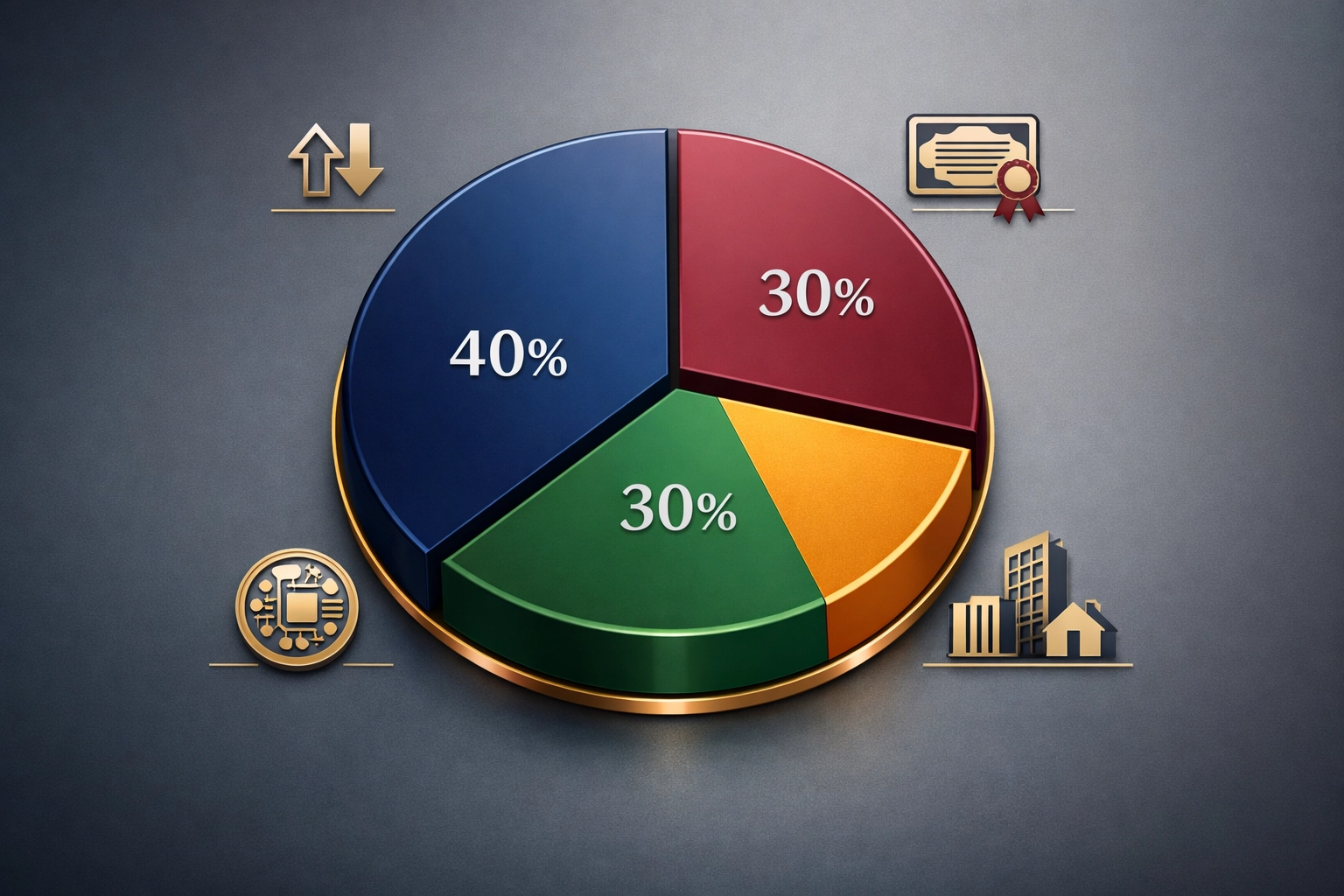

The 40/30/30 Portfolio Model: How Institutional Investors Are Blending Bitcoin with Traditional Assets in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 31

- 5 min read

The 60/40 portfolio is officially having a midlife crisis. After two years of watching both stocks and bonds move in tandem during market stress, institutional investors aren't just tweaking their allocations: they're rebuilding them from scratch.

Enter the 40/30/30 model, but with a 2026 twist. Instead of the traditional mix of equities, bonds, and vanilla alternatives, forward-thinking fund managers are carving out meaningful exposure to Bitcoin alongside private equity, real estate, and infrastructure. It's not about chasing hype. It's about acknowledging that digital assets have graduated from the kids' table to a permanent seat at the institutional portfolio.

What the Traditional 40/30/30 Actually Looked Like

Before we talk about Bitcoin, let's establish the baseline. The traditional 40/30/30 framework allocates:

40% to public equities (your standard stock market exposure)

30% to fixed income (bonds, treasuries, investment-grade debt)

30% to alternative investments (private equity, private credit, real estate, infrastructure, sometimes art or litigation finance)

The logic was simple: alternatives provided diversification, reduced correlation to public markets, and many came with inflation-adjustment clauses that acted as natural hedges. When stocks zigged and bonds zagged, alternatives were supposed to just... do their own thing.

That worked beautifully until 2022, when everything collapsed together. Suddenly, "diversification" felt like a theoretical concept rather than a practical risk management tool.

Why Bitcoin Is Crashing the Institutional Party

Here's what changed: institutional investors stopped viewing Bitcoin as internet Monopoly money and started treating it like a legitimate asset class.

The numbers tell the story. According to Natixis Investment Managers, 44% of institutional investors now consider crypto a legitimate investment opportunity: up from 38% just a year ago. Even more interesting? Half of institutional investors expect to hold crypto exposure by the end of 2026, and 38% plan to increase their allocations.

