The Ultimate Guide to Crypto and Real Estate Investing: Everything Accredited Investors Need to Succeed

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 3 hours ago

- 5 min read

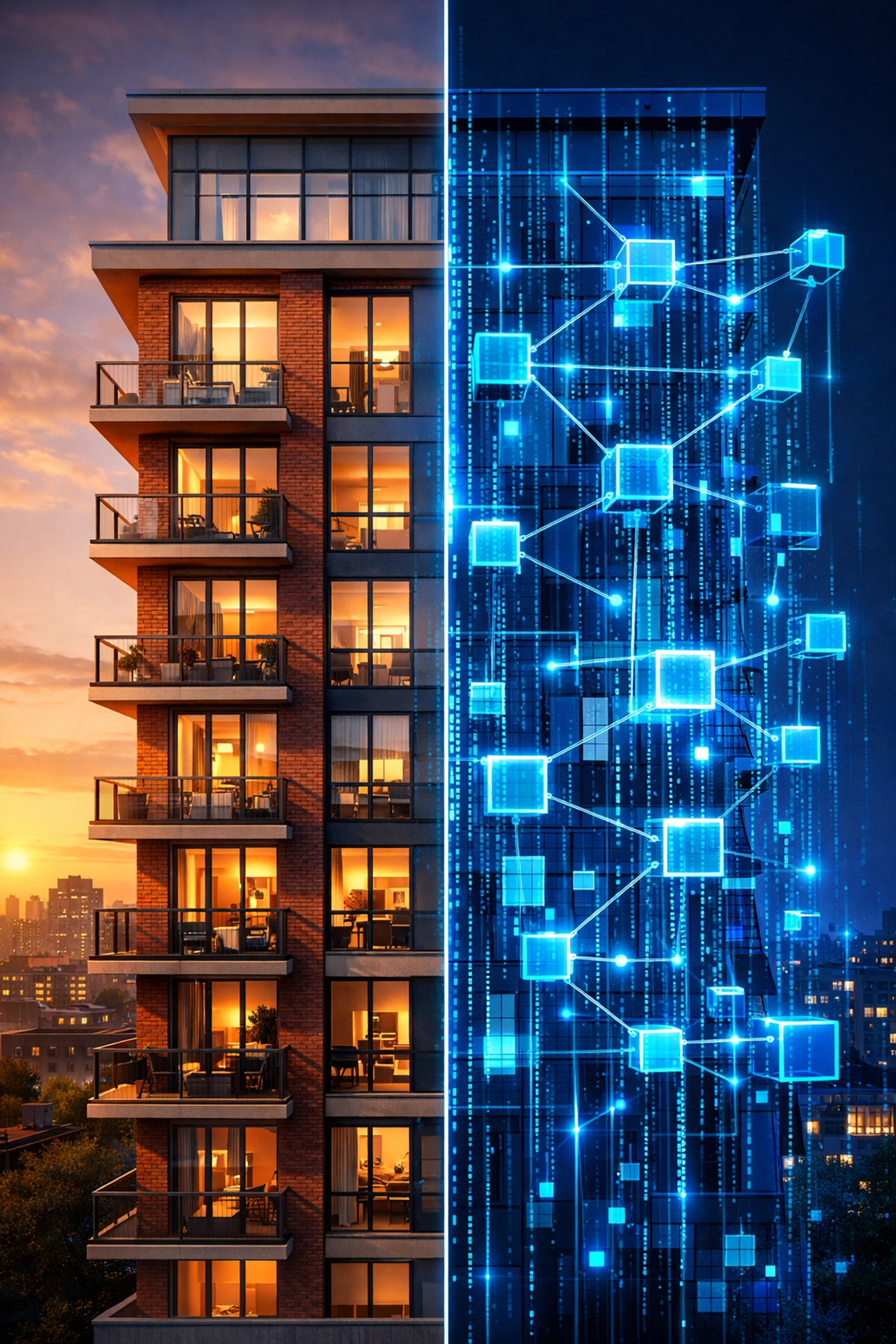

Look, if you're an accredited investor watching crypto and real estate markets evolve, you've probably wondered: what happens when these two asset classes collide? The answer is more interesting than you might think.

We're not talking about some far-off future scenario. Right now, there are legitimate ways to blend cryptocurrency holdings with real estate investments: and they're creating opportunities that didn't exist even five years ago.

Who Actually Qualifies as an Accredited Investor?

Before we dive in, let's get the basics straight. The SEC defines accredited investors pretty clearly: you need either an annual income exceeding $200,000 (or $300,000 jointly with a spouse) for the past two years, or a net worth over $1 million excluding your primary residence.

There are also professional credential paths: if you hold certain securities licenses, you're in. Why does this matter? Because many of the crypto-real estate platforms we're about to discuss require accreditation to participate.

Why Mix Crypto and Real Estate in the First Place?

Real estate has always been the steady performer in portfolios: tangible, income-generating, relatively stable. Crypto brings liquidity, 24/7 markets, and exposure to digital asset appreciation. Combining them isn't about chasing trends. It's about creating optionality.

Think of it this way: traditional real estate investments lock up capital for years. Crypto offers instant liquidity but higher volatility. What if you could get the stability of real estate with some of the flexibility of digital assets? That's what we're exploring here.

Method 1: Tokenized Real Estate: Fractional Ownership Reimagined

Tokenized real estate is exactly what it sounds like: property ownership converted into blockchain-based tokens. Instead of buying an entire building or pooling money in a traditional REIT, you purchase tokens representing fractional shares of specific properties.

Here's what makes this interesting for accredited investors:

Low barriers to entry: Some platforms offer tokens starting at $50. That means you can build a diversified real estate portfolio across multiple properties and geographies without tying up massive capital in single assets.

