Looking For Exclusive Investment Opportunities? Here Are 10 Things Accredited Investors Should Know About Alternative Asset Allocation

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 6 days ago

- 4 min read

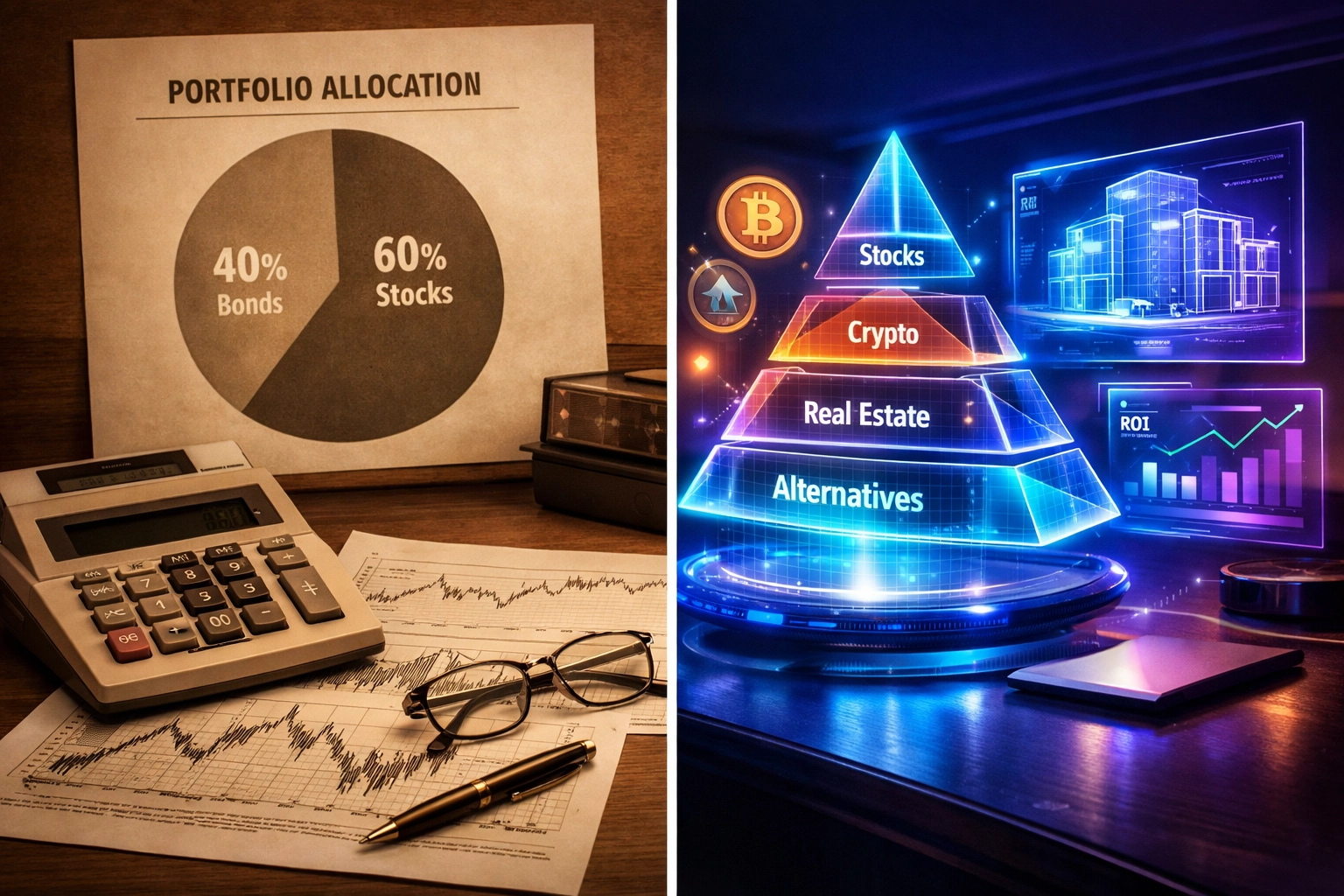

If you're an accredited investor, you've probably noticed that the traditional investment playbook isn't working like it used to. The 60/40 stock-bond split that financial advisors have recommended for decades? It's showing cracks. And with market volatility becoming the new normal, more sophisticated investors are looking beyond public markets for opportunities that can actually move the needle.

Alternative investments: from private equity to real estate syndications: are no longer just for institutional players or ultra-high-net-worth families. They're becoming essential tools for anyone serious about building wealth that can weather different market conditions.

But here's the thing: alternative asset allocation isn't as straightforward as buying an index fund. It requires a different mindset, more planning, and a solid understanding of what you're getting into. Let's break down the ten most important things you need to know.

1. Alternatives Give You True Diversification

When the stock market drops, your bonds are supposed to go up, right? Except that relationship hasn't been as reliable lately. Public markets have become increasingly correlated, meaning when stocks take a hit, almost everything else in your traditional portfolio follows.

