The 40/30/30 Portfolio Model: How Accredited Investors Are Diversifying Beyond Traditional Assets

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 3 hours ago

- 4 min read

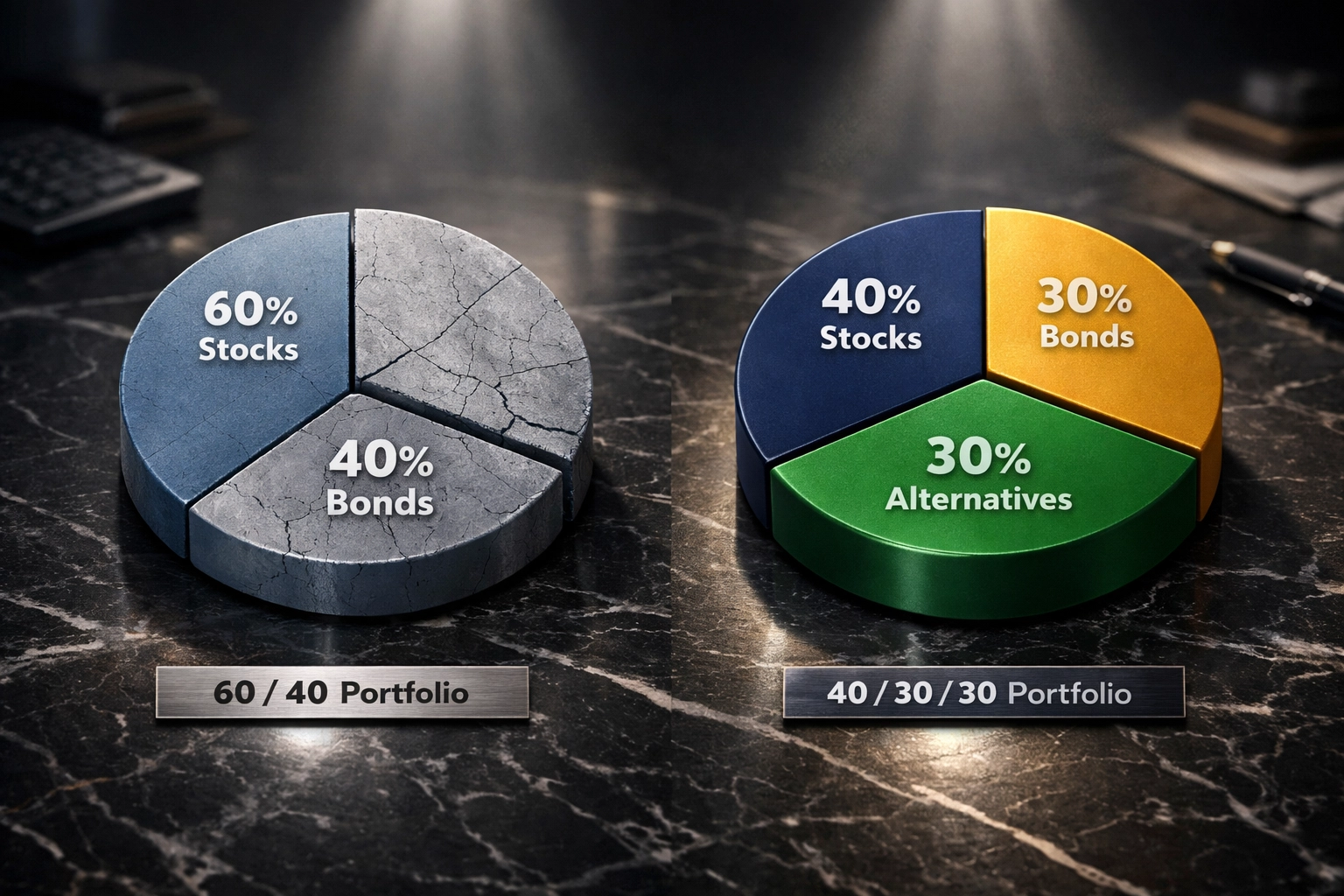

The old 60/40 portfolio split: 60% stocks, 40% bonds: has been the go-to formula for decades. But here's the thing: it's 2026, and that model is showing its age. When stocks tank, bonds often follow right behind them. When inflation spikes, both asset classes feel the burn.

If you're an accredited investor still clinging to that traditional split, you're leaving returns on the table and exposing yourself to more risk than necessary. Enter the 40/30/30 portfolio model: a framework that's gaining serious traction among institutional investors and family offices who understand that real diversification means going beyond Wall Street's greatest hits.

Why 60/40 Doesn't Cut It Anymore

Let's be blunt: the 60/40 portfolio was built for a different era. It worked beautifully when stocks and bonds had a nice negative correlation: when one went up, the other went down, balancing your risk. But those days are gone.

