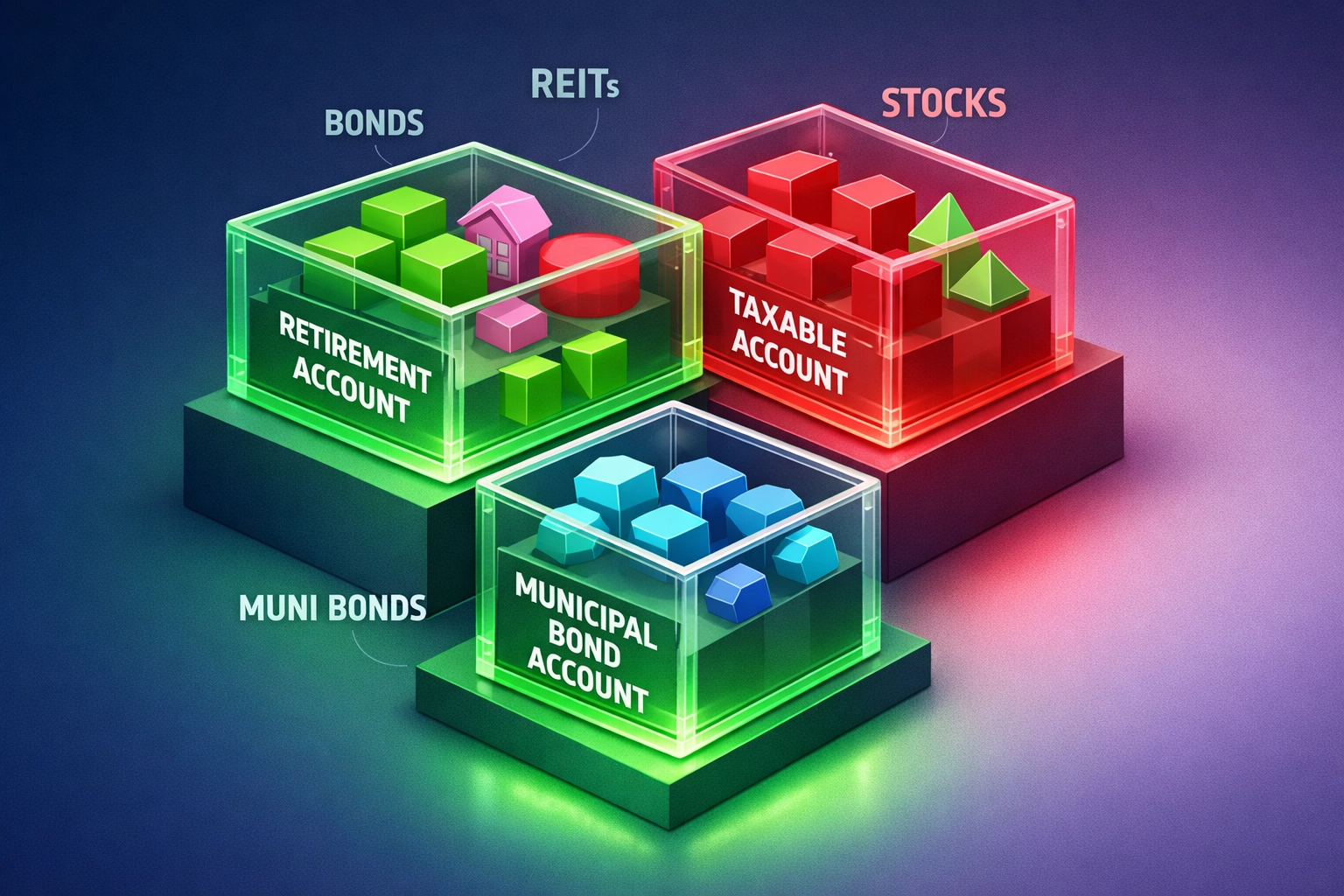

Mistake #2: Suboptimal Asset Location Across Accounts

This one's sneaky. You might have the right assets, but if they're in the wrong accounts, you're bleeding money to taxes unnecessarily.

Let's say you're holding REITs (which generate ordinary income taxed at your marginal rate) in your taxable brokerage account. Meanwhile, you've got municipal bonds (which are already tax-free) sitting in your IRA. That's backwards.