Alternative investments like private equity, private credit, and real estate move to their own beat. They generate income streams that don't necessarily care what the S&P 500 did yesterday. That's the kind of diversification that actually protects your wealth when markets get choppy.

2. The 60/40 Portfolio Isn't Built for Today's Market

Let's be honest: we're not living in our parents' investment world anymore. Inflation volatility is back. Interest rates are unpredictable. The stock-bond correlation that made the 60/40 portfolio work? It's broken.

If you want superior risk-adjusted returns in 2026, you need to think beyond traditional allocations. Alternatives aren't just a "nice to have" anymore: they're becoming a necessity for investors who want to maintain and grow their wealth.

3. Start With at Least 5% to Make It Worth Your Time

Alternative investments come with higher fees and more complexity than buying a mutual fund. That's just the reality. So if you're going to dip your toe in, make sure it's worth the effort.

Most advisors recommend allocating at least 5% of your portfolio to alternatives. Below that threshold, you're paying for complexity without getting meaningful diversification benefits. Once you understand the space, many accredited investors push that allocation to 20% or more.

4. Different Alternatives Serve Different Purposes

"Alternative investments" is a broad category. It includes private equity, private credit, hedge funds, real estate syndications, direct lending, commodities, and more. Each serves a different purpose in your portfolio.

Want uncorrelated income? Look at private credit. Seeking higher long-term returns? Private equity might be your answer. Need stability and consistent cash flow? Real estate syndications could fit the bill. The key is matching the right alternative asset class to your specific goals.

5. Be Clear About What You're Trying to Accomplish

This might sound obvious, but you'd be surprised how many investors jump into alternatives without a clear strategy. Are you looking for higher returns? Protection against inflation? Income that doesn't depend on stock market performance?

Your goals should drive your allocation decisions. A 40-year-old building wealth needs a different strategy than a 65-year-old protecting assets. Outcome-driven portfolio construction means starting with the end in mind and working backwards.

6. Real Estate Syndications Offer Steady Returns in Any Market

Here's something people often overlook: everyone needs a place to live, regardless of what's happening in the stock market. That's what makes multifamily real estate syndications so attractive.

These investments pool capital from multiple accredited investors to acquire professionally managed apartment communities. You get ongoing cash flow from rental income plus potential appreciation when the property is eventually sold. And because housing demand persists through economic cycles, these investments tend to be more stable than many other alternatives.

7. Plan Your Liquidity Carefully

Unlike stocks you can sell tomorrow, most alternative investments lock up your capital for years. Private equity funds might have 7-10 year terms. Real estate syndications typically run 5-7 years. You can't just cash out when you need money for something else.

That's why cash flow planning is critical. You need to maintain enough liquidity in traditional investments to handle your near-term needs while allocating to alternatives for long-term growth. Set realistic annual commitment targets and pace your investments so you're not overextended.

8. Portfolio Construction Gets More Complex

Building a portfolio with alternatives isn't like rebalancing a mix of stock and bond funds. It requires more sophisticated approaches to account for illiquidity, different return patterns, and the unique characteristics of each asset class.

Effective frameworks incorporate techniques like alpha-beta separation, return unsmoothing (because many alternatives report smoothed returns), and long-horizon risk estimation. This is where working with experienced advisors who understand these nuances becomes valuable.

9. Manager Selection Can Make or Break Your Returns

In public markets, picking the right index fund is pretty straightforward. In alternatives, manager selection is everything. The difference between a top-quartile and bottom-quartile private equity manager can be 10-15% annual return: or more.

This is why rigorous due diligence matters. You want advisors who have established processes for researching and vetting managers, understanding their strategies, and monitoring their performance over time. Institutional-quality manager selection significantly improves your odds of success.

10. Measure Success Against Your Goals, Not Just Benchmarks

Here's where many investors get tripped up: they try to measure their alternative investments against standard market benchmarks, which doesn't really make sense. A private real estate fund isn't trying to beat the S&P 500: it's trying to deliver stable income and appreciation with low correlation to public markets.

Monitor your alternative investments relative to the specific goals you set for them. Are they providing the diversification you wanted? The income stream you expected? The downside protection you needed? That's what matters.

Building a Smarter Portfolio

Alternative investments aren't magic, and they're not right for everyone. But for accredited investors who understand the trade-offs and have the patience to let these strategies work, they're powerful tools for building more resilient portfolios.

The key is approaching alternatives with clear goals, adequate planning, and the right expertise. Whether you're integrating private equity for growth, real estate for income, or Bitcoin for portfolio innovation, each piece should serve a specific purpose in your overall wealth strategy.

At Mogul Strategies, we help accredited and institutional investors navigate these complex decisions, blending traditional assets with innovative strategies to build portfolios that can thrive in any market environment.

The investment landscape is changing. The question is: are you positioned to take advantage of the opportunities that most investors never see?

Comments