The 40/30/30 Portfolio Framework: Your Quick-Start Guide to Institutional-Grade Diversification

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 31

- 4 min read

Remember 2022? Yeah, that year when your diversified portfolio... wasn't?

The traditional 60/40 portfolio: the one that had been a cornerstone of wealth management for decades: got absolutely hammered. Stocks down. Bonds down. Everything down. That simultaneous decline exposed what institutional investors had known for years: two asset classes aren't enough anymore.

Enter the 40/30/30 framework. It's not revolutionary, but it is practical. And for accredited investors looking to build institutional-grade portfolios without needing a team of analysts, it's a solid starting point.

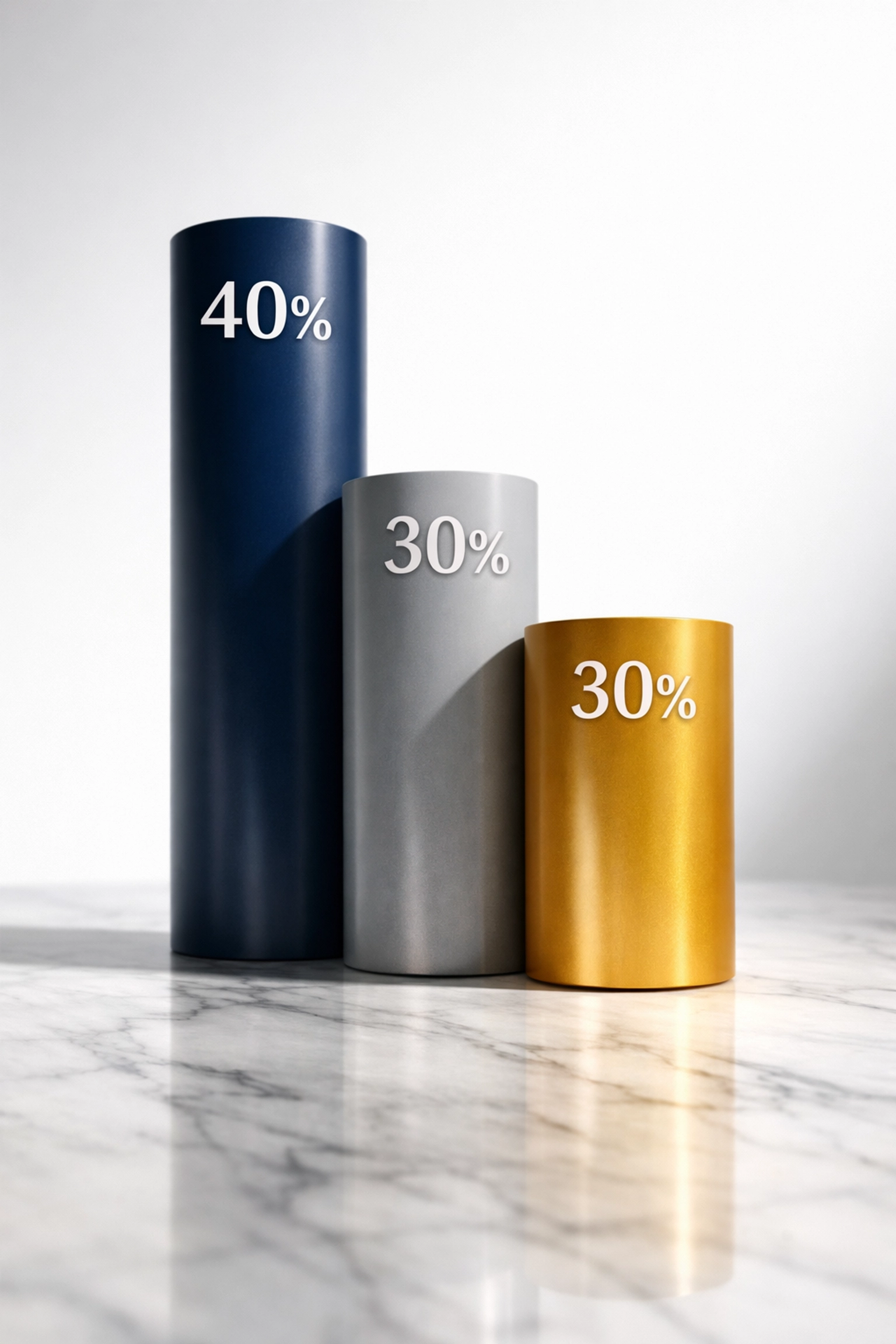

What Exactly Is 40/30/30?

The math is straightforward. Instead of allocating 60% to stocks and 40% to bonds, you're looking at:

40% Public Equities – Your traditional stock exposure

30% Fixed Income – Bonds and similar instruments

30% Alternatives – The game-changer

That 30% alternatives bucket is where things get interesting. You're essentially taking 20% from your equity allocation and 10% from bonds and redirecting it into investments that don't march in lockstep with traditional markets.

The goal? Create a third pillar that zigs when stocks and bonds zag. Or at least doesn't move in perfect correlation with them.

