The Proven 40/30/30 Framework: How Institutional Investors Balance Traditional Assets with Bitcoin

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 6 days ago

- 5 min read

The 60/40 portfolio is officially on life support. After decades of steady performance, the traditional mix of 60% stocks and 40% bonds got hammered when both asset classes dropped simultaneously in 2022. Institutional investors learned a hard lesson: when correlations converge, traditional diversification fails.

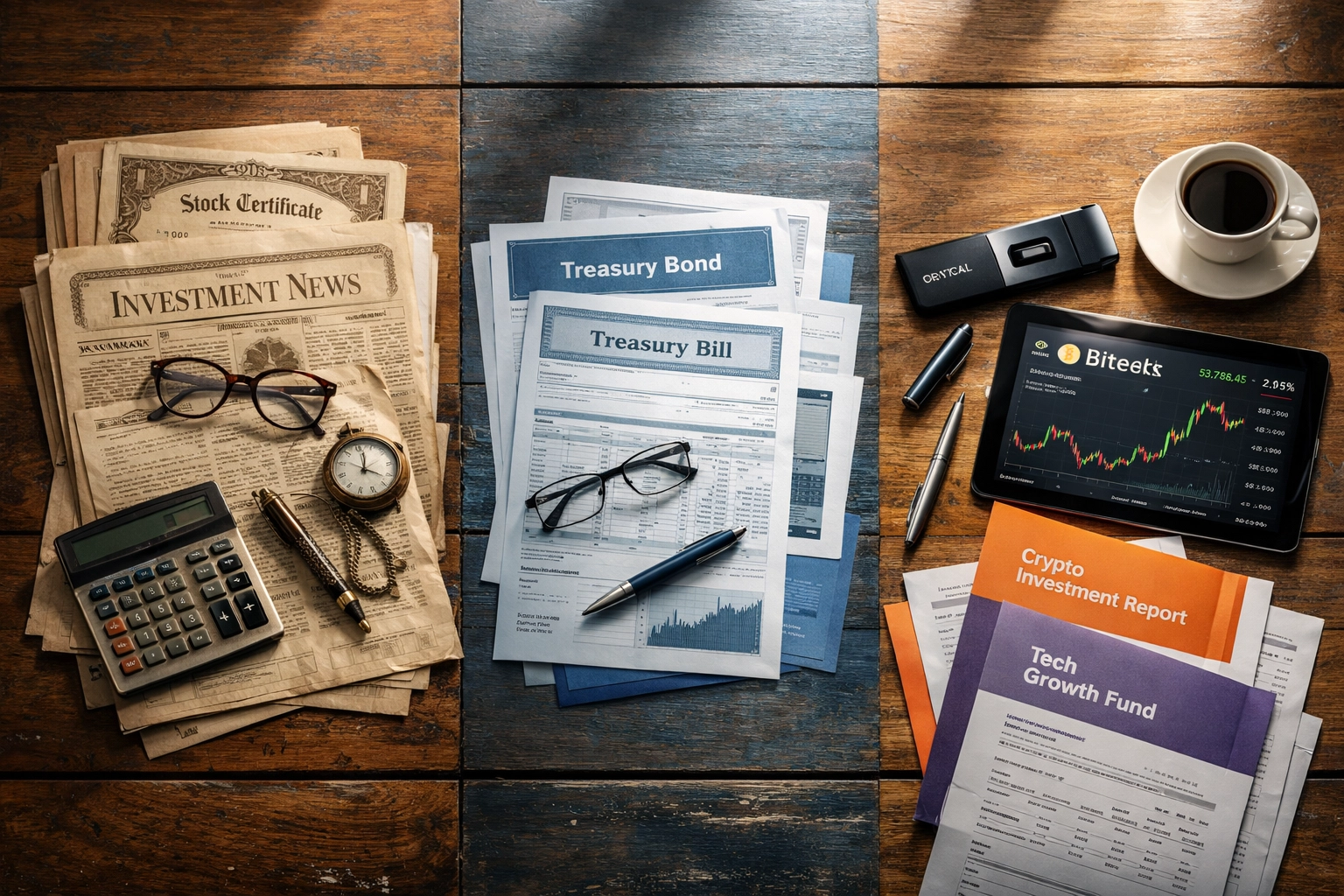

Enter the 40/30/30 framework: a smarter allocation strategy that's gaining traction with forward-thinking fund managers and family offices. Here's how it breaks down: 40% stocks, 30% bonds, and 30% alternative assets. Simple on paper, but the magic happens in how you fill that 30% alternatives bucket.

And increasingly, Bitcoin is earning its place in that allocation.

Why Traditional Portfolios Need a Makeover

Let's talk about what went wrong. The 60/40 portfolio worked brilliantly when stocks and bonds moved in opposite directions. Stock market crashes? Your bonds cushioned the blow. Rising rates helping bonds? Your equities captured growth.

But that negative correlation broke down. When inflation spiked and central banks raised rates aggressively, both stocks and bonds fell together. The protection investors counted on vanished.

Institutional portfolios need assets that actually move independently from traditional markets. That's where alternatives come in: and why Bitcoin deserves serious consideration alongside private equity, real estate, and hedge funds.

Breaking Down the 40/30/30 Framework

40% Stocks: This is your growth engine. Public equities still offer liquidity and long-term appreciation. But instead of the old 60% allocation, you're dialing it back to manage volatility exposure.

30% Bonds: Fixed income remains essential for stability and income generation. Treasury bonds, investment-grade corporates, and municipal bonds still have a role: just a smaller one. This reduced allocation acknowledges that bonds may not deliver the same risk-adjusted returns in a higher-rate environment.

