The Proven Risk Mitigation Framework: How Institutional Investors Blend Traditional Assets with Digital Strategies

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 31

- 5 min read

Let's be honest: market volatility isn't going anywhere. Whether it's geopolitical tensions, inflation scares, or the next black swan event nobody saw coming, institutional portfolios need protection that actually works.

For decades, the playbook was straightforward: stocks for growth, bonds for stability, maybe some alternatives if you were feeling adventurous. But that world is changing fast. The traditional 60/40 portfolio has shown cracks, bond yields have been unpredictable, and correlations that we thought were stable have broken down when we needed them most.

Enter the modern risk mitigation framework: one that doesn't throw out the old playbook but enhances it with digital strategies that institutional investors can no longer afford to ignore.

The Three-Tier Protection System

The most sophisticated institutional investors organize their risk mitigation into three distinct layers. Think of it like a defensive system in sports: you need players ready to respond at different speeds and distances.

First Responders are your immediate defense. These strategies activate the moment markets show stress. We're talking about tail risk hedges, long volatility positions, and protective options strategies. Their job isn't to make you rich: it's to stop the bleeding when everything else is tanking.

Second Responders kick in during broader market dislocations. Trend-following strategies and momentum-based approaches fall into this category. They're not as immediate as your first responders, but they capture larger moves and can actually generate positive returns during extended downturns.

Diversifiers are the secret sauce. These are alternative strategies generating returns from sources completely uncorrelated to your traditional portfolio. Private equity, real estate, hedge fund strategies: these are the assets that zig when everything else zags.

The goal of this entire framework is simple: generate positive long-term returns while maintaining negative to modestly positive correlations with traditional risk sources like equities, interest rates, and credit spreads. Sounds great in theory, but here's where it gets interesting.

Where Traditional Frameworks Fall Short

Traditional risk mitigation has a problem: everything is increasingly correlated. When markets panic, correlations shoot toward one. Stocks fall, bonds sometimes fall with them, even gold doesn't always show up when you need it.

The 2022 market showed this perfectly. Both stocks and bonds got hammered together, destroying the core premise of the 60/40 portfolio. Investors who thought they were diversified learned a painful lesson about correlation risk.

This is where digital assets enter the conversation: not as a replacement for traditional strategies, but as a complement that addresses specific gaps in the framework.

Integrating Digital Strategies Into Each Tier

Let's break down how Bitcoin and other digital assets can enhance each layer of protection without abandoning what works.

First Responders: Protected Digital Positions

For first responders, you're not just buying Bitcoin and hoping for the best. Institutional-grade integration means using structured products that combine digital assets with traditional hedging mechanisms.

Think of protected Bitcoin strategies: positions that use options strategies alongside Treasury holdings to create exposure with defined downside limits. You get the potential upside participation of digital assets while maintaining the capital preservation mandate that institutions require.

This isn't about going all-in on crypto. It's about having 2-5% of your portfolio in carefully structured digital positions that provide a different type of crisis-period behavior than traditional assets.

Second Responders: Trend Capture in Digital Markets

The second responder tier is where digital assets really shine. Bitcoin and major cryptocurrencies have shown strong trending behavior: when they move, they move.

Momentum strategies that incorporate digital assets can capture these trends while maintaining disciplined risk management. The key is treating them like any other trend-following position: set your entry rules, define your exit criteria, size positions appropriately.

Many institutional investors use managed futures strategies that now include Bitcoin futures alongside traditional commodity and currency trends. This isn't speculation: it's systematic trend capture with proper risk controls.

Diversifiers: Non-Correlated Return Streams

Here's where digital strategies add the most value. Bitcoin has demonstrated periods of genuine non-correlation to traditional markets. Not always, not perfectly, but enough to matter in a diversification framework.

The correlation between Bitcoin and the S&P 500 has fluctuated significantly over time, and during certain market regimes, it behaves like the uncorrelated diversifier that institutional portfolios desperately need.

Beyond Bitcoin, blockchain-based strategies offer exposure to entirely new return streams: decentralized finance yield generation, tokenized real estate, digital infrastructure investments. These aren't traditional assets dressed up in crypto clothing: they're genuinely different sources of return.

