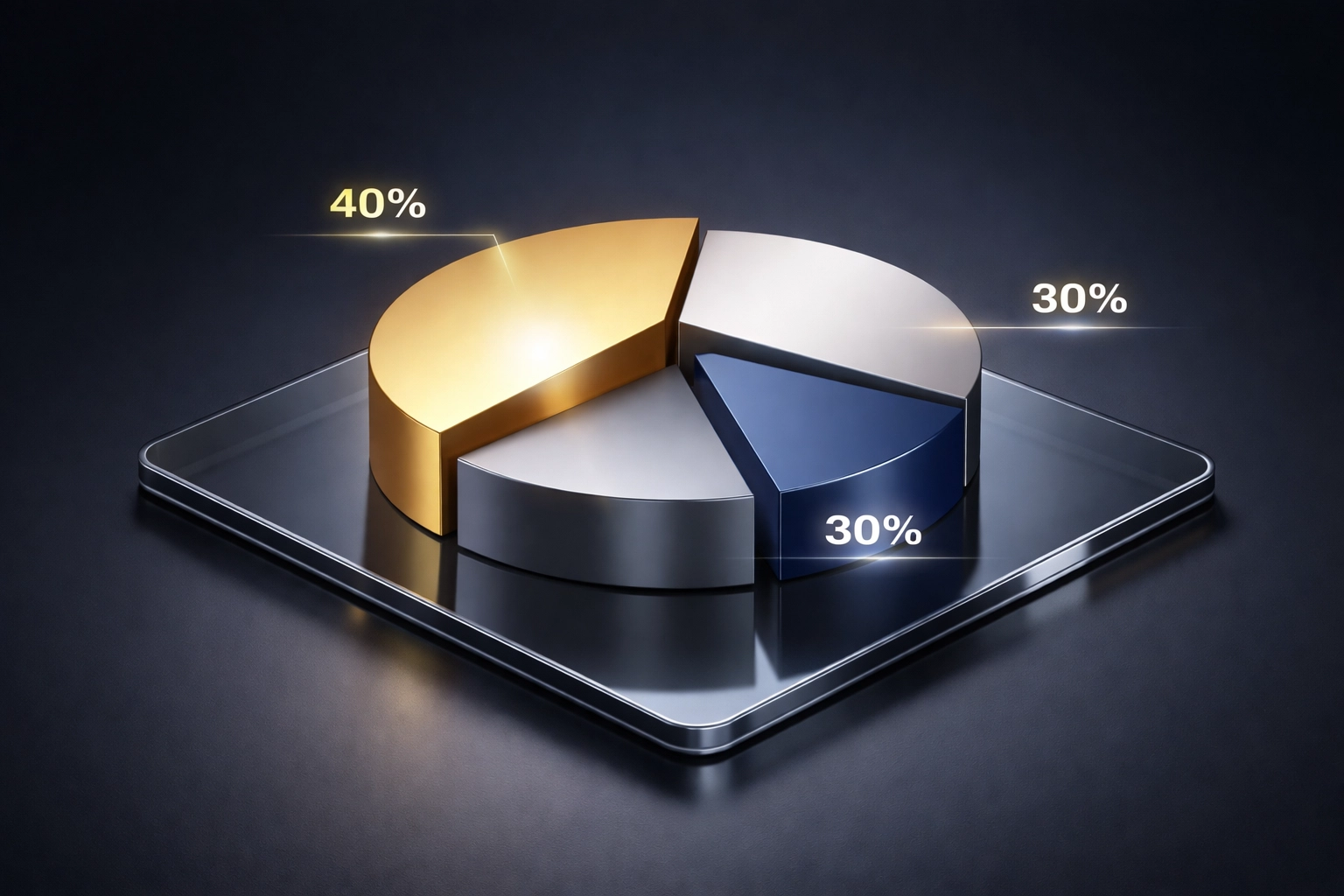

The Accredited Investor's Guide to the 40/30/30 Portfolio Model in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 28

- 5 min read

If you've been managing wealth for any length of time, you've probably heard the 60/40 portfolio praised as the gold standard. Sixty percent stocks, forty percent bonds: simple, elegant, and supposedly bulletproof.

Here's the thing: what worked for decades isn't necessarily working now. The investment landscape of 2026 looks nothing like it did even five years ago. Persistent inflation, elevated interest rates, and geopolitical uncertainty have fundamentally changed the game. That's why more accredited investors are turning to the 40/30/30 model: and the results are worth paying attention to.

Let's break down what this portfolio structure actually looks like, why it matters, and how you can implement it effectively.

What Exactly Is the 40/30/30 Portfolio?

The 40/30/30 portfolio is pretty straightforward in concept:

40% Public Equities : Your stocks, ETFs, and equity-based investments

30% Fixed Income : Bonds, treasuries, and other debt instruments

30% Alternative Investments : Private equity, real estate, hedge funds, infrastructure, and yes, even digital assets like Bitcoin

Think of it as an evolution of the classic 60/40, not a complete replacement. The key difference? That meaningful allocation to alternatives that can actually move independently from traditional markets.

Why the Traditional 60/40 Is Showing Its Age

Look, I'm not here to trash the 60/40 portfolio. It served investors well for a long time. But we need to be honest about what's happened.

During the 2008 financial crisis and the 2020 pandemic crash, many 60/40 portfolios lost more than 30%. The diversification that was supposed to protect investors? It largely disappeared when they needed it most.

The problem is correlation. When stocks and bonds start moving together: which they increasingly do during major market stress: your "diversified" portfolio suddenly behaves like it's all invested in one asset class. Research shows the 60/40 model now exhibits correlation close to 1 with equity markets during downturns.

