7 Portfolio Diversification Mistakes Accredited Investors Make (And How Hedge Funds Fix Them)

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 17

- 5 min read

You've done well. Built real wealth. Crossed the accredited investor threshold. But here's the thing: having significant capital doesn't automatically mean you're deploying it wisely.

I've seen portfolios worth eight figures that were essentially house-of-cards constructions waiting for the right market wind to blow them over. The mistakes aren't always obvious. Sometimes they're hidden behind the illusion of diversification.

Let's break down the seven most common diversification mistakes I see accredited investors make: and more importantly, how institutional hedge fund strategies can fix them.

Mistake #1: Under-Diversification (The Concentration Trap)

This one seems obvious, but it catches smart people all the time.

You made your money in tech, so you know tech. Your portfolio becomes 60% technology stocks because that's your comfort zone. Or maybe you received company stock options that now dominate your net worth. Perhaps you're heavy in real estate because that's what you understand.

The problem? Concentrating wealth in single assets or sectors exposes your entire portfolio to catastrophic losses if that area underperforms. Remember 2022? Tech stocks got crushed while the broader market held up better. Investors concentrated in growth tech watched decades of gains evaporate in months.

How hedge funds fix this: Institutional managers use strict position limits and sector caps. No single position exceeds a predetermined percentage. They build portfolios that can survive: and even thrive: when their highest-conviction ideas go wrong.

Mistake #2: Over-Diversification (The "Diworsification" Problem)

Here's the flip side that nobody talks about enough.

You own 47 different ETFs, 23 individual stocks, three mutual funds, and a handful of alternatives. You think you're diversified. In reality, you're holding a jumbled mess of overlapping positions that water down returns without meaningfully reducing risk.

Signs you've over-diversified:

Your portfolio performance mirrors (or underperforms) broad market indices

You can't explain what half your holdings actually do

Transaction costs and management fees are eating your returns

Adding new positions doesn't change your risk profile

How hedge funds fix this: Quality over quantity. Hedge funds typically hold concentrated, high-conviction positions: but across truly uncorrelated strategies and asset classes. It's not about owning more things. It's about owning the right things that actually behave differently from each other.

Mistake #3: Ignoring Correlation During Crises

This is the silent killer of "diversified" portfolios.

During normal market conditions, your stocks, bonds, and alternatives all dance to different tunes. Great. But when crisis hits: 2008, March 2020, or any future black swan: correlations spike. Everything moves together. Down.

Research consistently shows that diversification benefits can evaporate during market stress, precisely when you need them most. Your "diversified" portfolio becomes a synchronized symphony of losses.

How hedge funds fix this: Sophisticated managers actively model correlation behavior under stress scenarios. They include assets and strategies specifically designed to perform during dislocations: not just during calm waters. This might include long volatility positions, managed futures, or truly uncorrelated alternatives like certain digital asset strategies.

