The 40/30/30 Portfolio Model: How to Diversify Like Institutional Investors in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 4 days ago

- 4 min read

Remember 2022? That year when your "diversified" portfolio got absolutely hammered because stocks and bonds dropped together? Yeah, that wasn't supposed to happen.

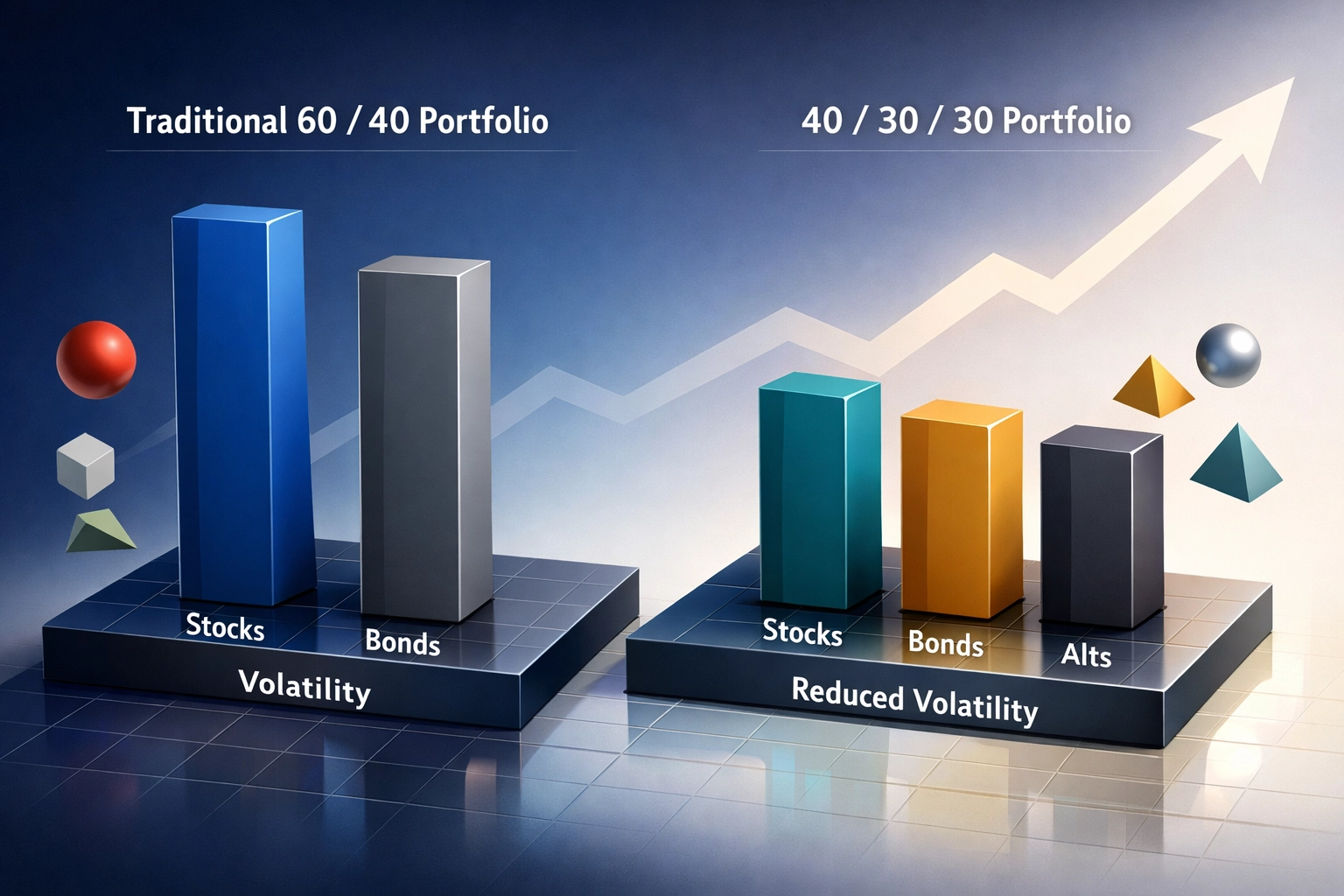

For decades, the 60/40 portfolio: 60% stocks, 30% bonds: was the gold standard. Financial advisors built entire careers on it. But when inflation roared back and interest rates spiked, both asset classes tanked simultaneously. The diversification everyone counted on simply... disappeared.

Institutional investors saw this coming. They've been quietly shifting their allocations for years, and now there's a framework that's gaining serious traction: the 40/30/30 portfolio model.

What Exactly Is the 40/30/30 Model?

It's pretty straightforward:

40% Public Equities (stocks)

30% Fixed Income (bonds)

30% Alternative Investments (private credit, real estate, infrastructure)

The key difference? That third bucket. Alternatives don't move in lockstep with public markets, which means when stocks and bonds are having a bad day (or year), you've got a third of your portfolio doing its own thing.

