The 40/30/30 Portfolio Model: How Accredited Investors Are Blending Traditional Assets With Digital Strategies

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- 2 days ago

- 5 min read

If you're still running a traditional 60/40 portfolio in 2026, we need to talk.

The old model: 60% stocks, 40% bonds: worked beautifully for decades. But between rising interest rates, inflation concerns, and the emergence of institutional-grade digital assets, that classic split is leaving serious money on the table. More importantly, it's exposing accredited investors to risks they shouldn't be taking.

Enter the 40/30/30 portfolio model: a framework that's gaining traction among sophisticated investors who understand that diversification means more than just stocks and bonds.

What Is the 40/30/30 Model?

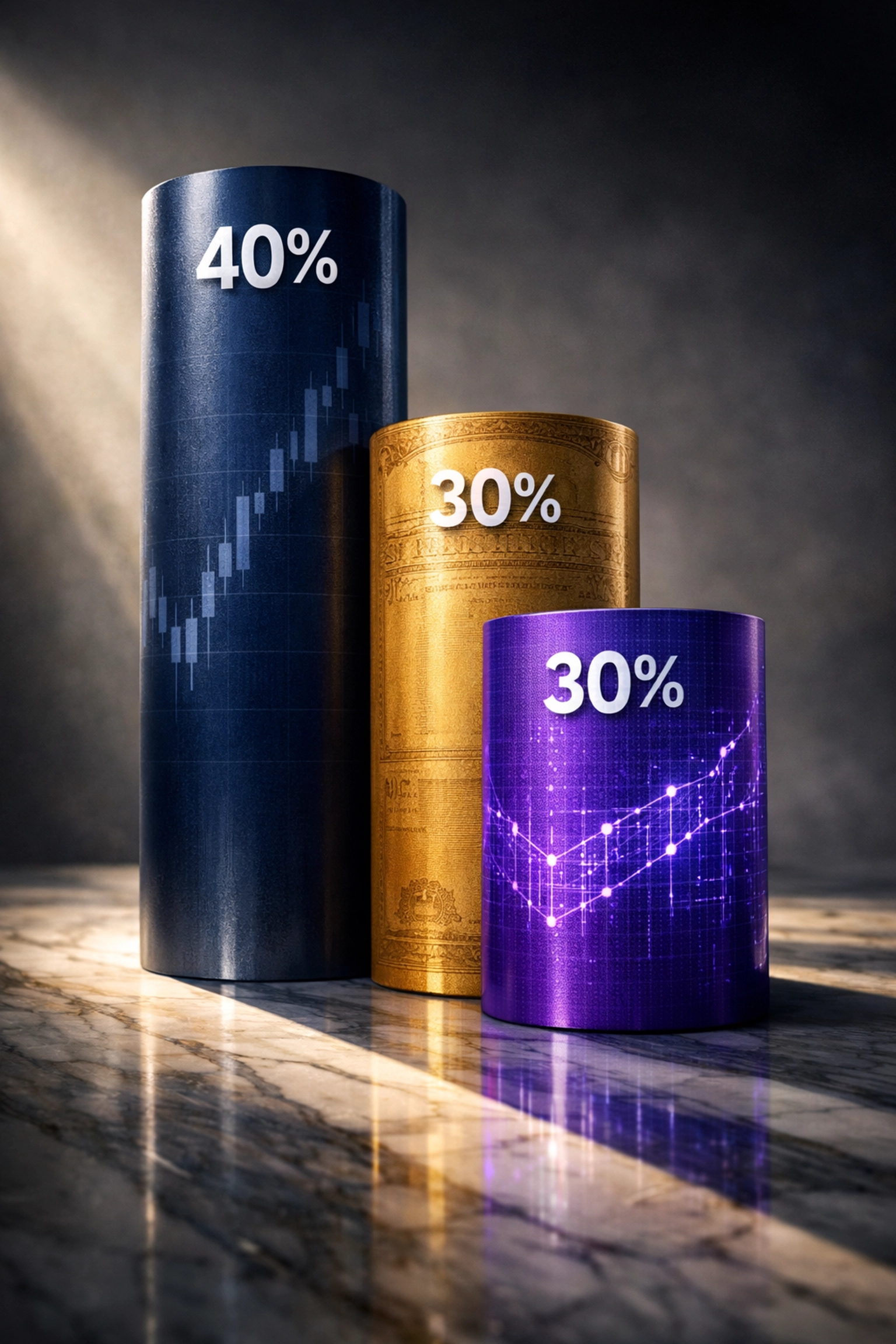

The 40/30/30 portfolio breaks down like this:

40% in public equities (stocks, ETFs, index funds)

30% in fixed income (bonds, treasuries, debt instruments)

30% in alternative investments (real estate, private equity, infrastructure, and yes: digital assets)

This isn't a radical departure from traditional investing. It's an evolution. We're taking what worked about the 60/40 model and adapting it for today's reality.

Why the Traditional 60/40 Portfolio Isn't Cutting It Anymore

Here's the uncomfortable truth: during both the 2008 financial crisis and the 2020 pandemic, the 60/40 portfolio dropped over 30%. That's because when markets tanked, the correlation between stocks and bonds approached 1: meaning they moved together instead of balancing each other out.

