The Proven 40/30/30 Portfolio Framework: How Accredited Investors Blend Traditional and Digital Assets

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 2 hours ago

- 5 min read

The classic 60/40 portfolio split, 60% stocks, 40% bonds, had a good run. For decades, it was the gold standard for balanced investing. But let's be honest: the investment landscape has changed dramatically, and so have the strategies that work.

If you're an accredited investor still relying solely on that old framework, you're probably leaving returns on the table. More importantly, you might not be as protected as you think when markets get choppy.

Enter the 40/30/30 portfolio framework, a smarter allocation strategy that's gaining serious traction among institutional investors and high-net-worth individuals. Here's everything you need to know about this approach and how it's reshaping modern portfolio construction.

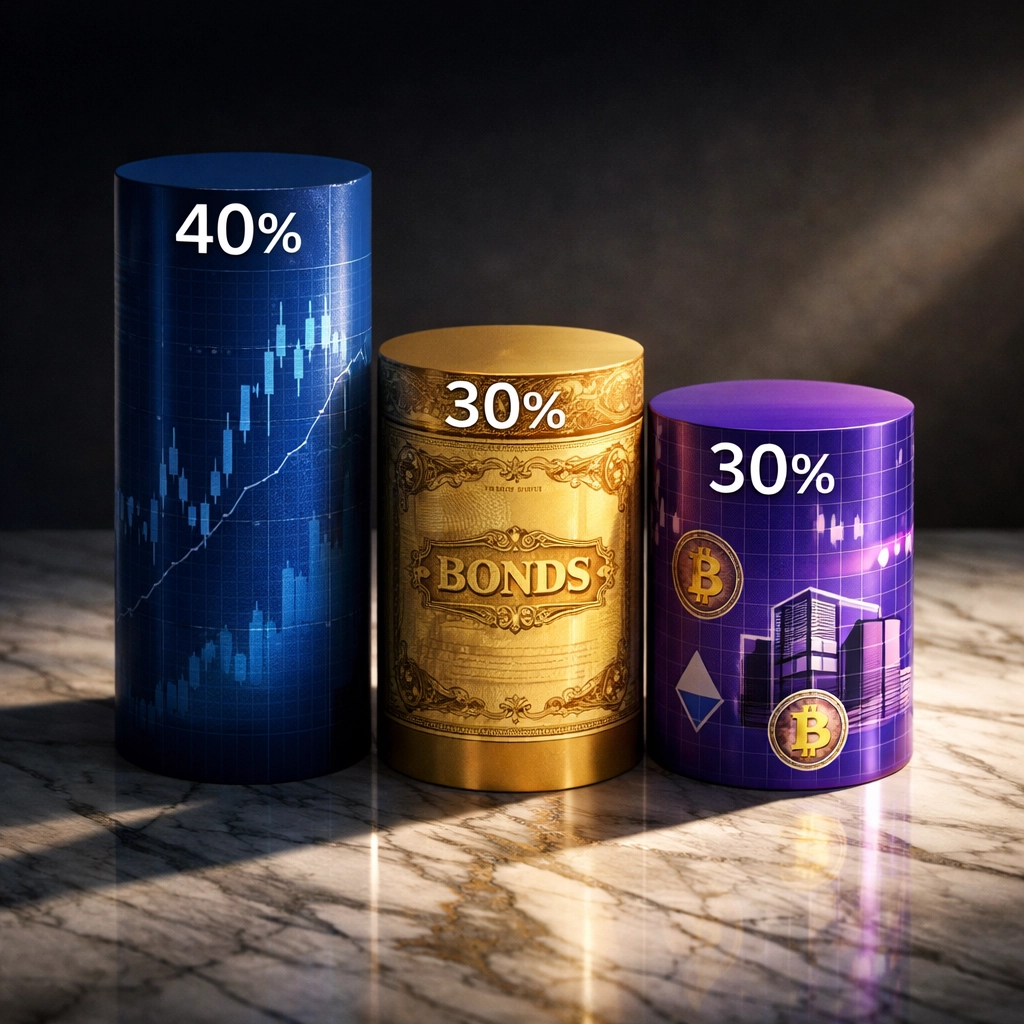

What Exactly Is the 40/30/30 Framework?

The math is straightforward: 40% public equities, 30% fixed income (bonds), and 30% alternative investments.

Think of it as the 60/40 portfolio's evolved cousin, one that's adapted to current market realities. Instead of betting your entire portfolio on just stocks and bonds, you're splitting your assets across three distinct buckets. That third bucket, alternatives, is where things get interesting.

The framework isn't some random number combination someone pulled out of thin air. It's backed by real research. J.P. Morgan found that adding a 25% allocation to alternative assets can boost traditional 60/40 returns by 60 basis points. That translates to an 8.5% improvement on a portfolio projected to return 7%. KKR's research echoed similar findings, showing 40/30/30 outperforming 60/40 across multiple timeframes.

