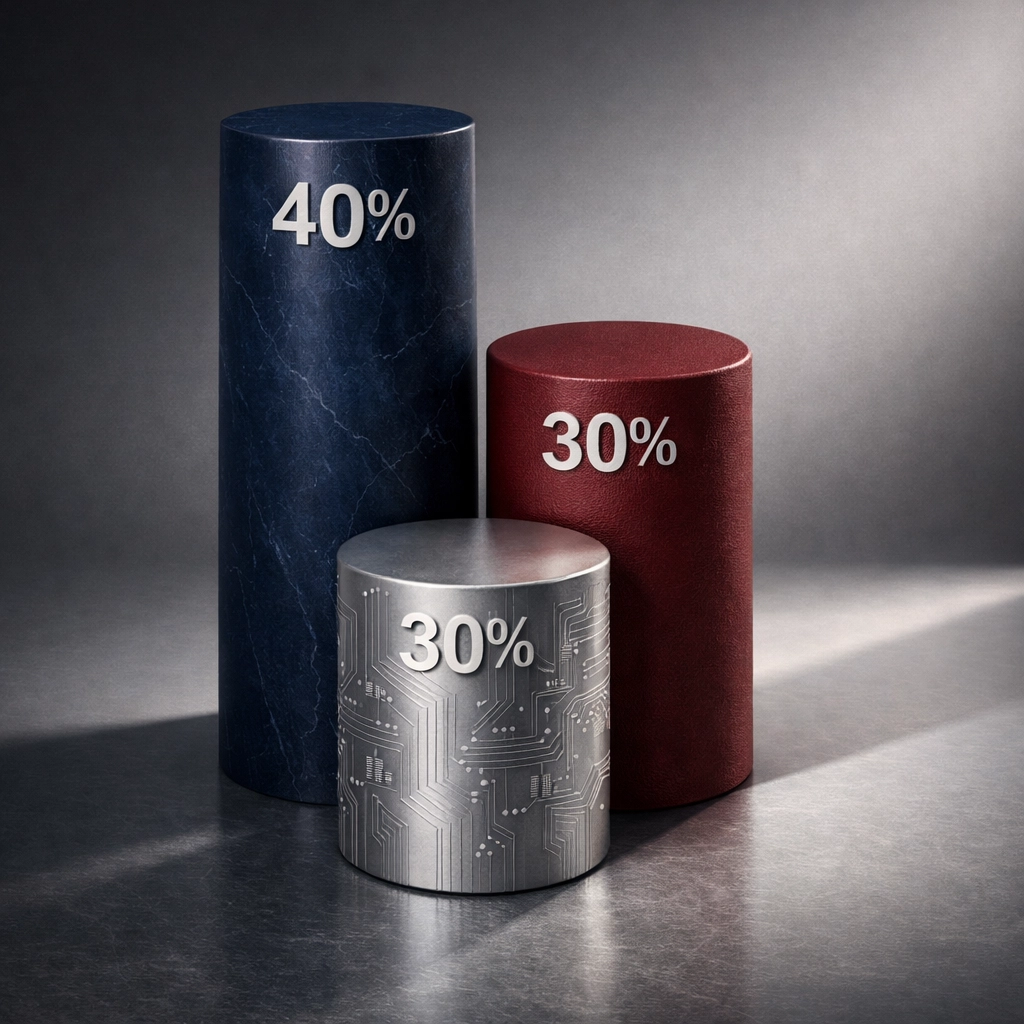

The Proven 40/30/30 Diversified Portfolio Framework for Accredited Investors

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 2 hours ago

- 5 min read

If you're an accredited investor, you've probably noticed something: the old 60/40 portfolio split just doesn't cut it anymore. Between market volatility, inflation concerns, and the emergence of new asset classes, high-net-worth individuals need a framework that actually reflects today's investment landscape.

That's where the 40/30/30 framework comes in.

This isn't some theoretical allocation dreamed up in a textbook. It's a practical approach we've developed at Mogul Strategies specifically for accredited and institutional investors who want true diversification without sacrificing growth potential.

Breaking Down the 40/30/30 Framework

The model is straightforward: 40% traditional core assets, 30% alternative investments, and 30% digital innovation strategies. Each segment serves a specific purpose in your portfolio, and together they create a balanced approach that traditional retail investors simply can't access.

Let's break down each component.

The 40% Core: Traditional Assets with Strategic Intent

This isn't your grandfather's stock-and-bond portfolio. The 40% core allocation focuses on institutional-grade equities, fixed income, and liquid securities that provide stability and consistent returns. But here's the key difference: we're not just buying index funds and calling it a day.

Within this segment, we prioritize:

Blue-chip equities with proven dividends – Companies that have weathered multiple market cycles and continue generating shareholder value. Think established tech giants, healthcare leaders, and consumer staples that won't disappear overnight.

Investment-grade corporate bonds – Not just treasuries. We're talking about carefully selected corporate debt that offers yield without excessive risk. In today's environment, selective credit exposure matters more than ever.