Add to that:

Persistent inflation eating into bond returns

Elevated interest rates constraining equity valuations

Geopolitical tensions creating unpredictable market swings

The environment that made 60/40 shine simply doesn't exist anymore. That doesn't mean it's useless: it just means thorough revision is necessary.

The Performance Case for 40/30/30

Here's where it gets interesting. The numbers actually back up the shift to 40/30/30.

Research demonstrates a 40% improvement in the Sharpe ratio compared to traditional 60/40 portfolios. For those who don't live and breathe finance metrics, the Sharpe ratio measures risk-adjusted returns. A higher Sharpe ratio means you're getting more return for each unit of risk you're taking on.

J.P. Morgan's analysis found that even a 25% allocation to alternatives can enhance 60/40 returns by approximately 60 basis points. That might sound small, but it represents an 8.5% improvement to projected returns. Over a 20 or 30-year investment horizon, that compounds into real money.

KKR's research reinforced this finding: 40/30/30 outperformed 60/40 across all timeframes studied.

The takeaway? This isn't just theory. The data supports making this shift.

Breaking Down Alternatives: A Functional Framework

Here's where most investors get it wrong. They hear "alternatives" and treat it like a single asset class. Throw some private equity in there, add a hedge fund, maybe some real estate: done.

But not all alternatives behave the same way. And that matters enormously.

A smarter approach classifies alternatives into three distinct functional roles:

1. Downside Protection

These are assets specifically designed to hedge against market declines. Think managed futures strategies, certain hedge fund approaches, or gold allocations. Their job is to hold value (or even gain) when everything else is falling.

2. Uncorrelated Returns

Strategies that generate returns independent of traditional markets. Private credit, certain infrastructure investments, and some digital asset strategies fall here. The goal isn't necessarily to protect against crashes: it's to provide returns that simply don't care what the S&P 500 is doing.

3. Upside Capture

Assets positioned to benefit from economic growth, often with leverage or operational improvements. Private equity buyouts, growth-focused real estate, and venture capital fit this category. They're designed to outperform during good times.

This segmentation enables something powerful: dynamic rebalancing based on macroeconomic conditions. When you sense increased downside risk, you shift alternative allocations toward protection. When growth looks strong, you emphasize upside capture.

It's not about picking winners: it's about building a portfolio that adapts.

Implementation for Accredited Investors in 2026

The good news? Access to alternatives has never been better for accredited investors.

Where minimum investments once exceeded $500,000 (and often much more), today you can access diverse alternative vehicles with considerably lower thresholds. Private credit funds, real estate syndications, infrastructure plays, and institutional-grade digital asset strategies are all within reach.

Specific Considerations:

Real Estate and Infrastructure: These offer something particularly valuable in today's environment: built-in inflation protection. Many underlying contracts include inflation adjustment clauses, meaning your returns naturally hedge against rising prices.

Private Credit: With traditional lenders pulling back, private credit has become a compelling fixed-income alternative. The yields are attractive, and the correlation to public markets is typically lower than traditional bonds.

Digital Assets: Bitcoin and select cryptocurrencies have matured significantly as institutional-grade investments. For accredited investors willing to accept the volatility, a measured allocation can provide genuine diversification benefits. The key word here is "measured": this isn't about betting the farm.

Hedge Fund Strategies: Risk mitigation remains a core function here. Strategies focused on absolute returns rather than benchmark-beating can provide the downside protection piece of your alternatives allocation.

The Active Management Imperative

I want to be direct about something: the 40/30/30 model requires more hands-on management than a simple index-based 60/40 portfolio.

A passive approach to alternatives offers some benefits, but it won't optimize performance. Success depends on:

Selecting alternatives that fulfill a defined functional role (protection, uncorrelation, or upside)

Dynamically rebalancing according to macroeconomic context

Centralized allocation management that sees the full picture

This is why working with an experienced asset management team matters. The complexity isn't unmanageable, but it does require expertise and attention.

Practical Positioning for 2026

So what does this look like in practice right now?

Equities (40%): Current positioning suggests neutral to modest overweight depending on valuation and growth prospects. Be selective about sectors and geographies rather than buying broad indexes blindly.

Fixed Income (30%): Adjust based on yield curve dynamics and credit conditions. The traditional approach of just holding treasuries isn't sufficient: consider diversifying across credit qualities and durations.

Alternatives (30%): Align allocations with your specific objectives. Are you prioritizing income generation? Capital appreciation? Volatility reduction? Your alternative mix should reflect those goals, not just chase the latest hot strategy.

The Bottom Line

The 40/30/30 portfolio model doesn't render the 60/40 obsolete. But it does acknowledge that the investment environment has fundamentally shifted: and our portfolios need to shift with it.

For accredited investors with the access and sophistication to implement alternatives properly, the potential benefits are clear: better risk-adjusted returns, genuine diversification, and a portfolio that can adapt to whatever 2026 and beyond throws at us.

The key is thoughtful implementation. Not every alternative is right for every investor, and the functional framework matters. Downside protection, uncorrelated returns, and upside capture each serve different purposes in your portfolio.

At Mogul Strategies, we specialize in blending traditional assets with innovative strategies: including institutional-grade digital asset integration: to help high-net-worth investors navigate this new landscape. If you're ready to explore what a modern portfolio could look like for your specific situation, we should talk.

Because in 2026, the investors who thrive won't be the ones clinging to yesterday's playbook. They'll be the ones who evolved.

Comments