Are 60/40 Portfolios Dead? How Accredited Investors Are Building Wealth with Alternative Diversification

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 5 days ago

- 5 min read

Let's address the elephant in the room: 2022 was brutal for traditional portfolios. The classic 60/40 split of stocks and bonds, the investing world's version of peanut butter and jelly, dropped about 17.5%. That might not sound catastrophic until you realize it was the worst performance in decades for a strategy that's supposed to be the safe, boring choice.

But here's the real kicker: both stocks and bonds tanked at the same time. That's not supposed to happen. The whole point of the 60/40 is that when one zigs, the other zags. Instead, they both zigged right off a cliff.

So are we attending a funeral for the 60/40 portfolio? Not exactly. But if you're an accredited investor still treating it like gospel, you're missing out on how the game has changed.

What Actually Broke in 2022

The 60/40 didn't fail because it's fundamentally flawed, it broke because the economic environment changed in ways we hadn't seen in 40 years. When inflation surged and the Fed slammed the brakes with aggressive rate hikes, both stocks and bonds got hammered simultaneously.

Historically, stocks and bonds moved in opposite directions about 70% of the time. That negative correlation was the secret sauce. But from 2006 to 2025, the correlation between public stocks and bonds has been creeping up, practically eliminating the diversification benefits that made the strategy work in the first place.

The annualized return during that period? A modest 7.3%. Not terrible, but not exactly the wealth-building engine that accredited investors are looking for.

The 60/40 Isn't Dead, It's Just Not Enough

Here's what most financial media gets wrong: the 60/40 actually bounced back hard. It posted 15%+ returns in both 2023 and 2024. Morgan Stanley's analysis of 200 years of data shows an 80% probability of positive returns in the two years following a year when both stocks and bonds decline.

So the portfolio works. It's just incomplete for sophisticated investors who have access to opportunities beyond public markets.

Think of it this way: the 60/40 is like having a solid foundation for a house. It's necessary, but if you stop there, you're living in a basement. Accredited investors are building additional floors with alternative assets that most retail investors can't access.

How Smart Money Is Adapting

Instead of abandoning the traditional mix entirely, institutional and accredited investors are doing something more nuanced: they're layering in alternatives that actually diversify.

Some are flipping the script to 40/60 (more bonds, fewer stocks) given current valuations. Vanguard made headlines suggesting this approach, pointing to high stock valuations and attractive bond yields hovering around 4.22% on 10-year Treasuries. The math suggests you can get similar returns with less volatility.

