The Proven Institutional Alternative Investment Framework for Wealth Preservation in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 3 days ago

- 5 min read

The investment playbook that worked for decades is getting rewritten in real-time. With inflation volatility, geopolitical uncertainty, and traditional 60/40 portfolios struggling to deliver consistent returns, institutional investors and high-net-worth individuals are asking the same question: How do we actually preserve wealth in 2026?

The answer isn't found in doubling down on public markets. Instead, leading institutions are adopting a systematic framework that blends traditional stability with alternative asset exposure. Here's what's working right now.

Why Traditional Portfolios Are Coming Up Short

Let's be honest: stocks and bonds alone aren't cutting it anymore. When both asset classes experience simultaneous drawdowns (like we saw in 2022), the classic diversification argument falls apart.

The correlation between traditional assets has increased significantly over the past decade. When everything moves in the same direction during market stress, you don't actually have diversification: you just have multiple ways to lose money at once.

That's why institutional investors have been steadily increasing their alternative allocations. And we're not talking about a 3-5% "alternative sleeve" anymore. According to recent data, roughly half of advisors now allocate more than 10% of portfolios to alternatives, with 88% planning to increase these allocations over the next two years.

The Core Framework: What Institutions Are Actually Doing

The most effective approach in 2026 isn't about picking one alternative asset and hoping for the best. It's about building a multi-layered alternative strategy that serves different purposes within your overall wealth preservation plan.

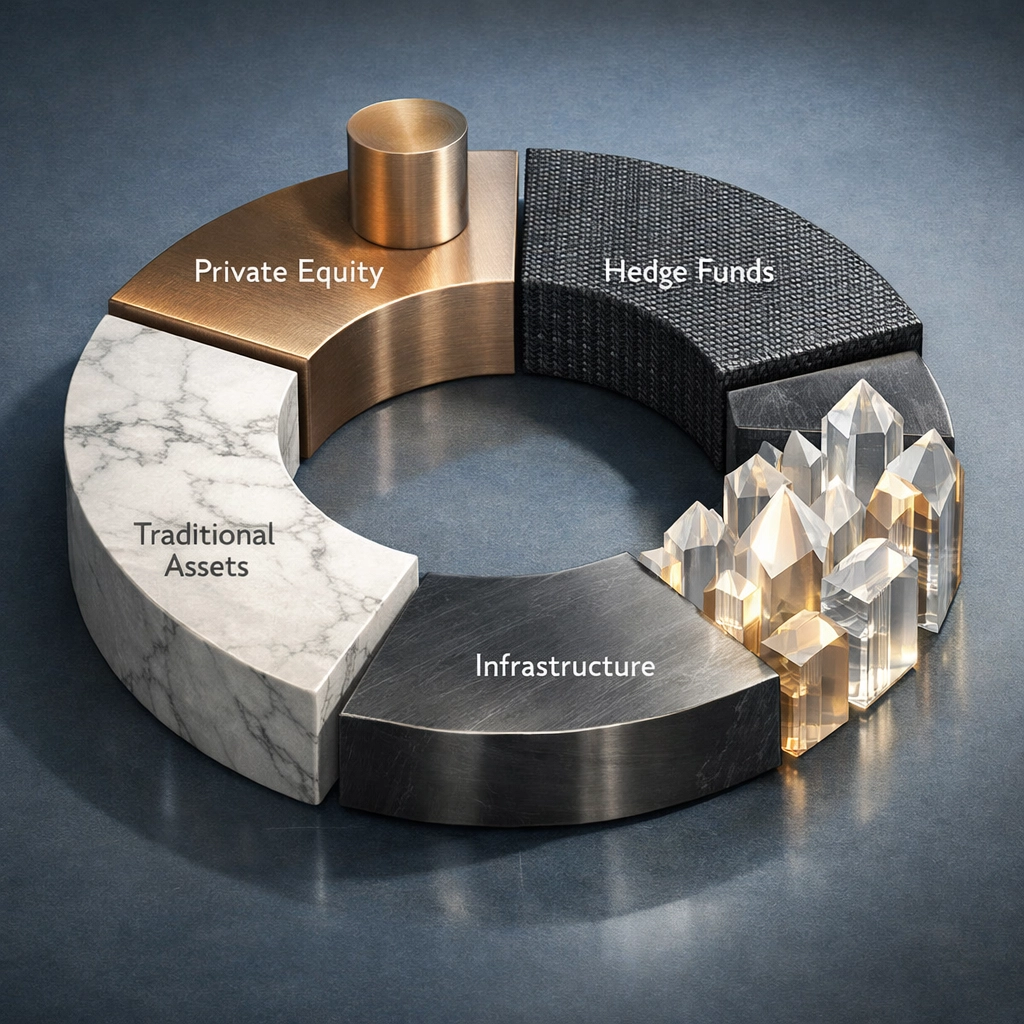

1. The Diversified Alternative Allocation Model

Think of alternative investments as a team where each player has a specific role:

Private Equity provides growth exposure outside of public market volatility. When structured properly, PE investments can capture value creation that simply isn't available through publicly traded securities.

Private Credit delivers yield: especially compelling in European markets right now: while offering seniority in capital structures. This means you're positioned ahead of equity holders when things go sideways.

