How to Build an Institutional-Grade Portfolio in 5 Steps (Bitcoin, Private Equity & Real Estate Included)

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Feb 1

- 5 min read

Building a portfolio that performs like the big institutional players isn't just about throwing money at stocks and bonds anymore. The landscape has changed. Bitcoin is sitting in corporate treasuries, private equity is driving innovation, and real estate continues to generate consistent cash flow.

If you're an accredited investor looking to build something that actually withstands market chaos, you need a structured approach. Here's how institutional investors are doing it in 2026.

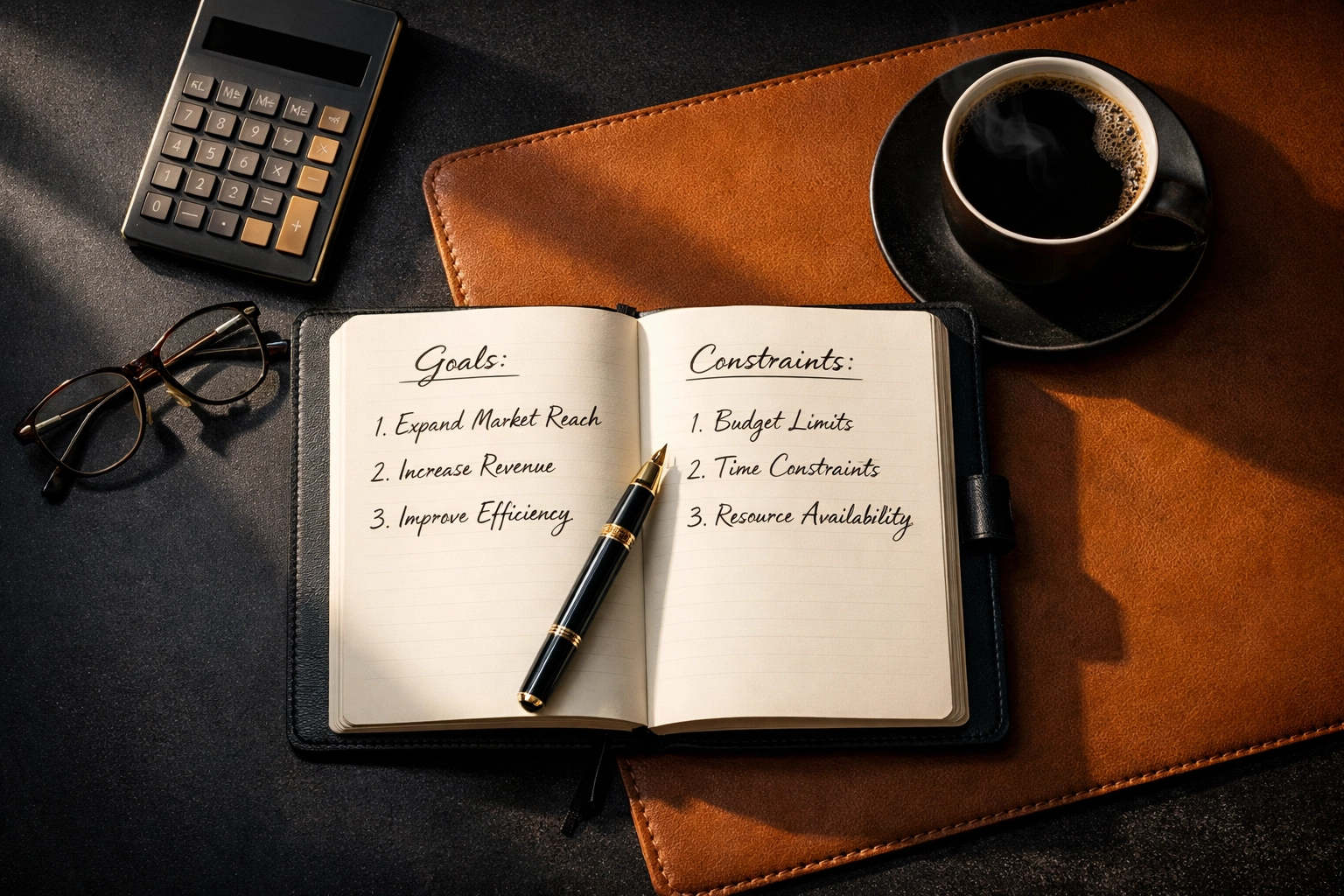

Step 1: Define Your Investment Mandate and Risk Boundaries

Before you touch a single asset, you need to get crystal clear on what you're actually trying to accomplish. This isn't about vague goals like "grow my wealth" or "beat the market." Institutional investors start with specific mandates.

Ask yourself these questions:

What's your actual risk tolerance when markets drop 30% in a month?

How much liquidity do you need on hand for emergencies or opportunities?

What's your investment horizon: five years, ten years, longer?

Are there any regulatory or personal constraints on what you can invest in?

Here's the thing: most people skip this step and jump straight to picking assets. That's backwards. Your mandate dictates everything else. If you need liquidity in the next two years, locking up capital in a seven-year private equity fund doesn't make sense, no matter how attractive the returns look.

Document your constraints. Write them down. This becomes your north star when markets get volatile and every financial advisor is pitching you the "next big thing."

Step 2: Understand How Each Asset Actually Functions in Your Portfolio

This is where most investors go wrong. They look at Bitcoin and see "high return potential." They look at real estate and see "steady income." But that's surface-level thinking.

Institutional portfolios assign specific roles to each asset class:

Bitcoin and Digital Assets: These function as asymmetric return generators with portfolio insurance characteristics. In simple terms, Bitcoin's low correlation to traditional assets means when stocks zig, Bitcoin might zag. It's also emerging as a hedge against currency debasement and monetary policy uncertainty.

