How to Blend Private Equity, Bitcoin, and Real Estate in 5 Strategic Steps (Easy Guide for High-Net-Worth Portfolios)

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 5 days ago

- 5 min read

If you're managing serious wealth, you've probably noticed something: traditional 60/40 portfolios aren't cutting it anymore. Bonds barely beat inflation, and public equities swing wildly with every Fed announcement.

The solution? Blend three powerful asset classes that don't move in lockstep: private equity, Bitcoin, and real estate. Each brings something different to the table. Private equity delivers operational growth and exit multiples. Real estate generates steady cash flow and tangible value. Bitcoin offers asymmetric upside and portfolio insurance against currency debasement.

Here's how to combine them strategically without overcomplicating your life.

Step 1: Start With Your Core Allocation Framework

Before you invest a single dollar, you need a framework. Random allocation is how portfolios blow up.

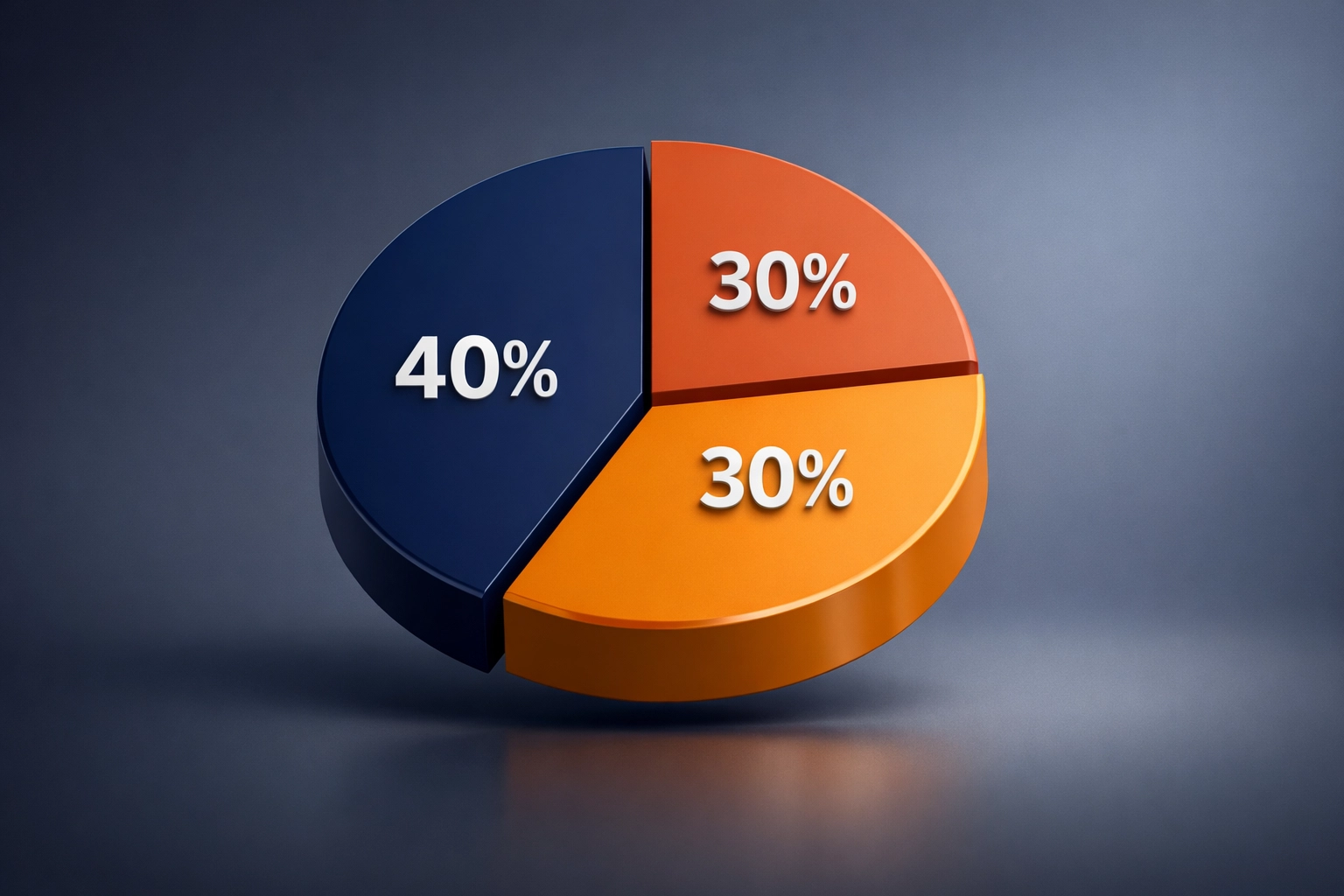

A solid starting point for high-net-worth investors: 40% Private Equity, 30% Real Estate, 30% Bitcoin and Liquid Assets. This isn't a rigid rule: it's a template you adjust based on your risk tolerance, liquidity needs, and investment timeline.

Why this breakdown works:

Private equity gets the largest allocation because it offers the best risk-adjusted returns over 7-10 year horizons. You're buying established businesses at reasonable valuations, improving operations, and exiting at higher multiples. Real estate provides the income stream that keeps your lifestyle funded while your illiquid investments mature. Bitcoin caps at 30% because despite its upside potential, it's still volatile enough to wreck your sleep if you're overexposed.

The key is rebalancing annually. If Bitcoin rips 200% in a year, you trim and redeploy into private equity deals or real estate opportunities. This forces you to sell high and buy low: the only strategy that actually works long-term.

Step 2: Layer Private Equity for Growth and Cash Flow

Private equity isn't just for Yale's endowment anymore. As an accredited investor, you can access PE funds, co-investment opportunities, and direct deals that generate 15-25% IRRs.

Focus on three PE strategies:

