The 40/30/30 Portfolio Model: Why Accredited Investors Are Ditching Traditional Diversification

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 1 hour ago

- 4 min read

Let's talk about something most wealth advisors won't admit: the traditional 60/40 portfolio is broken. Like, really broken.

For decades, the 60/40 split, 60% stocks, 40% bonds, was the gold standard of diversification. Financial advisors preached it like gospel. The logic was simple: when stocks zigged, bonds zagged. This negative correlation meant your portfolio stayed relatively stable even when markets went sideways.

But here's the problem. That correlation doesn't work anymore.

The Death of the 60/40 Portfolio

The world has changed, and traditional portfolio models haven't kept up. Today's market reality looks nothing like the environment that made 60/40 successful.

First, stocks and bonds now move in tandem. During recent market stress periods, they've fallen together instead of balancing each other out. The diversification benefit you're paying for? It's basically disappeared.

Second, the math just doesn't work anymore. During the 2008 financial crisis, the classic 60/40 portfolio lost over 30%. Same story in 2020 during the pandemic collapse. If your "diversified" portfolio can drop by a third, is it really diversified?

Add persistent inflation, volatile interest rates, and ongoing geopolitical tensions to the mix, and you've got a recipe for underperformance. Bonds aren't delivering the returns they used to, and they're certainly not providing the downside protection investors need.

Institutional investors figured this out years ago. Now, accredited investors are catching on, and they're making moves.

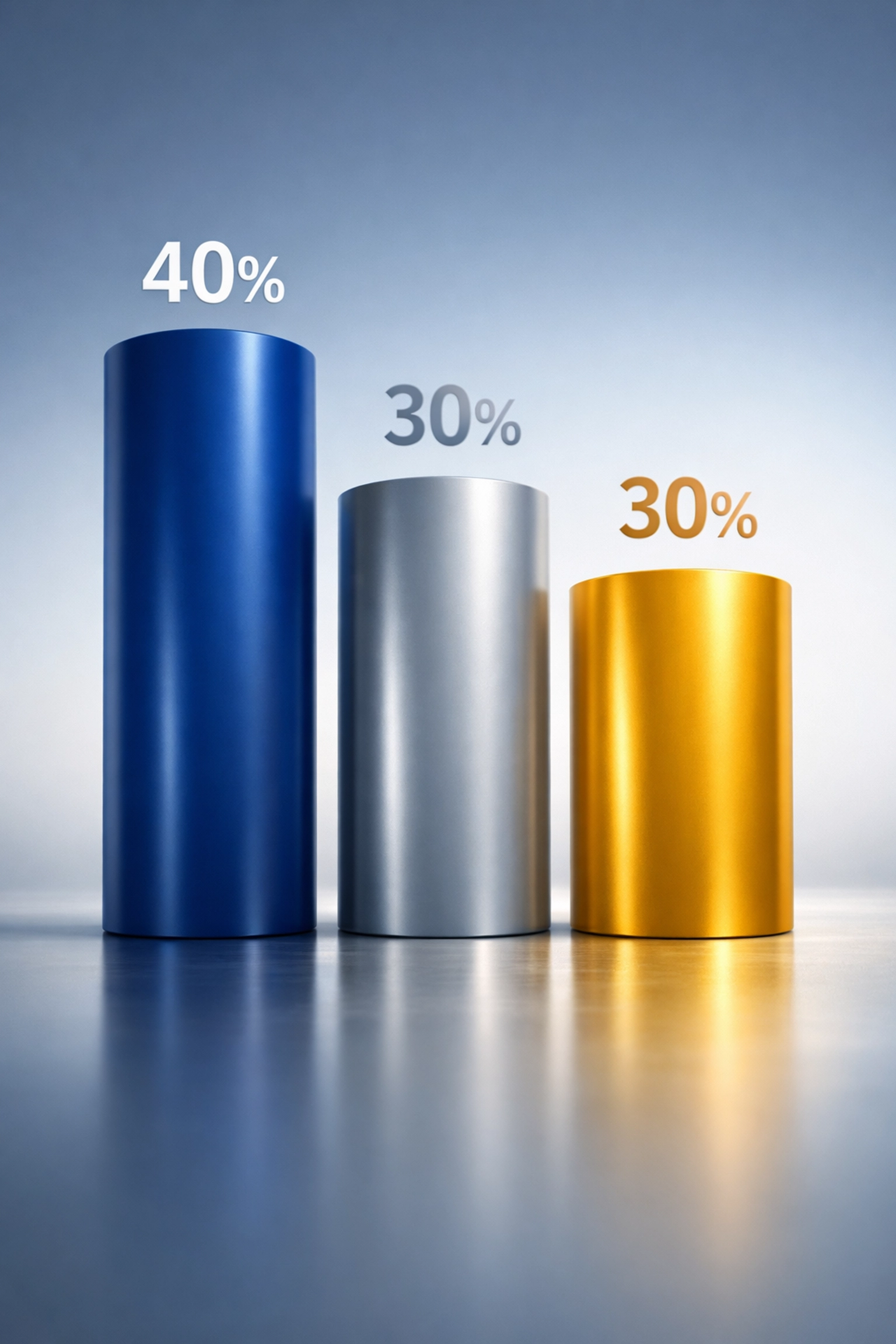

Enter the 40/30/30 Model

The 40/30/30 portfolio model isn't just a tweak to the old system. It's a fundamental rethinking of how diversification should work in 2026.

