How to Integrate Crypto and Real Estate Investing With Proven Hedge Fund Strategies (Easy Guide for Institutional Investors)

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 7 days ago

- 5 min read

Real estate and crypto might seem like they belong in completely different universes. One's been around for thousands of years. The other barely made it past its sweet sixteen. But here's the thing, institutional investors are finding powerful ways to combine these two assets using hedge fund strategies that actually work.

And no, this isn't about throwing Bitcoin and REITs into the same portfolio and calling it diversification. We're talking about sophisticated integration through tokenization, delta-neutral positioning, and arbitrage plays that leverage blockchain technology to create something entirely new.

Why This Convergence Makes Sense

The marriage between crypto and real estate isn't random. These assets often move in opposite directions during market swings, creating natural hedging opportunities. When crypto markets get volatile, real estate typically holds steady. When property markets stagnate, digital assets can provide growth and liquidity.

Tokenized real estate: digital tokens representing fractional ownership in actual properties: bridges these worlds. Instead of buying an entire commercial building or waiting months for a traditional real estate transaction to close, institutions can now access property exposure through blockchain platforms with smaller minimums and significantly better liquidity.

This creates a unique setup: the stable cash flow and inflation hedging of property combined with the digital asset flexibility and growth potential of cryptocurrency.

The Institutional Hedge Fund Playbook

Let's break down the specific strategies that sophisticated investors are actually using to integrate these assets.

Delta-Neutral and Market-Neutral Positioning

Delta-neutral trading isn't new for hedge funds, but applying it to a crypto-real estate portfolio is. Here's how it works in practice:

You simultaneously take long positions in tokenized real estate assets while offsetting with short positions in volatile cryptocurrencies. If crypto crashes, your shorts profit. If tokenized property appreciates, you capture that upside. You're not betting on direction: you're capturing spreads and managing volatility.

Crypto hedge funds increasingly use perpetual futures contracts to maintain this balance. The advantage? You can hedge against price drops in your crypto allocation while keeping your exposure to tokenized real estate intact.

Tokenized Asset Diversification for Stability

Here's where institutions separate themselves from retail investors: diversification beyond Bitcoin and Ethereum.

The smartest institutional funds are allocating to tokenized real-world assets: tokenized gold, bonds, and real estate. These don't move in tandem with crypto markets. When Bitcoin sells off 30%, your tokenized commercial property in Austin typically doesn't follow it down that rabbit hole.

This creates portfolio stabilization without sacrificing upside. You're not just holding crypto that might moon or crash. You're holding real assets that exist in the physical world but trade with the efficiency of digital tokens.

Futures Basis Arbitrage

This technique exploits small price differences between spot markets and futures contracts. It's low-risk, high-frequency, and perfect for institutional scale.

You simultaneously buy tokenized real estate in the spot market while selling corresponding futures contracts: or vice versa: to lock in risk-free profits. Individual gains per trade might be tiny, but institutional capital amplifies these returns through sheer volume.

The beauty? You're not taking directional risk. You're simply capturing pricing inefficiencies as they appear.

Cross-Platform Arbitrage

Decentralized exchanges and centralized platforms don't always agree on prices. When they diverge, there's profit.

For tokenized real estate, this means identifying pricing inefficiencies across different blockchain-based property platforms. Execute rapid cross-chain trades through crypto bridges, capture the spread, and maintain exposure to real estate fundamentals throughout.

It's algorithmic, it's fast, and it requires the kind of infrastructure that only institutional players can efficiently deploy.

