The Ultimate Guide to Institutional Alternative Investments: Everything You Need to Succeed

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 4 days ago

- 5 min read

The investment landscape has changed dramatically. What worked for institutional portfolios twenty years ago doesn't cut it anymore. Today's smart money: pension funds, endowments, family offices: is allocating 20-40% of capital to alternative investments. And they're not doing it to chase trends. They're doing it because the numbers speak for themselves.

Let's break down everything you need to know about institutional alternative investments and why they've become essential for serious wealth building.

What Are Alternative Investments, Really?

Alternative investments are anything outside the traditional stocks-bonds-cash trio. Think private equity, venture capital, real estate syndications, hedge funds, private credit, infrastructure, and yes: institutional-grade digital assets like Bitcoin.

The key difference? These assets don't trade on public exchanges. They're less liquid, require longer holding periods, and demand higher minimum investments. But in exchange, they offer something invaluable: low correlation to public markets and access to opportunities that retail investors simply can't touch.

The Core Categories You Need to Know

Private Equity is where institutions put serious capital to work. We're talking direct investments in private companies: growth-stage businesses, turnarounds, buyouts. The returns come from operational improvements and strategic exits, not just market movements. It's active investing at its finest.

Venture Capital gives you early-stage access to the next wave of innovation. Healthcare, AI, fintech: sectors that are reshaping our economy. The risk is higher, but historically, the returns have been outsized for those who know how to pick winners.

Real Assets include farmland, timber, infrastructure, and private real estate. These are tangible investments that often hedge against inflation while generating steady cash flow. Real estate syndication, in particular, has become a cornerstone strategy for institutional portfolios looking for predictable returns.

Private Credit has exploded in recent years. As banks pulled back from lending, private credit funds stepped in. The result? Higher yields than traditional fixed income and more flexible terms. For institutions needing income generation, this category has been a game-changer.

Hedge Funds use sophisticated strategies: long-short equity, global macro, event-driven: to generate returns regardless of market direction. While they've faced criticism over fees, the best managers consistently deliver alpha when public markets struggle.

Digital Assets are the newest addition to institutional portfolios, and they're no longer fringe. Bitcoin, institutional-grade crypto strategies, and blockchain infrastructure investments now sit alongside traditional alternatives in forward-thinking portfolios. The volatility is real, but so is the long-term growth potential.

Why Institutions Are Going All-In on Alternatives

The shift to alternatives isn't a fad: it's a structural change in how sophisticated investors build portfolios.

Enhanced Returns: Alternative assets have historically outperformed public markets over long time horizons. Pension funds and endowments aren't gambling here; they're following decades of data showing alternatives generate consistent alpha.

True Diversification: When public markets tank, alternatives often hold steady or even thrive. That low correlation is worth its weight in gold when you're managing billions in capital and can't afford traditional 60/40 portfolio meltdowns.

Access to Growth Drivers: The best companies are staying private longer. By the time they hit public markets, much of the exponential growth has already happened. Alternatives give you access before the crowd arrives.

Income in a Low-Yield World: Traditional bonds barely keep pace with inflation. Private credit, real estate, and infrastructure investments offer yields that actually move the needle.

Modern Portfolio Construction: Beyond 60/40

The old 60% stocks, 40% bonds model is dead. Progressive institutions are embracing more sophisticated allocation frameworks.

One increasingly popular approach is the 40/30/30 model: 40% traditional equities and fixed income, 30% alternative investments (private equity, real estate, hedge funds), and 30% in growth-oriented alternatives including venture capital and digital assets.

This framework acknowledges reality: you need traditional assets for liquidity and stability, proven alternatives for enhanced returns and diversification, and forward-looking investments for exponential growth potential.

The specific allocations vary based on your risk tolerance, liquidity needs, and investment horizon. But the principle remains: alternatives are no longer optional add-ons. They're core portfolio components.

