The 40/30/30 Portfolio Model Explained: Your Quick-Start Guide to Institutional-Grade Diversification

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 28

- 5 min read

If you've been in the investment game for any length of time, you've probably heard about the classic 60/40 portfolio. Sixty percent stocks, forty percent bonds. Simple. Elegant. And for about 50 years, it worked pretty well.

But here's the thing, markets evolve, and strategies that worked in the past don't always hold up in the present. Enter the 40/30/30 portfolio model: a modern approach to asset allocation that's been gaining serious traction among institutional investors and high-net-worth individuals who want more than what traditional portfolios can offer.

Let's break down exactly what this model is, why it matters, and how you can start thinking about it for your own wealth strategy.

What Exactly Is the 40/30/30 Portfolio?

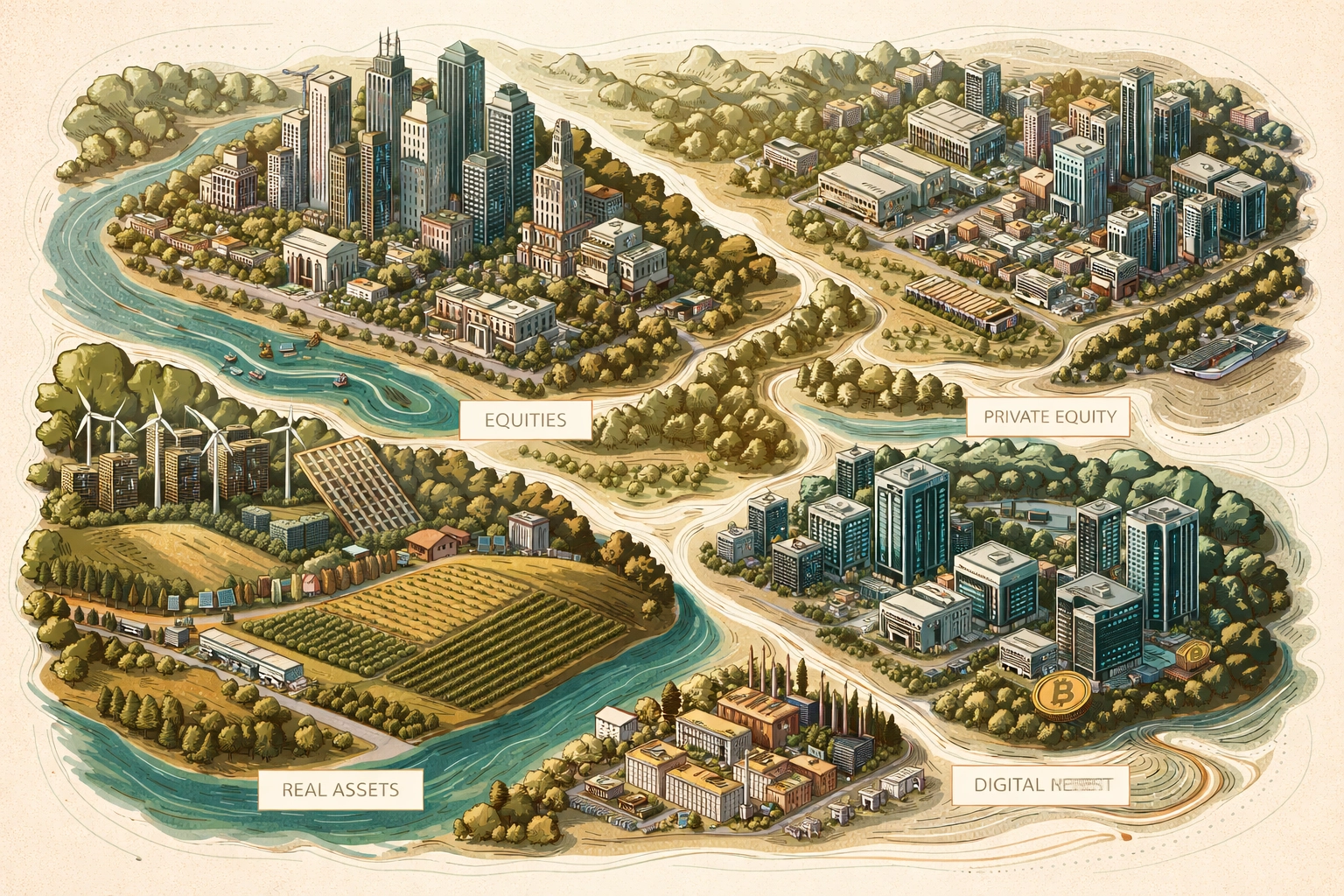

The 40/30/30 portfolio is a straightforward asset allocation framework:

40% public equities (stocks)

30% fixed income (bonds)

30% alternative investments (private equity, hedge funds, real assets, and more)

That's it. No complicated formulas or secret sauce. The magic is in how these three buckets work together to create something more resilient than the sum of its parts.

The key difference from the traditional 60/40 model? That 30% allocation to alternatives. This isn't just a tweak, it's a fundamental rethinking of how diversification should work in today's market environment.

Why the 60/40 Model Is Showing Its Age

For decades, the 60/40 portfolio was the gold standard. The logic was simple: stocks provide growth, bonds provide stability, and when one zigs, the other zags. This negative correlation meant that during stock market downturns, bonds would typically hold steady or even rise, cushioning the blow.

