The Ultimate Guide to Institutional Alternative Investments: Private Equity, Real Estate, and Digital Assets Combined

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Feb 1

- 4 min read

Look, if you're still running a portfolio that's 100% stocks and bonds, we need to talk. The institutional world figured this out years ago, alternatives aren't just fancy add-ons anymore. They're the backbone of serious wealth strategies.

Here's what most people miss: alternatives don't just boost returns. They create stability when everything else is going sideways. While your neighbor's portfolio swings 20% because the Fed sneezed, a well-constructed alternatives allocation keeps humming along.

Let's break down the three pillars that are reshaping institutional portfolios, and how you can actually put them to work.

Private Equity: Beyond the Public Markets

Private equity gets a bad rap for being complicated. It's really not. You're buying pieces of companies that aren't on the stock exchange. Simple as that.

The magic happens because you're not subject to the daily mood swings of public markets. When the S&P 500 drops 15% because of inflation fears, your private equity holdings? They're focused on actual business fundamentals, growing revenue, cutting costs, building value.

Three main flavors you should know:

Buyouts – This is where funds acquire mature companies, improve operations, and sell them for a profit. Think of it as buying a fixer-upper house, renovating it, and selling for a premium. Except the house is a $50 million manufacturing company.

Growth equity – You're backing companies that are already profitable but need capital to scale faster. Less risky than venture capital, more upside than buying established giants.

Venture capital – The startup game. High risk, potentially astronomical returns. Most institutional portfolios keep this slice smaller, but it's where you get exposure to the next big thing before everyone else.

The catch? Your money's locked up for 5-10 years typically. But historically, private equity has outperformed the S&P 500 over the long haul. That's why endowments and pension funds allocate 20-30% here.

Real Estate: The Income Engine

Real estate alternatives are having a moment, and for good reason. While private equity chases appreciation, real estate gives you both, cash flow today and equity growth tomorrow.

Here's where it gets interesting for institutional investors. We're not talking about buying a duplex and dealing with tenant calls at midnight. We're talking about syndications, fund structures, and institutional-grade properties.

Multifamily syndications remain the workhorse. You're pooling capital with other investors to acquire apartment complexes that no individual could buy alone. The returns are compelling, typically 12-18% IRR, and you're getting quarterly distributions while the asset appreciates.

Value-add opportunities take this up a notch. Buy a property below market, renovate units, increase rents, and either refinance or sell. When executed properly, you're looking at 15-25%+ net returns. Yes, there's more risk. But for investors with appropriate timelines, the risk-reward profile makes sense.

Ground-up development sits at the aggressive end. You're building from scratch. Higher risk, higher reward: 18-25%+ IRR potential. This is where you separate institutional strategies from retail approaches. Most individual investors can't access quality development deals. Institutional funds can.

The beauty of real estate? It's inflation-resistant. When prices rise, so do rents. Your returns actually benefit from the same economic conditions that destroy bond portfolios.

Digital Assets: The Missing Piece

Here's where most asset managers drop the ball. They'll talk your ear off about private equity and real estate, then completely ignore digital assets because they don't understand them or they're too scared to integrate them properly.

That's a mistake. A big one.

Bitcoin isn't some speculative gamble anymore: it's institutional infrastructure. Major pension funds, endowments, and family offices are allocating 1-5% of portfolios to digital assets. Not because they're chasing hype. Because the math works.

Why digital assets matter for institutional portfolios:

The correlation is absurdly low. Bitcoin doesn't move with stocks, bonds, or even gold consistently. That's exactly what you want in a diversification tool. When everything else correlates to 1.0 during a crisis, having an asset class that zigs while others zag is priceless.

The risk-adjusted returns speak for themselves. Even with Bitcoin's volatility, adding a small allocation (3-5%) to a traditional 60/40 portfolio has historically improved both returns and Sharpe ratios over multi-year periods.

And here's what nobody tells you: institutional crypto infrastructure has matured dramatically. Qualified custodians, regulated OTC desks, proper tax reporting: it's all there now. The Wild West phase is over.

