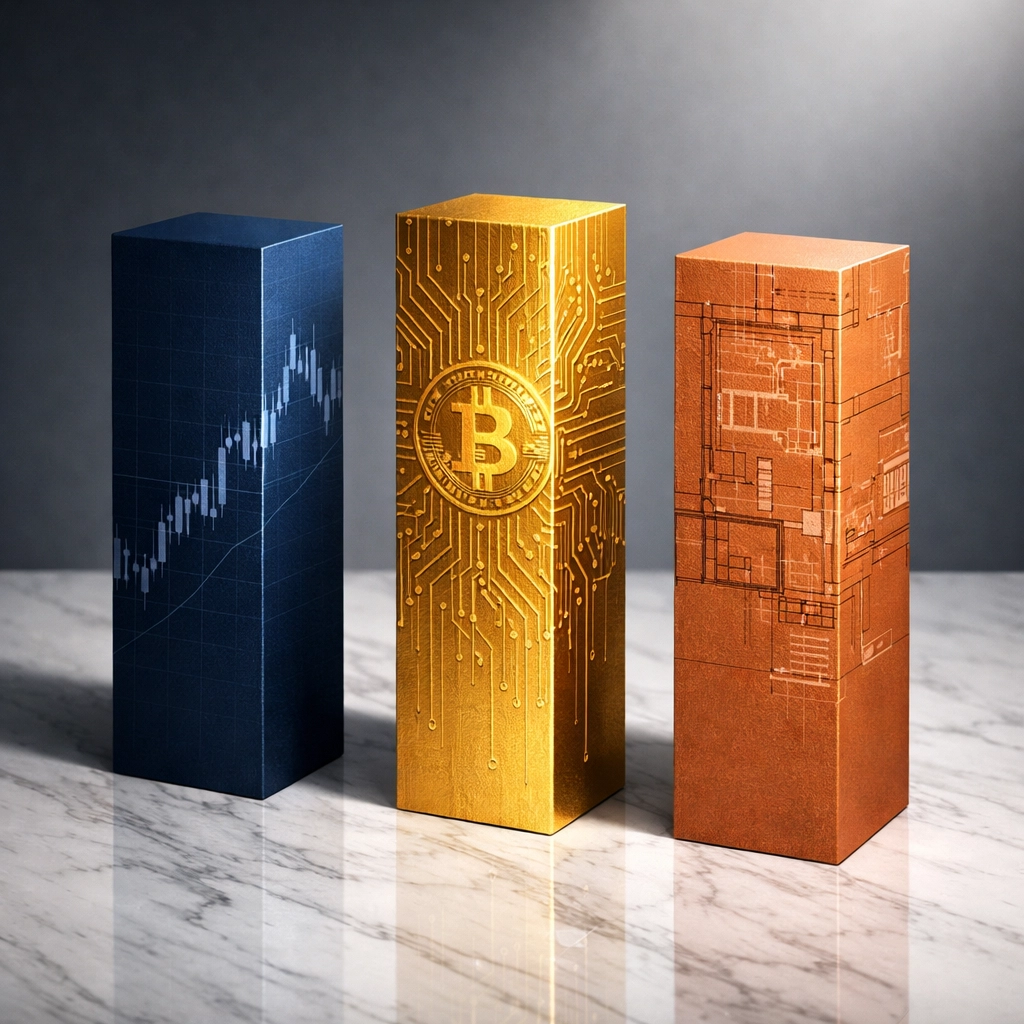

The Proven 40/30/30 Framework: How High-Net-Worth Investors Are Combining Equities, Digital Assets, and Real Estate

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 16 hours ago

- 5 min read

The traditional 60/40 portfolio is dead. Well, maybe not completely dead, but it's definitely on life support.

For decades, investors relied on the simple formula: 60% stocks, 40% bonds. It worked beautifully when stocks and bonds moved in opposite directions. When equities tanked, bonds cushioned the fall. But something fundamental has changed in recent years: stocks and bonds now often move together, especially during market stress. That correlation has broken the protective mechanism the 60/40 was built on.

Enter the 40/30/30 framework. This modernized approach reallocates 20% from equities and 10% from bonds into a dedicated alternative investments sleeve. The result? A portfolio that's 40% public equities, 30% fixed income, and 30% alternatives. And within that alternatives bucket, high-net-worth investors are finding compelling opportunities in digital assets and real estate.

Why the Shift Makes Sense

According to research from J.P. Morgan, adding a 25% allocation to alternative assets can improve traditional 60/40 returns by 60 basis points: that's an 8.5% improvement on a portfolio's projected 7% return. KKR's analysis found that 40/30/30 outperformed 60/40 across every timeframe they studied.

The math is straightforward. When you reduce your reliance on traditional assets that increasingly move in tandem, you're building multiple layers of fortification. Instead of two asset classes doing the heavy lifting, you now have three distinct buckets working together: each with its own risk-return characteristics and correlation patterns.

Think of it like this: if equities are your engine and bonds are your brakes, alternatives become your suspension system. They smooth out the ride during volatile market cycles while still helping you pursue meaningful returns.

Understanding the Alternatives Sleeve

The 30% alternative allocation isn't just a catch-all for "other stuff." It's typically structured around two distinct strategy types:

Diversifiers are strategies with low-to-zero correlation to traditional assets. They're designed to provide returns without significant market exposure. Think private credit, market-neutral hedge funds, or certain commodities strategies.

Enhancers have higher correlation and moderate-to-high beta. They amplify returns or mitigate specific risks of traditional assets. Private equity, venture capital, and certain real estate strategies fall into this category.