Here's the breakdown:

40% stocks (down from 60%)

30% bonds (down from 40%)

30% alternative investments (the game-changer)

That 30% allocation to alternatives is where the magic happens. Instead of relying on two asset classes that increasingly move together, you're introducing a third pillar of genuinely uncorrelated assets.

Think of it this way: the 60/40 model is like a two-legged stool. It worked fine for a while, but it was never stable. The 40/30/30 model adds a third leg, making the entire structure more balanced and resilient.

What Goes Into the Alternatives Bucket?

This is where it gets interesting, and where Mogul Strategies takes a different approach than most traditional asset managers.

The 30% alternatives allocation isn't a one-size-fits-all solution. You can break it down strategically based on what your portfolio actually needs:

Traditional alternatives like private credit, real estate, and infrastructure provide stability and uncorrelated returns. These assets don't dance to the same tune as public markets.

Digital assets like Bitcoin and select cryptocurrencies add a growth component with low correlation to traditional markets. Yes, they're volatile. But in a diversified alternatives sleeve, that volatility becomes a feature, not a bug.

Private equity opportunities give you access to growth that public markets can't offer, with longer time horizons and potentially higher returns.

The key is mixing these alternatives based on their portfolio role. Some provide downside protection during market crashes. Others generate returns that move independently of stocks and bonds. And some capture upside potential during recovery periods.

This functional approach: categorizing alternatives by what they do rather than what they are: creates multiple layers of protection against different market scenarios.

The Numbers Don't Lie

Performance data for the 40/30/30 model is compelling, especially when you look at risk-adjusted returns.

Candriam's research showed a 40% improvement in the Sharpe ratio compared to traditional 60/40 portfolios. For context, the Sharpe ratio measures how much return you're getting for each unit of risk you take. A 40% improvement is massive.

J.P. Morgan found that adding just a 25% allocation to alternative assets can boost returns by 60 basis points. That might not sound like much, but it represents an 8.5% improvement over the traditional portfolio's projected 7% return. Compounded over decades, that difference is worth millions.

KKR's analysis went even further, finding that 40/30/30 outperformed 60/40 across all studied timeframes. Not some. Not most. All.

These aren't theoretical projections. These are real-world results from institutional-grade portfolios that have actually implemented this model.

Why This Model Works Now

The 40/30/30 framework addresses the fundamental weaknesses that have emerged in traditional diversification:

Reduced single-point failure risk. When stocks and bonds fall together, a 60/40 portfolio has nowhere to hide. With alternatives, you've got assets that genuinely move differently.

Better inflation protection. Real assets like real estate and infrastructure, plus digital assets like Bitcoin, offer inflation hedges that bonds can't match in today's environment.

Access to institutional-grade strategies. For years, alternatives were the secret sauce that institutional investors used to outperform. The 40/30/30 model makes these strategies accessible to accredited investors.

Dynamic adaptation. Unlike the static 60/40 split, a well-managed 40/30/30 portfolio can adjust its alternatives allocation based on macroeconomic conditions.

Implementation Considerations

Moving to a 40/30/30 model isn't as simple as selling some stocks and buying a REIT. It requires thoughtful implementation and, frankly, access to opportunities that aren't available on public exchanges.

Liquidity matters. Some alternatives: like private equity or certain real estate syndications: have longer lock-up periods. Your alternatives allocation needs to balance illiquid, high-return opportunities with more liquid positions.

Quality varies wildly. Not all alternative investments are created equal. The difference between a well-structured private credit deal and a sketchy "alternative" fund can be enormous.

Tax efficiency. Different alternatives have different tax treatments. Bitcoin held long-term gets capital gains treatment. Real estate offers depreciation benefits. Private equity might generate carried interest. These details matter.

Rebalancing complexity. With three asset classes instead of two: and alternatives that don't always have daily pricing: rebalancing requires more sophistication than a traditional portfolio.

This is where working with an asset manager who actually understands alternative allocations becomes critical. You need a partner who can navigate private markets, digital assets, and traditional investments with equal competence.

The Mogul Strategies Difference

At Mogul Strategies, we've built our entire approach around blending traditional assets with innovative digital strategies. We're not just adding Bitcoin to a portfolio and calling it "alternative." We're constructing genuine diversification across uncorrelated assets.

Our 40/30/30 implementations combine institutional-grade private market access with digital asset integration and traditional portfolio management. It's a holistic approach that most traditional asset managers can't: or won't: offer.

The reality is simple: the investment landscape has changed. The strategies that worked for your parents' generation don't work anymore. Accredited investors who recognize this shift aren't just protecting their wealth: they're positioning themselves to actually grow it in a challenging market environment.

The question isn't whether traditional diversification is broken. It is. The question is what you're going to do about it.

Comments