Portfolio Allocation Framework That Actually Works

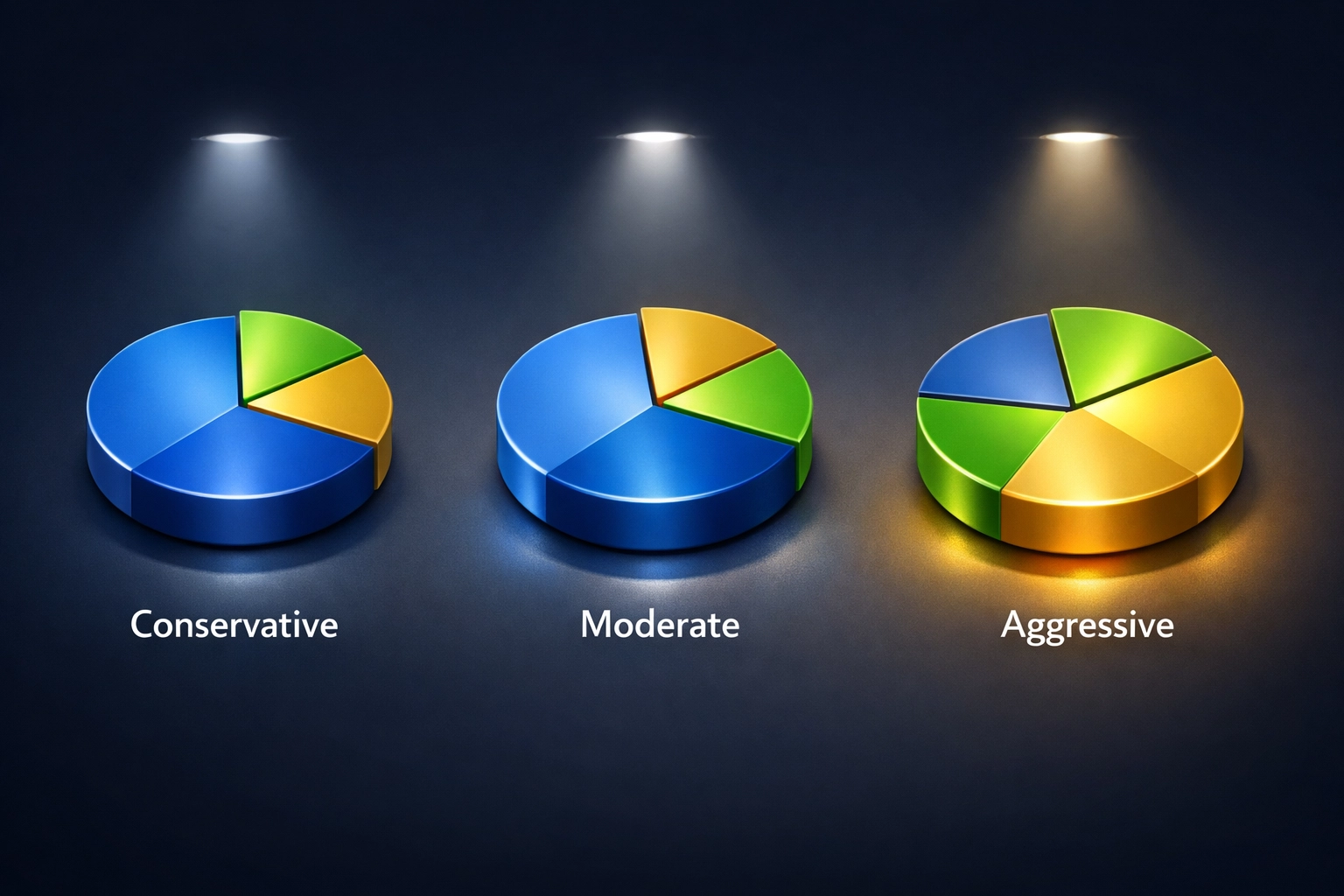

Theory is great. Implementation is what matters. Here's a practical allocation framework based on risk tolerance:

Conservative Allocation:

Tokenized Real Estate: 40-50%

Established Cryptocurrencies (Bitcoin/Ethereum): 5-10%

Traditional REITs or Real Estate Derivatives: 30-40%

Cash/Stablecoins: 10-20%

Moderate Allocation:

Tokenized Real Estate: 35-45%

Established Cryptocurrencies: 10-15%

Traditional REITs or Real Estate Derivatives: 25-35%

Cash/Stablecoins: 10-20%

Aggressive Allocation:

Tokenized Real Estate: 30-40%

Established Cryptocurrencies: 20-30%

Traditional REITs or Real Estate Derivatives: 20-30%

Cash/Stablecoins: 10-20%

The fundamental principle: property acts as your portfolio foundation, while crypto and tokenized assets provide growth and liquidity optionality. Even aggressive allocations maintain substantial real estate exposure because that's your stability anchor.

Implementation Steps for Institutional Investors

Start with Dollar-Cost Averaging Across Both Asset Classes

Don't try to time the market. Coordinate regular investment schedules across tokenized real estate and crypto to smooth volatility and reduce timing risk. This is especially important given crypto's infamous price swings.

Deploy Advanced Risk Management Systems

Institutional investors should leverage machine learning models to optimize volatility surfaces: essentially creating "weather forecasts" for market movements across different timeframes and price points. This enables proactive strategy adjustments rather than reactive panic.

You're not guessing. You're analyzing on-chain activity, regulatory developments, technological advancements, and traditional market drivers simultaneously.

Capitalize on Changing Correlations

As of 2025, Bitcoin and traditional assets like the S&P 500 have shown increasingly divergent correlations. Sometimes they move together. Sometimes they don't. Sometimes they move in opposite directions.

Your strategy needs to recognize crypto's unique risk profile. It's not just another equity. It responds to different catalysts, different news cycles, and different market dynamics than traditional assets.

Work with Multi-Disciplinary Expertise

Managing diversified portfolios across crypto and real estate requires specialized knowledge in tax optimization, regulatory compliance across multiple jurisdictions, and cross-asset market analysis. This isn't a one-person job.

You need crypto natives who understand blockchain mechanics. You need real estate professionals who know property fundamentals. You need tax specialists who can navigate the evolving regulatory landscape. And you need quantitative analysts who can model complex multi-leg strategies.

The Institutional Advantage: Scale and Complexity

Retail investors can buy Bitcoin and invest in REITs. What they can't efficiently do is execute complex multi-leg strategies combining delta-hedged trades, options strategies, and cross-chain arbitrage.

That's your institutional advantage.

Consider this: 58% of traditional hedge funds now trade digital asset derivatives as of 2025, up from just 38% in 2023. This isn't a niche experiment anymore. It's accelerating institutional adoption driven by real opportunity.

The convergence of property and crypto markets through blockchain technology is creating hybrid investment products that simply didn't exist five years ago. Tokenized real estate that trades 24/7. Fractional ownership with instant liquidity. Real estate exposure with crypto-level flexibility.

The Bottom Line

Integrating crypto and real estate isn't about blindly mixing assets. It's about leveraging blockchain technology to access real estate in new ways while applying proven hedge fund strategies to manage risk and capture inefficiencies.

Start with tokenized real estate as your foundation. Layer in established cryptocurrencies with proper hedging. Deploy arbitrage strategies across platforms and futures markets. Scale through institutional capital and infrastructure.

The institutions that figure this out early won't just diversify their portfolios: they'll access entirely new risk-return profiles that traditional real estate or standalone crypto simply can't deliver.

At Mogul Strategies, we help institutional investors navigate this convergence with strategies built for scale, sophistication, and long-term wealth preservation.

The future of asset management isn't crypto or real estate. It's crypto and real estate, integrated intelligently.

Comments