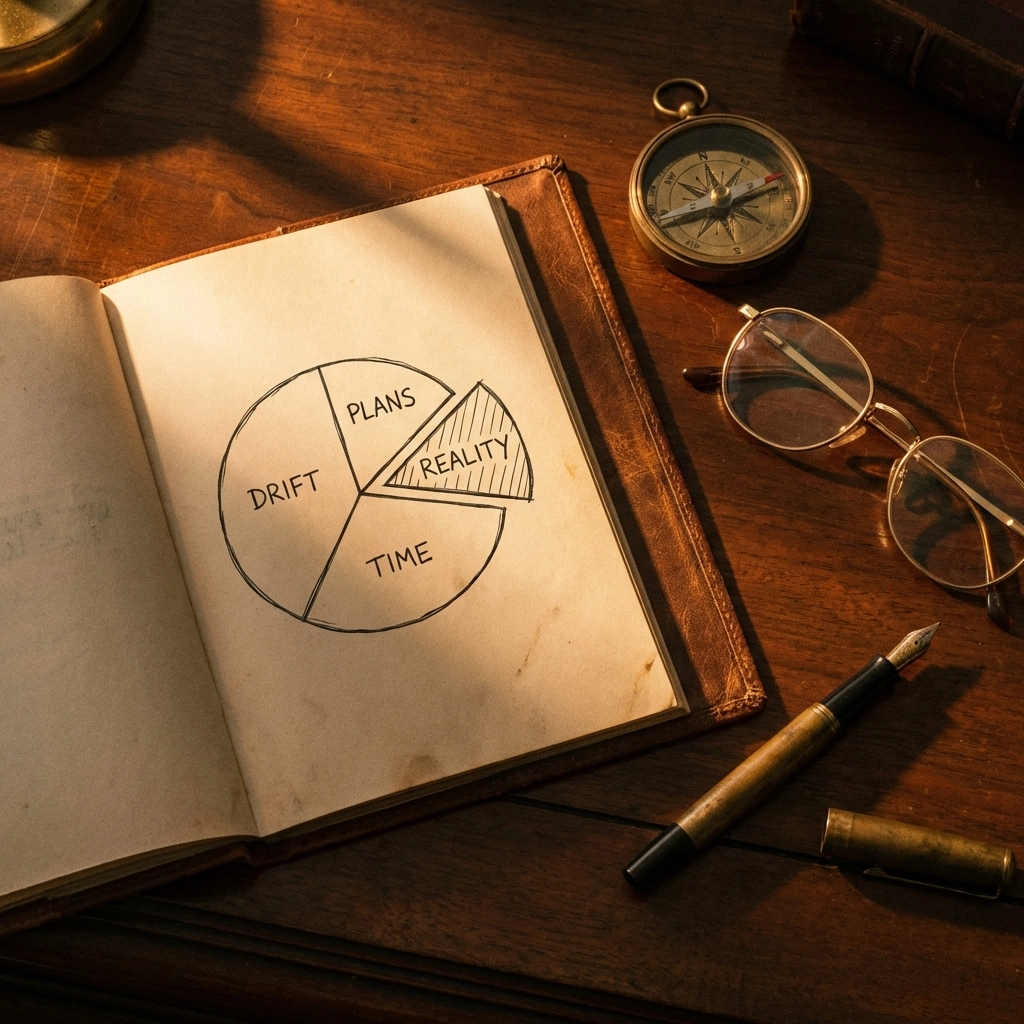

Mistake #4: No Clear Investment Goals

Investing without defined objectives is like driving without a destination. You might enjoy the scenery, but you'll probably end up somewhere you didn't want to be.

I see this constantly with successful entrepreneurs and executives. They have capital. They know they should invest it. But they haven't clearly defined:

Their actual time horizon

Their required rate of return

Their genuine risk tolerance (not just what they say on a questionnaire)

What they're actually trying to accomplish

Without these answers, portfolios become reactive hodgepodges: chasing last year's winners, panic-selling during corrections, and making decisions based on headlines rather than strategy.

How hedge funds fix this: Everything starts with an investment policy statement. Hedge funds define their mandate, risk parameters, and return objectives before making their first trade. Every subsequent decision gets measured against that framework. No emotional pivots. No chasing trends. Just disciplined execution against clearly defined goals.

Mistake #5: Inadequate Risk Assessment

There's the risk you think you can handle, and there's the risk you can actually handle. These are rarely the same number.

Risk capacity (your financial ability to absorb losses) and risk tolerance (your emotional comfort with volatility) often diverge wildly. A 45-year-old with a $10 million portfolio might have enormous capacity for risk: but discover during a 30% drawdown that their tolerance is far lower than they imagined.

The reverse happens too. Retirees sometimes choose overly conservative investments that sacrifice necessary growth potential, creating a different kind of risk: outliving their money.

How hedge funds fix this: Professional risk management isn't about questionnaires. It's about modeling scenarios, stress testing portfolios, and building in circuit breakers. Hedge funds use Value-at-Risk calculations, Monte Carlo simulations, and real-time risk monitoring. They know exactly how much they can lose in various scenarios: and they've accepted that before taking the positions.

Mistake #6: Geographic Concentration

Most American investors have significant home-country bias. And for years, that worked beautifully. U.S. markets outperformed international markets for over a decade.

But that's changing. International diversification isn't just about chasing returns: it's about reducing portfolio volatility and accessing growth opportunities that simply don't exist domestically. Emerging markets, developed international economies, and frontier markets all offer exposure to different economic cycles, currencies, and demographic trends.

How hedge funds fix this: Global macro funds and internationally-focused strategies build truly worldwide portfolios. They're not just adding international ETFs as an afterthought: they're actively analyzing opportunities across geographies and currencies, often hedging currency exposure to isolate the underlying investment returns.

Mistake #7: Rebalancing Failures

You built a beautiful 40/30/30 portfolio across traditional assets, alternatives, and digital assets. Perfect allocation for your goals. Then you never touched it again.

Three years later, your winners have grown and your underperformers have shrunk. That carefully designed allocation is now completely different from what you intended. Your risk profile has shifted without you making any conscious decision.

Alternatively, some investors rebalance too frequently, triggering unnecessary tax events and trading costs while second-guessing their own strategy.

How hedge funds fix this: Systematic rebalancing protocols. Hedge funds establish specific trigger points for rebalancing: either time-based (quarterly reviews) or threshold-based (when allocations drift beyond predetermined bands). This removes emotion and ensures the portfolio continuously reflects the intended risk/return profile.

The Hedge Fund Advantage: Putting It All Together

What separates institutional approaches from typical retail diversification isn't any single technique. It's the integration of all these elements into a coherent system.

At Mogul Strategies, we've built our approach around blending traditional asset management with innovative strategies: including institutional-grade digital asset integration: to create portfolios that are genuinely diversified, not just superficially spread across different ticker symbols.

The key elements include:

Correlation-aware construction: Building portfolios where components actually behave differently during stress

Clear mandate and discipline: No style drift, no emotional decisions

Sophisticated risk management: Real-time monitoring and defined exposure limits

Access to true alternatives: Private equity, real estate syndication, and digital assets that retail portfolios typically can't access

Active oversight: Professional management that adjusts to changing market conditions

The Bottom Line

Diversification isn't a box you check. It's an ongoing process that requires sophistication, discipline, and access to opportunities beyond traditional retail markets.

If you recognize any of these mistakes in your own portfolio, you're not alone. Most accredited investors: even very sophisticated ones: fall into at least two or three of these traps.

The good news? Each one is fixable. And the hedge fund playbook for addressing them isn't reserved for institutions anymore. High-net-worth investors increasingly have access to the same strategies, tools, and alternative investments that institutional managers have used for decades.

The question isn't whether you can afford to think like a hedge fund. It's whether you can afford not to.

Comments