Are Traditional Investment Models Dead? What Accredited Investors Need to Know About Alternative Assets in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 24 hours ago

- 5 min read

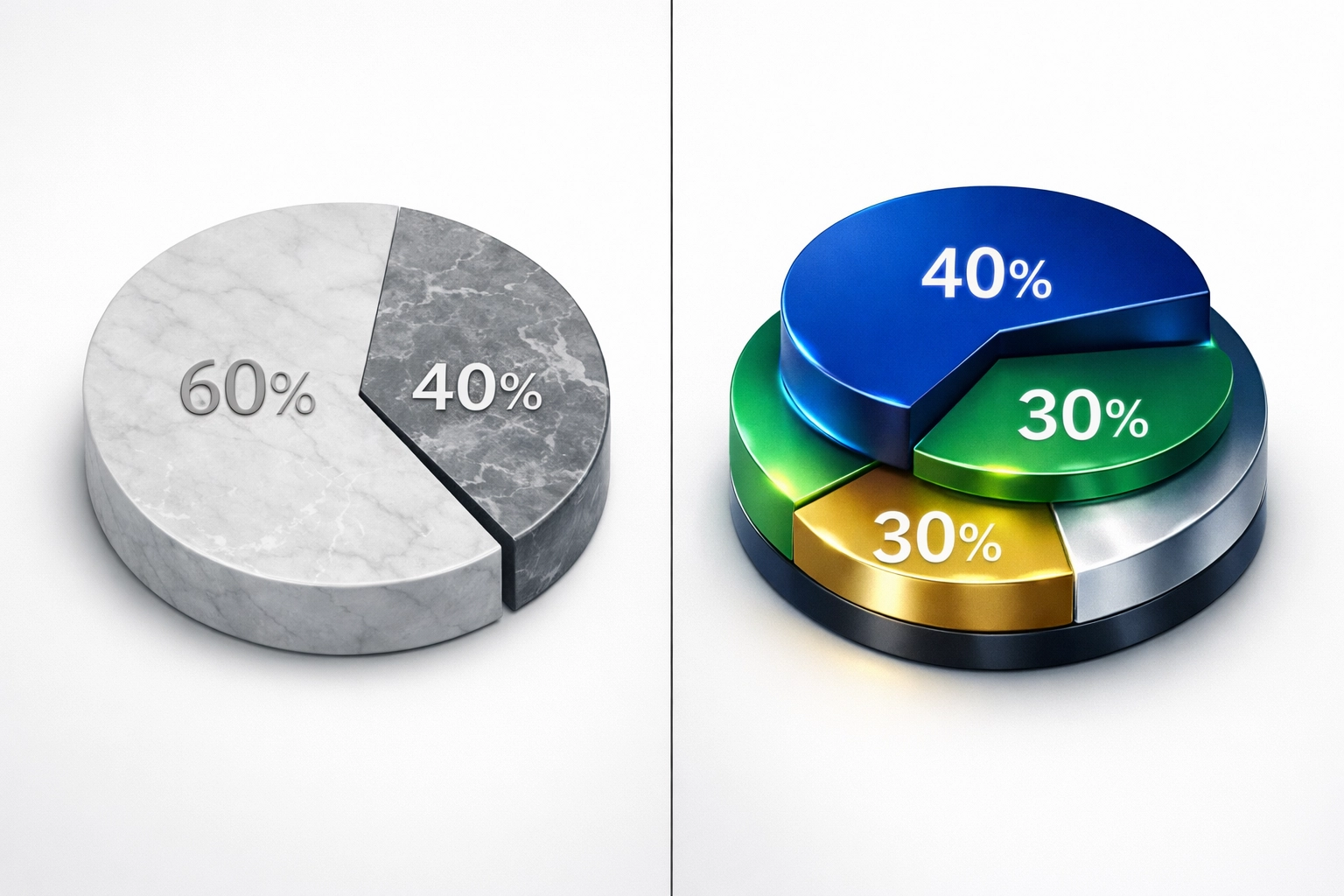

Let's cut through the noise: traditional investment models aren't dead. But if you're still relying solely on the classic 60/40 stock-bond split your financial advisor recommended a decade ago, you're leaving serious money on the table.

The investment landscape in 2026 looks fundamentally different than it did just five years ago. The old playbook: diversify across stocks and bonds, rebalance quarterly, and call it a day: no longer delivers the risk-adjusted returns accredited investors need to preserve and grow wealth.

Here's what's actually happening and what you need to know.

The Traditional Model Is Cracking (But Not Broken)

The problem with traditional portfolios isn't that stocks and bonds don't work anymore. It's that the relationships between asset classes have fundamentally shifted.

For decades, investors could count on bonds to zig when stocks zagged. That negative correlation was the cornerstone of portfolio construction. But in 2026, we're watching that correlation drift toward neutral: and sometimes positive. When both stocks and bonds fall together, you lose the diversification benefit that made the 60/40 portfolio so reliable.

Add to this the concentration risk in U.S. equities. The market has become dangerously top-heavy with mega-cap tech stocks. Great companies, sure. But when a handful of stocks drive the majority of index returns, you're not as diversified as you think.

The math is simple: traditional models still have a place, but they need reinforcement.

