The Ultimate Guide to Hedge Fund Risk Mitigation: Everything Institutional Investors Need in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Feb 2

- 5 min read

Let's be honest: hedge funds have gotten a bad rap over the years. Too expensive, too complex, too opaque. But here's what's changed in 2026: institutional investors aren't using hedge funds to chase returns anymore. They're using them as precision risk-management tools.

That's a completely different game.

With elevated volatility, policy uncertainty around Fed leadership, and AI disrupting entire sectors, the investment landscape looks nothing like it did five years ago. BlackRock just made its largest-ever recommendation to increase hedge fund allocations by up to five percentage points. CalPERS, which famously exited hedge funds in 2014, is back in the game.

This isn't a trend. It's a fundamental shift in how sophisticated allocators think about portfolio resilience.

Why 2026 Is Different

Three forces are reshaping markets right now: geopolitical fragmentation, monetary policy transitions, and artificial intelligence disruption. These create exactly the conditions where hedge funds shine: elevated dispersion, low correlations, and persistent uncertainty.

Here's the thing most people miss: over the last 20 years, equity long/short strategies captured about 70% of equity market gains while losing only half as much during major drawdowns. That asymmetry is what institutional investors are paying for.

You're not looking for home runs. You're building a portfolio that can weather storms without giving up the entire upside.

The Function-First Framework: Stop Organizing by Strategy Labels

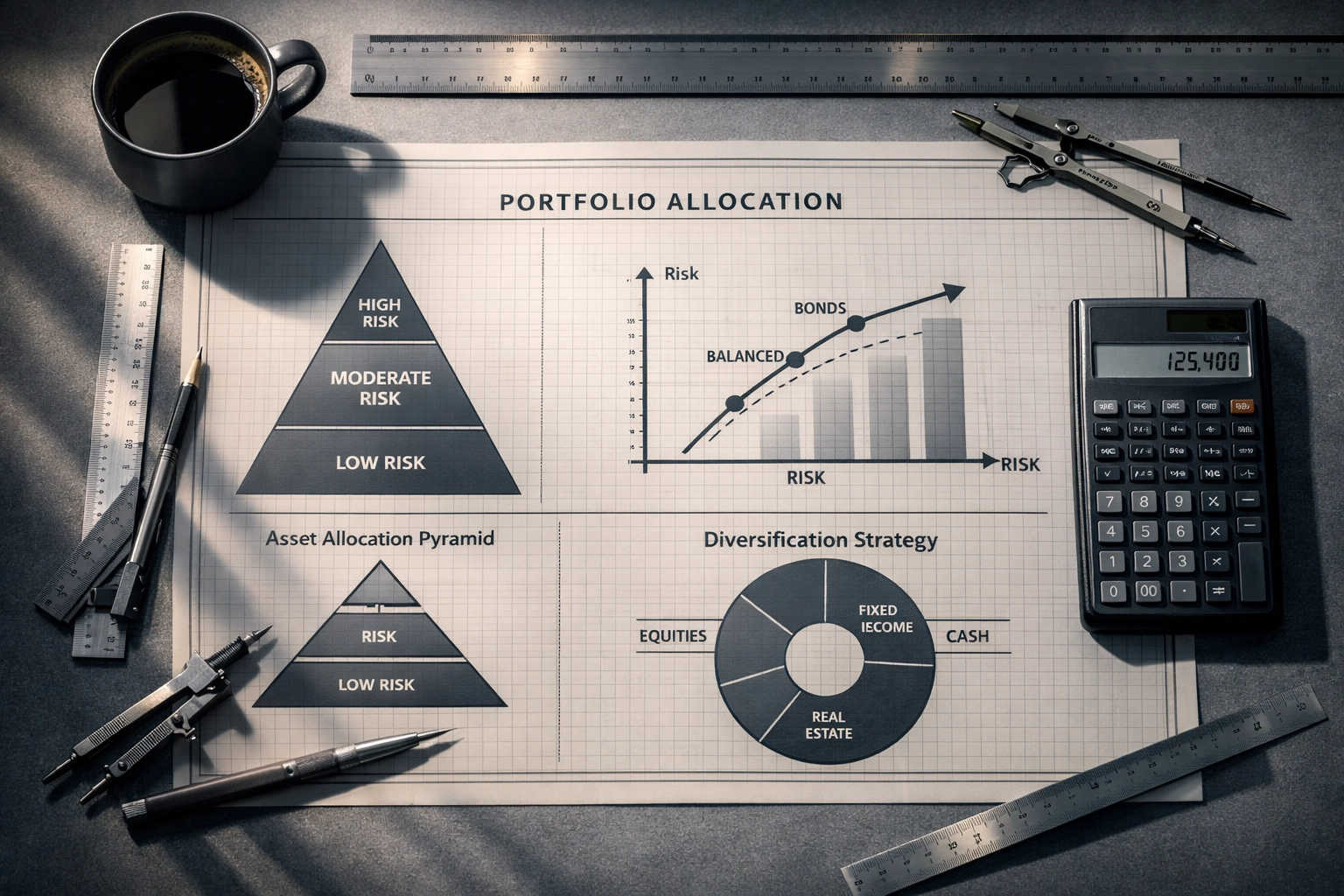

Forget about organizing hedge funds by strategy names. That's outdated thinking. Instead, map every allocation to a specific risk function it serves in your portfolio.

