Long-Term Wealth Preservation in 2026: The Accredited Investor's Guide to Blending Traditional and Digital Assets

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 1 day ago

- 5 min read

Wealth preservation isn't what it used to be. The old playbook, stick everything in a 60/40 stock-bond split and call it a day, doesn't cut it anymore. Between market volatility, inflation concerns, and tax changes on the horizon, accredited investors need a smarter approach that bridges traditional assets with emerging digital opportunities.

Let's talk about what actually works in 2026.

Why the Traditional-Only Approach Is Leaving Money on the Table

Here's the thing: private markets aren't niche anymore. They're essential. While your neighbor is still debating whether to buy another index fund, institutional investors have been quietly building portfolios that blend private equity, real estate, hedge funds, and yes, digital assets.

The reason is simple. These alternative investments move independently from public markets. When stocks take a dive, your private credit fund keeps generating those 8-12% yields. When bonds aren't performing, your multifamily syndication is still collecting rent checks.

But here's where most wealth managers are still behind the curve: they're ignoring the digital side of the equation entirely.

The Blended Portfolio Framework for 2026

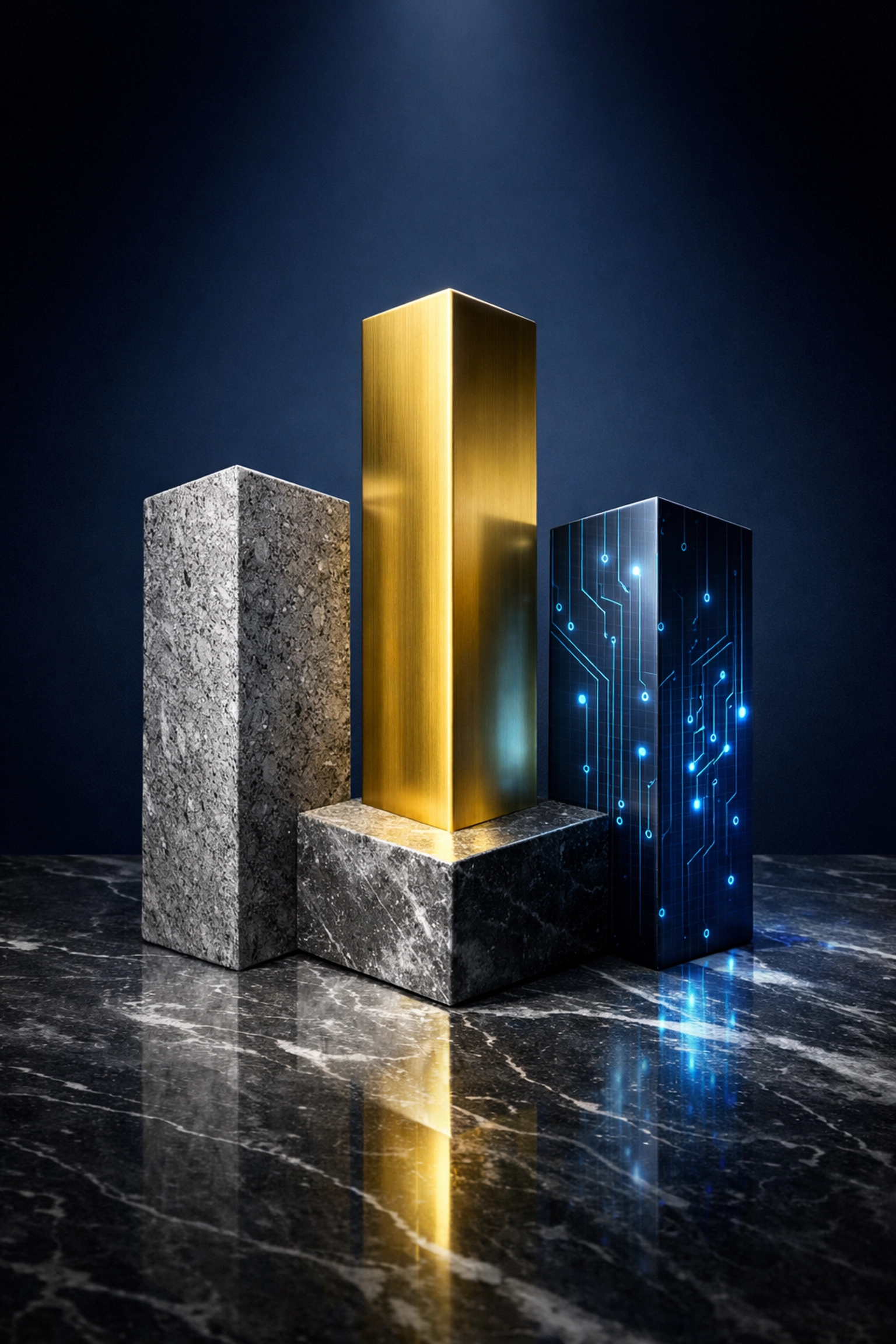

Think of your portfolio as a three-legged stool. You need stability, growth, and innovation working together.

The stability leg comes from income-focused vehicles. Private credit funds are the workhorse here, typically backed by real assets like multifamily properties, generating steady returns through interest payments. These aren't sexy, but they're reliable. Target returns usually land in the 8-12% range with moderate risk profiles.