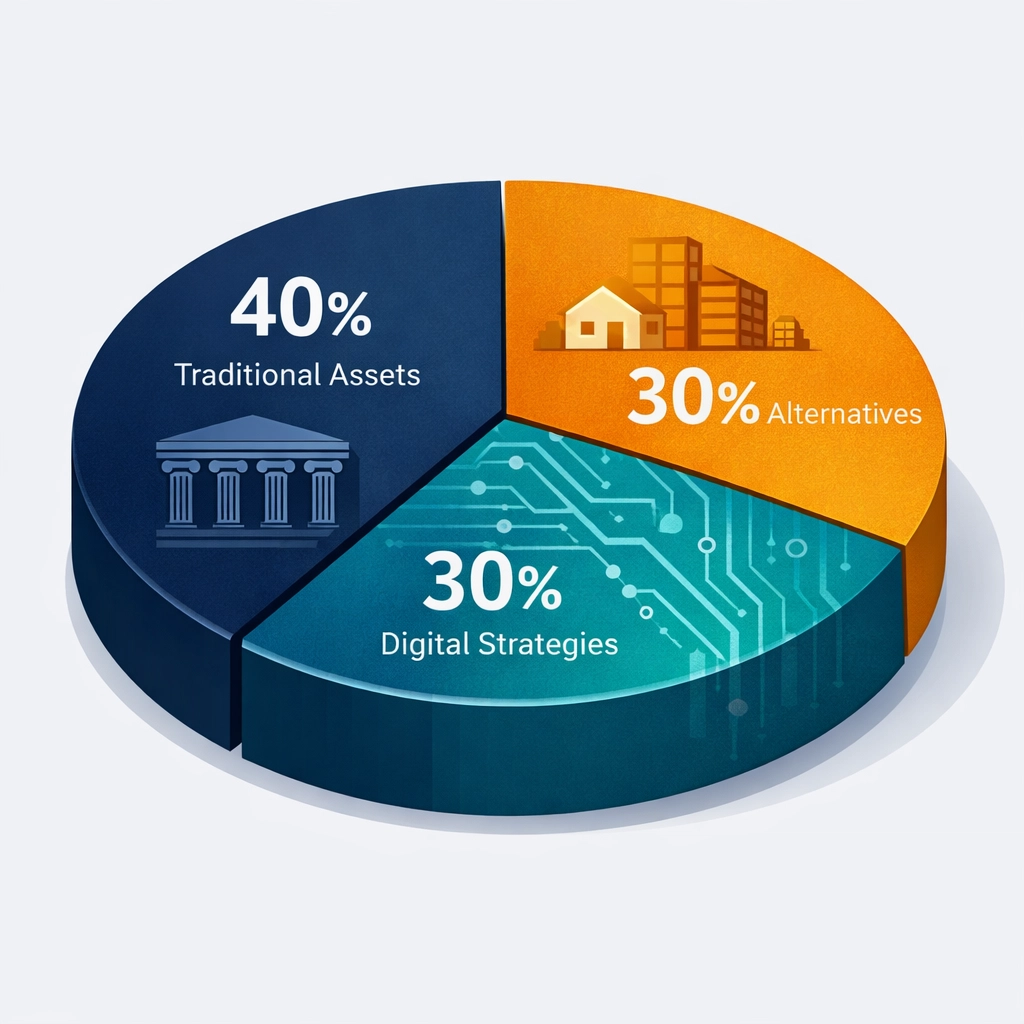

Real-World Application: The 40/30/30 Approach

We've seen sophisticated fund managers implement what we call the 40/30/30 model: a modern take on portfolio construction that acknowledges digital assets without abandoning traditional strengths.

40% in traditional core holdings: Large-cap equities, investment-grade bonds, the foundation that institutions understand and trust

30% in alternative assets: Real estate, private equity, hedge funds: the traditional diversifiers that have worked for decades

30% in enhanced strategies: This slice includes modest digital asset exposure (3-7%), opportunistic positions, and strategies designed specifically to benefit from the digital transformation of finance

This isn't a radical departure from institutional best practices. It's an evolution that recognizes the changing landscape while maintaining risk discipline.

Risk Considerations You Can't Ignore

Let's address the elephant in the room: digital assets are volatile. Bitcoin has experienced multiple 70%+ drawdowns. Regulatory uncertainty remains real. Custody solutions, while improving, require careful vetting.

Institutional integration of digital strategies requires:

Proper custody: Working with qualified custodians that meet institutional standards: Coinbase Custody, Fidelity Digital Assets, or similar institutional-grade solutions.

Regulatory compliance: Ensuring every position aligns with your mandate and regulatory obligations. This means working with legal counsel who understand both traditional securities law and digital asset regulations.

Size discipline: Even true believers shouldn't allocate more than 10% of institutional portfolios to digital assets. Most sophisticated investors start at 2-5% and adjust based on comfort and performance.

Operational infrastructure: You need trading, accounting, and reporting systems that can handle digital assets alongside traditional positions. This isn't trivial: it requires investment in technology and people.

The Evolution Continues

The institutions leading the way aren't the ones going all-in on crypto or completely ignoring it. They're the ones thoughtfully integrating digital strategies into proven risk mitigation frameworks.

Major pension funds have started allocating to Bitcoin. University endowments are exploring blockchain infrastructure investments. Family offices are dedicating portions of their alternative sleeves to digital assets with proper risk controls.

This isn't about chasing returns or following trends. It's about recognizing that the investment landscape has fundamentally changed, and risk mitigation frameworks need to evolve accordingly.

The question isn't whether to integrate digital strategies: it's how to do it properly. The answer lies in proven risk mitigation principles: diversification, correlation management, and disciplined sizing applied to an expanded opportunity set that includes both traditional and digital assets.

At Mogul Strategies, we help institutional and accredited investors navigate exactly this challenge: building portfolios that honor traditional risk management principles while capturing opportunities in the digital transformation of finance.

The future of institutional investing isn't traditional or digital. It's both, working together in a framework designed to protect and grow capital across market cycles.

Comments