Shock Hedgers protect you when markets break. Global macro and managed futures (CTAs) provide crisis participation and trend-following convexity. Think of them as your insurance policies: they cost you something during good times but pay off when everything goes sideways.

Diversifiers capture idiosyncratic opportunities that have nothing to do with your equity beta. Equity market-neutral, merger arbitrage, and fixed-income relative value strategies sit here. They're not trying to time markets; they're exploiting pricing inefficiencies and generating uncorrelated returns.

Liquidity Buffers ensure you can actually access your risk mitigation when you need it. These strategies can de-gross quickly with limited slippage. There's no point in having hedges that lock up during the exact moment you need them.

This approach aligns perfectly with modern governance frameworks. It forces you to articulate exactly what job each hedge fund allocation is doing and whether it's actually doing that job effectively.

Strategies Getting Upgraded for 2026

Not all hedge fund strategies are created equal right now. Man Group recently upgraded three strategies to positive outlook:

Long-Biased Equity Long/Short benefits from elevated dispersion and late-cycle dynamics. When markets stop moving in lockstep and individual stock selection matters again, skilled managers can exploit those inefficiencies. The AI-driven concentration in mega-cap tech names creates opportunities for managers who can look beyond the obvious.

Market Neutral Equity Long/Short captures alpha through single-stock selection rather than making macro bets. If you believe active management can add value in 2026's environment, this is where you want exposure.

Merger Arbitrage sits on top of record M&A activity. When deal flow is strong and spreads are attractive, arbitrage strategies can deliver consistent, low-volatility returns.

The only strategy receiving a negative outlook? Distressed credit. The risk-reward just isn't there right now for most situations.

The Institutional Implementation Playbook

Theory is great. Implementation is what separates successful allocators from everyone else. Here's the five-step framework that actually works:

1. Define Your Objectives and Baseline

Get specific. What's your maximum drawdown tolerance? What crisis beta cap can you live with? What are your funded-status volatility constraints?

Choose a reference mix that reflects these constraints, then judge every hedge fund allocation against this baseline. If it doesn't improve the mix, don't allocate.

2. Set Risk and Liquidity Budgets

For each hedge fund sleeve, specify:

Target volatility contribution to the total portfolio

Maximum correlation to your core assets

Days-to-liquidate under stress scenarios

Gate and notice period tolerances you can accept

These aren't suggestions: they're hard constraints. Don't let "success-to-scale" dilution creep in just because a manager is performing well.

3. Measure Excess Returns Rigorously

Cash yields actually matter now. Require each mandate to clear a cash-plus hurdle and demonstrate that it improves your total-fund efficiency versus the reference mix.

Use scenario analysis and risk attribution. Don't just look at returns: quantify the contribution to portfolio Sharpe ratio and drawdown reduction. That's what you're really buying.

4. Use Dynamic, Rules-Based Diversification

This is where most allocators fail. They set an allocation and forget it.

Instead, scale macro/CTA risk when policy regimes and rates break. Increase relative-value and equity market-neutral exposure after de-grossing episodes. Pare back when cross-manager correlations and factor overlap rise.

Make these adjustments rules-based, not discretionary. Otherwise, you'll always be one decision cycle behind.

5. Govern Liquidity Explicitly

Set a defined liquidity budget for your alternatives sleeve. You need minimums for daily or weekly liquidity needs and explicit gates for stress scenarios.

Codify this in your rebalancing rules. Don't leave it to discretion when markets are falling apart and everyone's making emotional decisions.

The Multi-Strategy Advantage

Here's a practical approach that's gaining traction: multi-strategy hedge funds that maintain balanced exposure across macro, long/short equity, and long/short credit.

Why? Because concentrating in a single strategy is a bet. Multi-strategy funds deliver a more stable risk and return profile. They're particularly valuable now that the traditional stock/bond relationship can't be relied on during inflationary periods.

Think of it as diversification within your diversification. You're getting multiple engines working at different times under different conditions.

What Actually Matters

Strip away all the complexity and here's what you need to remember:

Demand measured improvement over both cash and your reference portfolio. Your hedge fund allocations should earn their liquidity premium and contribute meaningfully to risk-adjusted returns. Period.

Focus on high-quality managers and strategic fit. Don't make directional market calls. Emphasize managers who can identify single-stock opportunities and exploit market inefficiencies.

Price liquidity properly. Size your positions so risk mitigation is available when you need it, not locked up when markets are in crisis mode.

Treat hedge funds as resilience tools, not discretionary bets. The convergence we're seeing: BlackRock's increased allocation, CalPERS' return, peer re-evaluations: reflects a fundamental shift toward systematic, rules-based hedge fund use for portfolio stability.

The Bottom Line

Hedge funds in 2026 aren't about swinging for the fences. They're about building portfolios that can participate in market upside while maintaining robust protection against extended volatility or unexpected downturns.

The institutions getting this right view hedge funds as essential components of diversified portfolios. They define clear objectives, set hard constraints, measure rigorously, and adjust dynamically based on rules rather than emotion.

If you're still thinking about hedge funds as return generators first and risk managers second, you're operating with an outdated playbook. The smartest allocators have already made the shift.

At Mogul Strategies, we help institutional and accredited investors navigate exactly these kinds of portfolio construction decisions: blending traditional assets with innovative strategies to build genuine resilience. Because in 2026, that's what actually matters.

Comments