40/30/30 Portfolio Model Vs Traditional 60/40: Which Is Better For Your Accredited Investor Portfolio?

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 1 day ago

- 5 min read

For decades, the 60/40 portfolio has been the gold standard: 60% stocks, 40% bonds, balanced and boring. It worked. Until it didn't.

Now, as an accredited investor with access to alternative investments, you've probably heard whispers about the 40/30/30 model. The question is: should you make the switch?

Let's break down both strategies, look at actual performance data, and figure out which one makes sense for your portfolio in 2026.

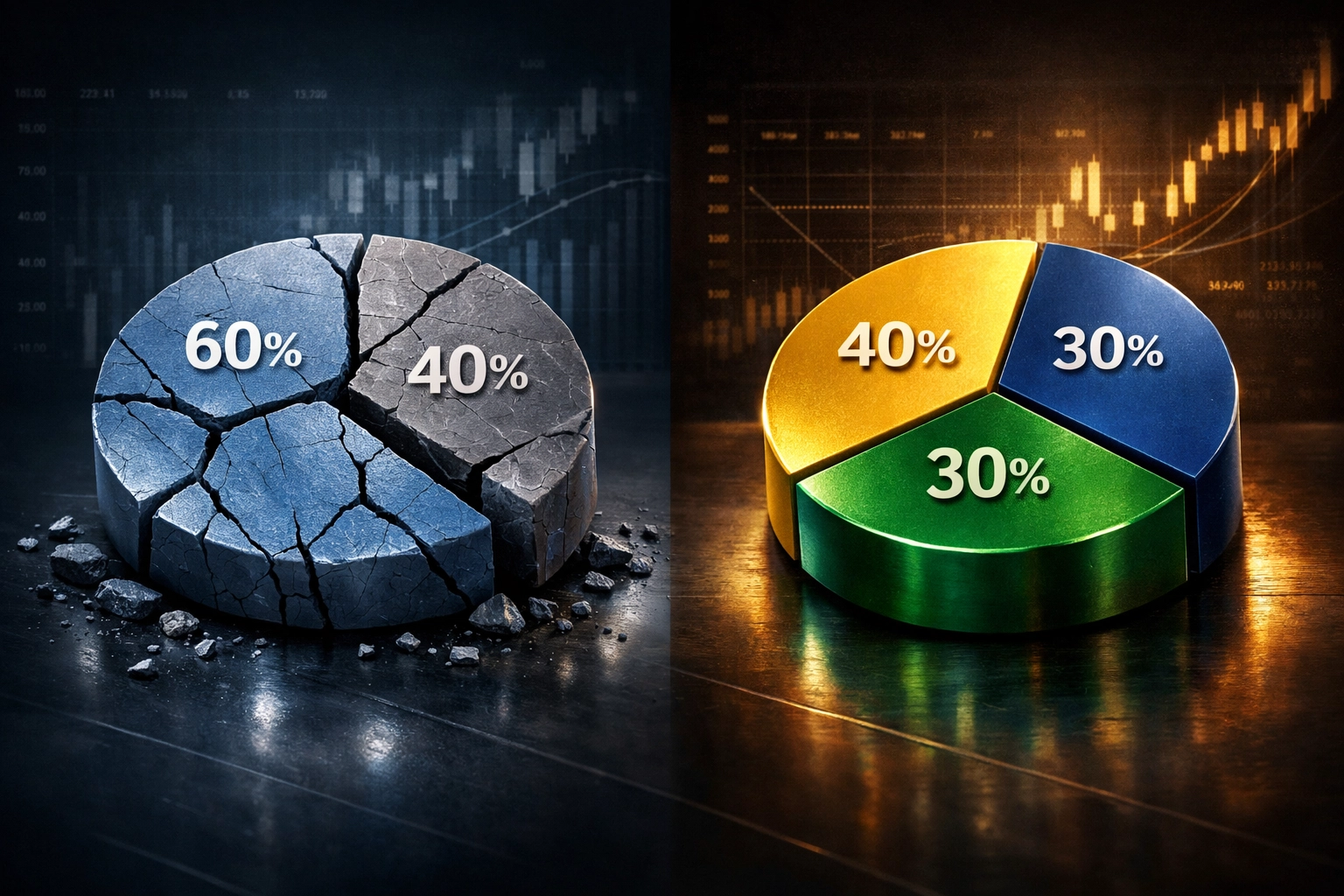

What's the 60/40 Portfolio (And Why It's Losing Steam)

The traditional 60/40 model allocates 60% to equities and 40% to bonds. Simple math, simple execution. For years, this provided decent returns with manageable risk.

But here's the problem: it's essentially become a stock portfolio with training wheels.

The correlation between 60/40 portfolios and the equity market now sits close to 1. Translation? When stocks tank, your "diversified" portfolio tanks with them. During 2008 and the 2020 pandemic crash, 60/40 portfolios regularly lost over 30%.