Why Traditional Portfolios Aren't Enough Anymore

Here's the problem with the old 60/40 split: it assumes stocks and bonds move in opposite directions. When stocks crash, bonds traditionally rally, cushioning the blow. That negative correlation was the whole point of diversification.

But we've entered a new era where stocks and bonds often move together, especially during periods of rising interest rates or inflation. When both go down simultaneously, you're not diversified. You're just exposed on two fronts.

This is exactly what happened in 2022. Both stocks and bonds took a beating, leaving traditional portfolios nowhere to hide. The diversification benefit that investors counted on for decades simply evaporated.

The 40/30/30 framework addresses this by reducing exposure to both stocks and bonds while introducing a meaningful allocation to alternatives that don't necessarily move in lockstep with traditional markets.

Breaking Down the Three Buckets

The 40% Equity Component

This is your growth engine. Public equities still play a crucial role in wealth building, but you're not over-indexed here. You maintain exposure to market upside while leaving room for other strategies.

For most accredited investors, this means a mix of domestic and international stocks, potentially with some sector tilts based on market conditions and long-term trends.

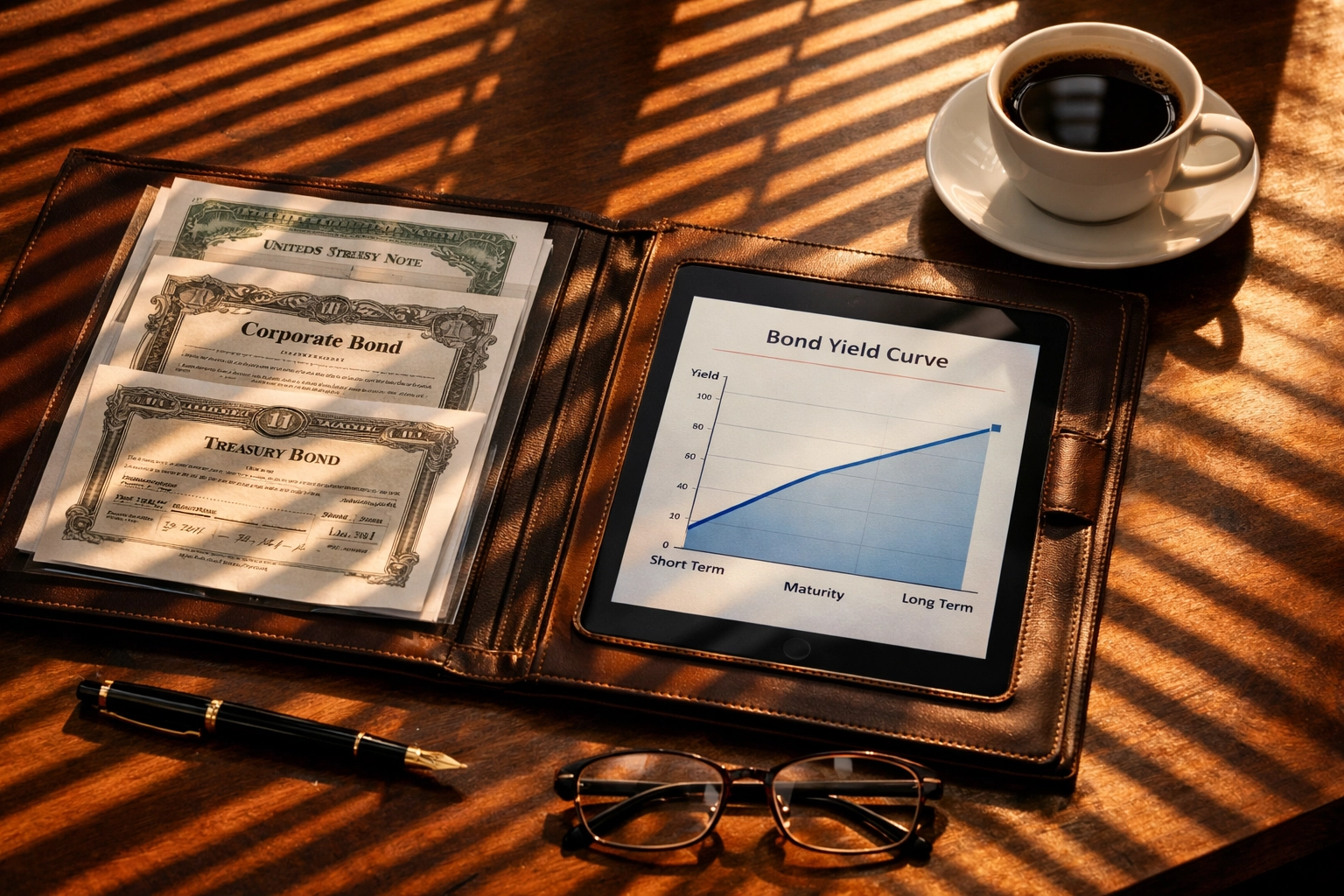

The 30% Fixed Income Component

Bonds aren't dead, they're just not the whole safety net anymore. This allocation provides income, stability, and some downside protection, especially during equity market stress.