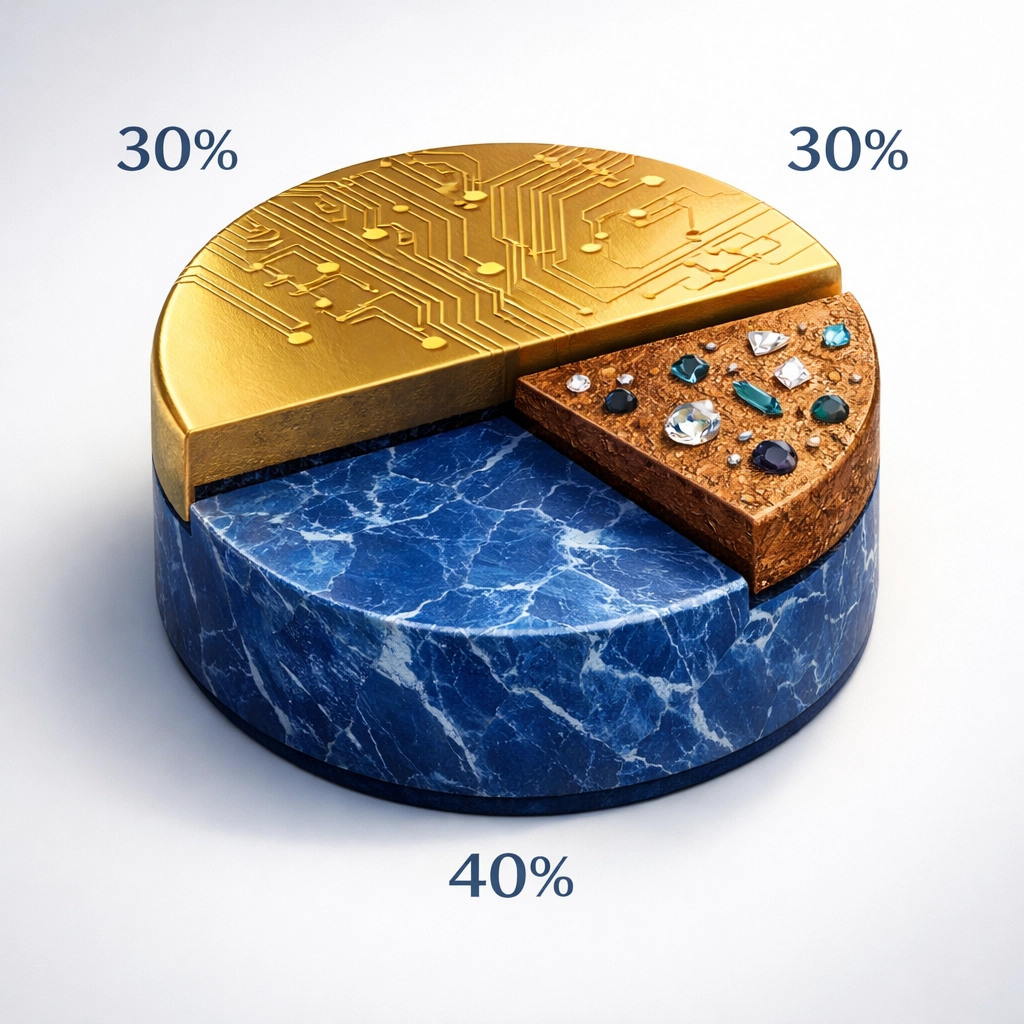

But the real innovation is happening with what we call the 40/30/30 model:

40% traditional public equities

30% alternative investments (private equity, real estate, hedge funds)

30% real assets and digital assets (commodities, real estate, Bitcoin/crypto)

This isn't just diversification for diversification's sake. It's about accessing return streams that don't move in lockstep with the S&P 500.

The Alternative Diversification Playbook

Let's break down what accredited investors are actually doing with that alternatives allocation:

Private Equity and Private Credit

Private markets offer something public markets can't: the illiquidity premium. Yes, you're locking up capital, but you're getting compensated for it. Private equity has historically delivered returns 2-3% above public equities over long time horizons. More importantly, these investments aren't subject to daily mark-to-market volatility, which can help you stay rational when public markets lose their minds.

Real Estate Syndication

Direct real estate investment through syndications provides cash flow, tax advantages, and a tangible asset that doesn't correlate perfectly with stocks. The key is accessing institutional-quality deals: office conversions, multifamily developments, industrial properties: that individual investors typically can't participate in.

Hedge Funds with Actual Risk Mitigation

Not all hedge funds are created equal, but strategies like long/short equity, global macro, and managed futures can provide genuine downside protection. The goal isn't to beat the market every year: it's to not lose 30% when the market tanks. That asymmetric risk profile is valuable.

Bitcoin and Digital Assets

This is where things get interesting. Bitcoin has matured from a speculative curiosity to an institutional asset class. With spot Bitcoin ETFs now approved and major institutions allocating 1-3% of portfolios, it's no longer a fringe bet.

The case for Bitcoin isn't that it will replace your bond allocation. It's that it provides exposure to a monetary network that's uncorrelated with traditional assets and has protection against currency debasement built into its code. Think of it as "digital gold" with better portability and verifiability.

For accredited investors, the opportunity extends beyond just holding Bitcoin. There are structured products, yield-generating strategies, and even private equity investments in blockchain infrastructure that can capture the upside of digital transformation while managing downside risk.

Building a Modern Portfolio That Actually Works

So what does this look like in practice? Here's a framework that's resonating with high-net-worth investors in 2026:

Core Holdings (40-50%) Start with a foundation of public equities and bonds, but be thoughtful about it. Consider tilting toward value stocks, dividend aristocrats, and shorter-duration bonds that won't get crushed if rates move.

Alternative Diversifiers (30-40%) This is where you layer in private equity, real estate syndications, and hedge fund strategies that have proven track records of providing downside protection or uncorrelated returns.

Real and Digital Assets (10-20%) Allocate to commodities, precious metals, and a measured Bitcoin position. This sleeve is your hedge against monetary instability and inflation surprises.

The exact percentages depend on your risk tolerance, time horizon, and liquidity needs. But the principle is the same: build a portfolio with multiple engines that don't all stall at the same time.

The Access Advantage

Here's the reality: most investors can't implement this strategy because they don't have access to institutional-quality alternative investments. Minimums are too high, due diligence is too complex, and the paperwork is overwhelming.

That's where working with an asset manager who specializes in alternative diversification makes sense. The right partner doesn't just get you into deals: they help you construct a portfolio where the pieces actually fit together.

At Mogul Strategies, we've built our approach around blending traditional assets with innovative digital strategies because that's where the opportunity is in 2026. It's not about chasing the hottest trend or abandoning time-tested principles. It's about expanding your toolkit.

The Bottom Line

Is the 60/40 portfolio dead? No. But if you're an accredited investor and that's all you're doing, you're leaving money on the table and exposing yourself to unnecessary risk.

The future of wealth building isn't about finding the one perfect portfolio allocation. It's about accessing multiple sources of return that work in different economic environments. When inflation spikes, your real assets and Bitcoin hold value. When markets crash, your hedge fund strategies provide cushion. When everything's calm, your private equity compounds quietly in the background.

That's alternative diversification. Not complicated for the sake of it: strategic because the world has changed.

Want to explore how this approach might work for your portfolio? Let's talk about building something more resilient than what worked in the 1980s.

Comments