The 40/30/30 Framework: How Institutional Investors Build Portfolios That Outperform

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 31

- 5 min read

The traditional 60/40 portfolio: 60% stocks, 40% bonds: has been the gold standard for decades. But here's the problem: it's not working like it used to.

Over the past few years, something fundamental shifted. Stocks and bonds started moving in the same direction at the same time. When markets got rocky, bonds didn't cushion the fall anymore. They fell right alongside equities. For institutional investors managing hundreds of millions or billions, that's a serious wake-up call.

Enter the 40/30/30 framework: a portfolio construction approach that's gaining serious traction among pension funds, endowments, and sophisticated family offices. Instead of loading up on stocks and bonds, this model carves out meaningful space for alternative investments that actually diversify.

Let's break down what makes this framework tick and why more institutional investors are adopting it in 2026.

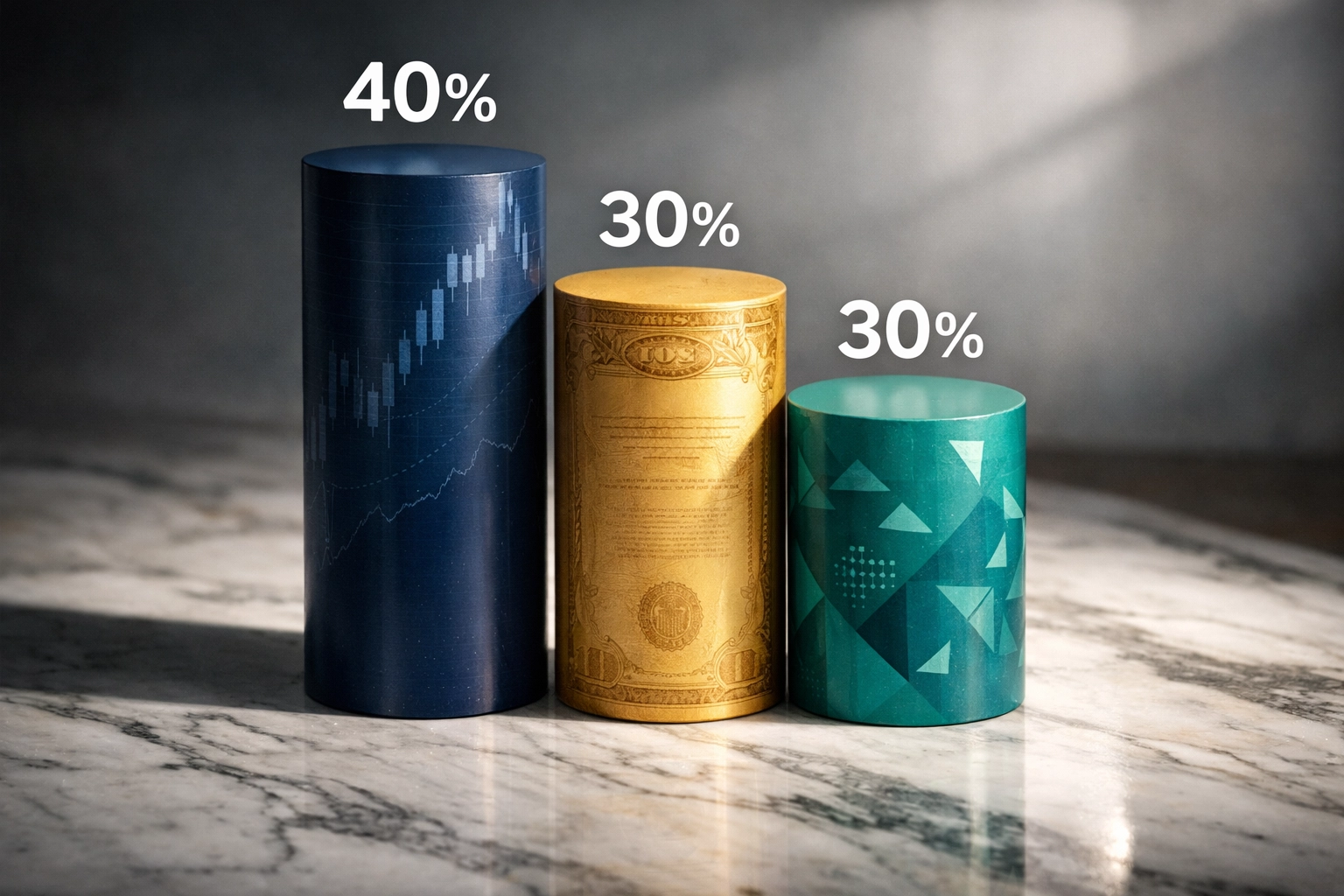

What Exactly Is the 40/30/30 Framework?

The breakdown is straightforward:

40% Public Equities – Your traditional stock exposure across domestic and international markets

30% Fixed Income – Bonds, treasuries, and other debt instruments

30% Alternative Investments – This is where it gets interesting

That 30% alternatives sleeve is the game-changer. We're talking about private equity, private credit, real estate, infrastructure, hedge fund strategies, and yes: increasingly: digital assets like Bitcoin when appropriate for the investor profile.

The shift happens by pulling 20% out of equities and 10% from bonds, then redirecting that capital into alternatives that offer actual diversification benefits.

Why Traditional 60/40 Stopped Working

The core issue is correlation. Historically, when stocks dropped, bonds rallied. That negative correlation provided a natural hedge within your portfolio. But in our current macroeconomic environment: characterized by persistent inflation pressures and interest rate volatility: that relationship broke down.

