Institutional Alternative Investments Explained: The Proven Framework for Portfolio Diversification

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 2 days ago

- 5 min read

Let's be honest, the 60/40 portfolio isn't cutting it anymore. With traditional stock-bond correlations breaking down and market volatility becoming the new normal, institutional investors and high-net-worth individuals are looking beyond conventional asset classes. That's where alternative investments come in.

If you're managing serious capital, whether for an endowment, pension fund, family office, or your own portfolio, understanding how to properly integrate alternatives isn't optional anymore. It's essential.

What Actually Qualifies as an Alternative Investment?

Alternative investments are any financial assets that fall outside the traditional trio of stocks, bonds, and cash. Simple enough, right? But the real power comes from understanding how these assets behave differently from your standard equity and fixed-income holdings.

The goal isn't just diversification for diversification's sake. It's about finding investments with uncorrelated returns, assets that zig when traditional markets zag. This creates a smoother ride for your overall portfolio and potentially better risk-adjusted returns.

The Four Pillars of Institutional Alternatives

When we work with institutional clients, we organize alternative investments into four main categories:

1. Real Assets

This bucket includes infrastructure projects, commodities, natural resources, and real estate. These are tangible assets that often provide inflation protection and generate consistent cash flows. Think toll roads, energy projects, timberland, or commercial real estate holdings.

2. Private Equity and Private Credit

This category encompasses venture capital, leveraged buyouts, growth equity, and direct lending opportunities. These investments typically offer higher return potential in exchange for illiquidity and longer holding periods. The key is accessing quality deal flow and managers with proven track records.

3. Hedge Funds

Despite the bad press some hedge funds have gotten, well-managed funds using strategies like long-short equity, managed futures, or global macro can provide genuine portfolio protection during market stress. The trick is finding managers who actually deliver alpha, not just leverage and fees.

4. Structured Products

These include credit derivatives, collateralized loan obligations, and other complex instruments. While not suitable for every portfolio, they can fill specific gaps in your risk-return profile when used appropriately.

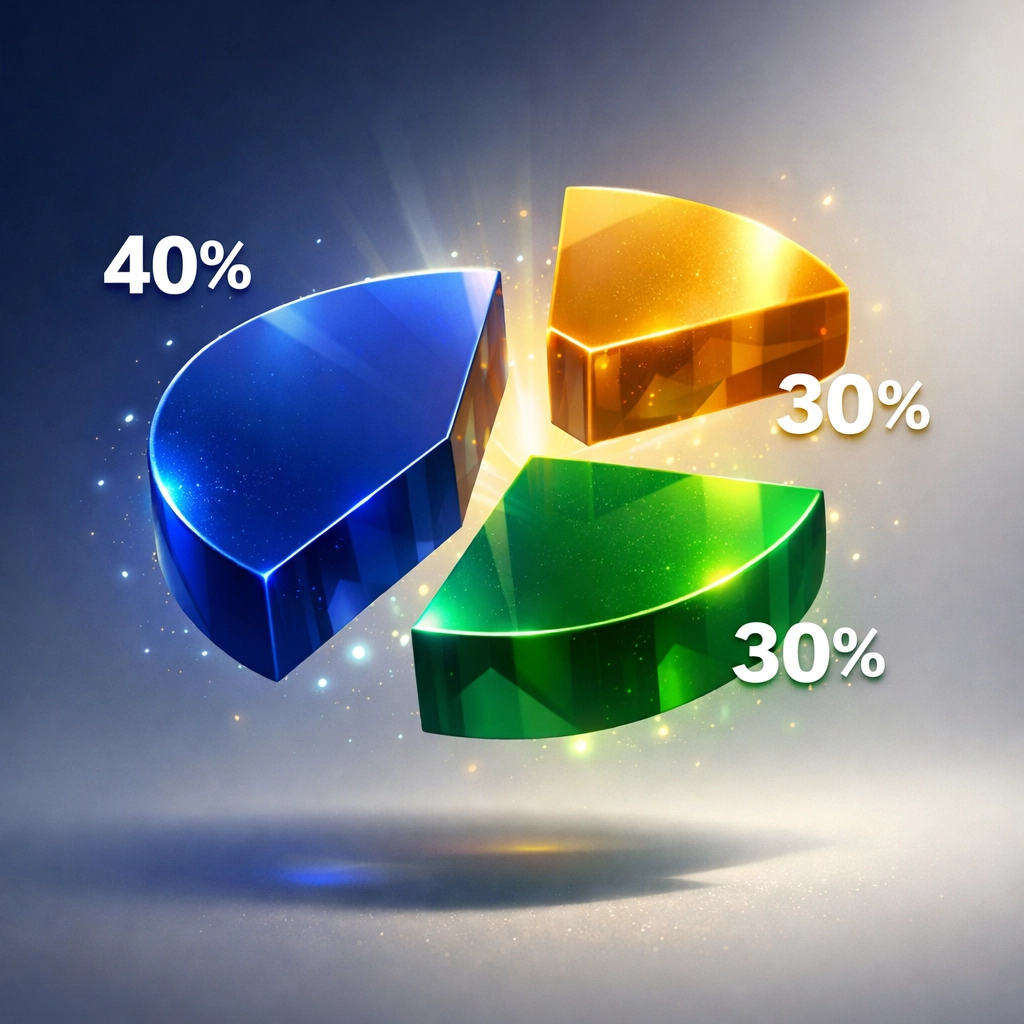

The 40/30/30 Framework: A Modern Approach

At Mogul Strategies, we often recommend what we call the 40/30/30 diversification model for institutional and accredited investors who can handle the illiquidity premium:

