7 Portfolio Diversification Mistakes Accredited Investors Make (And How to Fix Them)

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 17

- 5 min read

You've worked hard to reach accredited investor status. You understand markets. You've likely outperformed most retail investors over the years.

But here's the thing: even sophisticated investors make diversification mistakes that quietly erode their wealth.

The irony? These mistakes often come from the same instincts that made you successful in the first place. Confidence in your stock picks. Deep knowledge in your industry. The belief that more is always better.

Let's break down the seven most common portfolio diversification mistakes we see accredited investors make: and more importantly, how to fix them.

Mistake #1: Concentrating Too Much in Too Few Holdings

This is the classic trap. You found a winner. Maybe it's a tech stock that's tripled. Maybe it's your own company's equity. Maybe it's a real estate play in your backyard that you understand deeply.

So you double down. And then double down again.

The problem? Underdiversified portfolios create excessive risk exposure that can wipe out years of gains in a single market correction. Research consistently shows that investors who concentrate wealth in a small number of positions: even high-quality ones: expose themselves to unnecessary volatility.

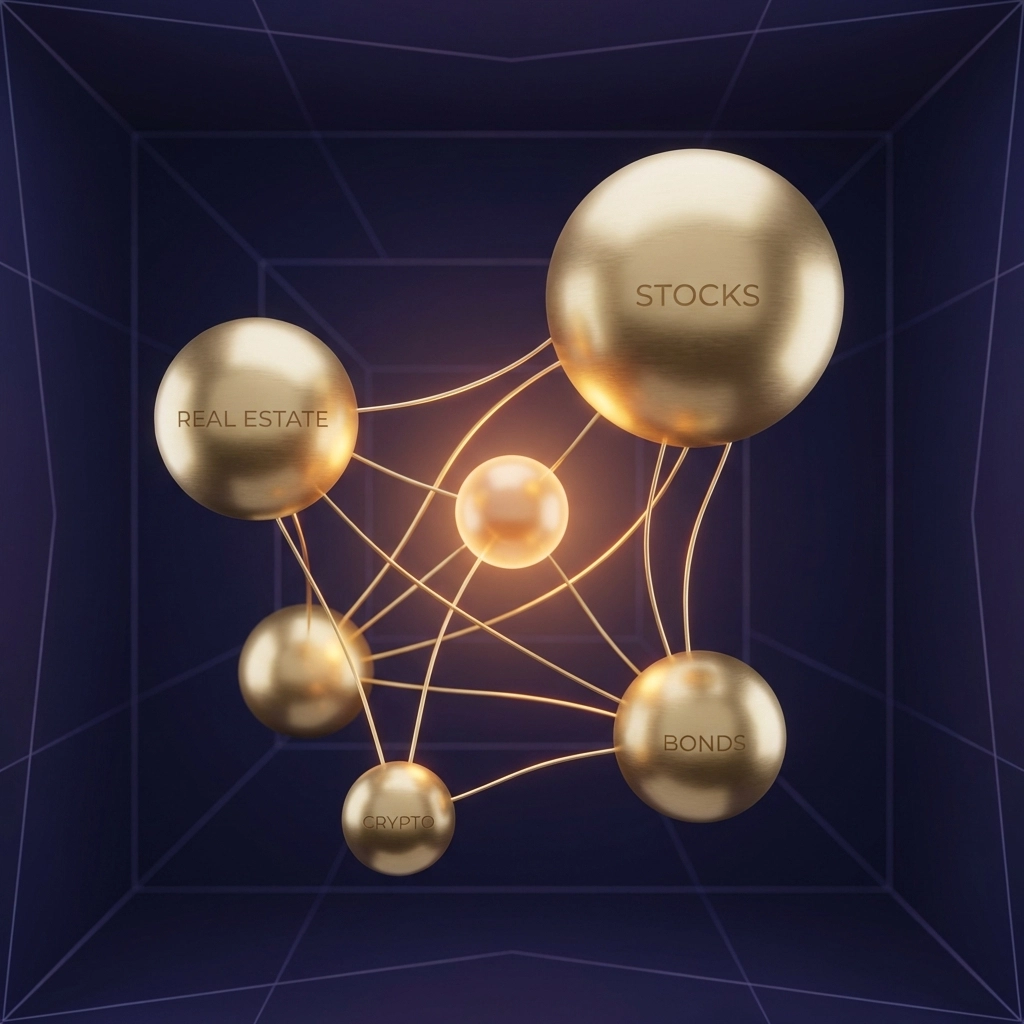

The fix: Spread investments across multiple asset classes, industries, and geographic regions. A portfolio that balances stocks, bonds, real estate, private equity, and alternative investments like Bitcoin significantly reduces the impact of any single failing investment.

At Mogul Strategies, we often recommend starting with a framework like the 40/30/30 model: 40% traditional equities, 30% alternative investments, and 30% fixed income and real assets. It's not a magic formula, but it's a starting point that forces diversification.

Mistake #2: Owning Investments That Only Look Different

Here's a sneaky one. You think you're diversified because you own 15 different stocks. But when you look closer, they're all tech companies. Or they all move in lockstep with the S&P 500.