30% Alternative Assets: This is where the framework gets interesting. Alternative investments are supposed to provide uncorrelated returns: meaning they don't move in lockstep with stocks or bonds. Think private equity, real estate syndications, commodities, hedge funds, and increasingly, digital assets like Bitcoin.

The beauty of this structure? You're not abandoning traditional assets, you're complementing them with strategies that behave differently during market stress.

Bitcoin's Role in the Alternatives Bucket

Here's where opinions split. Some institutional investors still see Bitcoin as too volatile, too speculative, or too difficult to custody properly. But others: particularly those who've watched Bitcoin survive multiple cycles: see it differently.

Bitcoin offers something unique: a non-sovereign, scarce digital asset with zero correlation to traditional markets over longer timeframes. It's not tied to corporate earnings, interest rates, or government policy in the same way stocks and bonds are.

When allocating that 30% alternatives slice, a growing number of institutions are dedicating 3-5% of their total portfolio to Bitcoin. That translates to roughly 10-15% of the alternatives bucket. Not a massive bet, but meaningful enough to move the needle if Bitcoin continues its long-term trajectory.

The case for including Bitcoin:

Uncorrelated returns: Over multi-year periods, Bitcoin's price movements show low correlation to equities and bonds. During certain market regimes, it acts as a portfolio diversifier.

Inflation hedge potential: With a fixed supply of 21 million coins, Bitcoin's scarcity makes it attractive during periods of monetary expansion. It's digital gold: but with better portability and divisibility.

Institutional infrastructure: Custody solutions, regulated exchanges, and spot ETFs have matured significantly. Fidelity, BlackRock, and other major players now offer institutional-grade Bitcoin exposure.

Asymmetric risk profile: A small allocation limits downside risk while capturing potential upside if Bitcoin adoption continues growing among corporations, nation-states, and retail investors.

Filling Out the Rest of Your Alternatives

Bitcoin isn't the only game in town for that 30% slice. Smart institutional portfolios blend multiple alternative strategies to maximize diversification benefits.

Private Equity (8-10%): Venture capital and growth equity funds offer access to pre-IPO companies and private market returns. The tradeoff is illiquidity, but the return potential often justifies the lockup periods.

Real Estate (5-7%): Commercial properties, multifamily syndications, and REITs provide income and inflation protection. Real estate tends to move independently from stock market volatility.

Hedge Funds (5-7%): Market-neutral strategies, long-short equity, and managed futures can generate returns regardless of market direction. Quality managers add value through active risk management.

Commodities and Precious Metals (3-5%): Gold, silver, energy, and agriculture provide inflation protection and crisis hedging. These assets often rise when financial assets struggle.

Bitcoin and Digital Assets (3-5%): For institutions comfortable with the risk profile, Bitcoin offers a modern portfolio diversifier with long-term growth potential.

Implementation Considerations

Shifting from 60/40 to 40/30/30 isn't a light switch. Institutional investors need to consider several practical factors:

Liquidity management: Alternative investments often come with lockup periods. Make sure you're not over-allocating to illiquid assets if you need portfolio flexibility.

Due diligence requirements: Vetting private equity funds, real estate sponsors, and Bitcoin custody providers takes time. You're not just buying an index fund here: manager selection matters enormously.

Fee structures: Alternative investments typically carry higher fees than passive equity or bond exposure. Make sure the net returns justify the cost.

Tax implications: Different alternatives have different tax treatments. Bitcoin held long-term qualifies for capital gains treatment, while some hedge fund strategies generate ordinary income.

Rebalancing complexity: With multiple alternative strategies, rebalancing becomes more nuanced. Some assets can't be sold on demand, requiring careful planning around contribution and distribution schedules.

Risk Mitigation in Practice

The 40/30/30 framework isn't about chasing returns: it's about managing risk more intelligently. By spreading exposure across truly uncorrelated strategies, you reduce the likelihood that your entire portfolio moves in one direction during market shocks.

Bitcoin's volatility concerns some investors, but position sizing addresses this. A 3-5% allocation means even a 50% drawdown in Bitcoin only impacts your total portfolio by 1.5-2.5%. Painful, but not catastrophic. Meanwhile, the upside potential remains intact.

The real risk isn't volatility: it's permanent capital impairment. By diversifying across multiple alternatives, you're protecting against the scenario where any single asset class or strategy fails to deliver.

Who Should Consider This Framework?

The 40/30/30 allocation makes sense for:

Accredited investors with portfolios above $1-2 million who can access institutional alternatives

Family offices managing multi-generational wealth and seeking modern diversification

Endowments and foundations with long time horizons and tolerance for illiquidity

High-net-worth individuals looking to move beyond traditional wealth management approaches

If you're still building your first $500K, stick with simpler strategies. But once you have meaningful capital and access to institutional-grade investments, the 40/30/30 framework offers a sophisticated approach to risk-adjusted returns.

The Bottom Line

The investment landscape has changed. Stocks and bonds no longer provide automatic diversification, and relying solely on traditional assets leaves portfolios vulnerable to simultaneous drawdowns.

The 40/30/30 framework offers a pragmatic solution: maintain exposure to public markets for liquidity and growth, reduce bond concentration to reflect current realities, and add truly alternative strategies: including Bitcoin: to improve risk-adjusted returns.

Is Bitcoin right for every institutional portfolio? No. But for investors who've done the research and understand the asset class, a modest allocation within a diversified alternatives bucket makes increasing sense.

At Mogul Strategies, we help accredited and institutional investors build portfolios that blend traditional asset management discipline with innovative strategies like Bitcoin integration. The goal isn't to abandon what works: it's to evolve your approach for a changing market environment.

If you're curious whether the 40/30/30 framework fits your investment objectives, let's talk. We're here to help you navigate these decisions with clarity, not hype.

Comments