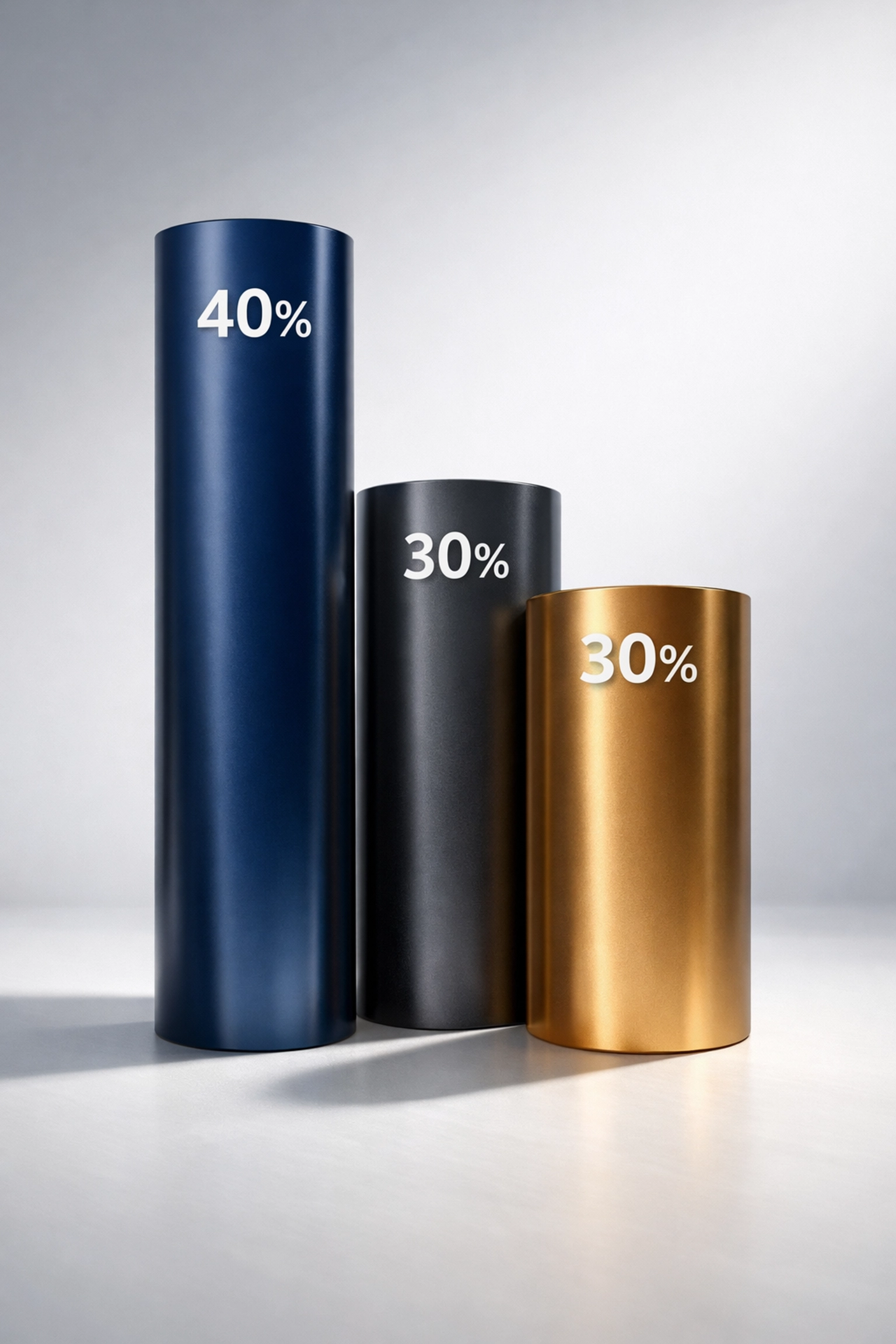

The 40/30/30 Portfolio Model: How Institutional Investors Are Blending Bitcoin with Traditional Assets in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 2 days ago

- 4 min read

Let's talk about something that's been on every institutional investor's mind lately: how do you build a portfolio that works in today's world?

The old 60/40 split between stocks and bonds? It's showing its age. When both stocks and bonds can tank together during inflation spikes, you need something better. That's where the 40/30/30 model comes in: and in 2026, we're seeing a fascinating twist with Bitcoin entering the equation.

What Is the 40/30/30 Model?

The traditional 40/30/30 framework breaks down like this:

40% Public Equities – Your standard stocks and market exposure

30% Fixed Income – Bonds and other debt instruments

30% Alternative Investments – Private equity, real estate, infrastructure, private credit

This setup addresses what the 60/40 model can't: the need for real diversification that actually protects you when markets get weird. And let's be honest, markets have been pretty weird lately.

The logic is simple. Alternatives give you access to assets that don't move in lockstep with the stock market. When public equities drop, your private real estate holdings or infrastructure investments might hold steady: or even appreciate. Research from J.P. Morgan showed that adding just 25% alternatives to a traditional 60/40 portfolio improved returns by 60 basis points. That's an 8.5% boost in performance.

