The 40/30/30 Portfolio Framework: How Institutional Investors Are Blending Bitcoin Integration with Traditional Assets in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Feb 1

- 5 min read

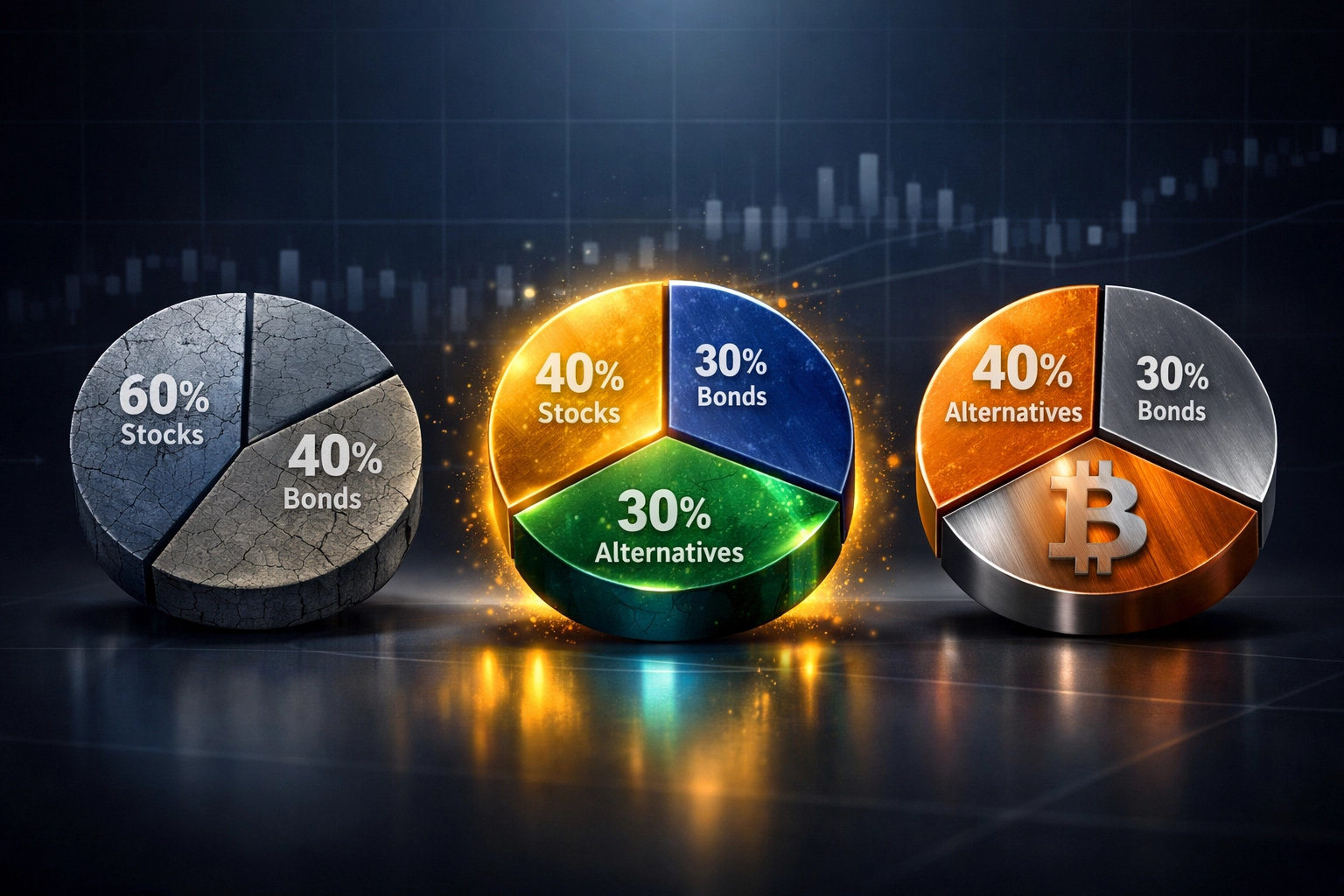

The 60/40 portfolio is officially having an identity crisis. For decades, the standard 60% stocks and 40% bonds allocation was the institutional investor's safety blanket. But here's the problem: when stocks and bonds started moving together instead of offsetting each other, that blanket got a lot thinner.

Enter the 40/30/30 framework: a more sophisticated approach that's gaining serious traction among institutional investors in 2026. And the twist? Smart allocators aren't just sticking to traditional alternatives anymore. They're integrating Bitcoin and digital assets into the mix.

Why Traditional Portfolios Aren't Cutting It Anymore

Let's get real about what happened. The diversification benefits that made 60/40 portfolios work relied on one simple assumption: when stocks went down, bonds would go up (or at least stay stable). That inverse correlation was the whole point.

But the past few years shattered that assumption. Rising interest rates, persistent inflation, and shifting monetary policy meant stocks and bonds often tanked together. Suddenly, that 40% bond allocation wasn't providing the cushion it used to.

The result? Institutional investors started hunting for actual diversification. Not the kind you get by splitting between two asset classes that move in lockstep, but real, uncorrelated returns.

The Traditional 40/30/30 Breakdown

The classic 40/30/30 portfolio looks like this:

40% Public Equities – Still your core growth engine, but with less concentration than the old 60/40 model.

30% Fixed Income – Bonds aren't dead, but they've been right-sized. This allocation provides stability and income without over-relying on a single defensive asset.