But something changed.

In recent years, stocks and bonds have started moving in tandem more often than not. When the market tanks, bonds aren't providing the protection they used to. Add in global inflationary pressures and central bank policy shifts we haven't seen since the 1980s, and suddenly that trusty 60/40 allocation isn't looking so bulletproof.

Think about it this way: if both your safety net and your growth engine can fall at the same time, do you really have diversification? Or just the illusion of it?

This is precisely why sophisticated investors, the endowments, pension funds, and family offices, have been quietly shifting toward models like 40/30/30 for years.

The Numbers Don't Lie: Performance Benefits

Let's talk data, because at the end of the day, performance matters.

Research from major institutions paints a compelling picture:

Better risk-adjusted returns: A traditional 60/40 portfolio reallocated to 40/30/30 improved its Sharpe ratio from 0.55 to 0.75 between 1989 and Q1 2023. For those unfamiliar, the Sharpe ratio measures return per unit of risk, and a jump from 0.55 to 0.75 is significant.

Enhanced overall returns: J.P. Morgan found that adding a 25% allocation to alternative assets boosts 60/40 returns by approximately 60 basis points. That might sound small, but on a projected 7% return, that's an 8.5% improvement. Over decades of compounding, we're talking serious money.

Reduced drawdowns: Adding alternatives like hedge funds can reduce maximum drawdowns by roughly one-third. Sleep better at night knowing your portfolio won't crater as hard during market chaos.

Consistent outperformance: KKR research shows that 40/30/30 outperformed 60/40 across all timeframes studied. Not some timeframes. All of them.

The Secret Ingredient: Alternative Investments

So what makes that 30% alternatives allocation so powerful? It comes down to three key factors:

Lower Correlation

Alternative investments, think private equity, private debt, hedge funds, real estate, and infrastructure, simply don't move in lockstep with public markets. When stocks are getting hammered, your private equity holdings aren't being marked down every second based on market panic. This reduced correlation is the diversification benefit that modern portfolios desperately need.

Income Stability

There's something to be said for illiquidity (yes, really). Private assets can't be bought and sold at the click of a button, which means managers can focus on long-term value creation rather than quarterly earnings pressure. This patient approach often translates to more consistent cash flows and less volatility in returns.

Built-In Inflation Protection

Here's a benefit that's become increasingly relevant: many alternative assets come with natural inflation hedges. Infrastructure projects and real estate investments often have inflation adjustment clauses baked right into their contracts. As consumer prices rise, so does your income from these assets. Compare that to a bond paying a fixed 4% while inflation runs at 5%, and the advantage becomes clear.

What Goes Into the Alternatives Bucket?

The 30% alternatives allocation isn't one-size-fits-all. Depending on your goals, risk tolerance, and investment horizon, it might include:

Private equity: Ownership stakes in companies not traded on public exchanges

Private credit: Direct lending to businesses, often with attractive yields

Hedge funds: Strategies designed to generate returns regardless of market direction

Real estate: Commercial properties, residential portfolios, or real estate debt

Infrastructure: Investments in essential assets like energy, transportation, and utilities

Digital assets: For those comfortable with the space, institutional-grade crypto exposure

The key is building a mix that aligns with your specific situation. A 35-year-old tech executive might load up on private equity for growth, while a retiree might emphasize private credit and real estate for income.

Accessibility: Not Just for Institutions Anymore

Here's the thing that's changed dramatically in recent years: you no longer need $500,000 minimums to access private markets.

Historically, alternatives were the playground of massive endowments and ultra-wealthy families. If you weren't writing seven-figure checks, the door was basically closed. But the investment landscape has evolved. New vehicles, structures, and platforms have democratized access to strategies that were previously off-limits.

J.P. Morgan now advises clients to allocate between 15% and 30% of investible funds to alternatives: advice that would have been impractical for most investors just a decade ago.

At Mogul Strategies, we've built our approach around making institutional-grade diversification accessible to accredited investors who want more than cookie-cutter portfolios can offer.

Getting Started: Practical Considerations

If you're intrigued by the 40/30/30 model, here are a few things to think about before diving in:

Understand your liquidity needs: Some alternatives have lock-up periods. Make sure you're not allocating money you might need in the short term.

Due diligence matters: Not all alternative investments are created equal. Manager selection, fee structures, and track records vary wildly.

Think long-term: The benefits of alternatives compound over time. This isn't a get-rich-quick play: it's a get-wealthy-steadily strategy.

Work with experts: The alternatives space can be complex. Having a team that understands the nuances can make a significant difference in outcomes.

The Bottom Line

The 40/30/30 portfolio model isn't about chasing the latest investment fad. It's about recognizing that the market environment has fundamentally changed and adapting accordingly.

When stocks and bonds are moving together, when inflation is eating into fixed income returns, and when volatility seems like the only constant: that's when true diversification becomes essential. And true diversification in 2026 means going beyond public markets.

The institutions have known this for years. The question is whether you're ready to apply the same thinking to your own portfolio.

The data supports it. The logic supports it. And for investors who qualify, the access is there. The 40/30/30 model isn't the future of portfolio construction; it's already the present for those paying attention.

Comments