But here's where things get interesting in 2026.

The Bitcoin Question

According to recent surveys, 44% of institutional investors now view cryptocurrency as a legitimate investment opportunity. That's up from 38% just last year. Even more telling? Half of all institutional investors expect to hold crypto by the end of this year, with 38% planning to increase their allocations.

These aren't retail traders gambling on meme coins. These are pension funds, endowments, and family offices with fiduciary responsibilities and risk management frameworks.

So the question becomes: where does Bitcoin fit in the 40/30/30 model?

Bitcoin as a New Asset Class Within Alternatives

Here's how forward-thinking institutions are thinking about this: Bitcoin doesn't replace any one category. Instead, it becomes a component within the alternatives bucket.

Think of it this way. That 30% alternative allocation traditionally includes:

Private equity (5-10%)

Real estate (5-10%)

Infrastructure (5-8%)

Private credit (5-7%)

Hedge funds (3-5%)

Now, institutions are carving out 2-5% for Bitcoin and select digital assets. They're treating it as a non-correlated asset class that offers unique benefits:

Inflation Protection – With central banks around the world continuing to print money, Bitcoin's fixed supply of 21 million coins looks more attractive every quarter.

24/7 Liquidity – Unlike private equity or real estate, you can move in and out of Bitcoin positions at any time. That's rare in the alternatives space.

Non-Correlation – Bitcoin doesn't move with traditional markets in predictable ways. When stocks drop due to Fed policy, Bitcoin might rise on adoption news. That's valuable diversification.

Institutional Infrastructure – By 2026, the custody solutions, regulatory frameworks, and trading platforms for Bitcoin have matured significantly. It's not the Wild West anymore.

Why This Matters Now

The timing of this shift isn't random. Several factors have converged to make Bitcoin institutional-grade:

The approval of Bitcoin ETFs has removed custody concerns for many institutions. You don't need to worry about private keys and cold storage when you can get exposure through regulated financial products.

Regulatory clarity has improved dramatically. While we don't have perfect rules yet, the SEC and other regulators have provided enough guidance that fiduciaries feel comfortable allocating capital.

Market maturity has reduced volatility: relatively speaking. Bitcoin still moves more than bonds, obviously, but the 80% drawdowns of early cycles are becoming less common as more institutional capital enters the market.

And here's the kicker: the correlation data supports the thesis. Bitcoin's correlation to stocks sits around 0.3-0.4, and its correlation to bonds is near zero. That's exactly what you want in a diversification play.

A Practical Example

Let's say you're managing a $100 million portfolio. Here's what a modern 40/30/30 allocation might look like:

Public Equities (40% = $40M)

U.S. Large Cap: $20M

International Developed: $12M

Emerging Markets: $8M

Fixed Income (30% = $30M)

Investment Grade Bonds: $18M

High Yield: $7M

TIPS: $5M

Alternatives (30% = $30M)

Private Equity: $9M

Real Estate: $8M

Private Credit: $6M

Infrastructure: $4M

Bitcoin/Digital Assets: $3M

That 3% Bitcoin allocation gives you meaningful exposure without taking on excessive risk. If Bitcoin doubles, you've added 3% to your total portfolio value. If it halves, you've lost 1.5%: manageable within a diversified framework.

The Risk Management Piece

Let's be clear: adding Bitcoin to institutional portfolios isn't about chasing moonshots. It's about calculated exposure to an emerging asset class with unique properties.

Smart institutions are approaching this with strict risk parameters:

Position sizing limits – Most cap Bitcoin at 5% maximum, with many starting at 1-3%.

Rebalancing protocols – When Bitcoin runs up and exceeds your target allocation, you sell into strength and rotate into other assets.

Custody standards – Using qualified custodians with insurance, not holding crypto on exchanges.

Due diligence processes – Treating Bitcoin allocation with the same rigor as any alternative investment.

The goal isn't to bet the farm on crypto. It's to capture asymmetric upside while maintaining downside protection through diversification.

Looking Ahead

As we move through 2026, the conversation is shifting from "should we allocate to Bitcoin?" to "how much and through what vehicles?"

The 40/30/30 model provides a proven framework for this. By treating Bitcoin as one component within a diversified alternatives allocation, institutions can participate in digital asset appreciation without abandoning the principles of sound portfolio construction.

Over 71% of institutional investors believe that portfolios with significant alternative allocations will outperform traditional stock-bond mixes. When you add Bitcoin's unique characteristics to that alternatives bucket, the case gets even stronger.

The key is doing it thoughtfully. Not every portfolio needs Bitcoin exposure, and not every institution has the risk tolerance or time horizon for digital assets. But for those that do, the 40/30/30 framework: with a measured Bitcoin allocation: offers a path forward that balances innovation with prudence.

That's the kind of evolution we're seeing in institutional portfolios right now. The models are adapting, the infrastructure is maturing, and the allocation decisions are getting more sophisticated.

At Mogul Strategies, we're helping clients navigate exactly these kinds of portfolio construction questions. Because in 2026, the institutions that win won't be the ones that ignored change or chased every trend( they'll be the ones that adapted intelligently.)

Comments