The 40/30/30 Portfolio Framework: How Institutional Investors Blend Bitcoin with Traditional Assets

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 1 day ago

- 5 min read

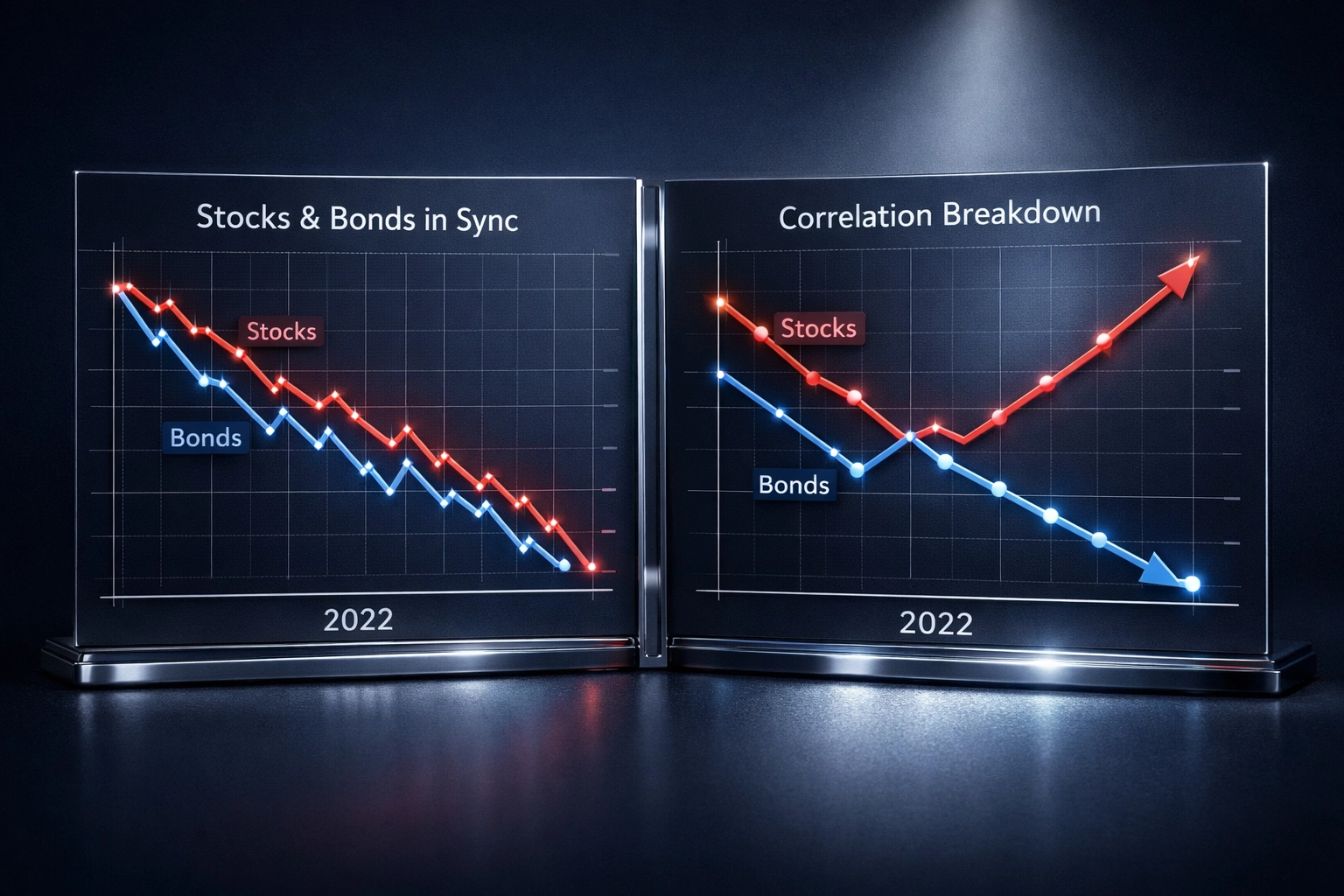

The classic 60/40 portfolio, 60% stocks, 40% bonds, used to be the gold standard for balanced investing. But let's be honest: that playbook doesn't work like it used to. When both stocks and bonds drop together (hello, 2022), you're left without the safety net you thought you had.

That's where the 40/30/30 framework comes in. And increasingly, institutional investors are using this model as a vehicle to bring Bitcoin and other digital assets into their portfolios without going all-in on crypto hype.

Why the 60/40 Portfolio Is Showing Its Age

The whole idea behind 60/40 was simple: when stocks go down, bonds go up, giving you balance. But that relationship has broken down. Modern correlations between equities and fixed income have flipped the script, especially during inflationary periods and rising rate environments.

The result? Your "diversified" portfolio isn't actually that diversified anymore. Both asset classes can, and do, move in the same direction, leaving investors exposed to more risk than they bargained for.

Breaking Down the 40/30/30 Framework

So what's the solution? Enter the 40/30/30 model:

40% Public Equities: Your growth engine. Think diversified equity exposure across markets, sectors, and geographies.

30% Fixed Income: Still important for stability and income, but with a smaller allocation to reflect their diminished diversification benefit.

30% Alternative Investments: This is where things get interesting, and where Bitcoin fits into the picture.

The magic happens in that 30% alternatives bucket. By carving out meaningful space for assets that don't move in lockstep with traditional markets, you're building genuine portfolio resilience.

Research shows that adding a 25% allocation to alternatives can boost portfolio returns by approximately 60 basis points, that's an 8.5% improvement over traditional models. Not too shabby for rebalancing your approach.

