The Institutional Investor's Guide to Blending Crypto and Real Estate in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 2 days ago

- 5 min read

If you've been building wealth in crypto over the past few years, you've probably asked yourself: "What do I do with these gains?" The answer more institutional investors are landing on in 2026: real estate.

This isn't about speculation or chasing the next hot trend. It's about converting digital assets into income-generating properties that'll be around for decades. And the infrastructure to make this happen smoothly? It's finally here.

Let's break down how sophisticated investors are actually doing this: and why it makes sense as part of a diversified portfolio strategy.

Why Institutional Money Is Moving Into Crypto Real Estate

The marriage of cryptocurrency and real estate solves several problems for institutional investors simultaneously.

First, there's the asset conversion opportunity. If you've accumulated significant crypto holdings, real estate offers a way to lock in gains into tangible, income-producing assets. Property values fluctuate, sure, but they don't swing 20% in a weekend.

Second, geographic diversification becomes dramatically easier. Want to add European exposure to your portfolio? With crypto, you can move capital across borders without the traditional banking headaches. No multi-week wire transfers. No endless compliance paperwork with three different banks.

Third, transaction costs drop significantly. Fewer intermediaries mean lower legal fees, reduced banking charges, and streamlined administrative processes. For large institutional transactions, these savings add up fast.

How It Actually Works (The Reality Check)

Here's what most people get wrong: you're probably not handing Bitcoin directly to a seller and getting keys in return.

The reality in 2026 is more sophisticated: and more practical. Most real estate transactions still require traditional fiat bank transfers for legal title registration. The magic happens in the bridge.

The institutional approach looks like this:

You identify a property and negotiate pricing in dollars or euros (standard practice). Then you use a regulated intermediary: often Swiss-regulated services that institutional investors trust: to convert your stablecoins into compliant bank transfers. These intermediaries handle SEPA, SWIFT, or ACH wire transfers to escrow agents or notaries, exactly as traditional transactions require.

This solves the "merchant gap." Most developers and government land registries don't accept direct crypto transfers. They don't need to. The regulated bridge handles conversion while maintaining full compliance with local property laws.

Portfolio Integration: Beyond Single Properties

The smartest institutional investors aren't just buying one vacation home with crypto proceeds. They're thinking about portfolio construction.

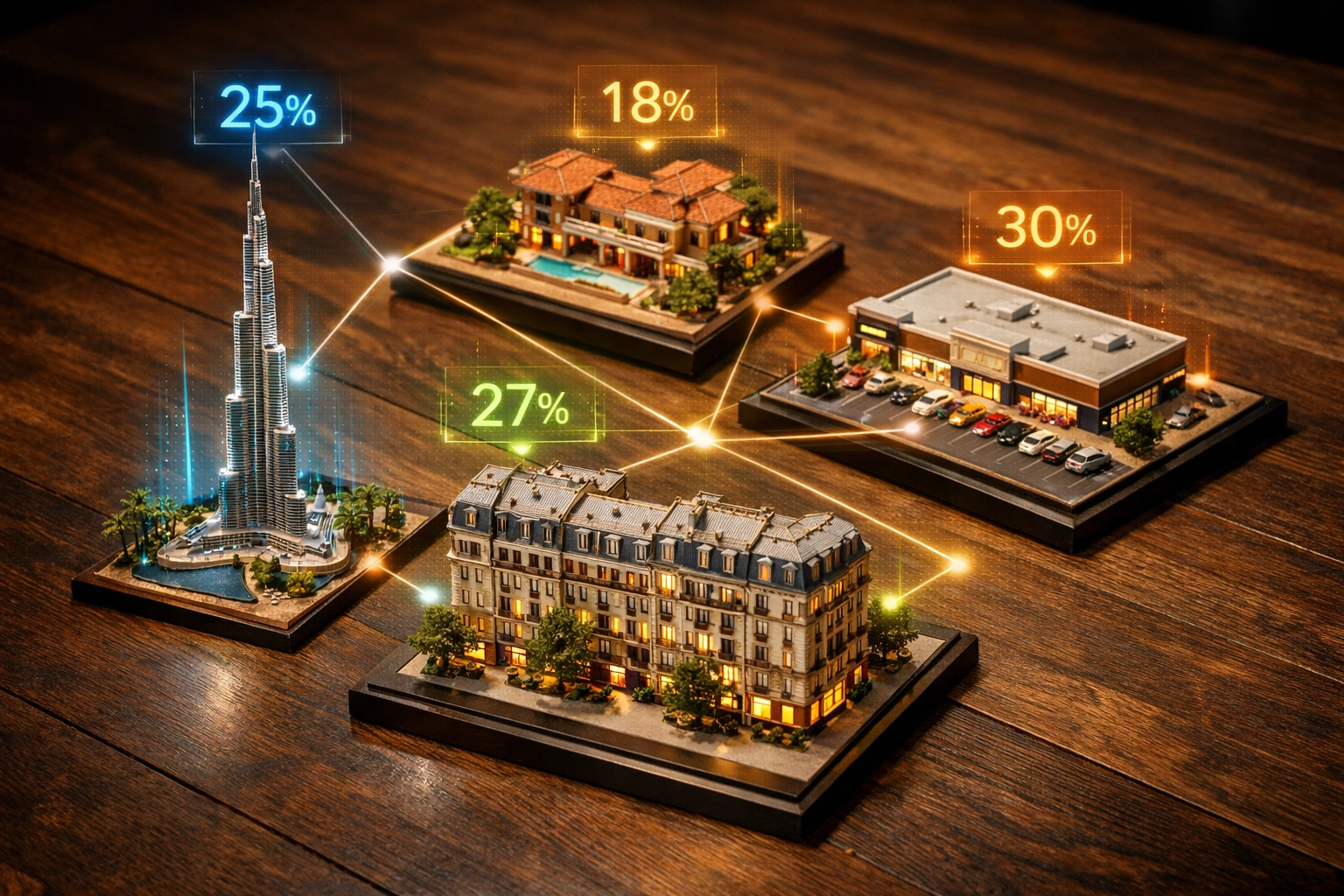

Fractional ownership through tokenization is changing the game. Instead of needing $5 million to buy an entire commercial property, blockchain-based tokenization lets you hold fractional stakes. This means you can diversify across multiple properties, asset classes, and jurisdictions without tying up massive capital in single assets.

