Long-Term Wealth Management in 2026: Why Diversified Portfolio Strategies Now Include Institutional-Grade Digital Assets

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 4 days ago

- 5 min read

Let's talk about something that would've sounded crazy just five years ago: institutional wealth managers are now actively recommending Bitcoin and other digital assets as part of long-term portfolio strategies. Not as a speculative side bet, but as a legitimate asset class sitting alongside bonds, real estate, and private equity.

If you're managing significant wealth: whether for yourself, your family, or your institution: you've probably noticed this shift. The question isn't whether digital assets belong in your portfolio anymore. It's how much, which ones, and how to access them at institutional grade.

The Diversification Game Has Changed

Traditional diversification used to be straightforward: split your holdings between stocks and bonds, maybe add some real estate, and call it a day. The classic 60/40 portfolio was the gold standard for decades.

But 2026 looks different. Interest rates have been on a rollercoaster. Geopolitical tensions continue to create market volatility. And perhaps most importantly, an entirely new asset class has matured enough to warrant serious consideration from wealth managers who previously dismissed it.

Modern diversification strategies are moving toward more sophisticated models. We're seeing approaches like the 40/30/30 allocation gaining traction: 40% in traditional equities, 30% in alternative assets (including digital), and 30% in fixed income and cash equivalents. The exact percentages shift based on risk tolerance and market conditions, but the principle remains: true diversification means looking beyond traditional categories.

Why Institutional-Grade Digital Assets Are Different

Here's where we need to be specific. When we talk about adding digital assets to wealth management portfolios, we're not talking about trading meme coins on your phone at 2am. We're talking about institutional-grade infrastructure, custody solutions, and regulatory compliance that makes these assets appropriate for serious wealth preservation.

What makes a digital asset "institutional-grade"? Several factors:

Custody solutions that meet the same security standards as traditional assets. This means regulated custodians, insurance coverage, and multi-signature protocols that prevent single points of failure.

Regulatory compliance has come a long way. ETFs, regulated exchanges, and transparent reporting now exist in ways they simply didn't a few years ago. The wild west days are fading, replaced by frameworks that institutional investors can actually work within.

Market maturity means deeper liquidity, more stable price discovery, and infrastructure that can handle large transactions without moving markets. Bitcoin, for instance, now has a market cap large enough that institutional allocations don't create the same price impact they would have in 2020.

Professional management options exist now that didn't before. Accredited investors can access digital assets through fund structures, separate accounts, and managed products that provide professional oversight.

The Case for Digital Assets in Long-Term Portfolios

So why are wealth managers actually recommending these allocations now? The reasons are both defensive and opportunistic.

From a defensive standpoint, digital assets: particularly Bitcoin: have demonstrated low correlation with traditional asset classes over time. When stocks zig, Bitcoin doesn't automatically zag, but it doesn't necessarily zig either. For portfolio construction, that lack of correlation is valuable. It means you're not just duplicating risk you already have.

The inflation hedge argument has merit too, though it's more nuanced than early advocates suggested. Bitcoin's fixed supply and decentralized nature provide characteristics that can serve as a hedge against currency debasement: not perfectly, not immediately, but as part of a broader strategy.

From an opportunistic angle, we're still relatively early in the adoption curve for institutional digital asset allocation. Many pension funds, endowments, and family offices are just now building their first positions. As this trend continues, there's potential for appreciation that goes beyond just speculation.

Beyond Bitcoin: The Broader Digital Asset Landscape

While Bitcoin gets most of the attention: and rightfully so as the most established digital asset: institutional portfolios are also considering other categories:

Ethereum has established itself as the infrastructure for decentralized applications and smart contracts. It's less about payments and more about providing the backbone for a new kind of programmable finance.

Stablecoins are being used for settlement and liquidity management. They're not growth investments, but they provide utility within digital asset strategies, especially for institutions that want to move capital efficiently.

Tokenized real-world assets represent another frontier. We're starting to see everything from real estate to private equity shares tokenized on blockchain infrastructure. This isn't widespread yet, but the trend is accelerating.

The key is selectivity. Not every digital asset deserves a place in a wealth preservation strategy. Institutional approaches focus on assets with clear use cases, robust infrastructure, and realistic paths to continued adoption.

Integration with Traditional Assets

The magic happens when you think about digital assets not as replacements for traditional holdings, but as complements to them. Here's what sophisticated portfolio construction looks like in 2026:

Core traditional holdings still form the foundation: public equities, investment-grade bonds, and real estate. These provide stability, income, and exposure to economic growth.

Alternative assets add diversification and return enhancement: private equity, hedge funds, commodities, and infrastructure investments. This is where many portfolios have found their edge over the years.

Strategic digital allocation rounds out the mix: typically 3-10% for conservative institutional investors, potentially more for those with higher risk tolerance. This allocation captures the unique characteristics of digital assets without creating undue risk.

Quarterly rebalancing has become standard practice rather than annual reviews. Markets move faster now, and digital assets in particular can experience meaningful swings that require periodic adjustment to maintain target allocations.

Risk Mitigation Strategies

Let's be honest: digital assets introduce risks that require active management. Volatility is the obvious one, but there are others: regulatory uncertainty, technology risks, custody concerns, and market infrastructure that's still evolving.

Smart wealth management approaches mitigate these risks through several mechanisms:

Position sizing keeps digital assets at levels where even significant drawdowns won't imperil the broader portfolio. A 5% allocation that drops 50% is a 2.5% portfolio impact: meaningful but manageable.

Staged entry spreads purchases over time rather than committing capital all at once. This averages out entry prices and prevents the psychological damage of buying at a peak.

