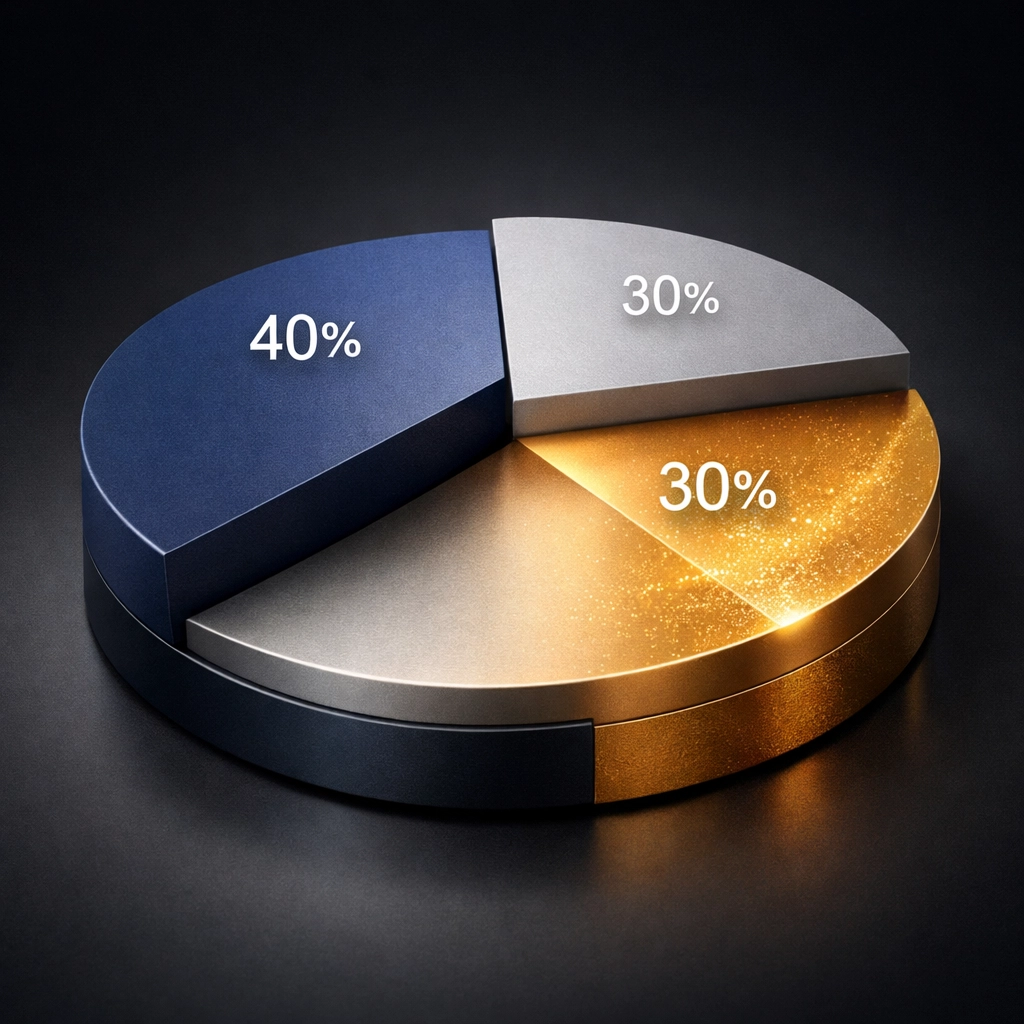

The 40/30/30 Portfolio Framework: How Institutional Investors Are Blending Bitcoin With Traditional Assets in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 3 days ago

- 5 min read

The 60/40 portfolio is having an identity crisis.

For decades, institutional investors leaned on the classic 60% stocks, 40% bonds split. It worked beautifully: until it didn't. When inflation roared back in 2022 and both stocks and bonds tanked together, the diversification playbook everyone trusted fell apart.

Enter the 40/30/30 framework. And now in 2026, some of the sharpest institutional minds are doing something that would've seemed unthinkable five years ago: they're carving out a slice of that alternatives bucket for Bitcoin.

Not because it's trendy. Because the math is starting to make sense.

Why the Traditional Model Broke Down

Let's get real about what happened. The 60/40 portfolio was built on one core assumption: when stocks drop, bonds go up. That negative correlation was the safety net.

But in recent years, that correlation flipped positive. Stocks and bonds started moving in the same direction, especially during inflation spikes. Suddenly, your "diversified" portfolio wasn't diversified at all.

The bond market wasn't offering much yield either. With rates near zero for so long, the fixed income portion of portfolios became more of a drag than a cushion. Institutional investors needed alternatives that could actually diversify and generate returns.

That's where the 40/30/30 model came in: 40% public equities, 30% fixed income, 30% alternatives.