Private Equity: This is your growth engine. Private equity historically outperforms public markets over longer time horizons because you're capturing the illiquidity premium. You're also getting access to companies before they go public: where real value creation happens.

Real Estate: This is your inflation hedge and cash flow generator. Quality real estate syndications provide quarterly distributions while your equity appreciates. When inflation spikes, rents go up. Your purchasing power stays protected.

Traditional Stocks and Bonds: These provide liquidity, baseline growth, and stability. They're not sexy, but they're the foundation that lets you take calculated risks elsewhere.

The key insight is that you're not building a collection of individual investments. You're building a system where each component has a job. When one asset underperforms, another should be positioned to compensate.

Step 3: Select Managers and Strategies That Actually Diversify

Here's a mistake even sophisticated investors make: they diversify across asset classes but not across strategies. You could own Bitcoin, private equity, and real estate, but if all your managers are making the same macro bets, you're not actually diversified.

When selecting where to deploy capital, focus on:

Different Investment Approaches: If your private equity allocation is all venture capital, you're concentrated in early-stage risk. Mix in growth equity or buyout funds. For real estate, combine value-add opportunities with stable income properties.

Geographic Diversification: Don't just invest in U.S. assets. Consider international exposure where regulatory frameworks support institutional investors.

Correlation Analysis: This gets technical, but it matters. During the 2022 drawdown, many "diversified" portfolios all moved in the same direction because correlations spiked. Look for managers whose strategies actually behave differently during stress periods.

For Bitcoin specifically, consider both direct holdings and exposure through funds that employ active risk management. The asset is volatile enough that pure buy-and-hold might not align with institutional risk budgets.

The research process here should be rigorous. Review track records, understand the manager's edge, and evaluate their risk controls. At Mogul Strategies, we spend months vetting opportunities before deploying a single dollar.

Step 4: Allocate Capital Based on Risk Contribution, Not Just Dollar Amounts

This is where institutional thinking diverges sharply from retail investing. It's not about saying "I'll put 10% in Bitcoin, 20% in private equity, and 30% in real estate." It's about understanding how much risk each allocation contributes to your total portfolio.

Here's why this matters: a 5% Bitcoin allocation might contribute 25% of your portfolio's total volatility. A 30% allocation to stable real estate might only contribute 10% of your risk. If you're only looking at dollar amounts, you're flying blind.

The 40/30/30 Framework (Adapted for Alternative Assets):

A modern institutional portfolio might look something like this:

40% Traditional Assets (stocks, bonds, cash equivalents for liquidity and stability)

30% Private Markets (private equity, venture capital, private credit)

30% Real Assets & Alternatives (real estate, infrastructure, commodities, and Bitcoin/digital assets)

But within that 30% alternatives bucket, you're risk-budgeting. Maybe Bitcoin gets a 3-5% nominal allocation but you're sizing it knowing it's more volatile. Real estate might get 20% because it's less volatile and provides income stability.

Use stress testing to understand how your portfolio would perform in different scenarios: a 2008-style credit crisis, a 1970s inflation spike, a technology bubble burst. Institutional investors run these scenarios constantly and rebalance when risk contributions drift too far from targets.

Step 5: Implement Disciplined Monitoring and Rebalancing

Building the portfolio is just the beginning. The real work is maintaining it. Markets move, correlations shift, and what was balanced six months ago might be completely out of whack today.

Set up a systematic rebalancing framework with clear triggers:

Time-Based Rebalancing: Review your portfolio quarterly at minimum. Annually reassess your overall strategy and whether your original mandate still holds.

Threshold-Based Rebalancing: If any asset class drifts more than 5% from its target allocation, that triggers a rebalancing review. If Bitcoin rallies from 5% to 12% of your portfolio, you're probably overexposed to that risk.

Liquidity Management: With illiquid assets like private equity and certain real estate funds, you can't rebalance instantly. Plan your liquidity needs years in advance. This is called "pacing strategy" in institutional investing: staggering your commitments so capital calls and distributions balance out over time.

The monitoring process should also include regular manager reviews. Are your private equity managers still executing their stated strategy? Is your real estate syndication hitting its distribution targets? Are there warning signs in their portfolio companies or properties?

The Integration Challenge: Making It All Work Together

The hardest part of building an institutional-grade portfolio isn't picking individual assets: it's making them work together as a cohesive system. Bitcoin's volatility needs to be offset by stable real estate income. Private equity's illiquidity needs to be balanced with liquid traditional holdings.

This is where having a clear framework becomes non-negotiable. When Bitcoin crashes 40%, you need the discipline to rebalance into it, not panic sell. When private equity is generating 25% returns, you need the discipline to take profits and rebalance, not get greedy.

The institutions that outperform aren't smarter about picking assets. They're more disciplined about following their process. They defined their mandate upfront, they understand each asset's role, they selected quality managers, they allocated based on risk, and they stick to their rebalancing rules.

That's the advantage you can replicate. You don't need billions under management. You need a framework, discipline, and access to quality opportunities across asset classes.

Building an institutional-grade portfolio in 2026 means embracing complexity while keeping your process simple. The five steps outlined here: define your mandate, assign asset roles, select quality managers, risk-budget your allocations, and maintain discipline through monitoring: are exactly what institutional investors do with billions.

The difference is you can move faster, take advantage of opportunities they can't access, and build something tailored to your specific situation. If you're ready to move beyond basic stock-and-bond portfolios and into institutional-grade investing, these five steps are your roadmap.

Comments