The 40/30/30 Portfolio Model: How Accredited Investors Are Diversifying Beyond Traditional Assets

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 5 days ago

- 4 min read

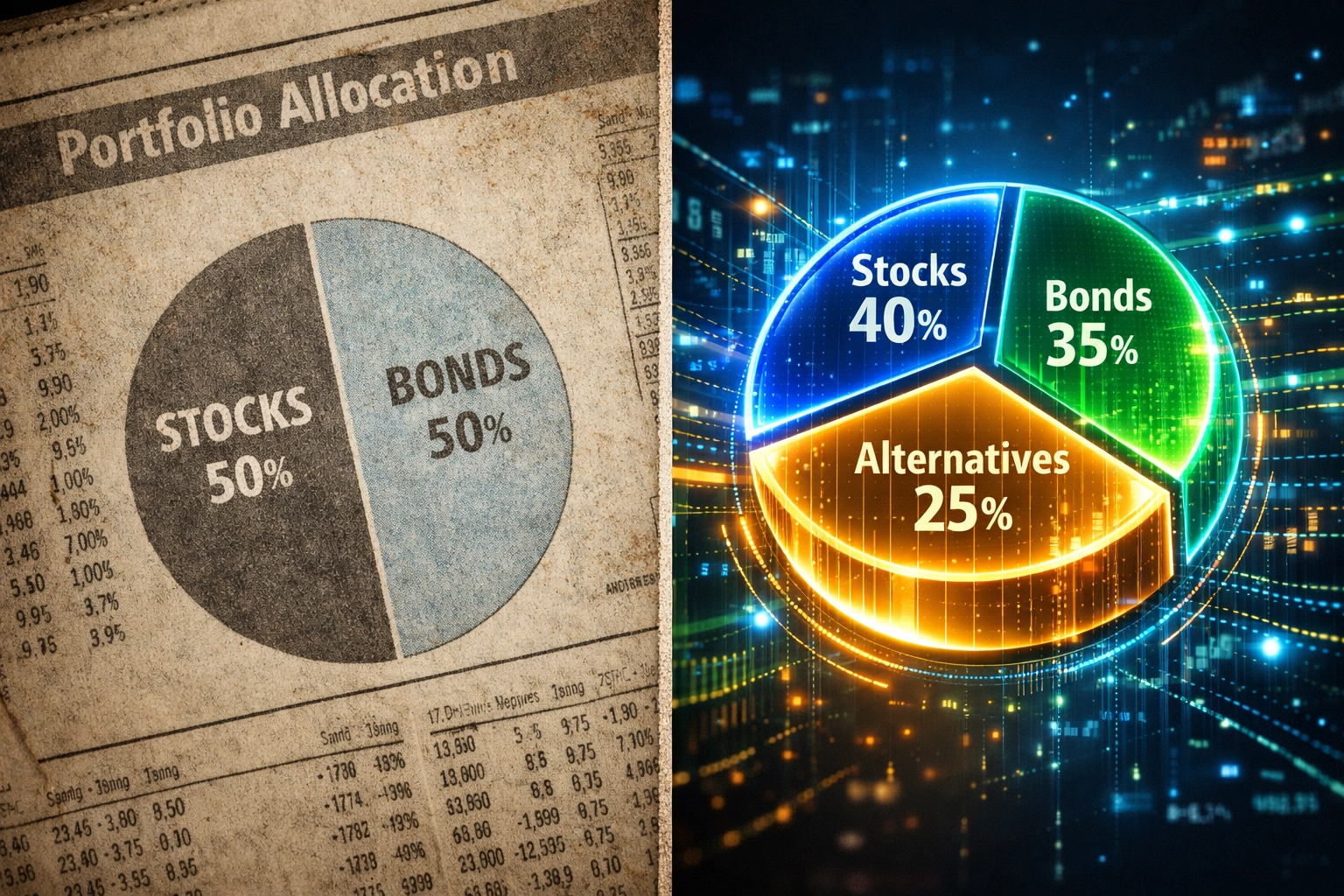

If you're still running a 60/40 portfolio in 2026, you're basically driving a 1990s minivan on the Autobahn. Sure, it'll get you there eventually, but you're missing out on performance, efficiency, and, let's be honest, the thrill of modern investing.

The traditional 60/40 split (60% stocks, 40% bonds) was a brilliant strategy for decades. But here's the problem: the market has evolved, and that old model hasn't kept pace. That's where the 40/30/30 portfolio comes in, a framework that's quickly becoming the go-to allocation for accredited investors and family offices looking to actually diversify their wealth.

What Exactly Is the 40/30/30 Model?

Let's break it down simply:

40% Public Equities – Your traditional stock market exposure

30% Fixed Income – Bonds and other debt instruments

30% Alternative Investments – This is where things get interesting

The magic happens in that 30% alternatives bucket. We're talking private equity, real estate syndications, hedge funds, commodities, and yes: even Bitcoin and digital assets for those who understand the landscape.