Over the past few years, we've watched stocks and bonds move together during market volatility. That's not diversification: that's just two different ways to lose money at the same time. Add persistent inflation and the "higher for longer" interest rate environment into the mix, and you've got a recipe for disappointing returns.

The reality? Both asset classes are facing headwinds we haven't seen since the 1980s. Interest rate fluctuations hit bonds hard. Market volatility hammers equities. And when everything moves in tandem, your carefully balanced portfolio isn't actually balanced at all.

Breaking Down the 40/30/30 Model

Here's where things get interesting. The 40/30/30 framework flips the script:

40% Public Equities: Still the growth engine, but trimmed back to make room for better opportunities

30% Fixed Income: Bonds still play a role, but a smaller one that reflects their reduced effectiveness

30% Alternative Investments: The secret sauce that changes everything

That 30% alternative allocation is what separates sophisticated investors from everyone else. We're talking about private equity, private credit, real estate, infrastructure, litigation finance, and even tangible assets like art. These are the investments that used to be exclusively available to pension funds and endowments: the same institutional players who've been allocating over 40% to alternatives for years.

The Alternative Advantage

So why dedicate nearly a third of your portfolio to alternatives? Three compelling reasons:

True Diversification: Alternative assets don't dance to the same tune as public markets. When the S&P 500 is having a bad day, your private equity investment in a regional healthcare company doesn't care. Your real estate syndication keeps collecting rent. Your infrastructure play keeps generating cash flow from tolls, ports, and cell towers. This is what real diversification looks like.

Inflation Protection: Many alternative investments have built-in inflation hedges. Infrastructure assets often include contract clauses that automatically adjust for rising prices. Real estate rents tend to increase with inflation. These aren't reactive adjustments: they're structural protections baked into the investment.

Consistent Income Streams: Here's something most investors don't appreciate: illiquidity can actually be a feature, not a bug. Private assets aren't subject to daily market panic. They're managed with a long-term perspective, which tends to produce more predictable, consistent returns. No checking your phone every hour to see if the market tanked another 2%.

The Numbers Don't Lie

Let's talk performance, because theory is great but returns are what matter.

J.P. Morgan's research found that adding just a 25% allocation to alternative assets can boost traditional 60/40 portfolio returns by 60 basis points. That might not sound like much until you do the math: on a projected 7% annual return, that's an 8.5% improvement. Over decades, that compounds into serious money.

KKR took it further and tested the 40/30/30 framework across multiple timeframes. The result? It outperformed the 60/40 allocation in every single period studied. Not some periods. Not most periods. All of them.

These aren't outliers or cherry-picked data points. This is consistent evidence that rethinking traditional allocation models leads to better outcomes.

The Democratization of Alternatives

Here's the good news: the barriers to alternative investments have collapsed. Ten years ago, you needed minimum checks of $500,000 or more to even think about entering private markets. Today, thanks to new fund structures, investment platforms, and wealthtech innovations, millions of individual investors can access these opportunities.

This democratization is real, but let's be clear: you still need to be an accredited investor for most of these deals. The SEC hasn't thrown the doors wide open to everyone. But if you meet the accreditation requirements, the playing field has leveled considerably.

Building Your 40/30/30 Portfolio

So how do you actually implement this? Start by assessing where you are now. Most investors have too much in public equities and not enough alternatives. The transition doesn't happen overnight: alternative investments often have lock-up periods and limited liquidity windows.

Begin by identifying which alternative categories make sense for your situation. Real estate syndications might offer steady income and tax advantages. Private equity funds could provide higher growth potential with a longer time horizon. Infrastructure investments deliver inflation protection and consistent cash flow.

The key is working with asset managers who understand how to blend traditional and innovative strategies effectively. This isn't about abandoning everything you know: it's about evolving your approach to match today's market realities.

The Bottom Line

The 40/30/30 portfolio model isn't some trendy investment fad. It's a pragmatic response to fundamental changes in how markets work. When traditional diversification fails, when inflation threatens purchasing power, when volatility becomes the new normal: that's when alternative investments prove their worth.

Institutional investors figured this out years ago. They've been quietly allocating massive portions of their portfolios to alternatives while retail investors were still debating growth versus value stocks. Now that access has expanded, accredited investors have the same opportunity to build portfolios that can actually weather different market environments.

The question isn't whether alternatives deserve a place in your portfolio. The question is whether you can afford to ignore them.

At Mogul Strategies, we help accredited investors navigate this transition, blending time-tested asset classes with innovative strategies that make sense for today's market landscape. Because sophisticated investing isn't about following old formulas( it's about adapting to new realities.)

Comments