The 40/30/30 Diversified Portfolio Framework: Why Institutional Investors Are Rethinking Traditional Allocation

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 4 days ago

- 5 min read

The 60/40 portfolio has been the gold standard for decades. Sixty percent stocks, forty percent bonds: simple, elegant, and effective. Until it wasn't.

If you're managing institutional capital or overseeing significant wealth, you've probably noticed something troubling: the traditional diversification playbook is breaking down. 2022 was a wake-up call when both stocks and bonds tanked simultaneously, leaving investors with nowhere to hide. That's not supposed to happen.

Enter the 40/30/30 portfolio framework: a modern allocation strategy that's gaining serious traction among institutional investors who refuse to keep doing the same thing while expecting different results.

Why 60/40 Is Losing Its Edge

Here's the uncomfortable truth: stocks and bonds are increasingly moving together during periods of rising inflation and interest rates. The negative correlation that made 60/40 work so well? It's disappearing when you need it most.

The problem isn't that 60/40 was ever a bad strategy. It's that the market environment has fundamentally changed. We're dealing with inflation dynamics, interest rate volatility, and geopolitical uncertainty that the old framework wasn't designed to handle.

When both asset classes decline at the same time, you're not diversified: you're just exposed in two different ways.

Understanding the 40/30/30 Framework

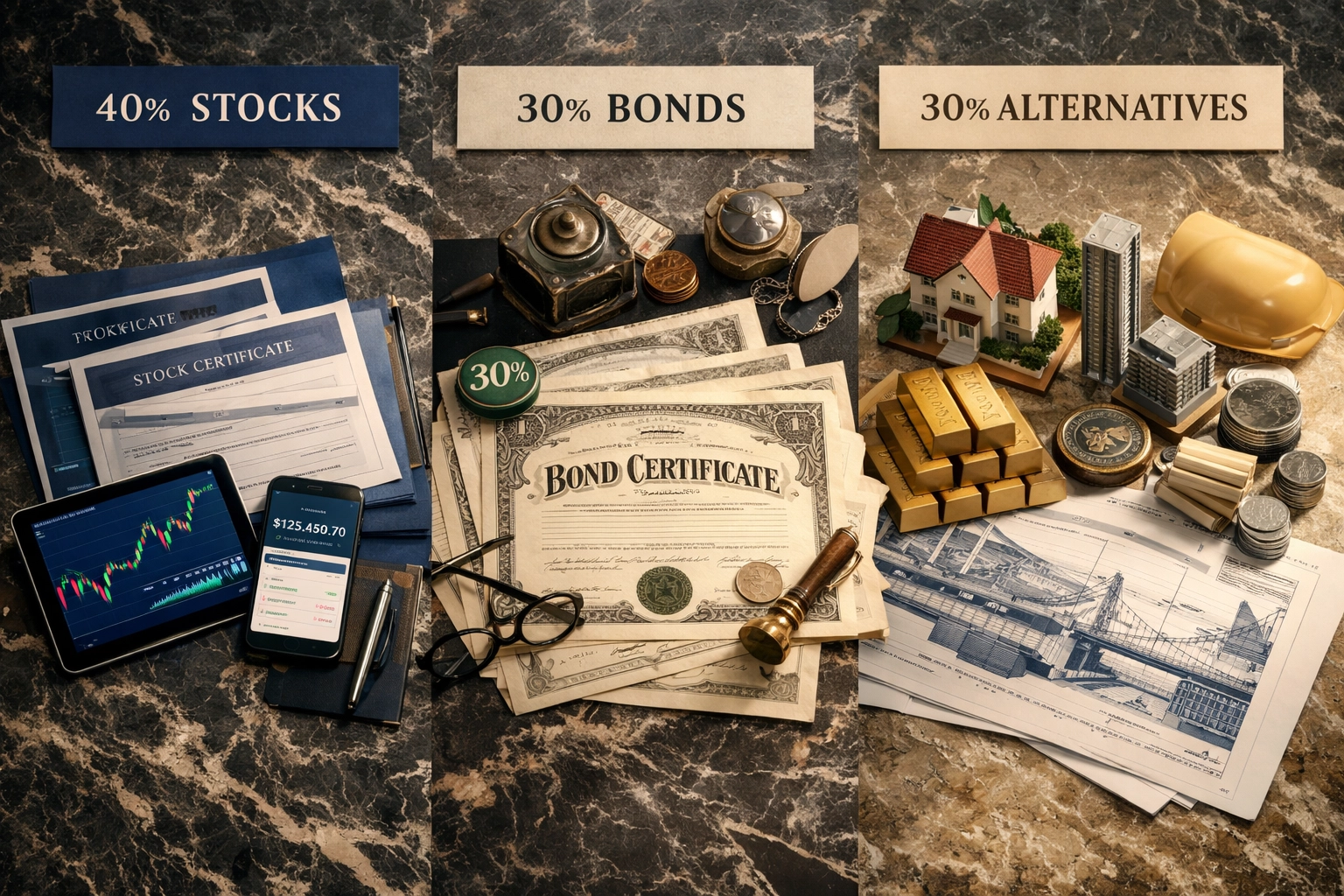

The 40/30/30 allocation breaks down like this:

40% Public Equities: Still the growth engine, but with reduced concentration risk

30% Fixed Income: Maintaining stability and income generation

30% Alternative Investments: The game-changer that provides true diversification

This isn't about chasing returns or getting fancy for the sake of complexity. It's about building multiple layers of protection into your portfolio instead of relying solely on the traditional stock-bond relationship.