Bonds were supposed to be your safety net. They're not anymore. Low yields, high interest rates, and persistent inflation have stripped bonds of their protective power. You're taking equity-level risk without getting equity-level returns.

That's not diversification. That's just watered-down exposure to the same market.

Enter the 40/30/30 Model

The 40/30/30 portfolio restructures things entirely:

40% equities

30% bonds

30% alternative investments

The 30% allocation to alternatives is where accredited investors have a real edge. This includes private equity, hedge funds, real estate, commodities, and even digital assets like Bitcoin: investments that non-accredited investors can't easily access.

This isn't about chasing higher returns (though that's a nice bonus). It's about building actual diversification that works when markets get ugly.

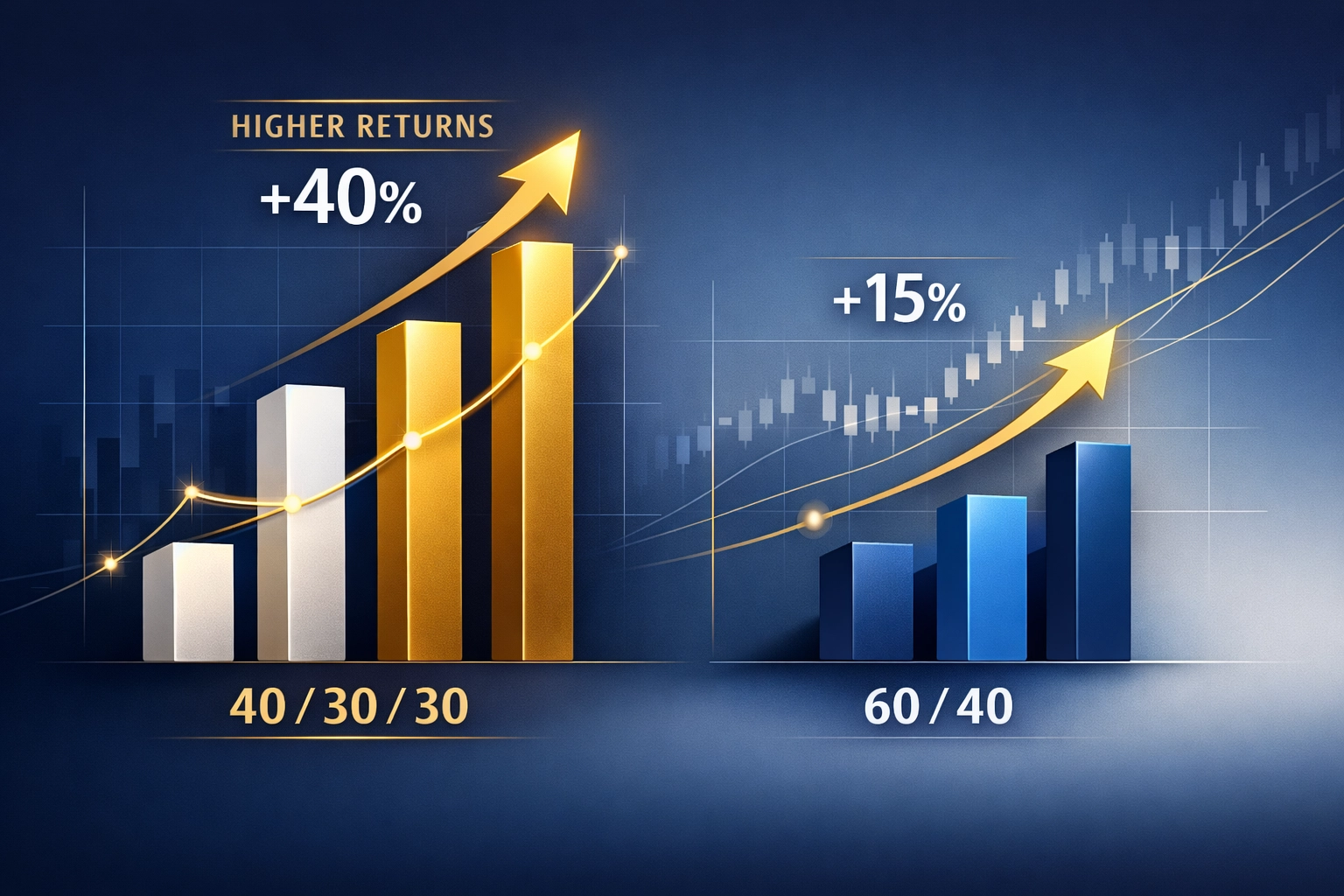

The Numbers Don't Lie: Performance Comparison

Research from the CFA Institute compared both models from 1989 through Q1 2023. The results? The 40/30/30 model improved its Sharpe ratio to 0.75 from the 60/40's 0.55: a 40% improvement in risk-adjusted returns.

Let's make that practical. The Sharpe ratio measures how much return you're getting for each unit of risk. A higher number means you're getting better bang for your buck. That 40% improvement isn't marginal: it's significant.