Hedge Funds (the right ones) provide low-volatility, uncorrelated returns. They're your shock absorbers when traditional markets get bumpy.

Private Infrastructure offers predictable cash flows tied to long-term structural trends like digital connectivity and renewable energy. These aren't speculative bets: they're investments in the physical systems that support economic activity.

2. The Total Portfolio Approach (TPA)

Here's where institutional thinking has evolved: Stop evaluating investments in isolation.

Instead of asking "Is this a good investment?" ask "How does this contribute to my overall portfolio goals?" Every position should serve at least one of these purposes:

Generating returns

Providing liquidity when needed

Offering true diversification (not just non-correlation during good times)

Building resilience against tail risks

This requires more upfront analysis and better coordination across your investment team or advisors. But institutions using TPA consistently achieve better outcomes because they're optimizing for the portfolio, not individual positions.

3. The Liquidity Balance: Semi-Liquid Structures

One of the biggest barriers to alternative investing used to be the liquidity trade-off. Traditional private equity funds lock up capital for 7-10 years. That works for university endowments but creates problems for investors who need some flexibility.

Enter semi-liquid alternatives and evergreen funds. These structures let you capture illiquidity premiums while maintaining reasonable access to capital:

Monthly subscription windows

Quarterly redemption opportunities (at net asset value)

Built-in liquidity sleeves to support withdrawals

No pressure to deploy capital immediately or harvest returns on artificial timelines

Currently, 82% of advisors use evergreen funds either exclusively or alongside traditional drawdown vehicles. The flexibility matters: especially when markets move unpredictably.

The 40/30/30 Framework in Practice

At Mogul Strategies, we've seen a specific allocation model gain traction among sophisticated investors: 40% traditional assets, 30% established alternatives, 30% innovative digital strategies (including institutional-grade Bitcoin and tokenized assets).

Here's why this works:

The 40% traditional allocation (stocks, bonds, liquid securities) provides baseline stability and liquidity for near-term needs. This isn't abandoning traditional markets: it's right-sizing them.

The 30% established alternatives (private equity, private credit, real estate syndication, infrastructure) delivers the diversification and uncorrelated returns that public markets can't offer. These are battle-tested strategies with decades of institutional adoption.

The 30% innovative digital strategies is where forward-thinking institutions are separating themselves. This includes:

Professionally managed Bitcoin exposure (not retail speculation)

Tokenized real-world assets

Digital infrastructure investments

Blockchain-based settlement systems

The key is approaching digital assets with the same institutional rigor you'd apply to any alternative investment. That means proper custody solutions, risk management protocols, and integration with your overall portfolio construction.

Integration: Where Bitcoin Fits in Institutional Portfolios

Let's address the elephant in the room. Bitcoin isn't a "crypto play" anymore: it's becoming infrastructure for institutional capital flows.

Major differences between 2021 speculation and 2026 integration:

Proper custody: Regulated, insured solutions with institutional counterparties

Risk-adjusted sizing: Typically 2-5% of alternatives allocation, not 50%

Correlation benefits: Bitcoin's relationship to traditional assets remains low over longer timeframes

Regulatory clarity: Evolving frameworks that support institutional participation

The investors seeing Bitcoin integration as "too risky" are often taking larger risks by maintaining concentrated exposure to traditional assets that move in lockstep.

Real Estate Syndication: The Overlooked Stabilizer

While private equity and credit get most of the headlines, real estate syndication remains one of the most effective wealth preservation tools available to accredited investors.

Why syndication specifically?

You get professional management, diversified property exposure, and passive income without the headaches of direct ownership. More importantly, real estate provides tangible asset backing and inflation protection: two things that matter when preserving purchasing power across decades.

Implementation: Your Next Steps

Moving from theory to practice requires addressing three key questions:

1. What's your current alternative allocation?

If you're below 10%, you're likely underexposed based on current institutional standards. If you're above 30%, ensure you're maintaining adequate liquidity for short-term needs.

2. Are your alternatives actually diversified?

Having five different real estate funds isn't diversification: it's concentration with extra paperwork. True alternative diversification means exposure across different return drivers and risk factors.

3. Who's managing the total portfolio strategy?

This is where many investors fall short. You might have excellent individual managers, but if no one is coordinating the overall strategy, you're missing the TPA benefits.

The Democratization Factor

Here's something that surprised us: Among advisors serving non-accredited clients, 80% already allocate to alternatives. Regulatory changes are enabling private assets in defined contribution plans through target date funds and managed accounts.

This matters because it signals that alternative investments aren't exotic anymore: they're becoming standard components of diversified wealth strategies across different investor segments.

What This Means for Your Wealth Strategy

The institutions that successfully preserve and grow wealth over the next decade won't be the ones with the most conservative approach or the most aggressive bets. They'll be the ones that systematically build diversified alternative exposure while maintaining discipline around total portfolio construction.

The framework is proven. The tools are available. The question is whether you're positioned to implement it effectively: or whether you're still relying on a playbook designed for a market environment that no longer exists.

At Mogul Strategies, we help accredited and institutional investors build alternative allocation strategies that actually work. Not theoretical models that look good on paper, but practical frameworks that preserve wealth across different market conditions.

Ready to evaluate your current alternative allocation strategy?Visit our website to learn how we're helping sophisticated investors implement institutional-grade frameworks for wealth preservation.

Comments