Growth equity targets established companies scaling revenue from $10M to $100M+. You're not betting on startups surviving: you're backing proven business models that need capital to expand. Think software companies acquiring competitors or manufacturing businesses entering new markets.

Buyout funds acquire mature companies with stable cash flows, optimize operations, and exit in 5-7 years. These generate steady distributions while your investment compounds. Look for funds with strong operational expertise, not just financial engineering.

Private credit fills the gap between traditional bank lending and equity. You're essentially the bank, earning 8-12% yields on secured loans to mid-market companies. This strategy kicks off quarterly income while your growth equity positions mature.

The magic happens when you combine these approaches. Growth equity and buyouts deliver the home runs. Private credit provides the base hits that fund your lifestyle and smooth out cash flow timing.

Step 3: Use Real Estate as Your Stability Anchor

Real estate is the boring middle child of this portfolio: and that's exactly why you need it. While private equity locks up capital for years and Bitcoin gyrates 30% monthly, real estate steadily deposits rent checks into your account.

Two real estate strategies actually work for this blend:

Commercial syndications pool investor capital to acquire apartment complexes, office buildings, or industrial warehouses. You invest $50K-$500K per deal, collect quarterly distributions (typically 6-8% annually), and capture appreciation when the property sells in 5-7 years. The sponsor handles property management: you just collect checks.

Debt funds let you become the lender on real estate projects. Rather than owning the property, you fund construction or bridge loans at 9-11% interest. Your capital is secured by the property itself, you receive monthly interest payments, and you avoid tenant headaches entirely.

Here's the strategic move most investors miss: use your real estate cash flow to accumulate Bitcoin. Instead of spending every distribution check, automatically funnel 30-50% into Bitcoin purchases. This dollar-cost-averages you into Bitcoin over time using income you didn't need, avoiding the psychological torture of timing a lump sum investment.