A well-constructed crypto-to-real-estate strategy might include:

U.S. commercial properties for stable dollar-denominated income

European residential for geographic diversification

Emerging market opportunities for growth potential

Fractional stakes in multiple assets rather than full ownership of fewer properties

The key is thinking long-term. Property value creation doesn't depend on whether Bitcoin is up or down this month. It depends on location, local demand, property condition, and rental yield potential. That's the foundation of sound real estate investing, whether you're paying in dollars or converting from crypto.

Where Institutional Capital Is Actually Flowing

Not all markets are created equal when it comes to crypto real estate integration. Some jurisdictions have embraced this evolution; others remain skeptical.

Dubai leads globally. The Dubai Land Department has streamlined processes for licensed intermediaries to settle deals in local currency after crypto conversion. The infrastructure is sophisticated, the government is supportive, and institutional investors know they're operating in a clear regulatory framework.

Spain and Portugal rank high for European exposure, particularly for investors interested in Golden Visa programs. Spanish notaries are increasingly familiar with crypto-originated wire transfers, making the process smoother than it was even two years ago.

The United States sees significant activity in Florida and Texas. Stablecoin settlements for luxury residential and commercial properties represent a top trend, particularly for institutional investors who want U.S. exposure without traditional banking delays.

Other markets worth watching include Cyprus for European diversification and select Southeast Asian markets where regulatory frameworks are developing quickly.

Legal and Tax Reality Check

This is where institutional investors separate from casual buyers. Getting the legal and tax structure right from the beginning saves enormous headaches later.

Property ownership, title registration, contracts, and escrow arrangements still follow conventional real estate procedures regardless of how you funded the purchase. That's actually good news: it means you're operating within established legal frameworks with predictable outcomes.

But the tax implications require attention. Converting crypto to fiat to buy real estate is a taxable event in most jurisdictions. The capital gains implications vary significantly by country, and getting this wrong can be expensive.

Institutional investors should:

Work with crypto tax specialists who understand both digital assets and real estate

Use regulated intermediaries that provide proper documentation for "source of wealth" verification

Understand the specific compliance requirements in each jurisdiction where they're buying

Structure ownership correctly from day one (LLCs, trusts, or other entities depending on goals)

Risk Management Essentials

Let's be direct: combining crypto and real estate introduces unique risks that require specific management strategies.

Volatility timing matters. If you're converting volatile crypto to buy property, timing can significantly impact your effective purchase price. Many institutional investors now use stablecoins or pre-agreed conversion rates to lock in pricing during the transaction window.

Escrow services are non-negotiable. Use trusted, regulated escrow services for all cryptocurrency transfers. The additional cost is insurance against catastrophic loss.

Due diligence doesn't change. Whether you're paying in dollars or converting from crypto, proper property verification, inspection, title search, and legal review remain essential. Don't let the excitement of using crypto distract from fundamental real estate due diligence.

Liquidity planning is critical. Real estate is illiquid. If you're converting a significant portion of crypto holdings to property, ensure you maintain adequate liquid reserves for other opportunities and emergencies.

The Infrastructure Evolution Continues

We're still in early innings of crypto-real estate integration. The infrastructure in 2026 is light-years ahead of where it was in 2022, but it's continuing to evolve rapidly.

Smart contracts are beginning to automate key transaction steps, reducing settlement time and human error. Blockchain-based recordkeeping for property documentation is emerging, though it's not yet standard practice in most jurisdictions. Digital settlement layers are streamlining cross-border transfers, making international diversification increasingly practical.

The most significant development might be standardized tokenization frameworks. These enable institutional participation in large-value assets through fractional ownership without the complexity of traditional syndication structures.

Practical Next Steps

If you're an institutional or accredited investor considering this strategy, start here:

First, clarify your objectives. Are you looking to convert crypto gains into stable, income-producing assets? Diversify geographically? Access specific markets? Your goals shape your strategy.

Second, build your team. You need professionals who understand both crypto and real estate: not just one or the other. A crypto tax specialist, a real estate attorney familiar with digital asset transactions, and a regulated conversion service form your core team.

Third, start with markets that have clear regulatory frameworks. Dubai, select European markets, and certain U.S. states offer institutional-grade infrastructure and predictable processes. Leave frontier markets for later.

Fourth, think portfolio construction. This isn't about one property. It's about building a diversified real estate portfolio funded by digital assets that complements your overall wealth strategy.

The Bottom Line

Blending crypto and real estate in 2026 isn't experimental: it's increasingly standard practice for institutional investors converting digital wealth into tangible, income-producing assets.

The infrastructure is mature enough to support sophisticated transactions. The regulatory frameworks in leading markets provide clarity. The economic rationale: converting volatile digital assets into stable, appreciating real property: makes fundamental sense for long-term wealth preservation.

At Mogul Strategies, we work with accredited and institutional investors to build diversified portfolios that bridge traditional and digital assets. If you're sitting on crypto gains and wondering about your next move, this might be the strategy that fits.

The key is approaching it like the institutional investor you are: with proper planning, professional guidance, and a clear long-term strategy. Done right, crypto-funded real estate can be a cornerstone of wealth preservation for decades to come.

Comments