Holding assets that are highly correlated with each other defeats the entire purpose of diversification. When the market drops, everything in your portfolio drops together.

The fix: Ensure your holdings are truly independent: not just nominally different. This means looking beyond sector labels and examining actual correlation data. A portfolio with stocks, real estate syndications, hedge fund allocations, and institutional-grade crypto exposure will behave very differently during market stress than a portfolio of 20 "different" growth stocks.

The goal isn't just variety. It's strategic non-correlation.

Mistake #3: Ignoring Alternative Investment Diversification

Accredited investors have access to opportunities that retail investors don't: venture capital, private equity, real estate syndications, and digital asset funds. That's a massive advantage.

But many investors treat alternatives as a single bucket. They'll put money into one startup, one private equity fund, or one crypto position and call it a day.

This is a recipe for disappointment. Individual startups fail all the time. Individual real estate deals go sideways. One major win can offset multiple failures: but only if you have multiple positions in the first place.

The fix: When investing in alternatives, spread your allocation across different managers, strategies, sectors, and stages. In venture capital, this might mean backing 10-15 startups rather than betting big on two or three. In real estate, it means diversifying across property types and markets.

The same applies to digital assets. Rather than going all-in on Bitcoin alone, consider a diversified crypto allocation that includes established protocols and emerging opportunities: ideally through an institutional-grade vehicle with proper risk management.

Mistake #4: Over-Diversifying Until Returns Disappear

Wait: didn't we just say diversification is good?

Yes. But there's a point where it becomes counterproductive.

It's called "diworsification." It happens when you add so many holdings that you dilute potential returns without meaningfully reducing risk. Research shows that diversification benefits plateau after a certain number of positions. Beyond that point, you're just adding complexity and drag.

Signs you might be over-diversified:

You own so many investments you can't track them all

Your portfolio consistently matches or underperforms broad market indices

Rebalancing feels like a full-time job

Transaction costs and management fees are eating into returns

The fix: Maintain a focused portfolio with a manageable number of core positions. Quality matters more than quantity. Set a maximum number of holdings and conduct regular reviews to consolidate redundant positions.

Mistake #5: Creating Unmanageable Complexity

This is the cousin of over-diversification. Your portfolio has become a sprawling empire of accounts, managers, and strategies. You have three different financial advisors, positions at four brokerages, alternative investments through six different platforms, and a crypto wallet you haven't checked in months.

An overly complex portfolio is harder to manage, harder to rebalance, and harder to optimize for taxes. The increased number of transactions and scattered oversight eat into returns in ways that are hard to see but very real.

The fix: Simplify ruthlessly. Consolidate accounts where possible. Work with managers who can provide a holistic view of your portfolio. Use technology to aggregate and track everything in one place.

At Mogul Strategies, we help investors consolidate their alternative investments: from private equity to digital assets: into a single, manageable strategy. Complexity should work for you, not against you.

Mistake #6: Misjudging Your Risk Capacity and Tolerance

Here's where things get psychological.

Risk capacity is your actual ability to take on risk: based on your time horizon, income stability, net worth, and liquidity needs. Risk tolerance is your emotional comfort with volatility and potential losses.

These are not the same thing. And confusing them leads to costly mistakes.

A 35-year-old executive with a high salary and decades until retirement might invest too conservatively because market drops make them anxious. A 60-year-old couple might inappropriately risk their retirement savings in volatile investments because they feel invincible after a bull market.

The fix: Be honest about both factors. Your portfolio allocation should reflect your actual capacity to absorb losses: not just how you feel on a good day in the market. Stress-test your assumptions. Ask yourself: "If this position dropped 50% tomorrow, would I need to sell? Would I panic?"

Reassess regularly. Life circumstances change. So should your risk profile.

Mistake #7: Investing Without Clear Goals

This might be the most fundamental mistake of all.

Without defined goals, investors often chase short-term trends, react emotionally to market news, and build portfolios that don't actually serve their needs. They accumulate positions without a plan. They diversify randomly rather than strategically.

The fix: Establish well-defined investment goals before making any allocation decisions. What are you trying to achieve? Wealth preservation? Income generation? Capital appreciation? Generational wealth transfer?

Each goal requires a different strategy. Each has a different time horizon. Each tolerates different levels of risk.

Your diversification strategy should flow from your goals: not the other way around.

The Bottom Line

Diversification isn't just about spreading money around. It's about building a portfolio that can weather different market environments while still capturing upside.

For accredited investors, that means going beyond traditional stocks and bonds. It means thoughtfully incorporating private equity, real estate syndications, hedge fund strategies, and institutional-grade digital asset exposure. It means balancing concentration with diversification, complexity with manageability.

Most importantly, it means having a plan.

If your portfolio has grown unwieldy: or if you're not sure whether your diversification strategy is actually working: it might be time for a fresh perspective. The mistakes we've covered here are common. But they're also fixable.

And fixing them could make all the difference in your long-term wealth.

Comments