What's Actually Changed in 2026

Several seismic shifts are forcing sophisticated investors to rethink their approach:

Labor markets and AI matter more than inflation. The pandemic-era inflation panic has subsided, but labor dynamics and artificial intelligence adoption are reshaping entire sectors. These forces create both opportunities and risks that traditional portfolios aren't designed to capture.

Market dispersion is increasing. We're seeing more dramatic winners and losers across sectors and individual securities. This isn't a "rising tide lifts all boats" environment. It's a stock-picker's market that rewards selectivity and active management.

Geopolitical fragmentation. Supply chains, trade relationships, and capital flows are reorganizing around new power dynamics. This creates opportunities in specific markets and asset classes that passive index strategies miss entirely.

The liquidity spectrum has expanded. Between fully liquid public markets and completely illiquid private investments, there's now a growing middle ground of semi-liquid alternatives that offer compelling risk-return profiles.

The Alternative Assets Imperative

If traditional models need reinforcement, where should accredited investors look? The answer is alternatives: but not all alternatives are created equal.

Private Credit: The New Fixed Income

Private credit has emerged as one of the most compelling opportunities in 2026. With yields significantly higher than comparable public bonds and low correlation to public markets, private credit fills the income gap that traditional fixed income used to occupy.

The key is accessing institutional-quality managers who understand credit underwriting and risk management. Done right, private credit can deliver 7-10% annual returns with less volatility than public equities.

Real Assets for Real Protection

Real estate, infrastructure, and commodities aren't just inflation hedges anymore. They're portfolio stabilizers that provide tangible cash flows regardless of what's happening in financial markets.

Real estate syndication, in particular, offers accredited investors access to institutional-grade properties with professional management. You get the benefits of real estate ownership: cash flow, appreciation potential, tax advantages: without the headaches of being a landlord.

The Crypto Question

By 2026, the conversation around Bitcoin and digital assets has matured considerably. This isn't about gambling on the next meme coin. It's about strategic allocation to an asset class that continues to show low correlation to traditional markets.

Institutional-grade crypto integration means secure custody, regulatory compliance, and sophisticated risk management. A modest allocation (typically 2-5% for most portfolios) provides meaningful exposure without outsized risk.

The sophistication is in the execution: working with managers who understand blockchain technology, regulatory frameworks, and proper portfolio integration.

Hedge Funds and Risk Mitigation

Hedge funds have gotten a bad rap from high fees and underwhelming returns. But the best managers are earning their keep in 2026 by doing what hedge funds were designed to do: hedge.

Long-short equity strategies, global macro funds, and market-neutral approaches can reduce portfolio volatility while maintaining return potential. The key is selectivity: avoiding the mediocre managers while accessing the truly skilled.

The New Portfolio Construction Playbook

So what does a modern portfolio actually look like?

Forward-thinking investors are moving beyond simple asset class buckets toward outcome-based portfolio construction. Instead of asking "how much should I allocate to stocks versus bonds," they're asking "what combination of strategies delivers the returns I need with the risk I can tolerate?"

One framework gaining traction: the 40/30/30 model. Roughly 40% in core equity positions, 30% in fixed income and credit strategies, and 30% in alternatives and real assets. The exact percentages matter less than the principle: building a truly diversified portfolio across asset classes, strategies, and liquidity profiles.

This approach requires looking at the portfolio holistically:

Strategic foreign exchange exposure. Currency movements can significantly impact returns, especially with increased international diversification.

Liquidity management. Not every dollar needs same-day liquidity. Accepting some illiquidity in exchange for higher returns makes sense when properly structured.

Tax efficiency. Alternative investments often provide superior tax treatment through depreciation benefits, qualified business income deductions, and long-term capital gains treatment.

What Accredited Investors Should Do Now

The shift to alternatives isn't about abandoning traditional investments. It's about augmenting them with strategies that enhance risk-adjusted returns in today's environment.

Here's what that looks like practically:

Audit your current allocation. Are you actually diversified, or just spread across different mutual funds that all own the same stocks? Look at your underlying exposures, not just your account statements.

Understand your liquidity needs. How much do you need accessible in the next 12 months? The rest can potentially be deployed into strategies with better return potential.

Vet managers carefully. Access to alternative investments is just the starting point. The real value comes from working with managers who have institutional experience, transparent fee structures, and aligned interests.

Think in timeframes. Private equity and real estate syndications typically require 5-10 year commitments. Make sure your allocation matches your timeline.

Start small and scale. You don't need to overhaul your entire portfolio overnight. Begin with modest allocations to alternatives, understand how they perform in your portfolio, then increase exposure as appropriate.

The Bottom Line

Traditional investment models aren't dead: they're evolving. The investors who thrive in 2026 and beyond won't be the ones who abandon stocks and bonds entirely. They'll be the ones who strategically complement traditional holdings with alternatives that provide genuine diversification, enhanced returns, and downside protection.

The question isn't whether to include alternatives in your portfolio. It's how to do it intelligently, with proper manager selection, appropriate allocation sizing, and clear understanding of the risks and opportunities.

At Mogul Strategies, we specialize in exactly this balance: blending time-tested investment principles with innovative strategies designed for today's market realities. Because the real opportunity isn't in choosing between traditional and alternative investments. It's in combining them strategically to build wealth that lasts.

Ready to see how alternative assets could fit into your portfolio? Visit our website to learn more about our approach to modern portfolio construction.

Comments