The Proven 40/30/30 Diversification Framework: Why Institutional Investors Are Switching in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Feb 1

- 4 min read

The 60/40 portfolio is broken. Not struggling: broken.

For decades, institutional investors relied on a simple formula: 60% stocks, 40% bonds. When stocks zigged, bonds zagged. It was elegant, predictable, and worked beautifully through multiple market cycles. But here's the uncomfortable truth that's reshaping institutional allocations in 2026: stocks and bonds now move together.

When they both drop simultaneously during market stress, your "diversified" portfolio isn't diversified at all. It's just a synchronized nosedive with extra steps.

This is exactly why sophisticated institutions are pivoting to the 40/30/30 framework: and why you should pay attention.

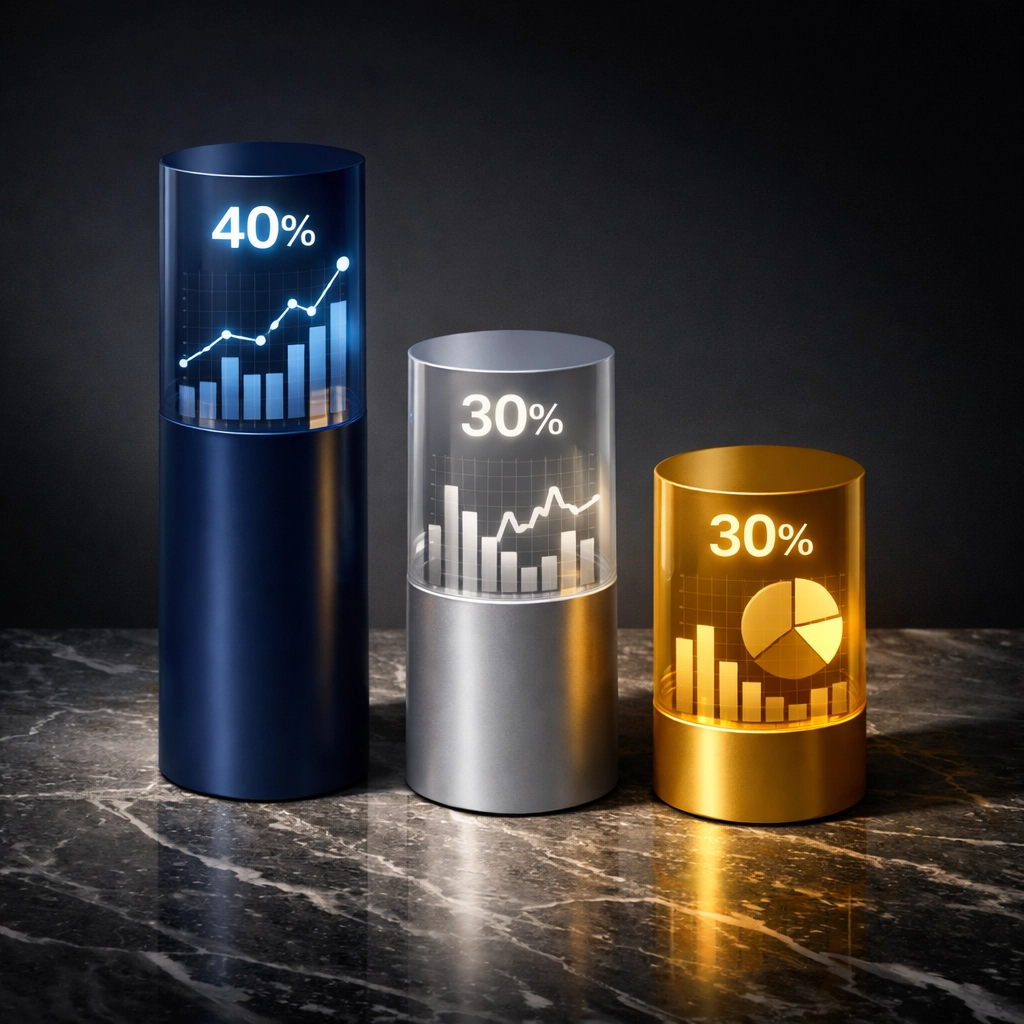

What Is the 40/30/30 Framework?

The 40/30/30 allocation breaks down like this:

40% public equities – Your growth engine, but with reduced exposure compared to traditional models

30% fixed income – Stability and income, but not the entire safety net

30% alternative investments – The game-changer that provides genuine diversification

Think of it as taking the training wheels off the 60/40 model. Instead of relying on just two asset classes that have started moving in lockstep, you're introducing a third dimension that operates independently of traditional market movements.

The alternatives bucket can include private equity, real estate, infrastructure, commodities, hedge fund strategies, and yes: digital assets like Bitcoin that offer non-correlated returns.

The Correlation Problem That Changed Everything

Here's what killed the 60/40 model: correlation breakdown.