J.P. Morgan's research added another data point: allocating 25% to alternatives (close to the 30% in this model) can boost returns by 60 basis points. If your 60/40 portfolio projected a 7% return, that's an 8.5% improvement just from strategic reallocation.

KKR conducted their own analysis and found the 40/30/30 outperformed 60/40 across every timeframe they studied. Not some timeframes. All of them.

What Makes the 40/30/30 Better?

Lower Volatility: You're not riding the stock market rollercoaster as intensely. The alternatives cushion the swings.

Better Downside Protection: When equities crash, your alternatives don't necessarily move in lockstep. Private equity, real estate, and certain hedge fund strategies can hold steady or even gain during public market corrections.

Uncorrelated Returns: This is the secret sauce. You're not just diversifying across asset classes: you're diversifying across return drivers. Real estate performs based on rental income and property values. Private equity depends on operational improvements and exit multiples. These don't necessarily correlate with whether Apple's stock is up or down.

Not All Alternatives Are Created Equal

Here's where strategy matters. You can't just throw 30% into "alternatives" and call it a day.

Candriam's research breaks alternatives into three functional categories:

Downside Protection: Assets that protect capital during market stress (managed futures, market-neutral strategies)

Uncorrelated Returns: Investments that move independently from traditional markets (private credit, infrastructure)

Upside Capture: Opportunities for outsized gains (venture capital, opportunistic real estate)

Your 30% alternative allocation should include a mix of all three, weighted toward your specific goals and risk tolerance. An investor focused on capital preservation might lean heavier into downside protection. Someone building generational wealth might allocate more to upside capture.

This requires active management and periodic rebalancing based on market conditions. It's more work than set-it-and-forget-it, but that's the price of better risk-adjusted returns.

Implementation for Accredited Investors

As an accredited investor, you have access to vehicles that make the 40/30/30 model practical:

Private Equity Funds: 5-10% of your alternatives allocation. Long lockup periods but potential for substantial returns uncorrelated with public markets.

Real Estate Syndications: 5-10% allocation. Provides income generation plus appreciation potential. Bonus: acts as an inflation hedge.

Hedge Funds: 5-10% for strategies like long/short equity or global macro. These can generate returns in any market environment.

Digital Assets: 2-5% for Bitcoin or diversified crypto exposure. Controversial but increasingly institutional. Offers asymmetric upside with appropriate position sizing.

Commodities and Infrastructure: 5-8% for inflation protection and economic cycle diversification.

The key is not putting all your alternatives eggs in one basket. Each component serves a different purpose in your overall risk-return profile.

The Liquidity Trade-Off

Let's address the elephant in the room: many alternative investments are illiquid. Private equity has 5-10 year lockups. Real estate syndications might tie up capital for 3-7 years.

For accredited investors, this usually isn't a dealbreaker. You have sufficient liquid assets to weather emergencies. The illiquidity premium: the extra return you earn for locking up capital: becomes a feature, not a bug.

But you need to plan accordingly. Don't allocate capital to illiquid alternatives if you might need it in the next 2-3 years. Structure your 40/30/30 portfolio so you maintain adequate liquidity for your lifestyle and potential opportunities.

So Which Model Is Better?

For most accredited investors seeking better risk-adjusted returns, the 40/30/30 model is superior. The data supports it. The logic supports it. The real-world experience of institutional investors who've made this shift supports it.

The traditional 60/40 made sense in a world of low correlation between stocks and bonds, reasonable bond yields, and less volatile inflation. That world doesn't exist anymore.

But: and this matters: the 40/30/30 requires more sophistication. You need to understand different alternative asset classes, their risk profiles, their liquidity terms, and how they interact with your equity and bond holdings. You need to actively manage the allocation, not just set it and check back in five years.

If you're committed to that level of engagement (or working with an asset manager who is), the 40/30/30 offers demonstrably better outcomes.

Making the Transition

If you're currently running a 60/40 portfolio and want to transition to 40/30/30, don't do it overnight. Alternative investments often require time to source, due diligence, and commitment periods that don't align with immediate rebalancing.

A practical approach:

Reduce your equity allocation by 20% over the next 1-2 quarters

As alternative opportunities meeting your criteria become available, deploy capital incrementally

Maintain your 30% bond allocation for stability during the transition

Reassess quarterly to ensure you're moving toward the target 40/30/30 split

The portfolio construction process matters as much as the final allocation. Rushed decisions into mediocre alternatives defeat the purpose.

The Bottom Line

The 60/40 portfolio isn't necessarily broken: it's just outdated for today's market environment. As an accredited investor, you have access to tools that can significantly improve your risk-adjusted returns without taking on more overall risk.

The 40/30/30 model isn't a magic formula. It's a framework that acknowledges reality: true diversification requires going beyond publicly traded stocks and bonds. It requires accessing investment opportunities that move independently from the S&P 500.

The choice isn't really about 40/30/30 versus 60/40. It's about whether you want a portfolio built for yesterday's markets or one designed for the actual conditions you're investing in today.

Comments