30% Alternative Investments – This is where things get interesting. Traditionally, this sleeve included private equity, private credit, infrastructure, real estate, and hedge fund strategies.

The beauty of this framework is the alternatives component. Private credit offers yield without direct stock market correlation. Infrastructure assets like pipelines and cell towers provide inflation-adjusted income. Real estate syndications deliver both cash flow and appreciation potential.

Research from J.P. Morgan showed that adding just 25% to alternatives boosted 60/40 portfolio returns by 60 basis points. KKR's analysis went further, finding that 40/30/30 outperformed 60/40 across every timeframe they studied.

The 2026 Evolution: Where Bitcoin Fits In

Here's where institutional thinking is shifting. That 30% alternatives sleeve was designed for low-correlation assets that behave differently than stocks and bonds. And guess what checks that box in a major way? Bitcoin.

By 2026, institutional investors aren't treating Bitcoin as a speculative gamble. They're viewing it as a legitimate portfolio diversifier with unique characteristics:

Uncorrelated Returns – Bitcoin's price movements have historically shown low correlation to traditional equity and bond markets. When inflation fears spike or currency devaluation concerns emerge, Bitcoin often moves independently.

Digital Scarcity – With a fixed supply of 21 million coins, Bitcoin offers scarcity in a world where central banks can print unlimited fiat currency.

24/7 Global Liquidity – Unlike private equity investments with 7-10 year lockups, Bitcoin can be bought or sold instantly on global exchanges.

Institutional Infrastructure – By 2026, the custody solutions, regulatory frameworks, and institutional-grade platforms have matured significantly. This isn't 2017 anymore.

How Institutions Are Actually Implementing This

The most sophisticated institutional investors aren't going all-in on Bitcoin or abandoning traditional alternatives. They're blending both within that 30% alternatives allocation.

Here's a practical example of how a $100 million institutional portfolio might be structured:

40% Public Equities ($40M)

Diversified across US, international, and emerging markets

Mix of value, growth, and dividend-focused strategies

30% Fixed Income ($30M)

Investment-grade bonds

Treasury securities

Short-duration credit

30% Alternative Investments ($30M)

10% Private Real Estate ($10M)

8% Private Credit ($8M)

5% Infrastructure ($5M)

5% Bitcoin & Digital Assets ($5M)

2% Hedge Strategies ($2M)

Notice that Bitcoin isn't replacing traditional alternatives: it's complementing them. That 5% allocation to digital assets provides meaningful diversification without creating concentration risk.

The Risk Management Perspective

Let's address the elephant in the room: Bitcoin is volatile. Its price can swing 30% in a month. So why are institutional investors adding it to carefully constructed portfolios?

Because volatility isn't the same as risk: especially when you're looking at long-term wealth preservation. The real risk for institutional portfolios is failing to achieve their target returns over multi-decade timeframes while protecting against inflation and currency debasement.

Bitcoin's volatility matters less when you consider:

Position Sizing – A 5% allocation means even a 50% drawdown in Bitcoin only impacts the total portfolio by 2.5%.

Rebalancing Benefits – High volatility creates rebalancing opportunities. When Bitcoin surges, you trim and redeploy to undervalued assets. When it drops, you buy at discounts.

Long-Term Trajectory – Over rolling four-year periods, Bitcoin has historically delivered positive returns despite significant interim volatility.

Inflation Hedge Characteristics – As central banks expanded money supply, Bitcoin's fixed supply became increasingly attractive as a long-term store of value.

What This Means for Accredited Investors

If you're an accredited investor or managing institutional capital, the 40/30/30 framework with Bitcoin integration offers several advantages:

True Diversification – You're not just diversified across asset classes, but across different economic regimes and inflation scenarios.

Future-Proofing – As digital assets become more mainstream, early institutional adoption positions you ahead of the curve rather than playing catch-up.

Access to Uncorrelated Alpha – The alternatives sleeve provides multiple sources of return that don't depend on the S&P 500 going up.

Flexibility – Unlike many traditional alternatives with long lockup periods, the framework allows for tactical adjustments as market conditions evolve.

Implementation Considerations

Building a 40/30/30 portfolio with Bitcoin integration requires more than just buying assets. Here's what institutional investors are focusing on:

Custody Solutions – Using institutional-grade custodians for digital assets, not consumer exchanges.

Regulatory Compliance – Ensuring all investments meet fiduciary standards and regulatory requirements for the specific investor type.

Due Diligence – Conducting thorough analysis of private market opportunities, not just chasing returns.

Rebalancing Discipline – Setting clear thresholds for when to rebalance between asset classes.

Tax Efficiency – Structuring investments to maximize after-tax returns, particularly important for digital assets.

The Path Forward

The 40/30/30 framework isn't a rigid formula: it's a philosophy. The specific percentages matter less than the underlying principle: build portfolios with truly diversified return streams.

For institutional investors in 2026, ignoring Bitcoin and digital assets in the alternatives sleeve is like ignoring private equity in 2006. The infrastructure has matured. The regulatory clarity has improved. The institutional adoption is accelerating.

The question isn't whether to integrate Bitcoin into institutional portfolios anymore. It's how much, how quickly, and alongside which other alternatives.

At Mogul Strategies, we're helping accredited and institutional investors navigate exactly these questions. Because the future of portfolio construction isn't choosing between traditional assets and digital innovation: it's strategically blending both.

The 60/40 portfolio had its day. The 40/30/30 framework with thoughtful Bitcoin integration is writing the next chapter.

Comments