Are Traditional Diversified Portfolios Dead? Why Accredited Investors Are Adding Bitcoin Now

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 5 days ago

- 5 min read

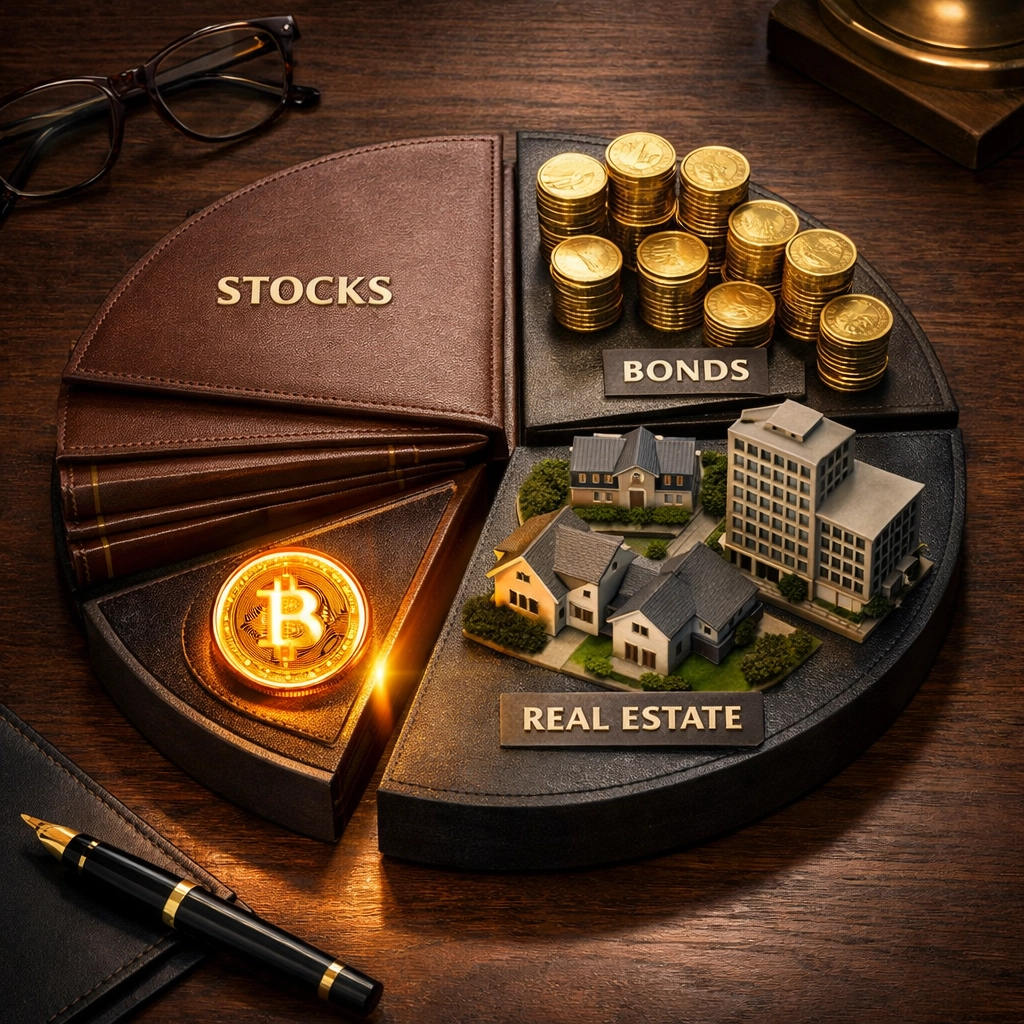

Let's get straight to the point: your "diversified" portfolio might not be as diversified as you think.

If you're an accredited investor sitting on the classic 60/40 stocks-to-bonds split, or even a more sophisticated blend of equities, high-yield credit, real estate, and private equity, you could be carrying more concentrated risk than a single tech stock position. Yeah, you read that right.

The uncomfortable truth is that traditional diversification strategies are facing an identity crisis in 2026. And smart institutional money is responding by doing something that would've seemed crazy a decade ago: adding Bitcoin to their portfolios.

The Diversification Illusion

Here's what changed. Traditional portfolio theory assumed that different asset classes would respond independently to market shocks. Stocks zig, bonds zag. Real estate does its own thing. Private equity offers uncorrelated returns.

Except that's not what happens anymore.

In today's interconnected financial system, nearly everything moves together when stress hits. Why? Because all these "different" assets share the same underlying dependencies: cheap leverage, continuous capital flows, stable trade financing, and accommodating central bank policy.

When any of these systemic conditions tighten: like we saw during the regional banking stress or when the Fed pivoted hawkish: seemingly unrelated assets suddenly correlate. Your diversified portfolio starts acting like a concentrated bet on the same macro factors.

Think about it: your public equities need low rates. Your real estate investments need cheap debt. Your private equity holdings need exit liquidity. Your high-yield bonds need refinancing markets to stay open. See the pattern?