Breaking Down the 40/30/30 Framework

The beauty of this framework is its flexibility. Here's how it typically works:

40% Public Equities – Your growth engine. This includes domestic and international stocks across various sectors. Nothing revolutionary here, but you're scaling back from the traditional 60% to make room for better diversification.

30% Fixed Income – Government and corporate bonds, TIPS, maybe some short-duration strategies. This portion still provides stability, but you're not over-relying on it anymore.

30% Alternatives – This is where things get interesting. Traditionally, this bucket held private equity, private credit, real estate, and infrastructure. These assets tend to have lower correlations with public markets and can provide inflation protection.

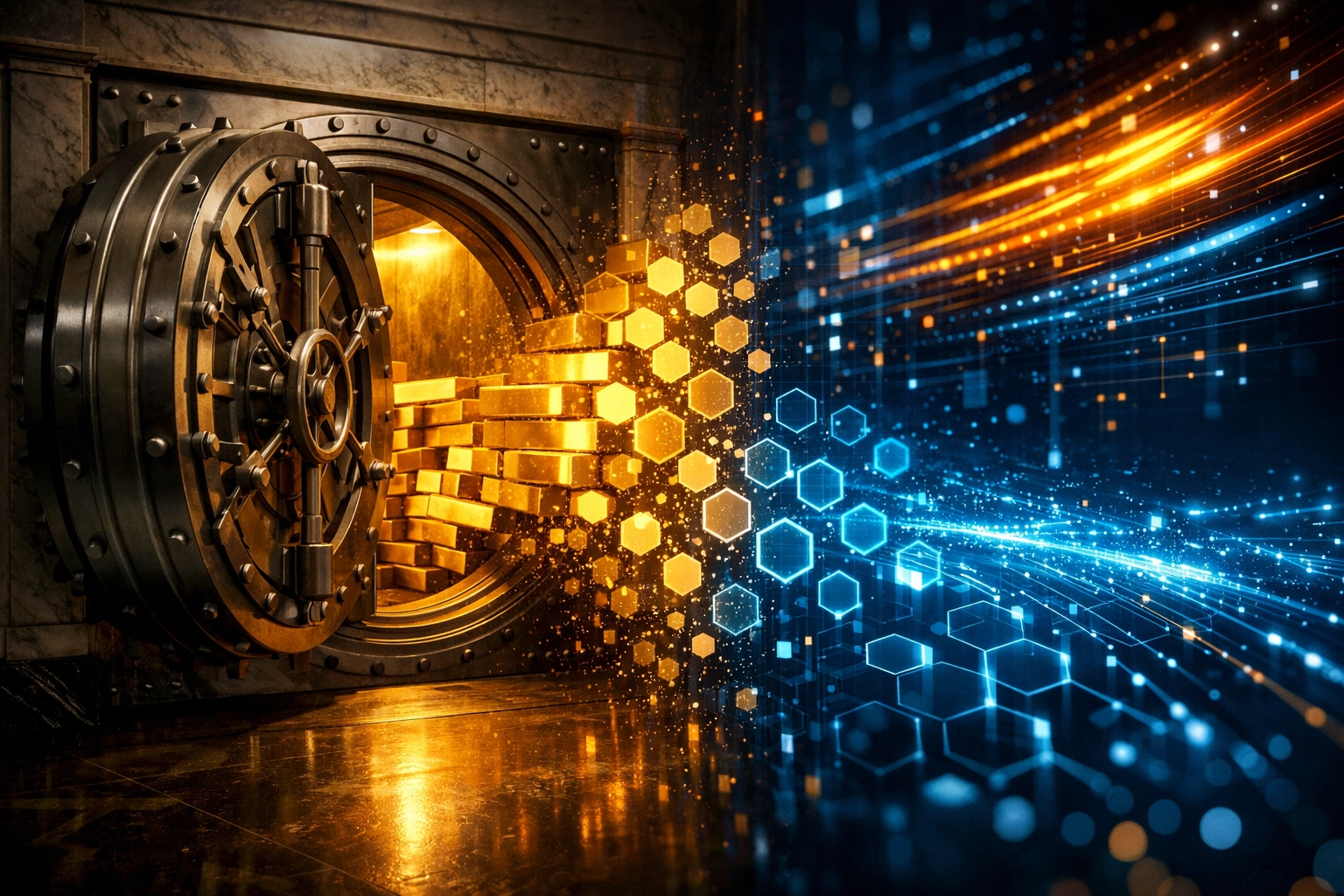

But in 2026, a growing number of institutions are allocating a portion of this alternatives sleeve to digital assets: specifically Bitcoin.

Why Bitcoin Is Entering the Alternatives Mix

Here's the thing about Bitcoin that makes institutional investors pay attention: it genuinely doesn't move like anything else in your portfolio.

The correlation data is compelling. Bitcoin has historically shown low to negative correlation with traditional asset classes over meaningful time periods. When you're building a portfolio, that kind of behavior is gold: or in this case, digital gold.