Why Diversification Needed an Update

For decades, the 60/40 split worked because stocks and bonds had a negative correlation. When equities tanked, bonds typically rallied, cushioning the blow. That inverse relationship was the foundation of portfolio construction.

But the financial environment has changed. Low interest rates, quantitative easing, and global monetary policy shifts have altered how asset classes interact. In 2022, rising inflation forced central banks to hike rates aggressively. The result? Both stocks and bonds declined together, destroying that protective correlation investors had counted on.

The 40/30/30 framework acknowledges this new reality. By introducing alternatives with "zero-to-low beta" to traditional assets, you're building multiple layers of protection across different market conditions.

Breaking Down the Alternatives Sleeve

The 30% alternatives allocation isn't a monolithic bucket. It typically breaks into two strategic categories:

Diversifiers are strategies with low correlation to stocks and bonds. Think hedge funds employing market-neutral strategies, managed futures, or certain commodity exposures. These provide protection during market stress and help smooth returns when traditional assets are volatile.

Enhancers have moderate-to-high correlation but serve to amplify returns or mitigate specific risks. Private equity, real estate, and growth-focused private credit often fall here. They're correlated enough to capture market upside but structured differently enough to add value through access, structure, or illiquidity premiums.

The beauty of this framework is flexibility. That 30% can be adjusted based on your goals, risk tolerance, and market outlook. Some portfolio managers might push it to 35% or pull back to 25% depending on opportunity sets and client objectives.

The Performance Trade-Off

Let's talk numbers because blind faith doesn't work in asset management.

Historical data from November 2001 through August 2025 shows a 40/30/30 portfolio delivered a 6.89% CAGR versus 7.46% for the traditional 60/40. On the surface, that looks like the 60/40 wins.

But here's where it gets interesting: the 40/30/30 framework delivered a Sharpe ratio of 0.71 versus 0.56 for the 60/40. That means you're getting significantly better risk-adjusted returns. You're earning more return per unit of risk taken.

Translation? You might make slightly less in absolute terms during raging bull markets, but you'll sleep better during drawdowns and market chaos.

J.P. Morgan's research suggests adding a 25% allocation to alternatives could boost 60/40 returns by approximately 60 basis points. Not earth-shattering, but meaningful over multi-decade time horizons, especially when compounded.

The Real-World Implementation Challenge

Here's where theory meets reality: institutional investors have been accessing sophisticated private alternatives for years. They have dedicated teams, deep relationships with managers, and the capital to meet high minimums.

Accredited investors and smaller institutions don't always have that luxury. But the landscape has improved dramatically. Publicly listed alternative ETFs, interval funds, and lower-minimum private funds have made this framework accessible to a broader audience.

That said, there are trade-offs:

Higher Fees: Alternative investments typically carry higher expense ratios than index funds. You're paying for active management, specialized strategies, and less liquid structures.

Complexity: Managing a 40/30/30 portfolio requires more work than set-it-and-forget-it index investing. Due diligence on managers, understanding strategy nuances, and monitoring performance takes effort.

Manager Selection Risk: Not all alternatives are created equal. The dispersion between top-quartile and bottom-quartile managers in alternatives is massive. Picking the wrong fund can tank your results.

Liquidity Constraints: Many alternatives have lock-up periods, redemption gates, or quarterly liquidity windows. You're trading immediate access for potential return enhancement.

Who Should Consider 40/30/30?

This framework isn't for everyone. If you're early in your career with a 30+ year time horizon and high risk tolerance, a 90/10 or even 100% equity allocation might make more sense. Time is your ally.

But if you're an accredited investor with:

Significant accumulated wealth you need to protect

Income needs from your portfolio

Lower tolerance for deep drawdowns

Interest in institutional-style diversification

Then 40/30/30 deserves serious consideration.

It's particularly compelling for investors transitioning from accumulation to preservation mode. You've built wealth. Now the focus shifts to keeping it while still generating reasonable returns.

Customization Is Key

Here's the truth: 40/30/30 is a framework, not a prescription. The specific implementation matters enormously.

Your 30% alternatives sleeve could include:

Private credit funds yielding 10-12%

Real estate syndications providing income and appreciation

Hedge funds with market-neutral strategies

Managed futures for crisis alpha

Digital assets like Bitcoin for asymmetric upside

The mix depends on your objectives, liquidity needs, and conviction around different strategies. At Mogul Strategies, we believe in blending traditional assets with innovative digital strategies tailored to each client's situation.

Final Thoughts

The 40/30/30 portfolio framework won't make you rich overnight. It won't beat the S&P 500 during euphoric bull runs. What it will do is provide more consistent, less volatile returns across full market cycles.

In an environment where traditional diversification has broken down, that's valuable. Really valuable.

For sophisticated investors looking to build resilient portfolios that can weather whatever the next decade throws at us: inflation, deflation, market crashes, geopolitical chaos: 40/30/30 offers a practical blueprint.

Just remember: the framework is simple. The execution isn't. Choose your managers carefully, understand the strategies you're deploying, and be honest about your liquidity needs and risk tolerance.

Because institutional-grade diversification isn't about complexity for its own sake. It's about building portfolios that actually work in the real world.

Comments