Automated income distribution: Smart contracts handle the heavy lifting. Rental income flows directly to token holders: often weekly or monthly: without property management headaches. Platforms like RealT and Lofty AI have refined this process significantly.

Real liquidity: Unlike traditional real estate, you can sell tokens on secondary markets when you need to rebalance. No waiting months for property sales or dealing with complicated exit strategies.

Transparent operations: Blockchain records provide clear ownership trails and transaction histories. You know exactly what you own and how properties are performing.

The trade-off? This market is still developing. Regulatory frameworks are evolving, and liquidity on secondary markets varies by platform and property. But for accredited investors looking to diversify real estate holdings with better flexibility, tokenization solves real problems.

Method 2: Direct Property Purchases Using Cryptocurrency

Some sellers now accept cryptocurrency directly for property purchases. It's straightforward in concept: find a willing seller, agree on crypto payment terms, transfer digital assets, and close the deal.

But here's what you need to know before going this route:

Tax implications hit immediately: The IRS treats crypto-to-property transfers as taxable events. You're essentially selling your cryptocurrency and buying property simultaneously, which means capital gains taxes apply to the crypto appreciation.

Financing gets complicated: Traditional mortgage lenders won't consider crypto holdings as income for qualifying purposes. However, newer fintech platforms like Milo are pioneering crypto-collateralized mortgages specifically for this scenario.

Seller acceptance is still limited: While growing, direct crypto acceptance remains the exception, not the rule, in real estate transactions.

This method works best when you have significant crypto gains you're planning to realize anyway, and you've found a property and seller willing to transact in digital assets. The tax planning becomes crucial: work with advisors who understand both real estate and crypto taxation.

Method 3: Crypto-Collateralized Loans for Real Estate

Here's a strategy that preserves your crypto exposure while accessing capital: borrow against your digital assets to fund real estate investments.

Two main approaches exist:

Centralized lending platforms use established custodians to hold your crypto collateral. You maintain ownership while the platform extends a loan secured by your holdings. These platforms typically offer more borrower-friendly terms and easier processes.

Decentralized finance (DeFi) protocols operate entirely through smart contracts. No intermediaries, just code governing the collateral and loan terms. This offers greater privacy but requires more technical knowledge.

The appeal is clear: you keep your crypto's upside potential while deploying capital into real estate. The risk? Volatility. If your collateral value drops significantly, you face margin calls. The platform can liquidate your crypto to cover the loan.

Best practices for this strategy:

Use stablecoins as collateral when possible

Keep loan-to-value ratios conservative (50% or less)

Maintain reserve crypto to add collateral if needed

Focus on properties with strong cash flow to service debt

Method 4: Real Estate-Focused Cryptocurrencies

Some cryptocurrencies are specifically designed around real estate operations. These aren't property investments directly: they're digital assets that derive value from real estate industry activities.

These might include:

Tokens powering property management platforms

Cryptocurrencies backing real estate development projects

Digital assets tied to rental income pools across multiple properties

This approach gives you crypto market participation with thematic real estate exposure. The correlation between the token's value and actual real estate performance varies significantly by project, so due diligence becomes critical.

Managing the Risks

Let's be real: combining crypto and real estate isn't without complexity.

Regulatory uncertainty remains significant. While recent developments like Ethereum ETF approvals signal growing mainstream acceptance, the regulatory landscape continues evolving. What's permissible today might face new restrictions tomorrow.

Technology risk matters. Smart contracts, while powerful, can contain bugs. Platform security varies. You're trusting code and platforms in ways traditional real estate doesn't require.

Volatility creates real consequences. Crypto's price swings can trigger forced liquidations on collateralized loans or affect tokenized property valuations on secondary markets.

Tax complexity multiplies. You're navigating both real estate and cryptocurrency tax treatment, often simultaneously. Professional guidance isn't optional: it's essential.

The key? Start small. Get comfortable with one approach before scaling. Use only capital you can afford to have locked up or at risk. And always work with advisors who understand both asset classes.

How This Fits Into Modern Portfolio Strategy

At Mogul Strategies, we see these crypto-real estate convergence strategies as tools, not solutions themselves. They work best as components of broader diversification approaches.

Consider the 40/30/30 portfolio model: 40% traditional assets (stocks, bonds), 30% alternative investments (real estate, private equity), and 30% digital assets (Bitcoin, crypto). Tokenized real estate and crypto-collateralized real estate loans can bridge multiple categories, offering characteristics of both alternatives and digital assets.

The goal isn't replacing traditional real estate investment entirely. It's adding optionality: creating flexibility to move capital more efficiently, access properties previously out of reach, and maintain exposure to both tangible and digital asset appreciation.

Moving Forward

The intersection of crypto and real estate is creating genuinely new investment structures. For accredited investors, this means opportunities that simply didn't exist in previous market cycles.

But opportunity comes with responsibility. These strategies require education, careful implementation, and ongoing monitoring. They're not passive "set it and forget it" investments.

If you're considering incorporating crypto-real estate strategies into your portfolio, start with clear objectives. Are you seeking better liquidity? Diversification? Income generation? Tax optimization? Your goals should drive your approach.

And remember: the best investment strategy is the one you fully understand and can manage through various market conditions. These tools are powerful, but they're most effective when deployed thoughtfully within a comprehensive wealth management plan.

The future of investing isn't choosing between traditional and digital assets: it's understanding how to use both strategically. For accredited investors willing to learn these emerging models, the potential advantages are substantial.

Ready to explore how crypto and real estate strategies might fit your portfolio? Visit Mogul Strategies to learn more about institutional-grade approaches to modern asset management.

Comments