The 40/30/30 Framework: How Institutional Investors Build Diversified Portfolios in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Feb 1

- 5 min read

Let's be honest: the traditional 60/40 portfolio isn't cutting it anymore. For decades, institutional investors swore by the simple formula of 60% stocks and 40% bonds. It was the gold standard. But 2026 looks nothing like the market environment that made 60/40 work.

Inflation is still unpredictable. Interest rates have stayed higher for longer than anyone expected. And that classic negative correlation between stocks and bonds? It's broken. When both asset classes move in the same direction during downturns, your "diversification" becomes a liability.

Enter the 40/30/30 framework: a portfolio structure that's becoming the new standard for institutional investors who want actual diversification, not just the illusion of it.

What Is the 40/30/30 Framework?

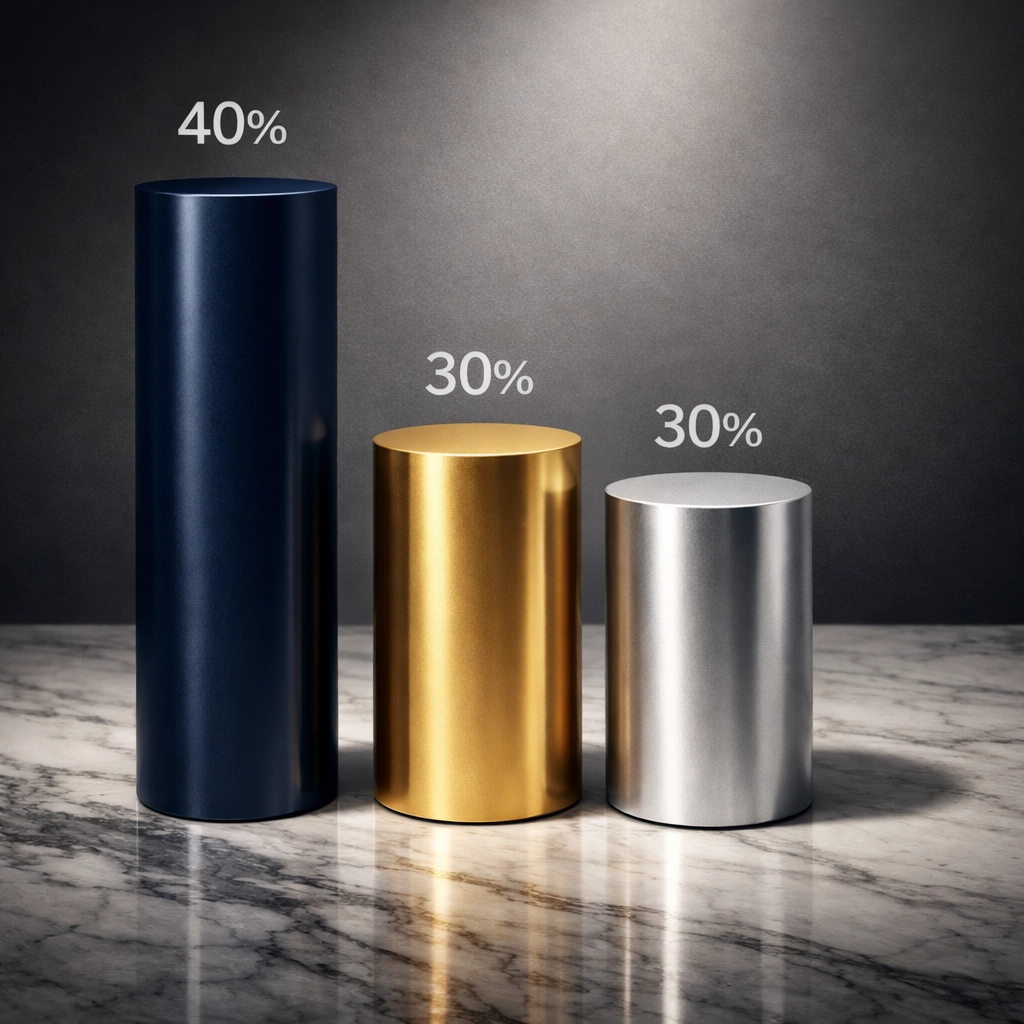

The 40/30/30 allocation is straightforward:

40% Public Equities – Still the growth engine, but with less concentration risk

30% Fixed Income – Bonds remain important, but in a smaller role

30% Alternative Investments – The secret sauce that changes everything

This isn't just a minor tweak to the old model. It's a fundamental shift in how sophisticated investors think about risk, return, and the role that different asset classes play in a portfolio.

The key difference? That 30% alternatives bucket opens the door to asset classes that don't move in lockstep with public markets. Real diversification means holding assets that zig when others zag.

Why Institutions Are Making the Switch

The market conditions of 2026 have exposed the weaknesses of traditional portfolios. Here's what's driving the change:

Higher Interest Rates, Higher Volatility: When rates were near zero, bonds provided stability without much yield. Now rates are higher, but the bond market has shown it can be just as volatile as equities when the Fed moves unexpectedly.

Inflation Isn't Going Away: Even as inflation has moderated from 2022 peaks, it's sticky. The old 2% target feels more aspirational than realistic. Portfolios need assets that can keep pace with rising prices.