But correlation isn't the only reason. Bitcoin offers something traditional alternatives can't: 24/7 liquidity, transparent pricing, and no gatekeepers. Try liquidating a private equity position on a Saturday at 2 AM. With Bitcoin, it's just another Tuesday.

The maturation of crypto infrastructure matters too. We now have regulated custody solutions from household names like Fidelity and BNY Mellon. Spot Bitcoin ETFs launched in 2024 made access even simpler. The "how do we even hold this thing" question has been answered.

What a Bitcoin-Enhanced 40/30/30 Actually Looks Like

Most institutions aren't going all-in on crypto. They're being measured about it. Here's a realistic breakdown of how Bitcoin fits into the alternatives portion:

Within that 30% alternatives bucket, you might see:

15% Private equity and venture capital

8% Real estate and infrastructure

5% Private credit

2% Bitcoin and digital assets

That 2% Bitcoin allocation might seem small, but in a $100 million portfolio, that's $2 million. And because of Bitcoin's volatility and potential returns, even a small allocation can meaningfully impact overall portfolio performance.

Some more aggressive institutional players are pushing that to 3-5%, especially funds targeting younger ultra-high-net-worth clients who understand the digital asset space. The key is sizing it appropriately for your risk tolerance.

The Risk Mitigation Playbook

Let's be clear: Bitcoin is volatile. Any institutional investor putting capital into digital assets needs a solid risk framework.

Position Sizing – This is rule number one. Size your Bitcoin exposure so that even if it goes to zero (it won't, but model for it), your portfolio survives. That 2-5% range exists for a reason.

Custody Solutions – Use institutional-grade custody. This isn't the wild west anymore. Multi-signature wallets, insurance, and regulated custodians are table stakes.

Rebalancing Discipline – Bitcoin can easily become 8% of your portfolio if it rips higher. Set rebalancing bands and stick to them. This forces you to take profits and maintain your target allocation.

Regulatory Awareness – The regulatory landscape for crypto is still evolving. Work with compliance teams and stay updated on guidance from the SEC, CFTC, and other relevant bodies.

Implementation Considerations for 2026

If you're considering integrating Bitcoin into your institutional portfolio this year, here's what the sophisticated players are thinking about:

Access Vehicles – Spot Bitcoin ETFs offer the cleanest exposure for most institutions. Lower operational complexity than direct custody, familiar structure, daily liquidity. For larger allocations, direct ownership with qualified custodians might make sense.

Tax Efficiency – Digital assets have unique tax considerations. Work with tax advisors who understand crypto reporting requirements and wash sale rules (which currently don't apply to crypto, giving it an interesting advantage).

Stakeholder Education – Your investment committee, board, or LPs need to understand why Bitcoin is in the portfolio. The narrative isn't "number go up." It's about uncorrelated returns, portfolio resilience, and adapting to a changing financial landscape.

Performance Attribution – Track how Bitcoin is actually impacting portfolio metrics. Is it providing the diversification you expected? How is it affecting your Sharpe ratio? Make decisions based on data, not headlines.

The Long-Term Thesis

Here's where this gets interesting for the next decade. Bitcoin's supply is capped at 21 million coins. No central bank can print more. No government can inflate it away. As more institutions allocate even small percentages, and as Bitcoin's supply continues shrinking through halving events, the supply-demand dynamics get increasingly favorable.

We're also seeing Bitcoin mature as a treasury reserve asset. Corporations like MicroStrategy and countries like El Salvador were the early movers. Whether or not you agree with their strategies, they've normalized the conversation about Bitcoin as a balance sheet asset.

The 40/30/30 framework with a Bitcoin allocation isn't about chasing returns or being a crypto maximalist. It's about building resilient portfolios that can handle whatever the next decade throws at us: whether that's inflation, currency debasement, geopolitical instability, or just garden-variety market volatility.

Is This Right for Your Portfolio?

The 40/30/30 framework with Bitcoin integration isn't for everyone. If you're managing a pension fund with strict regulatory constraints or a conservative family office that can't stomach volatility, traditional alternatives might be a better fit.

But if you're an institutional investor looking to genuinely diversify, willing to do the operational work, and comfortable with measured risk-taking, this framework deserves serious consideration.

The institutions making this shift in 2026 aren't the cowboys. They're the calculated strategists who recognize that standing still is its own form of risk. The financial landscape is evolving, and portfolios need to evolve with it.

The question isn't whether Bitcoin belongs in institutional portfolios. For a growing number of sophisticated investors, that question has been answered. The real question is: what's the right allocation for your specific objectives, constraints, and risk tolerance?

That's a conversation worth having. And it's one we're having every day at Mogul Strategies as we help institutional and accredited investors navigate this new landscape.

Because in 2026, building a resilient portfolio means thinking beyond the traditional playbook.

Comments