The key insight? By introducing a third asset class with non-correlated exposures, you can actually reduce portfolio risk while potentially enhancing returns. That's not a trade-off: that's an upgrade.

The Performance Case for 40/30/30

Let's talk numbers, because theory only goes so far.

KKR's analysis shows that the 40/30/30 portfolio has the potential to deliver better returns while reducing risk across most macroeconomic scenarios. Not just in bull markets: across different environments.

J.P. Morgan's research found that adding a 25% allocation to alternatives can improve traditional 60/40 returns by 60 basis points. That might not sound massive, but it represents an 8.5% enhancement to projected returns. Over time, that compounds significantly.

More importantly, look at risk-adjusted performance. Data shows that 40/30/30 portfolios have achieved a Sharpe ratio of 0.71 versus 0.56 for traditional 60/40 allocations. That means you're getting better returns per unit of risk taken: which is what sophisticated investing is really about.

Mercer's modeling went even further, testing multiple scenarios and finding that client outcomes improved across all of them when transitioning from 60/40 to 40/30/30 portfolios. Not some scenarios. All of them.

What Goes Into That 30% Alternatives Sleeve?

This is where strategy gets interesting: and personal. The 30% alternatives allocation isn't a monolithic block. It's a diversified portfolio within your portfolio.

For institutional investors, KKR recommends splitting the alternatives sleeve equally among:

Private Credit (10%): Providing income with lower correlation to public markets

Real Estate (10%): Inflation protection and tangible asset exposure

Infrastructure (10%): Long-term cash flows with defensive characteristics

But that's just one approach. Depending on your objectives, risk tolerance, and market outlook, your alternatives allocation might include:

Private equity for long-term growth

Hedge fund strategies (long-short, market-neutral)

Commodities for inflation hedging

Return amplifiers like 130-30 funds

The point isn't to follow a rigid formula. It's to construct an alternatives allocation that aligns with your specific goals while providing genuine diversification from traditional public markets.

Why Institutional Money Is Making the Move

If you're wondering whether this is just theoretical portfolio construction or actual capital in motion: it's the latter.

Institutional investors aren't making this shift because it looks good in a pitch deck. They're doing it because the alternative is accepting suboptimal outcomes in an environment where every basis point matters.

The traditional 60/40 worked brilliantly when bonds provided a reliable diversification benefit. But when inflation surges or rates spike, that benefit evaporates. Institutions need portfolio construction that can handle multiple economic scenarios without relying on a single diversification relationship.

Beyond just risk management, there's an opportunity cost consideration. With alternatives historically providing returns that can exceed public equities with different risk profiles, leaving that 30% in bonds during certain market environments means leaving returns on the table.

The Real-World Trade-Offs

Let's be honest about the downsides, because there's no perfect portfolio allocation.

Higher fees are reality number one. Alternative investments typically carry higher management fees and potential performance fees. You need to factor this into your return expectations and determine whether the net benefit justifies the cost.

Complexity is reality number two. Manager selection in alternatives requires significantly more due diligence than buying an index fund. You're evaluating track records, strategies, team stability, and operational infrastructure. It takes time and expertise.

Liquidity constraints matter. Many alternative investments have lock-up periods or limited redemption windows. If you need immediate access to capital, this creates challenges.

Bull market underperformance is possible. During strong equity rallies, a 40/30/30 portfolio will likely trail a traditional 60/40 or pure equity approach. That's the cost of downside protection: giving up some upside participation.

The question isn't whether these trade-offs exist. It's whether they're worth it for your specific situation and goals.

Implementation Considerations

Transitioning to a 40/30/30 framework isn't a light switch you flip overnight. It requires thoughtful planning and execution.

Start by assessing your current allocation and identifying where you have flexibility. If you're heavily concentrated in public equities, the first move might be reducing that exposure gradually while building your alternatives pipeline.

Due diligence on alternative managers is critical. Past performance matters, but so do operational capabilities, alignment of interests, and consistency of strategy execution. You're not just buying an asset: you're entering a partnership.

Think about rebalancing mechanics. With less liquid alternative investments, your rebalancing approach needs to account for timing and availability. This requires more active portfolio management than a traditional 60/40 allocation.

Consider tax implications as well. Different alternative investments have different tax treatments, and the timing of distributions can vary significantly from public securities.

The Bottom Line

The 40/30/30 framework isn't a magic solution that works for everyone. It's a modern approach to portfolio construction that addresses real limitations in traditional allocation models.

For institutional investors and accredited investors managing significant wealth, the case for exploring this framework is compelling. The data supports it. The logic makes sense. And the institutions with the most sophisticated investment operations are already making the move.

The question isn't whether the 60/40 portfolio had a good run: it absolutely did. The question is whether it's still the right tool for the current market environment.

At Mogul Strategies, we're constantly evaluating how to position portfolios for long-term success across different market scenarios. Sometimes that means challenging conventional wisdom. Sometimes it means embracing new frameworks that better serve our objectives.

The 40/30/30 allocation isn't about being trendy. It's about being thoughtful, data-driven, and willing to evolve when the facts change. That's what disciplined asset management looks like in 2026.

Comments