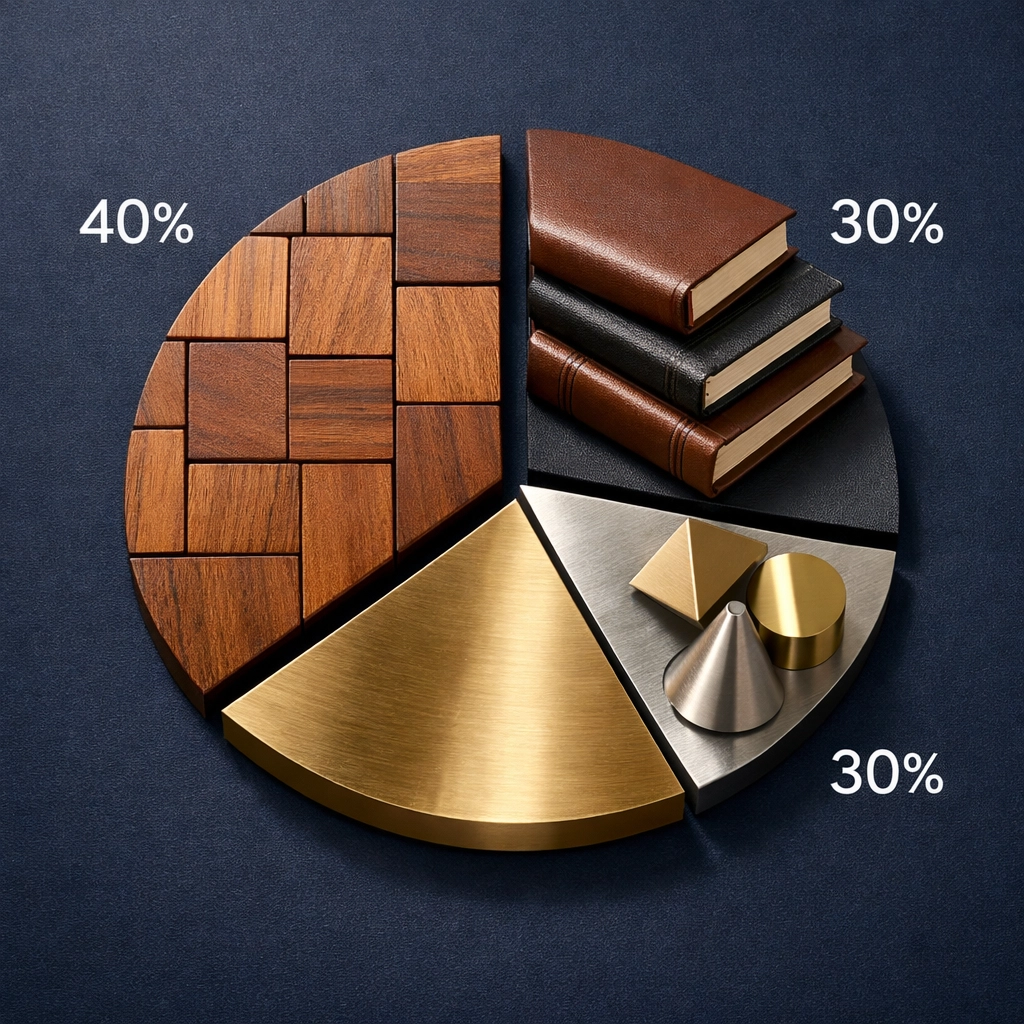

The 40/30/30 Model: Putting It Together

So how do you actually construct a portfolio that uses all three?

The 40/30/30 framework we use at Mogul Strategies is straightforward:

This isn't dogma. It's a starting point. Conservative institutional investors might run 50/25/25. Aggressive family offices might flip it to 30/35/35. The key is having all three buckets working together.

Risk Management Reality Check

Let's be honest about the risks, because sugar-coating helps nobody.

Liquidity risk is real. Most alternatives lock up your capital. Private equity for 7-10 years. Real estate syndications for 3-7 years. You need to plan for this. Never put money into alternatives that you might need in the next 3-5 years.

Manager selection matters enormously. Unlike buying an S&P 500 index fund, alternatives performance varies wildly based on who's managing the investment. Top quartile private equity funds return 3-4x what bottom quartile funds return. This isn't a place to go with the cheapest option.

Due diligence is non-negotiable. Track records, references, audited financials, legal structures: if you're not reviewing all of this, you're gambling, not investing.

The good news? When done right, these risks are manageable. The key is working with managers who have institutional experience, transparent reporting, and aligned interests.

Getting Started

Most institutional alternatives require accredited investor status: $200k+ annual income or $1M+ net worth excluding primary residence. If you meet those thresholds, you've got options.

Start by getting your current allocation mapped out. Where's your money actually sitting today? Most people are shocked to discover they're 80%+ in publicly traded securities with minimal real diversification.

Then identify your goals. Are you prioritizing income? Growth? Capital preservation? Different alternative strategies serve different objectives.

The institutional world figured this out decades ago. Private equity, real estate, and digital assets aren't competing strategies: they're complementary pieces of a modern portfolio.

Your move is deciding whether you want to keep playing by 1980s rules, or build a portfolio that actually works in 2026.

Comments