Think of it this way: you're taking 20% from your stock allocation and 10% from your bond allocation and redirecting it into investments that don't march to the same drummer as public markets. That's the core principle: diversification that actually means something.

Why the 60/40 Portfolio Stopped Working

Here's an uncomfortable truth: during the 2008 financial crisis and the 2020 COVID crash, the 60/40 portfolio behaved like it was 100% stocks. The correlation between stocks and bonds approached 1.0, meaning they moved together instead of offsetting each other.

That defeats the entire purpose of diversification.

When both your stocks and bonds are tanking simultaneously, you don't have a diversified portfolio: you have a portfolio with an identity crisis.

Add to this the current market environment: inflation volatility, interest rate uncertainty, geopolitical tensions, and bonds that can't provide the downside protection they once did. The 60/40 model isn't just outdated; it's potentially dangerous for wealth preservation.

The Numbers Don't Lie

Let's talk performance, because that's what actually matters.

J.P. Morgan's research found that adding just a 25% allocation to alternative assets can boost returns by 60 basis points. That might not sound like much, but it represents an 8.5% improvement on a projected 7% return. For a $10 million portfolio, that's an extra $60,000 per year. Compounded over a decade? We're talking real wealth creation.

KKR's analysis went further, showing that the 40/30/30 model outperformed the traditional 60/40 across every single timeframe they studied. Not some timeframes: all of them.

Candriam took it to the next level by examining risk-adjusted returns. They found a 40% improvement in the Sharpe ratio (which measures how much return you're getting for the risk you're taking). The 40/30/30 portfolio delivered higher overall returns, lower volatility, and better downside protection.

Translation: you make more money with less drama.

What Actually Goes in the Alternatives Bucket?

This is where most investors get confused, so let's clear it up.

The 30% alternatives allocation isn't a monolithic block. Smart investors break it down by function:

Return Enhancers (10-15%)

Private equity funds

Venture capital opportunities

Growth-focused real estate deals

Strategic crypto allocations

Risk Diversifiers (10-12%)

Hedge fund strategies (long/short equity, market neutral)

Managed futures

Commodities

Gold and precious metals

Downside Protectors (5-8%)

Private credit with senior secured positions

Infrastructure investments

Defensive real estate (medical facilities, storage)

The key is understanding that these assets behave differently from each other and from traditional stocks and bonds. When public equities are struggling, your private equity investments might be thriving. When inflation spikes, your commodity positions can offset losses elsewhere.

This is diversification that actually works.

Implementation for Accredited Investors

Here's the reality: you can't just wake up tomorrow and flip a switch to move from 60/40 to 40/30/30. Alternative investments require accredited investor status, higher minimums, and: most importantly: longer lock-up periods.

Step 1: Assess Your Liquidity Needs

Before allocating 30% to alternatives, make sure you've got adequate liquidity for the next 3-5 years. Many alternative investments have limited redemption windows, and you don't want to be forced to sell at the wrong time.

Step 2: Start With One Alternative at a Time

Don't try to build out the entire 30% overnight. Begin with one alternative asset class you understand: maybe real estate if you've got experience there, or a hedge fund strategy that makes sense for your risk profile.

Step 3: Focus on Fees and Access

Alternative investments come with higher fee structures. That's the price of admission. But make sure you're getting institutional-quality access, not retail-packaged products with waterfall fees that eat into returns.

Step 4: Rebalance Dynamically

The 40/30/30 isn't a "set it and forget it" strategy. Macroeconomic conditions change, and your alternatives allocation should adjust accordingly. When private equity valuations get frothy, dial back. When real estate faces headwinds, look for opportunities in other alternatives.

The Institutional Edge in 2026

What separates successful 40/30/30 portfolios from mediocre ones isn't just the allocation: it's the quality of opportunities within each bucket.

Institutional investors have been running versions of this model for years, accessing top-tier private equity funds, exclusive hedge fund strategies, and co-investment opportunities that regular investors never see. That access advantage is what drives outperformance.

The good news? The alternative investment landscape has democratized significantly. Accredited investors now have access to institutional-quality opportunities that were previously reserved for pension funds and endowments.

Beyond Traditional Thinking

Look, the 60/40 portfolio worked beautifully when interest rates were predictable, inflation was stable, and global markets moved independently. That world doesn't exist anymore.

The 40/30/30 model isn't some trendy investment fad: it's a logical evolution based on modern market realities. It's designed for an environment where traditional diversification fails, where correlations spike during crises, and where real alpha comes from accessing uncorrelated return streams.

For accredited investors serious about wealth preservation and growth, the question isn't whether to adopt a more sophisticated allocation strategy. The question is: what are you waiting for?

The market has changed. Your portfolio should too.

Ready to explore how alternative investments can strengthen your portfolio? At Mogul Strategies, we help accredited and institutional investors navigate the complexities of modern portfolio construction. Let's talk about what a diversified allocation strategy could look like for your specific situation.

Comments