The Concentration Problem Nobody's Talking About

Here's another wake-up call: as of 2025, just eight mega-cap companies accounted for more than 40% of the S&P 500's total return. That level of concentration actually exceeds what we saw during the late-1990s tech bubble.

If you're tracking a market-cap-weighted index: which most "diversified" portfolios do to some degree: you're essentially making a leveraged bet on a handful of tech giants. Your portfolio might hold 500 company names, but the economic reality is much more concentrated.

For accredited investors and family offices, this creates a dilemma. You can't just opt out of equities entirely. But staying fully invested in traditional allocations means accepting concentration risk that your risk models probably aren't capturing.

Enter Bitcoin: The Actually Uncorrelated Asset

This is where Bitcoin enters the conversation: and not in the way retail investors talk about it.

Institutional and accredited investors aren't adding Bitcoin because they think it's going to make them rich overnight. They're adding it because it's one of the few genuinely uncorrelated assets available at scale.

Bitcoin doesn't need:

Bank credit lines to function

Central bank accommodation to maintain value

Trade finance infrastructure to settle

Corporate earnings to justify its price

Government intervention to stay liquid

It operates on a completely separate infrastructure with different participants, different incentives, and different risk factors. When traditional financial plumbing breaks down, Bitcoin keeps processing transactions. When correlation across traditional assets spikes to 1, Bitcoin frequently moves independently.

That's not speculation: that's what institutional allocators observed during the March 2023 banking stress when Bitcoin surged while regional banks collapsed. Or when correlations tightened during liquidity crunches but Bitcoin maintained separate dynamics driven by network growth and adoption metrics.

The Allocation Question

So how much Bitcoin should an accredited investor hold?

The honest answer: it depends on your risk tolerance, time horizon, and portfolio objectives. But here's how sophisticated allocators are thinking about it in 2026.

Most institutional frameworks suggest starting with a 1-5% allocation to Bitcoin as a "portfolio insurance" position. At 1%, you get meaningful diversification benefits without material downside impact if Bitcoin underperforms. At 5%, you're making a more assertive bet on the asset class while still maintaining prudent risk management.

Some family offices and funds with longer time horizons are pushing toward 10-15%, particularly those who view Bitcoin as "digital gold 2.0": a scarce, portable, censorship-resistant store of value that could eventually capture a meaningful portion of gold's $12 trillion market cap.

The key is thinking about Bitcoin not as a growth speculation, but as a strategic hedge against the systemic fragilities built into traditional portfolios. It's portfolio construction, not gambling.

Integration Strategies That Actually Work

Adding Bitcoin to an institutional portfolio isn't as simple as clicking "buy" on an exchange. Here's how accredited investors are actually implementing this:

Regulated custody solutions: Using qualified custodians like Coinbase Custody, Fidelity Digital Assets, or Anchorage Digital that offer institutional-grade security and regulatory compliance. This isn't about self-custody with hardware wallets: it's about audit trails, insurance, and fiduciary standards.

Structured products: Some allocators prefer gaining Bitcoin exposure through futures, options, or structured notes that provide downside protection or reduce volatility through derivative overlays.

Phased accumulation: Rather than timing a single entry, many institutions dollar-cost-average over 6-12 months to smooth out price volatility and reduce implementation risk.

Rebalancing discipline: Setting clear bands for when to trim or add to Bitcoin positions based on portfolio drift, not market predictions.

The point isn't to abandon traditional diversification entirely. It's to acknowledge its limitations and complement it with assets that genuinely behave differently.

The Risks You Need to Consider

Let's be clear: Bitcoin isn't a risk-free solution. It's volatile. Regulatory frameworks continue evolving. Custody requires technical competence. And it's still a relatively young asset class with uncertain long-term outcomes.

But here's the question accredited investors are asking in 2026: Is the risk of holding Bitcoin worse than the risk of not holding it?

When your "diversified" portfolio increasingly behaves like a concentrated position on central bank policy and financial system stability, a 2-3% allocation to an uncorrelated asset starts looking less like speculation and more like prudent risk management.

Building Portfolios for 2026 and Beyond

Traditional diversification isn't dead: but it needs an upgrade. The 60/40 portfolio that worked for decades now faces structural headwinds: persistent inflation pressures, elevated valuations, geopolitical fragmentation, and technological disruption that concentrates rather than distributes returns.

Smart allocators are responding by expanding their definition of diversification beyond traditional asset classes. That means looking at international exposure beyond mega-cap U.S. growth stocks. It means active management of interest-rate and credit risk within fixed income. It means alternatives that genuinely provide alternative risk exposures.

And increasingly, it means adding Bitcoin as a strategic allocation that provides true uncorrelated returns in a world where correlation itself has become a systemic risk.

At Mogul Strategies, we help accredited investors navigate these transitions with portfolios that blend traditional asset management discipline with innovative exposure to digital assets. Because in 2026, the biggest risk might not be what you own: it's owning the same thing as everyone else without realizing it.

Comments