The 40/30/30 Portfolio Framework: How Institutional Investors Blend Bitcoin with Traditional Assets

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 5 days ago

- 5 min read

The traditional 60/40 portfolio, 60% stocks, 40% bonds, has been the go-to strategy for decades. But let's be honest: it's showing its age. When both stocks and bonds drop together during market stress (like we've seen repeatedly in recent years), that classic diversification just doesn't cut it anymore.

Enter the 40/30/30 framework. It's not revolutionary rocket science, but it is a smarter way to think about portfolio construction in today's market environment. And here's the interesting part: institutional investors have been using alternative assets for years to boost returns and reduce risk. Now, with the emergence of Bitcoin and digital assets, there's a compelling case for individual and smaller institutional investors to adopt a similar approach.

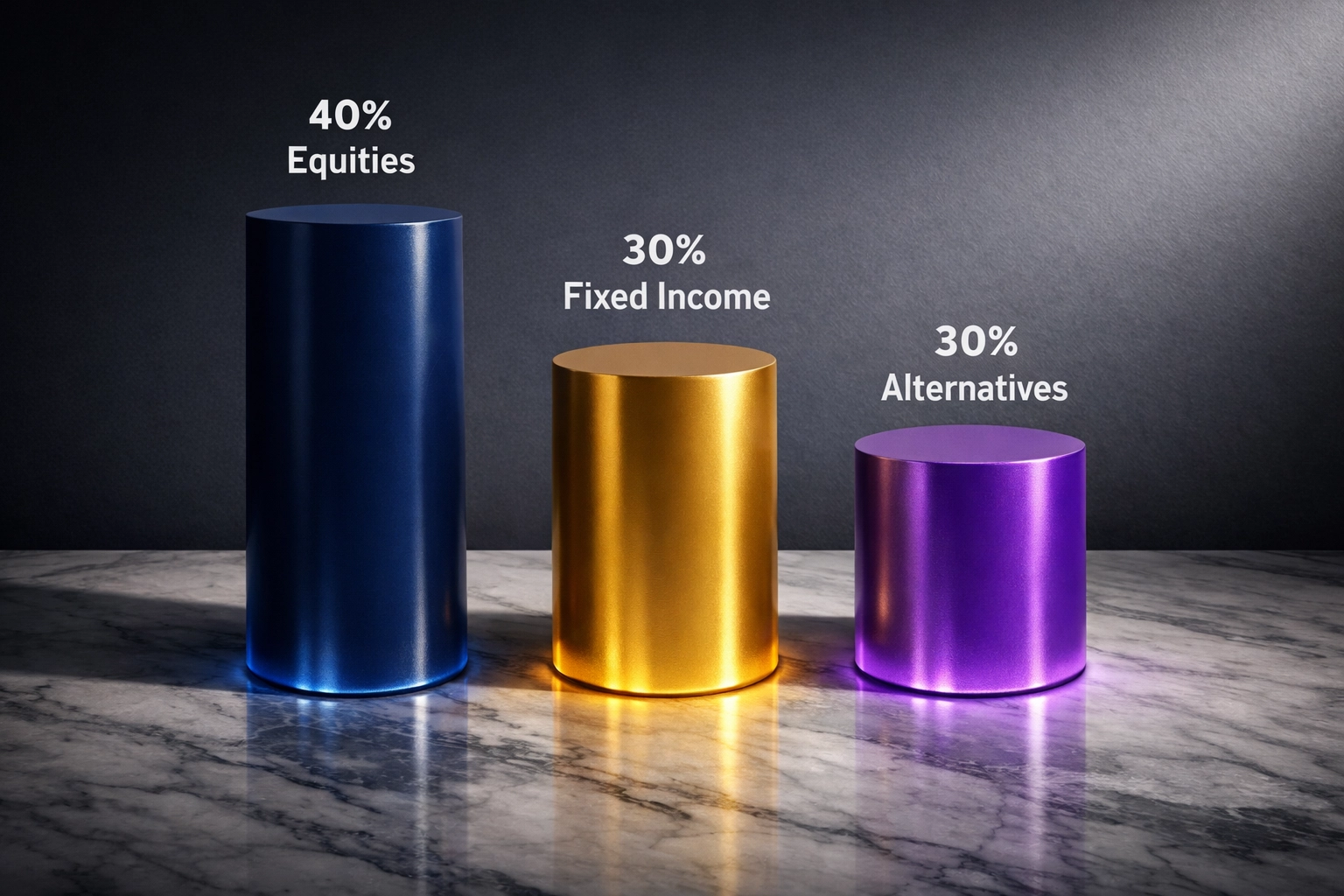

Breaking Down the 40/30/30 Model

The framework is straightforward:

40% Public Equities – Your traditional stock exposure

30% Fixed Income – Bonds and other income-generating securities

30% Alternative Investments – This is where it gets interesting

Think of it as taking 20% from what would normally be your stock allocation and 10% from bonds, then redirecting that capital into alternatives. You're not abandoning traditional assets, you're just rebalancing toward a more resilient structure.

The magic happens in that 30% alternatives sleeve. This is where private equity, real estate, hedge fund strategies, and increasingly, Bitcoin and blockchain equities come into play. These assets don't march in lockstep with public markets, which means when stocks zig, your alternatives might zag (or just sit still, which is also valuable).