Geopolitical Uncertainty: Supply chain disruptions, regional conflicts, and policy divergence between major economies create an environment where traditional correlations break down. What worked in the "great moderation" era doesn't work in a multipolar world.

Research backs this up. Studies show that 40/30/30 portfolios have delivered better risk-adjusted returns than 60/40 portfolios across most macroeconomic scenarios, particularly when inflation runs hot.

Breaking Down the 40% Equities Allocation

Forty percent in public equities might seem low compared to the traditional 60%, but there's a method here. By reducing equity concentration, you're not abandoning growth: you're making room for alternative sources of return that don't come with the same market beta.

Within this 40%, institutional investors are getting more strategic about what they own. This isn't passive index investing across the board. Instead, smart allocators are:

Overweighting quality companies with pricing power that can handle inflationary pressure

Including international exposure to capture growth in emerging markets

Adding tactical tilts toward sectors that benefit from structural trends (infrastructure, technology, healthcare)

The goal is to keep the growth potential of equities while reducing the portfolio's overall sensitivity to market swings.

The 30% Fixed Income Piece

Bonds still matter, but their role has changed. In a 40/30/30 framework, fixed income provides stability and income, but it's not expected to be the primary shock absorber during equity drawdowns: because we've learned it can't always play that role.

Smart institutional investors are diversifying within their fixed income sleeve:

Investment-grade corporate bonds for steady income

Shorter duration bonds to reduce interest rate sensitivity

TIPS (Treasury Inflation-Protected Securities) as an inflation hedge

Floating rate notes that benefit when rates stay elevated

The key is recognizing that in 2026, bonds are one piece of the defensive allocation, not the entire defense.

The Game-Changing 30% Alternatives Allocation

This is where the 40/30/30 framework really shines. That 30% alternatives bucket is designed to deliver returns that aren't correlated to traditional markets. When stocks and bonds both struggle, these assets can hold steady or even thrive.

Here's how institutional investors typically break down the alternatives allocation:

Private Credit (10%)

Private credit has become a favorite among institutions. These are loans to middle-market companies that aren't borrowing from public markets. The advantages:

Higher yields than public bonds (often 10%+ in today's environment)

Floating rate structures that benefit from higher rates

Lower correlation to stock market movements

Senior secured positions that offer downside protection

Real Estate & Infrastructure (10%)

Real assets provide a natural inflation hedge. Commercial real estate, data centers, renewable energy projects, and infrastructure assets often have escalation clauses built into their contracts. As inflation pushes prices higher, the income from these assets rises too.

In 2026, institutional allocators are particularly interested in:

Industrial properties supporting e-commerce logistics

Data centers powering AI and cloud computing

Renewable energy infrastructure backed by long-term contracts

Private Equity (10%)

Private equity captures the "illiquidity premium": the extra return investors earn for tying up capital in non-traded investments. By gaining access to high-quality private companies before they go public, investors can capture growth that public market investors miss.

The trade-off? You need a longer time horizon and the ability to lock up capital for 7-10 years. But for institutional investors with patience, the returns have historically been worth it.

Implementing 40/30/30 in 2026

The beauty of this framework is that it's adaptable. Your exact implementation depends on your liquidity needs, risk tolerance, and investment horizon.

For Large Institutions with minimal liquidity constraints, some allocators push private equity to one-third of the total equity allocation, effectively creating a portfolio that's heavier on alternatives while maintaining the core diversification benefits.

For Smaller Institutions or Family Offices that need more liquidity, a conservative approach might allocate the alternatives as: 10% private equity, 5% real estate, 5% infrastructure, and 10% private credit. This maintains diversification while keeping some dry powder available.

The critical success factor is access. Alternative investments have traditionally been reserved for the largest institutions. But the landscape has democratized significantly. Fund structures, co-investment opportunities, and specialized platforms now make these asset classes accessible to accredited investors who previously couldn't meet the minimum check sizes.

Why This Matters in 2026

We're living through a period of transition. The old rules don't apply, but the new playbook is still being written. In this environment, the institutions winning are those that:

Prioritize actual diversification over asset class labels

Build inflation resilience into portfolio construction

Accept illiquidity in exchange for better risk-adjusted returns

Stay flexible as markets evolve

The 40/30/30 framework isn't a magic formula that works forever. It's a response to the specific challenges of the current market cycle. But for institutional investors navigating 2026's uncertainty, it offers something the old 60/40 model can't: true diversification that works when you need it most.

The Bottom Line

If your portfolio still looks like it was built for 2010, it's time for an update. The 40/30/30 framework represents a practical evolution in portfolio construction: one that acknowledges market realities while maintaining focus on long-term wealth preservation and growth.

At Mogul Strategies, we work with institutional and accredited investors to build portfolios designed for the world as it is, not as it used to be. That means blending traditional assets with alternative strategies that actually diversify risk.

The shift from 60/40 to 40/30/30 isn't just about changing numbers. It's about rethinking what diversification means in a world where the old correlations no longer hold. And for institutions that get it right, the payoff is portfolios that can weather whatever 2026 and beyond throws at them.

Comments