Multiple custody solutions reduce single-point-of-failure risk. Serious institutional allocations often split holdings across multiple regulated custodians.

Regular reporting and reconciliation ensures you always know what you own and where it sits. This sounds basic, but custody practices in digital assets require more active verification than traditional securities.

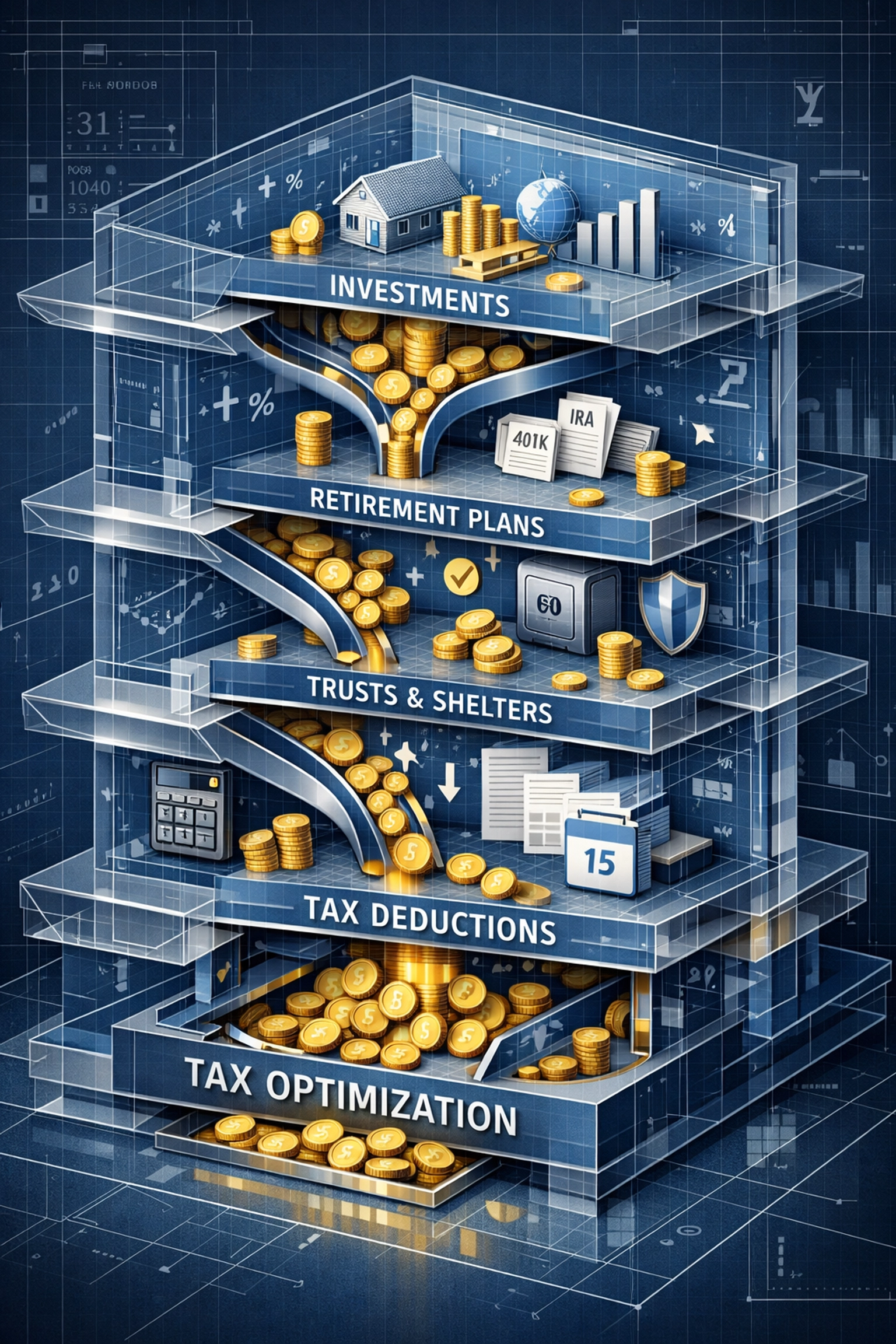

Tax Optimization in the Digital Age

Digital assets introduce specific tax considerations that wealth managers need to address. Every trade can create a taxable event. Holding periods matter for capital gains treatment. And different jurisdictions treat digital assets differently.

Strategic approaches include:

Using tax-advantaged accounts where possible for digital asset exposure

Harvesting losses to offset gains elsewhere in the portfolio

Being thoughtful about rebalancing timing to optimize holding periods

Structuring investments through entities that provide flexibility

These aren't exotic strategies: they're the same tax-aware wealth management principles applied to a new asset class.

Looking Forward

The integration of institutional-grade digital assets into diversified portfolios isn't a fad or a temporary trend. It reflects the maturation of an entirely new asset class and the infrastructure needed to access it professionally.

For accredited investors and institutions, the question in 2026 isn't whether to consider digital assets, but how to implement them thoughtfully within a broader wealth preservation strategy. This requires working with advisors who understand both traditional portfolio construction and the nuances of digital asset allocation.

The portfolios that will thrive over the next decade won't be the ones that ignore digital assets entirely, nor the ones that go all-in. They'll be the portfolios that find the right balance: maintaining the stability and income generation of traditional assets while capturing the diversification and growth potential that institutional-grade digital assets can provide.

At Mogul Strategies, we specialize in exactly this kind of integrated approach: blending time-tested wealth management principles with innovative digital strategies. Because in 2026, sophisticated portfolio management means having expertise across the full spectrum of modern investment opportunities.

The future of wealth management isn't traditional OR digital. It's traditional AND digital, implemented with institutional discipline and long-term perspective.

Comments