The key is balancing both types within your alternatives allocation.

Digital Assets: The New Frontier for Sophisticated Portfolios

Here's where things get interesting for high-net-worth investors. Digital assets: primarily Bitcoin and other institutional-grade cryptocurrencies: are emerging as a compelling addition to the alternatives bucket.

Why? Because Bitcoin's correlation to traditional equities remains relatively low over longer time horizons. During certain market cycles, it acts as a portfolio diversifier. During others, it serves as an enhancer with significant upside potential.

A small allocation to digital assets: typically 5-10% of the alternatives sleeve, or roughly 1.5-3% of the total portfolio: can provide meaningful diversification benefits without excessive risk. The key is treating digital assets as institutional investments, not speculative trades. That means:

Using regulated custodians and secure storage solutions

Focusing on liquid, established protocols with real utility

Implementing proper risk management and position sizing

Viewing the allocation through a 5-10 year lens

For accredited investors, the digital asset space also offers opportunities beyond simple token holdings. Bitcoin mining operations, blockchain infrastructure investments, and crypto-focused funds provide exposure with different risk profiles than direct ownership.

The volatility is real, but so is the asymmetric return potential. That's why position sizing matters. A 2% allocation that doubles provides meaningful portfolio uplift. If it goes to zero? The damage is contained.

Real Estate: The Time-Tested Alternative

While digital assets represent the new frontier, real estate remains the backbone of most sophisticated alternatives allocations. It's tangible, income-producing, and has centuries of track record as a wealth preservation tool.

Within the 40/30/30 framework, real estate typically occupies 10-15% of the total portfolio: or roughly one-third to one-half of the alternatives sleeve. But not all real estate investments are created equal.

High-net-worth investors increasingly favor:

Real Estate Syndications offer access to institutional-quality properties: multifamily complexes, commercial buildings, industrial warehouses: without the headaches of direct management. These structures pool capital from accredited investors to acquire and operate properties that would be unreachable individually.

Private REITs provide diversification across property types and geographies while maintaining liquidity advantages over direct ownership. Unlike publicly traded REITs that correlate heavily with stock market movements, private REITs tend to reflect actual property fundamentals.

Development Projects for investors comfortable with higher risk, development deals offer enhanced returns in exchange for illiquidity and execution risk. These work best as a smaller slice of the real estate allocation.

The beauty of real estate within this framework is its dual role. It provides diversification from public markets while generating steady income: something particularly valuable when bond yields remain challenged. Plus, real estate investments offer inflation protection, as rents and property values tend to rise with general price levels.

Implementing the Framework for High-Net-Worth Investors

Theory is great, but execution is everything. Here's how sophisticated investors actually implement the 40/30/30 model:

Start with the equity sleeve (40%). This doesn't mean 40% in a single S&P 500 index fund. Diversify across domestic and international equities, large and small caps, growth and value. Consider factor-based strategies that can reduce volatility while maintaining equity exposure.

Build the fixed income allocation (30%) with intention. Don't just buy a bond index. Layer in investment-grade corporates, treasuries, municipal bonds for tax efficiency, and potentially some high-yield or emerging market debt for enhanced returns. Duration management matters: especially in uncertain rate environments.

Construct the alternatives sleeve (30%) methodically over time. This isn't built in a day. Start with more liquid alternatives like private REITs or liquid alternative mutual funds. Layer in digital assets at appropriate sizing. Add private equity or real estate syndications as opportunities arise and as your liquidity needs allow.

The implementation timeline matters. Fully deploying an alternatives allocation might take 12-24 months. That's okay. Many alternative investments are illiquid by nature, and proper due diligence takes time. Better to build slowly with quality investments than rush into mediocre opportunities.

Risk Considerations You Can't Ignore

The 40/30/30 framework isn't a magic bullet. It comes with its own set of challenges:

Illiquidity is the big one. Many alternative investments lock up capital for years. Make sure you maintain adequate liquidity buffers outside the portfolio for emergencies and opportunities.

Complexity increases with alternatives. You need to understand fee structures, tax implications, and operational mechanics of private investments. Due diligence requirements are significantly higher than buying a stock or bond fund.

Valuation challenges arise with illiquid assets. Your quarterly statements might look stable, but that's partly because real estate and private equity investments aren't marked-to-market daily. Don't confuse infrequent pricing with low volatility.

Manager selection matters enormously in alternatives. The dispersion between top-quartile and bottom-quartile alternative managers dwarfs the spread in traditional asset management. Bad manager selection can torpedo returns.

Why This Matters Now

We're living through a unique moment in financial markets. Interest rates are in flux after years of artificially low levels. Equity valuations remain elevated by historical standards. Geopolitical risks abound. Traditional correlations are unreliable.

In this environment, portfolio construction matters more than ever. The 40/30/30 framework isn't about chasing returns: it's about building resilience while maintaining upside participation. It's about recognizing that diversification isn't just holding different assets, it's holding assets that genuinely behave differently under stress.

For high-net-worth investors, the combination of equities, digital assets, and real estate within a structured framework offers something powerful: optionality. You're positioned to benefit whether growth accelerates, inflation persists, or markets remain choppy. Each sleeve does its job, and together they create a portfolio that's stronger than the sum of its parts.

At Mogul Strategies, we're focused on helping investors navigate exactly these kinds of structural shifts. The markets have evolved. Portfolio construction should evolve with them. The 40/30/30 framework isn't just theory: it's a practical approach that sophisticated investors are using right now to build wealth that lasts.

Comments