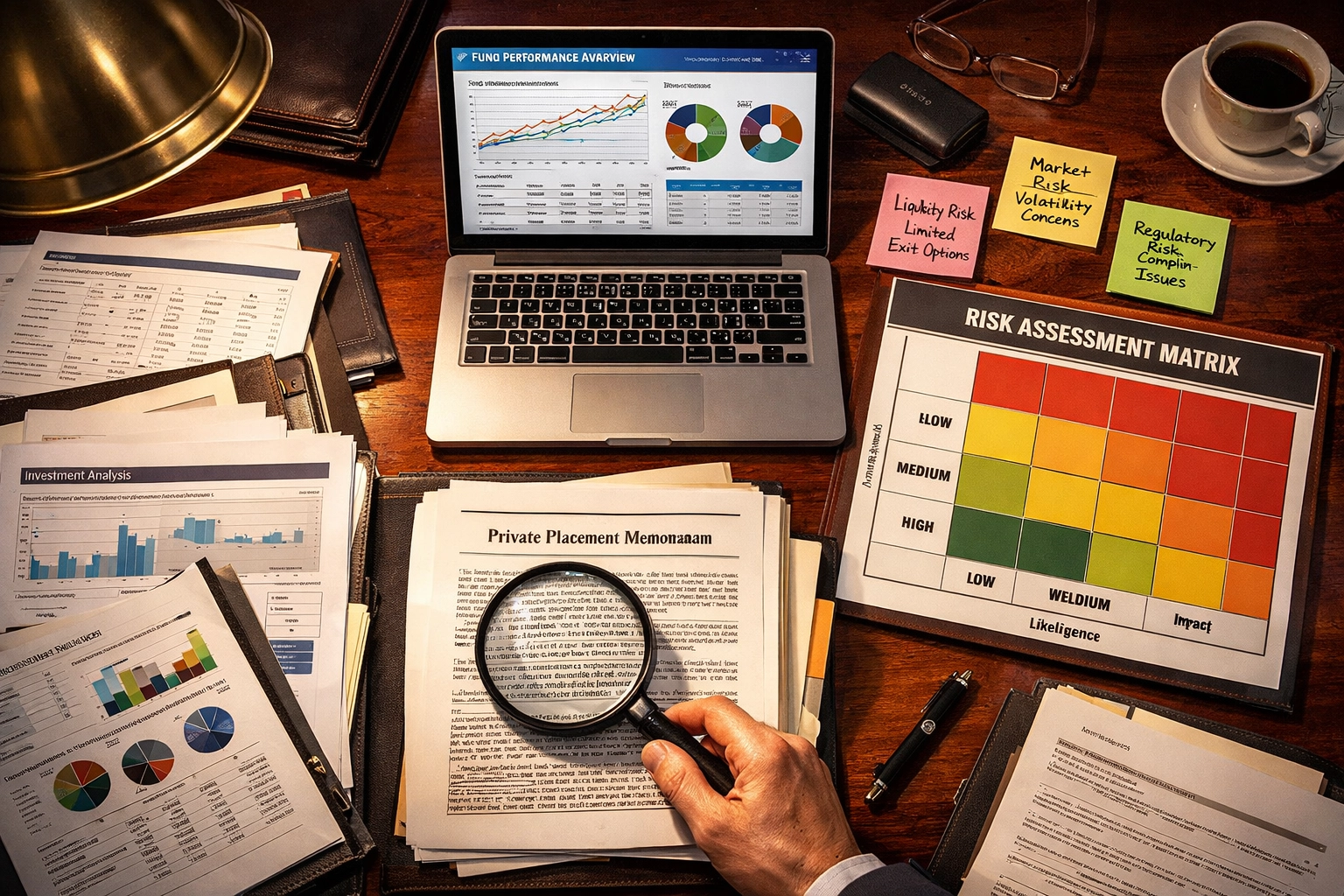

Risk Management and Due Diligence That Actually Works

Here's where institutions separate themselves from speculators. Alternative investments require serious due diligence.

Manager Selection: The dispersion of returns in alternatives is massive. Top-quartile private equity managers can outperform bottom-quartile managers by 10-15% annually. Manager selection isn't just important: it's everything.

Operational Excellence: You're not just evaluating strategy. You're assessing the fund's operations, compliance frameworks, reporting capabilities, and governance structures. Institutional-quality alternatives demand institutional-quality operations.

Liquidity Management: Alternatives typically have lock-up periods and capital calls. Smart institutions ladder their commitments over multiple years, maintain dry powder for opportunistic investments, and use secondaries markets strategically to manage liquidity needs.

Tail Risk Protection: The best alternative allocations include strategies specifically designed to perform during market dislocations. This might mean systematic macro strategies, catastrophe bonds, or uncorrelated digital asset positions.

The New Era: Blending Traditional and Digital

This is where the investment world gets really interesting. The most forward-thinking institutions aren't choosing between traditional alternatives and digital assets: they're integrating both.

Institutional-grade Bitcoin allocation provides uncorrelated returns and potential hedge against monetary debasement. Paired with traditional private equity and real estate, you create a portfolio positioned for both current economic realities and future paradigm shifts.

The key is treating digital assets with the same rigor as any other alternative investment. That means proper custody solutions, institutional-grade counterparties, sophisticated risk management, and long-term strategic positioning rather than tactical trading.

Building Your Alternative Investment Strategy

If you're an institutional investor or accredited individual looking to enhance your portfolio with alternatives, start with clarity around your objectives.

Define your liquidity needs, risk tolerance, and time horizon. Alternatives aren't one-size-fits-all. A pension fund with 30-year liabilities has different needs than a family office focused on wealth preservation.

Build relationships with general partners who have proven track records. Access to top-tier funds often requires existing relationships and demonstrated commitment to the asset class.

Consider fund-of-funds or multi-strategy platforms for initial exposure. They provide instant diversification across managers and strategies while you build expertise and direct relationships.

Start with systematic allocations rather than trying to time markets. Dollar-cost averaging into alternative commitments over 3-5 years smooths out vintage year risk and builds a diversified portfolio.

The Bottom Line

Alternative investments have evolved from niche institutional corners to mainstream portfolio essentials. The data is clear: institutions allocating significant capital to alternatives have delivered superior risk-adjusted returns over time.

The opportunity is real. The strategies work. But success requires sophistication, discipline, and partnership with managers who truly understand both traditional and emerging alternative asset classes.

At Mogul Strategies, we specialize in helping institutional and accredited investors navigate this complex landscape, blending proven traditional alternatives with innovative digital strategies. Because the future of institutional investing isn't either/or: it's both/and.

Ready to explore how alternatives can transform your portfolio? Let's talk about building a strategy that works for your specific needs and objectives.

Comments