Tactical sector positioning – Unlike passive investing, this approach allows for strategic overweights in sectors showing institutional accumulation and fundamental strength.

The goal here isn't to shoot the lights out with returns. It's about creating a reliable foundation that generates predictable income and preserves capital during market downturns. Think of it as your portfolio's shock absorber.

The 30% Alternative Bucket: Where Accredited Status Pays Off

Here's where being an accredited investor really matters. This 30% allocation gives you access to opportunities that most retail investors will never see. We're talking about investments with low correlation to public markets and the potential for outsized returns.

Private Equity Opportunities

Direct investments in established businesses or PE fund commitments that target middle-market companies. These investments typically require longer holding periods (5-10 years), but historically they've delivered returns that justify the illiquidity premium.

The key is selectivity. Not all private equity is created equal. We focus on sponsors with proven track records and investment theses that make sense in the current economic environment.

Real Estate Syndication

Commercial real estate syndications offer something special: tangible assets, tax advantages through depreciation, and regular cash flow distributions. Whether it's multifamily properties, industrial warehouses, or specialty real estate like medical office buildings, this asset class provides both income and appreciation potential.

What we like about syndications is the professional management aspect. You're not becoming a landlord – you're investing alongside experienced operators who handle everything while you collect distributions.

Hedge Fund Strategies

Carefully selected hedge fund positions that provide downside protection and uncorrelated returns. We're not talking about every hedge fund under the sun. We focus on strategies like long-short equity, market neutral, and event-driven approaches that actually deliver on their promise of reduced volatility.

The alternative bucket is where diversification truly happens. When stocks zig, these assets often zag. That's not just theory – it's portfolio protection in action.

The 30% Innovation Strategy: Digital Assets and Future-Focused Investments

This is where traditional asset managers get nervous, but it's exactly why the 40/30/30 framework makes sense for sophisticated investors who understand where markets are heading.

Institutional-Grade Bitcoin and Digital Assets

Bitcoin isn't speculation anymore – it's a legitimate asset class with institutional adoption, regulated custody solutions, and growing acceptance as a portfolio diversifier. The 30% innovation allocation includes measured exposure to Bitcoin and select digital assets through regulated vehicles and institutional custody.

We're not talking about day-trading altcoins. This is about strategic allocation to digital assets that have established network effects, regulatory clarity, and institutional infrastructure.

Digital Real Estate and Tokenization

The future of real estate investment is digital. Tokenized real estate allows fractional ownership of high-value properties with enhanced liquidity compared to traditional real estate investments. This segment represents the convergence of blockchain technology and tangible assets.

Emerging Technology Funds

Venture capital exposure to breakthrough technologies – artificial intelligence, quantum computing, biotech innovations, and clean energy solutions. These investments carry higher risk but offer asymmetric return potential that can significantly enhance portfolio performance.

The innovation bucket isn't about chasing trends. It's about strategically positioning capital in areas with secular tailwinds that will shape the next decade of wealth creation.

Why This Framework Works for Accredited Investors

The 40/30/30 model addresses the three critical needs every high-net-worth investor faces:

Risk Management – By spreading capital across uncorrelated asset classes, you're not dependent on any single market segment. When public equities struggle, your alternatives and digital assets can pick up the slack.

Growth Potential – The combination of traditional stability, alternative income, and innovation exposure creates multiple paths to portfolio growth. You're not betting everything on one outcome.

Access Advantages – As an accredited investor, you have legal access to investments that generate superior risk-adjusted returns. This framework is designed to leverage that advantage fully.

Implementation Considerations

Building a 40/30/30 portfolio isn't something you do overnight. It requires thoughtful planning, proper due diligence, and ongoing management.

Liquidity Management – With 60% of your portfolio in less-liquid investments, maintaining adequate cash reserves outside this allocation is crucial. Most investors should keep 6-12 months of expenses in highly liquid accounts separate from this framework.

Due Diligence – Every private investment requires thorough vetting. This means reviewing offering documents, understanding fee structures, assessing manager track records, and evaluating exit strategies before committing capital.

Rebalancing Discipline – Market movements will shift your allocations over time. Quarterly reviews and annual rebalancing help maintain your target weightings and harvest gains from outperforming segments.

Tax Optimization – Different asset classes receive different tax treatment. Strategic placement of investments across taxable and tax-advantaged accounts can significantly enhance after-tax returns.

The Bottom Line

The 40/30/30 framework isn't for everyone – and that's exactly the point. It's designed specifically for accredited investors who have both the financial capacity and the risk tolerance to pursue sophisticated diversification strategies.

If you're still relying on traditional allocation models designed for retail investors, you're leaving opportunity on the table. The investment landscape has evolved, and your portfolio strategy should evolve with it.

At Mogul Strategies, we've built our approach around this framework because it works. It balances prudent risk management with aggressive growth positioning. It combines time-tested investment principles with innovative opportunities that didn't exist a decade ago.

Want to explore how the 40/30/30 framework might work for your specific situation? Let's talk about building a portfolio that reflects both where markets have been and where they're heading. Visit us at Mogul Strategies to start the conversation.

Comments