Historically, when the stock market tanked, high-quality bonds rallied as investors fled to safety. This negative correlation was the entire point. Your bond allocation cushioned the blow when equities got hammered.

But something fundamental shifted. During recent inflation shocks and market downturns, stocks and bonds declined together. Suddenly, that 40% bond allocation that was supposed to protect you became just another source of losses.

When your diversification strategy stops diversifying, you don't have a strategy: you have hope disguised as methodology.

The 40/30/30 framework solves this by introducing alternative investments that genuinely don't move in sync with traditional markets. Real estate with inflation-adjusted leases. Infrastructure projects with contractual protections. Private equity opportunities disconnected from public market sentiment. Digital assets with their own unique drivers.

This is what researchers call "breadth of diversification": multiple independent layers of protection against different types of risk.

The Performance Numbers Don't Lie

Let's talk results, because theory is worthless without execution.

J.P. Morgan's research found that adding 25% alternative assets to a traditional 60/40 portfolio improved returns by 60 basis points. That translates to an 8.5% improvement over the 60/40's projected 7% return. Over a 20-year horizon, that's the difference between comfortable retirement and generational wealth.

KKR went further, testing the 40/30/30 framework across multiple time periods. The verdict? It outperformed 60/40 in every single timeframe studied.

But here's what matters more than absolute returns: risk-adjusted performance.

By reducing equity allocation from 60% to 40%, you're cutting exposure to equity-specific risks: sector concentration, market timing sensitivity, and volatility drag. You're not sacrificing returns; you're achieving similar or better outcomes through genuinely diversified sources.

Why Institutions Have Been Doing This for Years

Large endowments, pension funds, and family offices have allocated over 40% to alternatives for decades. Yale's endowment has been running variations of this approach since the 1980s. Major pension funds routinely allocate 30-50% to alternatives.

Why? Because they understood something retail investors and traditional wealth managers were slow to grasp: true diversification requires assets that respond to different market forces.

The difference in 2026 is that alternative strategies once reserved for institutions are becoming increasingly accessible to accredited investors. Private equity funds are lowering minimums. Real estate syndications are opening to qualified purchasers. Digital asset infrastructure has matured to institutional standards.

The 40/30/30 framework isn't asking you to pioneer unproven strategies. It's asking you to adopt what sophisticated institutions have validated over decades.

Key Advantages of the 40/30/30 Approach

Inflation Protection That Actually Works

Many alternative assets include built-in inflation adjustments. Infrastructure projects often have contractual escalators tied to CPI. Real estate leases include periodic rent increases. Commodities and certain digital assets have historically served as inflation hedges.

When inflation spikes and your stock-bond portfolio gets crushed, these alternatives maintain purchasing power through structural protections rather than market timing luck.

Reduced Drawdown Risk

The math is simple: 60% equity exposure means bigger swings. When markets drop 30%, your 60/40 portfolio takes a serious hit. The 40/30/30 model, with its lower equity allocation and non-correlated alternatives, experiences smaller drawdowns during equity bear markets.

Smaller losses mean you need smaller gains to recover. Compounding works in your favor instead of against you.

Multiple Return Drivers

Instead of relying solely on equity risk premium and interest rate movements, you're tapping into private market premiums, real asset cash flows, alternative strategy alpha, and digital asset growth potential.

When one engine sputters, others keep running.

Building Your 40/30/30 Portfolio in 2026

The alternatives bucket is where this framework gets interesting: and where most investors need guidance.

Your 30% alternatives allocation might include:

Private equity and venture capital (8-10%) – Access to pre-IPO growth and private market premiums

Real estate and infrastructure (8-10%) – Cash flow, inflation protection, and tangible assets

Hedge fund strategies (5-7%) – Market-neutral approaches and tactical opportunities

Digital assets (3-5%) – Bitcoin and select crypto exposure for non-correlated upside

The exact allocation depends on your risk tolerance, liquidity needs, and investment timeline. But the principle holds: you're building genuine diversification across assets that respond to different economic forces.

At Mogul Strategies, we specialize in exactly this type of construction: blending traditional institutional-grade assets with innovative digital strategies to create portfolios that actually diversify.

The Bottom Line

The 60/40 portfolio served investors well for generations. But markets evolve, correlations shift, and strategies that worked in low-inflation, declining-rate environments may not thrive in the world we're entering.

The 40/30/30 framework isn't a radical departure. It's a measured evolution that acknowledges current market realities while maintaining the core principle of diversification: just with assets that genuinely diversify.

Institutional investors made this switch years ago. The question isn't whether this approach works (the data confirms it does). The question is whether you're still clinging to a framework that stopped working.

If you're ready to explore how the 40/30/30 model could strengthen your portfolio, let's talk. We help accredited and institutional investors navigate exactly these types of transitions.

Comments