Why Traditional Diversification Isn't Enough

Here's the problem with the 60/40 portfolio: correlation. Stocks and bonds used to move independently. When stocks fell, bonds would rally, cushioning the blow. But in recent years, that relationship has broken down. During market stress, both asset classes can decline simultaneously, leaving investors with nowhere to hide.

J.P. Morgan's research shows that adding a 25% allocation to alternative assets can enhance traditional portfolio returns by 60 basis points, an 8.5% improvement. That's not trivial. For a $10 million portfolio, that's an extra $850,000 over time.

The 40/30/30 framework addresses this by introducing non-correlated exposures. Alternatives don't necessarily move in sync with stocks or bonds, which reduces overall portfolio volatility while maintaining (or even improving) return potential.

Where Bitcoin Fits In

Now, let's talk about the elephant, or should I say, the digital coin, in the room: Bitcoin.

Bitcoin is volatile. There's no sugarcoating that. On its own, it can swing 30% or more in a matter of weeks. That's not ideal for conservative institutional portfolios. But here's what the research shows: when you integrate Bitcoin and blockchain equities into a diversified 40/30/30 structure, something interesting happens.

A study covering the period from May 2022 to May 2025 found that a modest 3% allocation to crypto and blockchain equity components within the alternatives sleeve improved annualized returns by 1.1%, from 6.7% to 7.8%. Even better, it only added 0.5% additional volatility. The Sharpe ratio (a measure of risk-adjusted returns) improved from 0.28 to 0.39.

Translation: You got better returns without proportionally increasing risk. That's the definition of portfolio efficiency.

What's happening here? Diversification. When Bitcoin is combined with other alternatives and traditional assets, its individual volatility is dampened by up to 20%. It's still there, but it's muted by the stabilizing influence of the broader portfolio.

The Institutional Playbook

Institutional investors, pension funds, endowments, family offices, have been using alternatives for decades. They understand that access to non-public markets and uncorrelated strategies provides an edge that retail investors typically can't access.

Here's what they know:

1. Alternatives Add Breadth

Hedge fund strategies like long-short equity, market-neutral positions, and global macro plays add multiple layers of portfolio protection. When public markets are struggling, these strategies can generate alpha through skill-based investing rather than just riding market beta.

2. Real Assets Provide Inflation Protection

Real estate, infrastructure, and commodities tend to perform well during inflationary periods, exactly when traditional bonds struggle. This creates a natural hedge within the portfolio.

3. Private Equity Captures Illiquidity Premium

By accepting that capital will be locked up for several years, investors in private equity can earn higher returns than comparable public investments. This illiquidity premium has historically added 300-500 basis points of excess return.

4. Bitcoin Offers Asymmetric Upside

Unlike traditional alternatives, Bitcoin has the potential for significant appreciation if adoption continues to grow. A small allocation (1-5%) means you're not betting the farm, but you're positioned to benefit if digital assets become a larger part of the global financial system.

Building Your Own 40/30/30 Portfolio

So how do you actually implement this? It's not as complicated as it might seem.

Start with the Foundation (70%)

Your 40% equity allocation should be globally diversified, U.S. large-cap, international developed markets, and emerging markets. Don't get fancy here. Index funds work fine.

Your 30% fixed income sleeve should include a mix of government bonds, investment-grade corporate debt, and potentially some high-yield exposure if your risk tolerance allows.

Design Your Alternatives Sleeve (30%)

This is where you need to be more thoughtful. Consider:

Private Equity/Venture Capital (10-12%): Access to high-growth private companies

Real Estate (8-10%): REITs or direct real estate investments

Hedge Fund Strategies (5-7%): Long-short equity, market-neutral, or managed futures

Bitcoin/Blockchain Equities (3-5%): A modest allocation to capture digital asset upside

The exact percentages depend on your risk tolerance, time horizon, and access to institutional-quality alternative investments.

Risk Management Considerations

Let's be clear: alternatives aren't risk-free. They come with their own challenges, illiquidity, higher fees, complexity, and in Bitcoin's case, regulatory uncertainty.

But that's precisely why diversification matters. By spreading your alternatives allocation across multiple strategies and asset classes, you're not overly dependent on any single bet. If Bitcoin underperforms, your private equity or real estate positions can pick up the slack. If public markets surge, your 40% equity allocation captures that upside.

The key is understanding that portfolio construction isn't about eliminating risk, it's about managing and diversifying it intelligently.

The Bottom Line

The 40/30/30 framework isn't a magic formula. Market conditions change, and no single allocation strategy works perfectly in all environments. But what it does offer is a more thoughtful approach to portfolio construction that acknowledges today's market realities.

Stocks and bonds aren't enough anymore. The traditional 60/40 portfolio worked brilliantly in a declining interest rate environment with reliable negative correlation between asset classes. That world is gone.

By embracing alternatives, and yes, that includes Bitcoin when sized appropriately: investors can build more resilient portfolios that generate better risk-adjusted returns over time. The institutions figured this out decades ago. Now, with improved access to alternative investments, accredited and smaller institutional investors can implement the same strategies.

The question isn't whether you should consider alternatives. It's whether you can afford not to.

Interested in exploring how the 40/30/30 framework might work for your portfolio? Visit Mogul Strategies to learn more about institutional-grade investment strategies.

Comments