The Institutional Fix: Strategic asset location that places tax-inefficient investments (like bonds, REITs, and actively managed funds) in tax-sheltered accounts while keeping tax-efficient assets (like index funds and qualified dividends) in taxable accounts. It's not sexy, but it can add 0.75% or more to your annual returns without taking on any additional risk.

Mistake #3: Treating RMDs Like an Afterthought

Required Minimum Distributions are the IRS's way of saying "pay up" once you hit a certain age. For high-net-worth investors, RMDs can push you into higher tax brackets, increase Medicare premiums, and trigger additional taxes on Social Security benefits.

Most investors wait until December, take the minimum distribution, and call it done. That's reactive, not strategic.

The Institutional Fix: Multi-year RMD planning that coordinates distributions with other income sources to smooth tax liability over time. This might include Roth conversions in lower-income years, strategic charitable giving through QCDs (Qualified Charitable Distributions), or coordinated liquidation strategies that minimize lifetime tax burden.

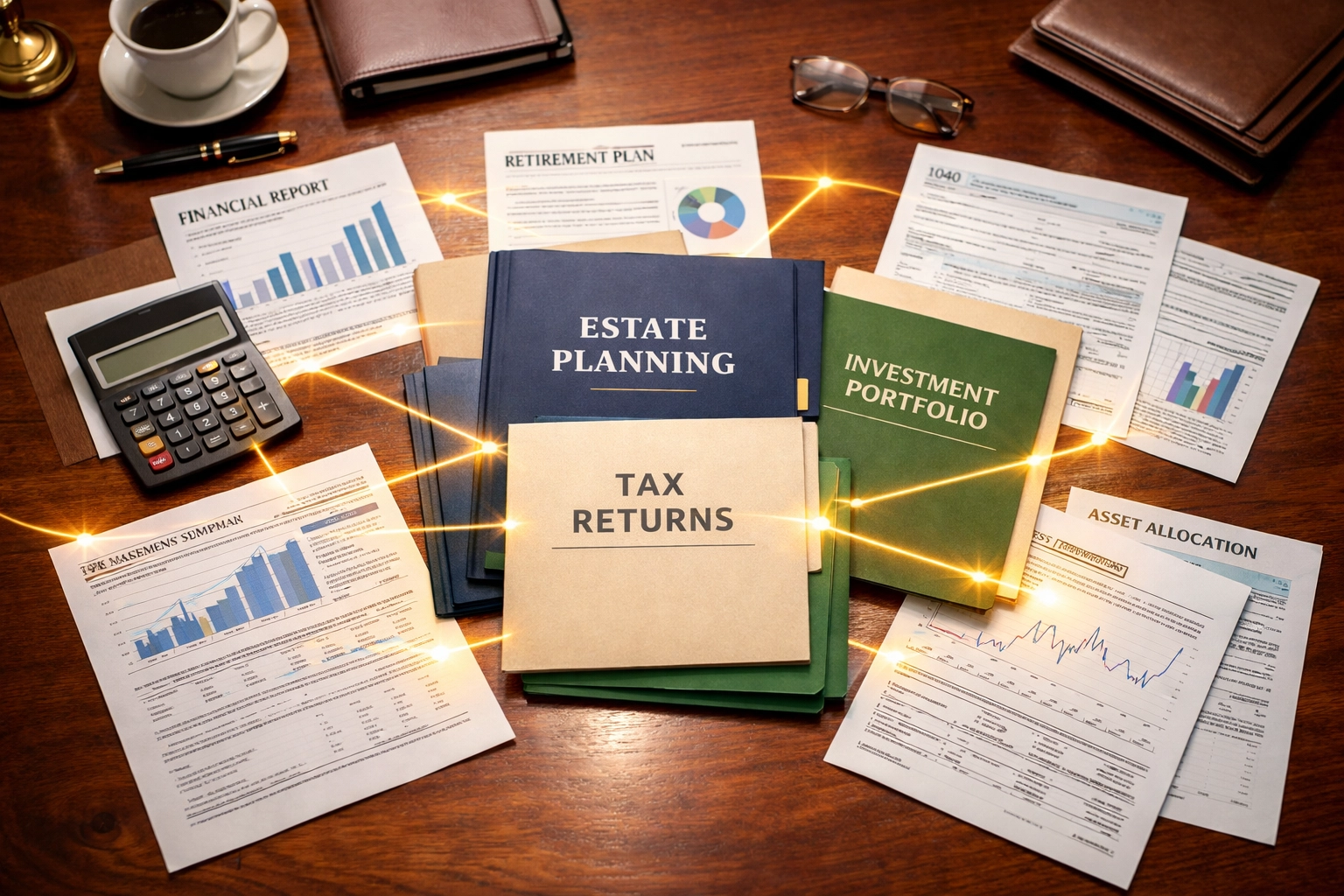

Mistake #4: The Fragmented Financial Team Problem

You've got an accountant who handles your taxes. A lawyer who manages your estate planning. An investment advisor who picks your stocks. Maybe a separate person for your real estate holdings.

None of them talk to each other.

The result? Your tax strategy contradicts your investment approach. Your estate plan doesn't align with your asset allocation. Opportunities fall through the cracks because no one sees the full picture.

The Institutional Fix: Comprehensive wealth management that integrates tax planning, investment strategy, estate planning, and goal-based financial planning under one coordinated approach. When everyone's working from the same playbook, strategies reinforce each other instead of working at cross-purposes.