Grant Cardone demonstrates this approach perfectly: he leverages stable real estate yields to systematically accumulate Bitcoin without liquidating his core holdings. You get real estate's stability plus Bitcoin's upside without forced choices.

Step 4: Add Bitcoin for Asymmetric Upside and Portfolio Insurance

Bitcoin is the most misunderstood asset in this blend. It's not a "get rich quick" speculation: it's portfolio insurance against monetary debasement and a call option on the future of money.

With only 21 million coins ever existing and increasing institutional adoption, Bitcoin offers something traditional assets can't: provable scarcity in an era of unlimited money printing. When the Fed expands the money supply by trillions, your Bitcoin allocation holds its value because no one can create more.

Three ways to integrate Bitcoin strategically:

Direct allocation: Simply allocate 15-30% of your portfolio to Bitcoin held in secure custody. This gives you pure exposure to price appreciation without complexity. Use a reputable custodian: losing your private keys means permanently losing your wealth.

Use Bitcoin as collateral: Some lenders now allow you to borrow against Bitcoin holdings at 50% loan-to-value ratios. You can fund real estate investments or private equity commitments without selling Bitcoin and triggering capital gains taxes. This preserves your upside in both assets simultaneously.

Staged accumulation: Rather than investing everything at once, commit to buying $X worth of Bitcoin monthly from your real estate distributions. This removes emotion from the equation and averages your entry price across market cycles.

The critical rule: never use leverage to buy Bitcoin. Only deploy capital you won't need for 5+ years. Bitcoin can drop 50% in months: if you're forced to sell during drawdowns, you've destroyed wealth instead of building it.

Step 5: Create Synergies Between Asset Classes

This is where the portfolio becomes more than the sum of its parts. Smart investors don't just hold these assets separately: they create strategic connections that compound returns.

Cross-collateralization strategies: Use Bitcoin as collateral for real estate down payments, preserving your upside in both assets. Or borrow against real estate equity to fund private equity co-investments when exceptional deals emerge.

Tax optimization: Private equity losses can offset Bitcoin gains in the same tax year. Real estate depreciation shelters income from other sources. Coordinate with your CPA to harvest losses strategically and defer gains using opportunity zones or 1031 exchanges.

Liquidity laddering: Structure your portfolio so capital becomes available in stages. Keep 10-15% in liquid Bitcoin for emergencies. Have real estate distributions cover living expenses. Time private equity commitments so exits happen in different years, avoiding forced selling during market dislocations.

Hybrid opportunities: Some funds now offer exposure to all three asset classes in a single vehicle. Mogul Strategies, for example, structures portfolios that blend institutional-grade Bitcoin integration with traditional private equity and real estate opportunities, handling the complexity so you don't have to.

The biggest synergy? Counter-cyclical rebalancing. When Bitcoin surges, you trim and deploy into cheap private equity deals. When real estate corrects, you redeploy maturing PE distributions into discounted properties. This systematic approach forces you to buy fear and sell greed: the only reliable edge in investing.

The Reality Check

This strategy isn't for everyone. You need significant capital ($500K+ investable), a long time horizon (7-10 years minimum), and the temperament to watch Bitcoin drop 40% without panic-selling.

You'll also need access to quality deal flow. Private equity minimums often start at $250K. Real estate syndications require accreditation. Bitcoin custody demands technical competence or expensive custodial services.

But if you meet these requirements, blending private equity, Bitcoin, and real estate offers something rare: a portfolio that generates current income, captures growth, and hedges against monetary chaos: all while reducing correlation to public markets.

The institutions already do this. Yale's endowment has been blending alternatives for decades. Sovereign wealth funds are accumulating Bitcoin. Family offices are restructuring around these exact strategies.

The only question is whether you'll join them or stick with outdated 60/40 portfolios while inflation silently erodes your purchasing power.

If you want to explore how these strategies might work for your specific situation, Mogul Strategies specializes in helping high-net-worth investors navigate exactly these types of alternative asset allocations.

Comments