The Accredited Investor's Guide to the 40/30/30 Diversification Model in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 28

- 5 min read

If you've been in the investing game for a while, you've probably heard the 60/40 portfolio praised as the gold standard of diversification. Sixty percent stocks, forty percent bonds: simple, elegant, and reliable. For decades, it worked beautifully.

But here's the thing: the market conditions that made 60/40 shine have fundamentally changed. And if you're still clinging to that classic split in 2026, you might be leaving serious returns on the table while taking on more risk than you realize.

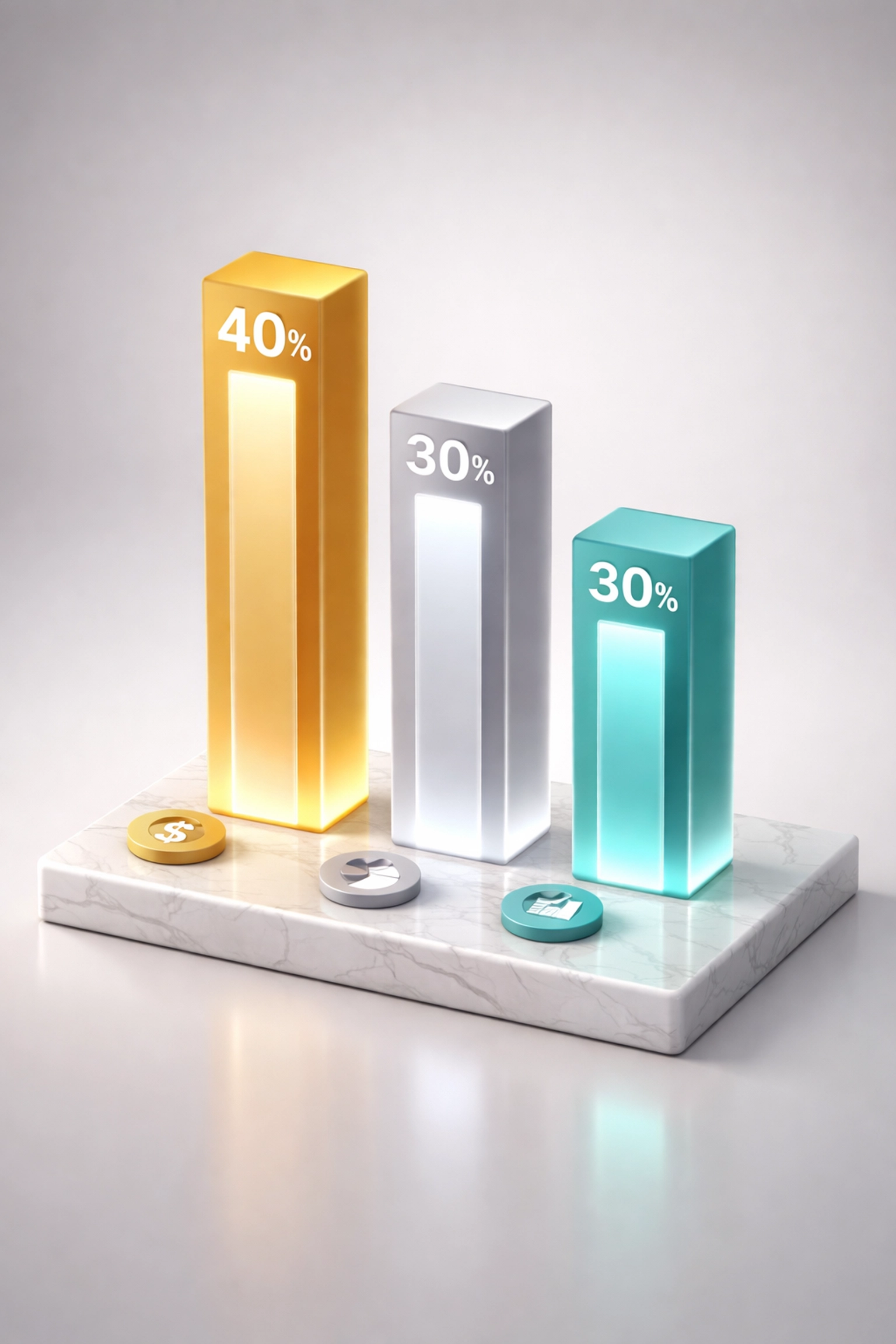

Enter the 40/30/30 model: a modern evolution that's gaining traction among sophisticated investors who want better risk-adjusted returns without completely reinventing the wheel. Let's break down what it is, why it works, and how you can implement it effectively.

Why the 60/40 Model Is Showing Its Age

The traditional 60/40 portfolio was built on a simple premise: when stocks go down, bonds go up. This negative correlation provided a natural hedge, smoothing out the bumps during market turbulence.

The problem? That relationship has broken down.

Research from Candriam found that the 60/40 allocation has become increasingly correlated with equity markets. During major selloffs like 2008 and 2020, 60/40 portfolios suffered losses exceeding 30%: not exactly the downside protection investors were counting on.

The structural shift is clear: the positive correlation between stocks and bonds has become a persistent feature, not a temporary anomaly. When both asset classes move in the same direction during stress periods, the diversification benefit evaporates precisely when you need it most.

Add in modest forward-looking return expectations for equities and the continued low-yield environment for bonds, and the case for sticking with 60/40 gets weaker by the day.