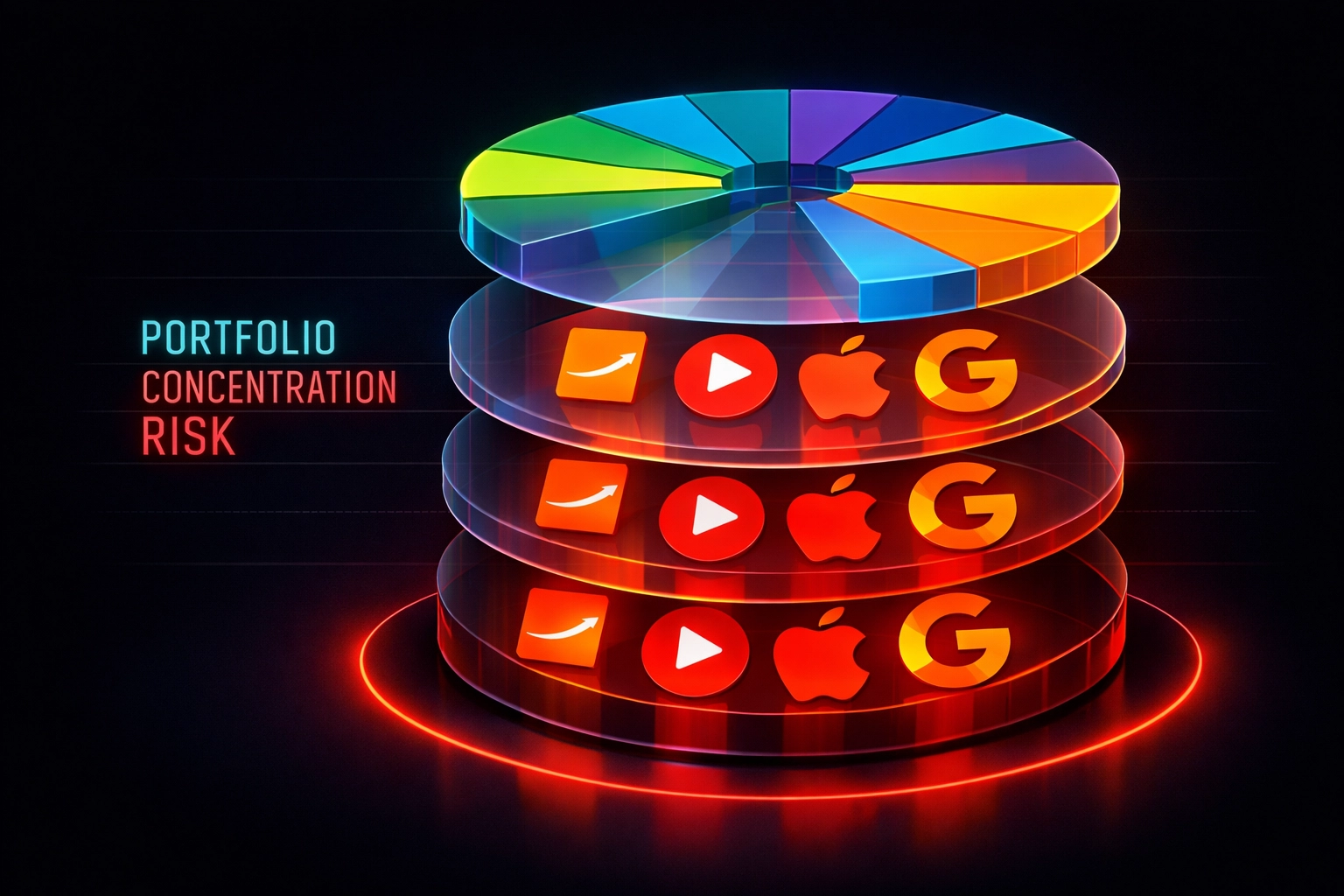

Mistake #5: Hidden Concentration Risk Through Duplicate Holdings

You've diversified, right? You own 10 different mutual funds and a handful of individual stocks. Diversification achieved.

Except... have you actually looked at what's inside those funds?

Many investors unknowingly own Apple, Microsoft, Amazon, and NVIDIA across multiple funds, plus as individual holdings. These mega-caps already represent 17% of standard U.S. stock funds. Add in your individual positions, and suddenly your "diversified" portfolio has 30% or more concentrated in just four companies.

The Institutional Fix: Portfolio X-ray analysis that looks through the wrapper to identify actual exposures. Sophisticated analytics reveal overlap, eliminate redundancy, and ensure your diversification is real: not just an illusion created by holding multiple funds with similar underlying positions.

Mistake #6: Asset Allocation Frozen in Time

Your portfolio allocation made sense ten years ago when retirement was a distant concept. But circumstances change. Time horizons shift. Risk tolerance evolves.

Many high-net-worth investors remain in aggressive allocations well past the point where it makes strategic sense, simply because "it's worked so far." Others shift too conservatively too early, leaving growth on the table.

The Institutional Fix: Dynamic asset allocation tied to specific goals with different time horizons. Your allocation shouldn't be static: it should evolve as you move closer to major financial milestones. This means different buckets for different purposes: liquidity for near-term needs, growth for long-term goals, and alternatives for diversification beyond traditional markets.

This is where sophisticated strategies like the 40/30/30 model come in: 40% traditional equities, 30% fixed income, and 30% alternatives (including digital assets, private equity, and real estate). It's not just diversification across asset classes; it's strategic allocation across return profiles and risk characteristics.

Mistake #7: Optimizing Investments While Ignoring the Full Wealth Plan