40% Traditional Assets: High-quality stocks and bonds provide liquidity and market exposure

30% Alternative Investments: Private equity, real estate, and hedge strategies for enhanced returns

30% Real Assets & Emerging Opportunities: Infrastructure, commodities, and, yes: institutional-grade digital assets

This framework isn't rigid. It's a starting point that gets adjusted based on your specific risk tolerance, liquidity needs, and return objectives. But it represents a significant departure from the old 60/40 model and acknowledges the reality of modern portfolio construction.

Liquid vs. Illiquid Alternatives: Know the Difference

Not all alternative investments are created equal when it comes to accessing your capital. Understanding the liquidity spectrum is crucial:

Liquid alternatives invest in frequently traded instruments. You get regular pricing, periodic redemption options, and transparency. Think alternative mutual funds, traditional hedge funds, or commodity ETFs. These work well when you need flexibility or might face unexpected capital calls.

Illiquid alternatives invest in privately traded assets with extended lockup periods. This includes most private equity funds, direct real estate, and infrastructure projects. You're typically looking at 5-10 year commitments, but that illiquidity premium can add 200-400 basis points of additional returns for patient capital.

The right mix depends on your liquidity profile. Most institutional portfolios need both.

The Digital Asset Opportunity: Bitcoin and Beyond

Here's where it gets interesting. While the research on traditional alternatives is well-established, we're now seeing a new frontier emerge: institutional-grade digital assets.

Bitcoin and select cryptocurrencies are increasingly viewed as legitimate portfolio components, not speculative gambles. Why? Because the correlation data tells a compelling story. Bitcoin has shown low correlation to traditional assets during certain periods, offering genuine diversification benefits.

At Mogul Strategies, we approach crypto integration with the same rigor as any institutional alternative:

Custody matters: We only work with regulated custodians offering institutional-grade security

Position sizing: Typically 2-5% allocations for most institutional portfolios

Strategic intent: Bitcoin as digital gold and a potential inflation hedge, not a momentum trade

The key is treating digital assets as part of your alternatives allocation, not as a separate casino bet. They belong in that 30% emerging opportunities bucket, alongside other real assets.

Risk Mitigation Through True Diversification

The academic research is clear: portfolio-level risk evaluation beats analyzing investments in isolation. This concept, which gained prominence in the 1980s and 1990s, fundamentally changed institutional investing.

Instead of asking "What's the risk of this hedge fund?" you should ask "How does this hedge fund change my portfolio's overall risk profile?"

This mindset shift leads to better decisions. A highly volatile investment might actually reduce your portfolio volatility if its returns are uncorrelated or negatively correlated with your other holdings. That's not theory: it's math.

Market Growth and Improved Access

The alternative investment market has exploded. Assets under management grew from approximately $7.2 trillion in 2014 to an estimated $18.2 trillion in 2024. Forecasts project this could reach $29.2 trillion by 2029.

But here's the good news: access is improving. New vehicles like interval funds and business development companies (BDCs) are democratizing alternatives that were previously available only to the ultra-wealthy. These structures provide better liquidity than traditional private placements while maintaining exposure to institutional-quality investments.

For accredited investors who don't meet the typical $10 million minimums for top-tier private equity funds, these vehicles open doors that were previously locked.

Building Your Alternative Investment Strategy

So where do you start? Here's our practical framework:

1. Assess Your Constraints Be honest about your liquidity needs, time horizon, and risk tolerance. Not every institutional investor should have the same alternatives allocation.

2. Start with Core Alternatives Real estate and diversified private credit funds make excellent first steps. They're easier to understand and have decades of performance data.

3. Layer in Complexity Gradually As you get comfortable, add hedge funds, venture capital, or infrastructure projects. Don't try to build a complete alternatives program overnight.

4. Consider Emerging Opportunities Once your core is solid, explore digital assets and other emerging alternatives with a small, strategic allocation.

5. Reevaluate Regularly Your alternatives portfolio should evolve with market conditions and your changing needs. Annual reviews are minimum; quarterly is better.

The Bottom Line

Institutional alternative investments aren't a magic bullet, but they're increasingly essential for serious portfolio construction. The proven framework: combining real assets, private equity, hedge strategies, and now digital assets: offers genuine diversification benefits that traditional 60/40 portfolios simply can't match.

The markets are more complex than ever. Your portfolio strategy should reflect that reality. At Mogul Strategies, we specialize in building alternative investment programs that blend proven institutional strategies with innovative approaches to digital assets and emerging opportunities.

Whether you're managing a family office, endowment, or your own high-net-worth portfolio, the question isn't whether to include alternatives. It's how to do it right.

Ready to explore how institutional alternatives could strengthen your portfolio? Let's talk about your specific situation.

Comments