But only 20% currently have skin in the game.

That gap between belief and action is closing fast, and it's driven by three factors:

1. Regulatory clarity is finally arriving. The U.S. regulatory environment shifted dramatically in late 2025 and into 2026. With clearer frameworks around custody, taxation, and compliance, institutions can actually deploy capital without their legal teams having panic attacks. Fifty-one percent of institutional investors say more accommodating regulation would accelerate their adoption: and they're getting it.

2. Bitcoin's correlation profile changed. During periods of market stress in 2024 and 2025, Bitcoin demonstrated lower correlation to traditional equities than many expected. It's not perfectly uncorrelated (nothing is), but it behaves differently enough to matter in a diversified portfolio.

3. The infrastructure matured. Institutional-grade custody solutions, prime brokerage services, and derivatives markets for Bitcoin have evolved. You can now get exposure through vehicles that meet institutional risk management standards: no need to explain to your board why you're holding private keys on a hardware wallet.

The New 40/30/30: Where Bitcoin Fits

So what does the 2026 version actually look like?

40% Public Equities No major changes here. Global stocks, sector diversification, quality tilts. This portion provides liquidity and captures broad economic growth. Some managers are overweighting technology and energy, but the core philosophy remains intact.

30% Fixed Income This is where things get interesting. Instead of loading up entirely on traditional bonds, savvy allocators are splitting this bucket:

20% in traditional fixed income (treasuries, investment-grade corporate bonds)

10% in private credit or structured debt

The private credit portion offers yield pickup and lower interest rate sensitivity. It also creates room in the portfolio's overall risk budget for...

30% Alternatives + Digital Assets Here's the evolution. Instead of alternatives being a monolithic 30%, the allocation breaks down into:

15-20% traditional alternatives (private equity, real estate, infrastructure)

5-10% Bitcoin and digital assets

5-10% opportunistic strategies (distressed debt, secondaries, niche real estate)

That 5-10% Bitcoin allocation might seem small, but it's sufficient to meaningfully impact portfolio returns without dominating risk metrics. Bitcoin's volatility means a little goes a long way: both in potential upside and portfolio-level variance.

Implementation: How This Actually Works in Practice

Theory is cheap. Execution is where most strategies fall apart. Here's how institutions are implementing this model:

Step 1: Size the Bitcoin allocation based on volatility, not arbitrary percentages. A 5% allocation to Bitcoin has roughly the same volatility contribution as 15-20% in public equities. Risk parity matters more than nominal weights. Most fund managers are targeting 3-7% of portfolio volatility coming from digital assets.

Step 2: Use multiple custody solutions. No single point of failure. Institutions are splitting Bitcoin holdings across regulated custodians, with clear succession planning and insurance. The days of exchange custody for large allocations are over.

Step 3: Implement via multiple vehicles. Some exposure through spot holdings, some through futures for liquidity management, some through equity proxies (mining companies, Bitcoin treasury companies) for tax efficiency. Diversification applies to implementation, not just asset selection.

Step 4: Rebalance systematically. Bitcoin's volatility means it will dominate portfolio drift if left unchecked. Quarterly rebalancing bands (typically 4-8% for the Bitcoin allocation) keep the portfolio aligned with risk targets without triggering excessive trading costs.

Risk Management: What Could Go Wrong

Let's be honest about the risks, because they're real:

Regulatory reversal. Just because regulation improved doesn't mean it can't deteriorate. A future administration could take a hostile stance toward digital assets. This is why the allocation stays under 10%: it's not bet-the-fund money.

Technology risk. Bitcoin's underlying protocol has operated flawlessly for 17 years, but smart contract integrations, layer-2 solutions, and custody technologies introduce new attack surfaces. Institutions are underwriting technology risk seriously, not dismissing it.

Liquidity in stress scenarios. Bitcoin is liquid in normal markets, but during extreme stress, bid-ask spreads can widen dramatically. The assumption that you can exit a meaningful position without moving the market needs stress testing.

Correlation breakdown. The hypothesis that Bitcoin provides diversification could prove wrong in the next crisis. If retail and institutional investors both panic-sell everything simultaneously, correlation goes to one regardless of asset class.

These aren't reasons to avoid Bitcoin: they're reasons to size the position appropriately and manage it actively.

Why This Matters Right Now

The timing of this portfolio evolution isn't accidental. We're in a unique window where:

Interest rates have normalized but remain elevated enough that fixed income provides real yield

Private markets are experiencing valuation resets, creating entry opportunities

Bitcoin has survived multiple regulatory challenges and emerged with institutional legitimacy

Traditional diversification tools (international equities, commodities) haven't delivered promised correlation benefits

The 40/30/30 model with Bitcoin integration isn't a bet on crypto mania. It's a recognition that portfolio construction in 2026 requires tools that weren't in the toolkit a decade ago.

For family offices, endowments, pension funds, and RIAs managing accredited investor capital, the question isn't whether to consider this framework. It's whether you can afford not to: especially when competing for capital against peers who are already implementing it.

The Bottom Line

The 40/30/30 portfolio model represents a practical middle ground between reckless innovation and stubborn tradition. It maintains exposure to public market growth, preserves the risk-buffering role of fixed income, captures the diversification benefits of alternatives, and acknowledges that Bitcoin has earned its place in institutional portfolios.

Not everyone will adopt this exact framework. Some will go heavier on alternatives, others will keep Bitcoin allocations smaller. The specific percentages matter less than the underlying philosophy: modern portfolio construction requires modern tools.

At Mogul Strategies, we're helping institutional and accredited investors navigate this transition: not by following trends, but by building portfolios that actually work in the world we have, not the one we wish existed.

The 60/40 portfolio had a great run. But it's 2026, and the rules have changed. Time to build accordingly.

Comments