During the 2022 market turmoil, both stocks AND bonds got hammered simultaneously. Investors who thought they were diversified got a harsh lesson: owning two asset classes that move together isn't diversification at all.

This isn't a temporary blip. We're likely in a different regime now where inflation remains stickier than the past four decades. When inflation rises, it hurts both equity valuations and bond prices. The 60/40 portfolio has no structural answer to this problem.

Breaking Down the 30% Alternatives Allocation

Not all alternatives are created equal. Institutional investors typically divide this sleeve into three buckets:

Enhancers (10%)

These strategies aim to deliver better risk-adjusted returns than traditional equities and bonds. Think private equity, venture capital, and 130-30 funds. They're seeking outsized returns but come with longer lock-up periods and less liquidity.

Private equity has historically outperformed public markets over full cycles, but you need the stomach and balance sheet to handle 7-10 year commitments.

Diversifiers (10%)

This bucket includes hedge fund-style strategies: long-short equity, market-neutral approaches, global macro funds, and managed futures. The key characteristic is lower correlation to traditional markets.

When stocks are tanking, a well-constructed long-short strategy might be flat or even positive because it's betting on relative performance, not directional moves.

Stabilizers (10%)

These are inflation-resistant assets with steady cash flows: private credit, infrastructure, and real estate. Many of these investments have built-in inflation indexation: think toll roads where fees rise with CPI, or commercial leases with annual escalators.

KKR's specific recommendation splits this evenly: 10% private credit, 10% private infrastructure, 10% private real estate. The goal is income generation and capital preservation, not moonshot returns.

The Performance Reality Check

Here's where things get nuanced. The 40/30/30 framework doesn't necessarily beat 60/40 on raw total returns during raging bull markets. Historical data from November 2001 through August 2025 shows the 40/30/30 generated a 6.89% compound annual growth rate versus 7.46% for traditional 60/40.

But here's what matters more: risk-adjusted returns. That same period showed the 40/30/30 achieved a Sharpe ratio of 0.71 versus 0.56 for the 60/40. In plain English, you're getting better returns per unit of risk taken.

During drawdowns and periods of market stress, the alternatives sleeve provides genuine downside protection that bonds alone can't deliver anymore. For institutional investors with specific liability matching needs or regulatory capital requirements, this matters enormously.

The underperformance during bull markets reflects the alternatives drag: private markets don't move as fast as public equities during melt-ups. But institutional investors aren't optimizing for maximum returns in perfect conditions. They're building portfolios that can weather all seasons, especially the nasty ones.

Implementation Challenges (And Why They Matter)

Let's be real: you can't just log into your brokerage account and build a 40/30/30 portfolio in 20 minutes. The alternatives sleeve requires:

Access – Many of the best private equity, credit, and real estate opportunities are closed to retail investors. Minimum checks start at $250,000 to $1 million per investment.

Due Diligence – Manager selection is everything. Two private equity funds can have radically different performance even in the same vintage year. You need deep operational expertise to separate signal from noise.

Liquidity Management – Most alternatives lock up capital for years. You can't build a 30% alternatives allocation unless your liquidity needs are managed elsewhere in the portfolio.

Fee Structures – Private markets come with management fees (typically 1.5-2%) plus performance fees (15-20% of profits). These need to be earned through actual outperformance.

This is where specialized asset managers and family offices add real value. The framework is only as good as the implementation.

Modern Portfolio Construction: Beyond Traditional Alternatives

Here's where things get interesting for forward-thinking institutions. That 30% alternatives sleeve doesn't have to be exclusively private equity and real estate.

In 2026, we're seeing more sophisticated investors incorporate digital assets as part of their alternatives allocation. Bitcoin, for instance, has shown essentially zero long-term correlation with traditional asset classes. A 2-3% allocation within the alternatives bucket can provide meaningful diversification benefits without introducing excessive volatility at the portfolio level.

The key is thoughtful position sizing. Bitcoin shouldn't dominate your alternatives allocation, but it also shouldn't be completely ignored if your mandate allows for it. The same risk management principles that guide private equity allocation apply here: know your exposure, understand the risks, and don't bet the farm.

Who Should Consider the 40/30/30 Framework?

This approach makes most sense for:

Institutional investors with long-term horizons (pension funds, endowments, foundations)

Family offices managing multi-generational wealth

High-net-worth individuals with at least $5-10 million in investable assets

Accredited investors who can handle illiquidity and have sophisticated tax planning

If you need to access 100% of your portfolio value on short notice, this isn't for you. The alternatives sleeve requires patient capital.

But if you're building wealth meant to last decades: not trading around quarterly earnings: the 40/30/30 framework offers institutional-grade diversification that the 60/40 simply can't match anymore.

The Bottom Line

The 40/30/30 framework isn't revolutionary. It's evolutionary: a pragmatic response to changed market conditions. When stocks and bonds move together, you need a third leg to the stool. Alternative investments, properly selected and sized, provide that stability.

Does it guarantee outperformance? No investment framework does. But it structurally improves your odds of generating consistent, risk-adjusted returns across different market environments. In 2026 and beyond, that's what sophisticated portfolio construction looks like.

At Mogul Strategies, we help accredited and institutional investors navigate these exact decisions: blending traditional assets with modern alternatives to build portfolios designed for the world as it is, not as it was. If your current allocation still looks like 2015, it might be time for a conversation.

Comments