Real estate syndications add another layer. Multifamily properties especially have proven recession-resistant. People always need somewhere to live, even when the economy gets rocky. We're seeing solid 12-18% IRR on quality deals with hold periods between 2-10 years.

The growth leg includes traditional private equity positions and ground-up development opportunities. Yes, these come with longer lockup periods (think 8-12 years) and higher risk, but the upside potential of 20%+ returns makes them worth considering for a portion of your portfolio.

The innovation leg: and this is where most advisors go silent: is where digital assets come in. Bitcoin and institutional-grade crypto allocations aren't speculation anymore when done correctly. They're portfolio diversifiers with a completely different risk-return profile than anything else you own.

Building Your Traditional Asset Foundation

Before you touch anything digital, get your traditional foundation right.

Start with understanding capital structure. Not all investments are created equal. Senior debt sits at the top of the stack: first in line if things go sideways. Preferred equity comes next. Common equity is last. Each carries different risk levels and return expectations.

This matters because proper portfolio construction means layering these positions strategically. You want senior positions for stability, equity positions for growth, and everything calibrated to your actual risk tolerance: not what sounds good at a dinner party.

Hedge funds deserve consideration too, but be selective. Multi-strategy and quantitative funds can deliver uncorrelated returns that cushion your portfolio during market stress. Just watch those fee structures. Make sure the performance justifies the cost.

Integrating Digital Assets the Right Way

Let's address the elephant in the room: crypto isn't a meme anymore, but it's also not a free-for-all.

Institutional-grade Bitcoin integration requires operational due diligence. You need proper custody solutions: none of this "write your seed phrase on a napkin" nonsense. You need security protocols that meet the same standards as your other assets. And you need position sizing that makes sense within your overall risk framework.

For most accredited investors, a digital asset allocation in the 5-10% range provides meaningful exposure without creating sleepless nights. The key is treating it like any other alternative investment: understand the thesis, implement proper safeguards, and monitor regularly.

The beauty of adding digital assets to a diversified portfolio is the correlation benefit. When everything else zigs, crypto often zags. That non-correlation is valuable for risk-adjusted returns over time.

But here's the critical part: don't go it alone. Digital asset integration requires expertise in custody, security, tax treatment, and regulatory compliance. One misstep can create headaches that take years to unwind.

Risk Management That Actually Works

All the diversification in the world won't help if you're not stress-testing your assumptions.

Run worst-case scenarios on every position. What happens if rents drop 20%? What if cap rates widen by 200 basis points? What if your exit timeline stretches by two years? If your investment thesis falls apart under realistic stress tests, it probably shouldn't be in your portfolio.

Interest rate risk management is crucial right now. Fixed-rate debt and hedging strategies help ensure your financing costs stay predictable. Variable rate exposure can crush otherwise solid deals when rates move against you.

Focus on recession-resistant asset classes. Multifamily housing, student housing, assisted living: these sectors maintain demand even when economic conditions weaken. You want assets that throw off cash flow regardless of market sentiment.

Tax Optimization for the Next 18 Months

2026 brings tax changes that make planning right now critical.

If you've been thinking about charitable contributions, accelerate them. Roth conversions? Review them carefully. Asset location strategies across taxable, tax-deferred, and tax-free accounts? Time to optimize.

Real estate investors should be maximizing 1031 exchanges, cost segregation studies, and depreciation benefits. These aren't loopholes: they're legitimate tax strategies that significantly enhance after-tax returns.

Tax-loss harvesting remains valuable for offsetting capital gains, especially in higher-bracket years. Just remember the wash sale rules: no buying back substantially identical securities within 30 days.

For digital assets specifically, understand the tax treatment. Crypto-to-crypto trades trigger taxable events. Holding periods matter. Record-keeping requirements are stricter than traditional assets. Get professional guidance here: the IRS is paying attention.

Beyond Returns: Protecting What You've Built

Wealth preservation isn't just about investment performance.

Cybersecurity is now part of wealth management. Your financial information is valuable to bad actors. Protecting sensitive data is as important as protecting your portfolio balance. Review your digital security regularly. Use proper authentication. Monitor accounts for unauthorized access.

Insurance coverage deserves an annual review. Make sure your estate structures are current. If you hold digital assets, ensure your estate plan accounts for them properly: including custody access for heirs.

Keep an emergency fund covering three to six months of expenses in fully liquid accounts. This seems basic, but it's the foundation that lets you hold longer-term positions without forced liquidation during temporary market stress.

Putting It All Together

Wealth preservation in 2026 requires thinking beyond traditional boundaries. The most resilient portfolios blend private market stability, traditional growth assets, and carefully integrated digital positions: all wrapped in robust risk management and tax optimization.

This isn't about chasing the hottest trend or abandoning proven strategies. It's about building a portfolio architecture that can weather different market environments while capturing opportunities across the full investment spectrum.

The investors who get this right won't be the ones with the highest single-year returns. They'll be the ones still compounding wealth a decade from now, regardless of what markets throw at them.

If you're an accredited investor looking to modernize your wealth preservation strategy with institutional-grade expertise in both traditional and digital assets, let's talk. The window for tax-advantaged positioning before 2026 changes is closing, and proper implementation takes time to execute correctly.

Comments