Here's the trap: You're laser-focused on beating the S&P 500, but you haven't considered how your investment strategy integrates with estate planning, charitable giving goals, business succession planning, or legacy wealth transfer.

Investment performance matters, but it's not the whole game. A killer portfolio that creates estate tax nightmares or doesn't align with your actual life goals is a failed strategy.

The Institutional Fix: Holistic wealth planning that treats investment management as one piece of a larger puzzle. This means coordinating investment strategy with tax optimization, estate planning, philanthropic goals, and business interests. Your investments should serve your plan: not the other way around.

The Bridge Between Traditional and Innovative

What separates institutional-grade strategies from standard diversification is the integration of alternative assets alongside traditional holdings. We're seeing sophisticated investors blend Bitcoin and digital assets, private equity opportunities, real estate syndication, and hedge fund strategies with their equity and bond positions.

This isn't about chasing the latest trend. It's about accessing return streams that aren't correlated with traditional markets, adding genuine diversification while managing risk through institutional-grade due diligence and portfolio construction.

Moving Forward

If you recognized your portfolio in any of these mistakes, you're not alone. These are incredibly common: even among investors with significant wealth and experience.

The difference between good and great portfolio management often isn't the assets you hold. It's the strategy behind how you hold them, where you hold them, and how they coordinate with everything else in your financial life.

Institutional-grade strategies aren't reserved for endowments and pension funds anymore. The same sophisticated approaches that protect and grow institutional capital are available to high-net-worth investors who know where to look.

The question isn't whether you need to fix these mistakes. It's whether you can afford not to.

Ready to upgrade your portfolio strategy beyond basic diversification? Let's talk about what institutional-grade management could mean for your wealth.

Comments