Why the 60/40 Stopped Working

The traditional 60/40 worked brilliantly for decades because stocks and bonds typically moved in opposite directions. Stocks down? Bonds usually up. It was a natural hedge.

But that relationship broke down when inflation returned with a vengeance. Rising rates crushed bond values while simultaneously tanking stock prices. Suddenly, diversification was an illusion.

The problem isn't just about one bad year. We're in a fundamentally different environment now:

Inflation is stickier than it was in the 2010s

Interest rates are higher and more volatile

Geopolitical tensions are reshaping global capital flows

The "easy money" era is over

In this landscape, you need assets that genuinely behave differently from each other. That's where alternatives come in.

Breaking Down That 30% Alternative Allocation

So what goes in the alternatives bucket? Most institutional investors split it three ways:

Private Credit (10%)

Think direct lending to companies that can't: or won't: access traditional bank financing. These are floating-rate instruments, which means when rates rise, your income rises too. And since you're not trading these on public exchanges, you avoid the daily price volatility.

Real Estate (10%)

Not REITs necessarily, but actual property investments or real estate syndications. The magic here is that many commercial leases have inflation escalators built directly into the contracts. Rent goes up when inflation goes up. It's a natural hedge.

Infrastructure (10%)

Toll roads, cell towers, energy pipelines: essential assets with predictable cash flows and often inflation-linked pricing. These investments tend to chug along regardless of what's happening in the stock market.

The beauty of these three? They're relatively uncorrelated to each other and to public markets. When the S&P 500 is having a meltdown, your toll road investment doesn't care.

The Numbers Don't Lie

Here's where it gets interesting. Research shows that a 40/30/30 portfolio doesn't just reduce risk: it actually delivers better risk-adjusted returns.

The Sharpe ratio (basically, return per unit of risk) for a 40/30/30 portfolio comes in at 0.71 versus 0.56 for the traditional 60/40. That's a meaningful improvement.

J.P. Morgan found that adding a 25% allocation to alternatives can boost returns by 60 basis points. That might not sound like much, but over 20-30 years? It compounds into serious wealth.

More importantly, the 40/30/30 model performs better during market stress. When everything's melting down, you want assets that hold their value. Alternatives provide that ballast.

How Institutional Investors Actually Implement This

Major institutions: endowments, pension funds, family offices: have been playing this game for years. Their alternative allocations often exceed 40%, not 30%.

Why? Because they have:

Access to top-tier private funds with manager selection expertise

Long investment horizons (they can lock up capital for 7-10 years)

Sophisticated due diligence teams to vet managers and deals

Scale to negotiate better fees and terms

They're not worried about quarterly liquidity. They think in decades.

For accredited investors working with firms like Mogul Strategies, you can access similar structures through fund-of-funds, direct co-investments, or managed alternative portfolios. The key is working with managers who have institutional-quality deal flow and can actually execute this strategy properly.

What About Retail Investors?

Here's the reality: implementing a true 40/30/30 model as a retail investor is challenging but not impossible.

You can use publicly traded alternative ETFs: things like infrastructure funds, private credit interval funds, or liquid alternative strategies. But there are trade-offs:

Higher fees: Alternative strategies aren't cheap, especially when wrapped in fund structures.

Liquidity constraints: Some interval funds only allow redemptions quarterly or even annually.

Manager selection risk: Not all alternative managers are created equal. The difference between a top-quartile and bottom-quartile private equity fund is enormous.

The honest truth? If you don't have at least a seven-figure portfolio and access to institutional channels, replicating this model perfectly is tough. But the principles still apply: diversifying beyond just stocks and bonds is increasingly essential.

When Does This Model Make Sense?

The 40/30/30 framework isn't for everyone. It works best if you believe:

We're not returning to the 2010s (low growth, low inflation, low rates)

Volatility is here to stay across both stocks and bonds

Inflation will remain elevated compared to the past decade

You have a long-term horizon (10+ years minimum)

If you think we're heading back to a period where tech stocks rip 30% annually and bonds provide steady 3% returns, stick with 60/40. But most institutional investors aren't betting on that scenario.

The 40/30/30 model also requires comfort with complexity. You're not just checking two numbers in your portfolio app. You're managing private investments with capital calls, distribution schedules, and K-1 tax forms. It's more work.

The Bottom Line

Diversification isn't just about owning different stocks. It's about owning different types of assets that respond to different economic forces.

The 40/30/30 model represents how sophisticated investors are thinking about portfolio construction in 2026. It's not a magic bullet: nothing is: but it addresses the core weakness that broke the 60/40 model: correlated risk.

For accredited and institutional investors, this framework offers a proven path to better risk-adjusted returns in an environment where traditional diversification has lost its edge. The institutions figured this out years ago. Now it's available to investors willing to think beyond the conventional playbook.

The question isn't whether alternatives belong in your portfolio. It's whether you can afford to build a portfolio without them.

Comments