The key is being strategic. In today's environment, consider diversifying across different bond types: investment-grade corporates, municipals, and potentially some allocation to shorter-duration bonds that are less sensitive to interest rate changes.

The 30% Alternatives Component

This is where the framework really differentiates itself. Alternatives can include a wide range of assets and strategies:

Private equity and venture capital: Access to pre-IPO companies and private market opportunities

Real estate: Both direct property ownership and REITs, offering inflation hedges through rent adjustments

Infrastructure: Assets like energy pipelines, cell towers, and utilities with built-in inflation protection

Digital assets: Bitcoin, select cryptocurrencies, and tokenized assets that offer non-correlated returns

Where Digital Assets Fit In

For forward-thinking accredited investors, digital assets have become an increasingly important component of that 30% alternatives bucket.

Bitcoin, despite its volatility, has shown low correlation to traditional asset classes over time. That's exactly what you want in an alternatives allocation, something that zigs when the rest of your portfolio zags.

A typical approach might allocate 5-10% of your total portfolio to digital assets. Within that 30% alternatives sleeve, that could represent roughly one-third of your alternative investments, with the remainder in more traditional alternatives like private equity and real estate.

The key is treating digital assets as true alternatives, not as a replacement for equities. Yes, Bitcoin can be volatile. But when blended properly with other non-correlated assets, it can actually improve your overall risk-adjusted returns.

Some investors are also exploring tokenized real estate, digital securities, and other blockchain-based assets that bridge traditional and digital markets. These instruments are still emerging but represent interesting opportunities for portfolio diversification.

The Performance Reality Check

Let's talk numbers. Historical data from November 2001 through August 2025 showed a 40/30/30 portfolio delivered a 6.89% compound annual growth rate versus 7.46% for the traditional 60/40 split. At first glance, that looks like a loss.

But here's what matters more: the 40/30/30 framework achieved a Sharpe ratio of 0.71 compared to 0.56 for 60/40. Translation? You got better risk-adjusted returns. You earned more return per unit of risk taken.

This means the framework might deliver slightly lower total returns during strong bull markets, but it provides significantly better protection during downturns and market stress periods. For investors focused on long-term wealth preservation: not just chasing the highest returns: that tradeoff often makes sense.

Implementing the Framework: Practical Considerations

Moving to a 40/30/30 allocation isn't something you do overnight. Here are some key considerations:

Access Requirements: Many alternative investments require accredited investor status. You'll need to verify you meet the income or net worth thresholds.

Liquidity Considerations: Alternatives are often less liquid than stocks and bonds. Private equity funds might lock up your capital for years. Even Bitcoin, while tradable 24/7, can experience periods where large positions are difficult to exit without moving the market.

Fee Structures: Alternative investments typically come with higher fees than index funds. Make sure the net-of-fee returns justify the allocation.

Rebalancing: With three distinct buckets moving independently, you'll need a clear rebalancing strategy. Set specific thresholds and review quarterly.

Tax Implications: Different assets have different tax treatments. Digital assets, in particular, have specific tax reporting requirements you'll need to manage.

Is 40/30/30 Right for You?

The framework works particularly well for accredited investors who:

Have sufficient capital to meet minimum investment thresholds for alternative assets

Can handle the reduced liquidity that comes with private investments

Are focused on risk-adjusted returns rather than absolute returns

Want exposure to non-traditional assets like digital currencies

Have a long-term investment horizon (10+ years)

It's less suitable if you need high liquidity across your entire portfolio or if you're exclusively focused on maximizing returns during bull markets.

Building for the Future

The investment world isn't standing still. The strategies that worked for your parents' generation won't necessarily work for yours. The 40/30/30 framework represents an evolution: a recognition that true diversification requires looking beyond just stocks and bonds.

By thoughtfully blending traditional equities and fixed income with alternatives including digital assets, you're building a portfolio designed for today's market realities, not yesterday's assumptions.

At Mogul Strategies, we help accredited investors navigate these complex allocation decisions, integrating both traditional and digital assets into cohesive portfolio strategies built for long-term wealth preservation and growth.

The question isn't whether to evolve your portfolio approach. It's whether you'll do it strategically: or watch from the sidelines while market dynamics leave traditional allocations behind.

Comments