The Alternatives Sleeve: More Than Just Hedge Funds

When we talk about alternatives, most people immediately think hedge funds or private equity. And yes, those belong here. But the 30% alternatives allocation is increasingly becoming home to digital assets like Bitcoin.

Why? Because Bitcoin behaves differently than traditional assets. It's not tied to corporate earnings, interest rates, or GDP growth in the same way. That makes it a legitimate diversifier: when implemented correctly.

Here's what the alternatives sleeve might include:

Private equity and venture capital

Real estate and infrastructure

Commodities and precious metals

Hedge fund strategies (long/short, market neutral, etc.)

Digital assets (Bitcoin, crypto equity exposure)

The key is balancing these components based on risk tolerance, liquidity needs, and conviction levels.

How Bitcoin Fits Into Institutional Portfolios

Let's cut through the noise: institutions aren't YOLOing into Bitcoin. They're approaching crypto integration methodically, often starting with a 2-5% allocation within the alternatives bucket.

One popular approach is carving a 3% allocation to a crypto and blockchain equity sleeve. This gives exposure to the space while maintaining some traditional equity characteristics. Think companies like MicroStrategy, Coinbase, or blockchain technology firms rather than direct Bitcoin holdings.

But increasingly sophisticated investors are also making room for direct Bitcoin exposure through:

Spot Bitcoin ETFs: Now that regulatory clarity has improved, these provide straightforward access without custody headaches.

Institutional custody solutions: Services like Coinbase Custody or Fidelity Digital Assets offer the security infrastructure institutions require.

Treasury-grade Bitcoin allocation: Some funds are putting 1-3% directly into Bitcoin as a non-correlated hedge, similar to how they might hold gold.

The data is compelling: adding cryptocurrency exposure through a diversified approach can reduce overall portfolio volatility by up to 20% compared to concentrated positions in individual digital assets.

Operational Due Diligence: Not Your Average Asset Class

Here's where things get real for institutional investors. You can't just buy Bitcoin on an exchange and call it a day. The operational requirements are completely different from traditional assets.

Custody considerations are paramount. Who holds the keys? What's the insurance situation? How do you handle transaction signing? These aren't theoretical questions: they're deal-breakers for fiduciaries.

Counterparty risk needs scrutiny. Not all crypto service providers are created equal. You need partners with track records, regulatory compliance, and institutional-grade infrastructure.

Valuation and reporting present unique challenges. Unlike stocks with clear daily prices and established accounting standards, Bitcoin's 24/7 trading and complex tax treatment require specialized systems.

Smart institutions are also thinking about manager selection. Do you want passive Bitcoin exposure, or active management that includes tactical trading and a broader digital asset mandate? The answer shapes everything from fee structures to risk parameters.

Building Your Position: A Phased Approach

Most institutional investors don't jump straight to their target allocation. They phase in gradually, learning and adjusting as they go.

Phase 1 might be a 1% allocation to Bitcoin through a spot ETF or blockchain equity sleeve. This lets you understand the volatility, reporting requirements, and how it behaves in your portfolio.

Phase 2 could expand to 2-3% with a mix of direct Bitcoin exposure and crypto-adjacent equities. Now you're building infrastructure and internal expertise.

Phase 3 might involve more sophisticated strategies: lending programs, staking (for other digital assets), or tactical overlays based on market conditions.

The beauty of the 40/30/30 framework is that it gives you room to experiment within the alternatives sleeve without betting the farm. A 3% Bitcoin position within a 30% alternatives allocation means you're dedicating 10% of your alternatives to crypto: meaningful, but not reckless.

Risk Management: Keeping the Guard Rails Up

Let's be clear: Bitcoin is volatile. We're talking about an asset that can swing 20% in a week. That's why risk management is non-negotiable.

Position sizing is your first line of defense. Even if you love Bitcoin's long-term potential, there's a big difference between a 1% allocation and a 10% allocation when things get choppy.

Rebalancing discipline matters more with digital assets than almost anything else. When Bitcoin runs, it can quickly become a larger portion of your portfolio than intended. Systematic rebalancing forces you to take profits and maintain your strategic allocation.

Correlation monitoring should be ongoing. One of Bitcoin's key benefits is low correlation to traditional assets: but that relationship isn't static. You need to track whether your diversification thesis is actually playing out.

The Mogul Strategies Approach

At Mogul Strategies, we help institutional and accredited investors navigate exactly these questions. How much Bitcoin makes sense for your specific situation? What implementation structure aligns with your operational capabilities? How do you integrate digital assets without disrupting your existing portfolio management?

The 40/30/30 framework isn't about chasing returns or following trends. It's about building more robust portfolios that can weather different economic environments. Bitcoin and digital assets are simply tools in that toolkit: powerful ones when used correctly.

The Bottom Line

The investment landscape has changed, and portfolio construction needs to evolve with it. The 40/30/30 framework offers a more realistic approach to diversification in today's world, where stocks and bonds no longer provide the same complementary behavior they once did.

Adding Bitcoin to the mix isn't about going crypto crazy. It's about recognizing that digital assets have earned a seat at the institutional table. When integrated thoughtfully within a diversified alternatives allocation, Bitcoin can enhance risk-adjusted returns while providing exposure to a genuinely different return stream.

The question isn't whether to consider alternatives like Bitcoin anymore. It's how to implement them in a way that's consistent with your fiduciary responsibilities and institutional requirements.

Ready to explore how the 40/30/30 framework could work for your portfolio? Let's talk about building a strategy that makes sense for your specific goals and constraints. Reach out to Mogul Strategies to start the conversation.

Comments