The 40/30/30 Framework Explained

The 40/30/30 model redistributes your portfolio into three buckets:

40% Stocks – Your growth engine, capturing equity market upside

30% Bonds – Still providing some income and stability

30% Alternatives – The new diversification workhorse

That 30% alternatives allocation is where things get interesting. By carving out a meaningful slice for non-traditional assets, you're adding a layer of true diversification that stocks and bonds alone can no longer provide.

This isn't a radical departure from conventional wisdom. Institutional investors and endowments have been running portfolios with 40%+ alternatives allocations for decades. The 40/30/30 model simply makes that institutional-grade resilience more accessible to accredited investors who don't need the extreme illiquidity of an endowment-style approach.

The Performance Case for 40/30/30

Numbers don't lie, and the data supporting 40/30/30 is compelling.

According to research from Candriam, the 40/30/30 portfolio demonstrated a 40% improvement in risk-adjusted returns (Sharpe ratio) compared to the traditional 60/40 split. That's not a marginal gain: it's a meaningful upgrade in efficiency.

J.P. Morgan's analysis tells a similar story. They found that adding just a 25% allocation to alternative assets boosts projected 60/40 returns by approximately 60 basis points. On a portfolio expecting 7% returns, that's an 8.5% improvement. Compound that over a decade or two, and you're talking about real money.

KKR's research confirmed the trend: 40/30/30 outperformed 60/40 across all timeframes studied. Whether you're looking at 5-year, 10-year, or 25-year windows, the enhanced allocation consistently delivered better results.

Historical analysis using broad indices: a global equity index, a US Treasury index, and a diversified hedge fund index: showed that this basic 40/30/30 allocation enhanced returns while simultaneously reducing both volatility and drawdowns. That's the holy grail of portfolio construction: better returns with less risk.

Building Your 30% Alternatives Sleeve

Not all alternatives are created equal. The key to making 40/30/30 work is selecting alternative assets based on what they actually do for your portfolio, not just lumping them into a generic "other" category.

Candriam proposes a functional allocation framework that categorizes alternatives by their portfolio role:

Downside Protection

These are your defensive alternatives: assets designed to cushion the blow during market stress. Think put options, volatility strategies, and managed futures that tend to profit when traditional assets struggle.

Uncorrelated Returns

This bucket includes hedge funds, private credit, and strategies that generate returns independent of stock and bond market movements. The goal here is adding return streams that don't move in lockstep with your equity exposure.

Upside Capture

For those willing to accept some illiquidity, venture capital and growth-oriented private equity can provide exposure to opportunities not available in public markets.

Within these categories, certain asset types stand out for accredited investors:

Essential infrastructure and real estate often feature inflation adjustment clauses built into their contracts. As consumer prices rise, so do the income streams: a natural hedge that's particularly valuable in today's inflation-conscious environment.

Private credit has gained significant prominence as a diversifying component. With banks pulling back from certain lending activities, private credit funds have stepped in, offering attractive yields with different risk characteristics than traditional fixed income.

The relative illiquidity of many private alternatives isn't necessarily a drawback. It enables patient, long-term strategic management and often results in more consistent, predictable income streams. For capital you don't need immediate access to, that trade-off can work in your favor.

Implementation Considerations

Moving from theory to practice requires some thought. Here's what to keep in mind:

Start With Your Liquidity Needs

Before allocating 30% to alternatives, honestly assess how much of your portfolio you can lock up for extended periods. Some alternatives offer quarterly liquidity; others might have 7-10 year lockups. Match your allocation to your actual liquidity requirements.

Diversify Within Alternatives

Don't put your entire 30% into a single hedge fund or one real estate deal. Spread across multiple strategies and managers to avoid concentration risk. The whole point of alternatives is diversification: apply that principle within the alternatives sleeve itself.

Mind the Fee Structures

Alternative investments typically carry higher fees than index funds. That's not automatically a dealbreaker, but it means you need genuine alpha to justify the cost. Focus on managers with track records that demonstrate persistent skill, not just lucky timing.

Consider Tax Efficiency

Many alternative investments generate complex tax consequences. Work with your tax advisor to understand the implications and, where possible, hold tax-inefficient alternatives in tax-advantaged accounts.

Dynamic Management: Stay Flexible

One of the advantages of the 40/30/30 framework is its flexibility. Rather than setting your allocation once and forgetting it, the model benefits from active rebalancing responsive to macroeconomic conditions.

As interest rates, inflation expectations, and geopolitical risks evolve, your optimal mix within each bucket may shift. A dynamic approach allows you to tilt toward defensive alternatives when storm clouds gather or lean into growth-oriented strategies when conditions favor risk-taking.

This doesn't mean market timing: it means staying responsive to regime changes rather than rigidly adhering to static targets regardless of circumstances.

The Bottom Line

The 40/30/30 model isn't about abandoning time-tested diversification principles. It's about updating them for a world where the old correlations no longer hold and new opportunities have emerged in the alternatives space.

For accredited investors seeking institutional-grade portfolio construction without the extreme illiquidity of endowment models, 40/30/30 offers a compelling middle ground. Better risk-adjusted returns, genuine diversification, and the flexibility to adapt as markets evolve.

The traditional 60/40 portfolio served investors well for a long time. But in 2026, the smart money is looking at what comes next. The 40/30/30 model might just be the upgrade your portfolio needs.

At Mogul Strategies, we specialize in building diversified portfolios that blend traditional assets with innovative strategies for high-net-worth investors. Reach out to learn how we can help you implement a modern allocation approach tailored to your goals.

Comments