The whole point of bonds was to cushion the blow when equities crashed. But in recent years, they've failed at that job.

Add to this the "higher for longer" interest rate environment we've been navigating, and you've got a risk-return profile that doesn't match what most accredited investors need. When bonds and stocks both underperform or crash together, you're not diversified: you're just exposed.

The 40/30/30 model addresses this by reducing equity exposure while introducing a meaningful allocation to alternatives that actually move differently than traditional markets.

Breaking Down the Allocations

40% Public Equities: Your Growth Engine

Stocks still matter. They're your primary growth driver, offering liquidity and upside potential. But at 40% instead of 60%, you're not putting all your eggs in the equity basket.

This allocation should focus on:

Broad market index exposure

International diversification

Sector-specific opportunities aligned with long-term trends

The reduced weighting gives you growth potential without the wild swings that keep you up at night.

30% Fixed Income: Stability With Realistic Expectations

Bonds serve as ballast, but at 30% instead of 40%, we're acknowledging they're not the magic shield they once were. This allocation provides income and reduces overall portfolio volatility, but we're being realistic about what bonds can deliver in the current environment.

Consider:

Investment-grade corporate bonds

Treasury securities for safety

Inflation-protected securities (TIPS) as a hedge

The key is accepting that bonds won't save you in every downturn, which is exactly why we need that third bucket.

30% Alternatives: Where the Magic Happens

This is where the 40/30/30 model gets interesting: and where accredited investors have access to opportunities that retail investors simply can't touch.

Traditional Alternatives:

Real estate syndications, infrastructure assets (think cell towers, pipelines, ports), and private equity have long been the domain of institutional investors. These assets typically have low correlation with public markets and can provide:

Steady cash flow

Inflation protection (many infrastructure contracts include automatic price adjustments)

Tax advantages

Portfolio diversification that actually works

Research from J.P. Morgan shows that adding just 25% to alternative assets can improve traditional portfolio returns by 60 basis points: that's an 8.5% improvement. And the 40/30/30 model showed a 40% improvement in Sharpe ratio compared to the 60/40 approach.

Digital Strategies:

Here's where things get really interesting for forward-thinking accredited investors.

Bitcoin and institutional-grade crypto assets are no longer fringe investments. Major institutions, family offices, and sophisticated fund managers are allocating to digital assets as part of their alternatives bucket. Why?

Non-correlation: Bitcoin historically moves independently of stocks and bonds, providing true diversification

Inflation hedge potential: With a capped supply, digital assets offer protection against currency debasement

Asymmetric upside: While volatile, the risk-reward profile can be compelling in small allocations

Growing institutional infrastructure: Custody solutions, regulatory clarity, and professional-grade platforms have matured dramatically

Within the 30% alternatives allocation, a measured exposure to digital strategies: say 5-10% of the total portfolio: offers accredited investors a way to participate in this asset class without betting the farm.

The Performance Advantage

Numbers don't lie. The 40/30/30 portfolio has demonstrated measurable improvements over traditional models:

Better risk-adjusted returns (40% higher Sharpe ratio)

Reduced correlation with equity markets

Improved downside protection during market stress

Enhanced income generation from alternative assets

But here's what really matters: this model gives you exposure to multiple return streams that don't all rise and fall together. When public markets stumble, your real estate holdings might be generating steady rental income. When inflation spikes, your infrastructure investments automatically adjust. When traditional assets stagnate, your digital strategies might be capturing upside.

That's real diversification.

Who Is This Model For?

Let's be clear: the 40/30/30 portfolio isn't for everyone. It's designed for accredited investors who:

Have investment minimums to access quality alternative investments

Understand illiquidity (many alternatives lock up capital)

Can handle complexity beyond traditional stocks and bonds

Think in terms of decades, not quarters

Want institutional-quality diversification

If you're an accredited investor tired of watching your portfolio move in lockstep with the S&P 500, this model deserves serious consideration.

Implementation Considerations

Building a 40/30/30 portfolio isn't as simple as rebalancing your brokerage account. Here's what you need to think about:

Access: Many of the best alternative investments require accredited investor status and have high minimums. Real estate syndications might start at $50K. Private equity funds can require $250K or more.

Liquidity: Unlike stocks and bonds, alternatives often have lock-up periods ranging from months to years. Make sure you have sufficient liquid reserves before tying up capital.

Due Diligence: Not all alternative investments are created equal. Vetting sponsors, understanding fee structures, and assessing track records requires expertise.

Digital Asset Custody: If you're adding crypto exposure, institutional-grade custody solutions are non-negotiable. Self-custody might work for enthusiasts, but serious allocations demand professional infrastructure.

Tax Complexity: K-1s from partnerships, depreciation schedules from real estate, and crypto tax reporting add layers of complexity. Work with advisors who understand these structures.

The Bottom Line

The 40/30/30 portfolio model represents a pragmatic evolution in how sophisticated investors are thinking about diversification. By reducing equity concentration, maintaining bond exposure for stability, and meaningfully allocating to alternatives: including digital strategies: accredited investors can build portfolios designed for today's market realities, not yesterday's assumptions.

Is it more complex than buying an index fund? Absolutely. Does it require higher minimums and longer time horizons? Without question. But for investors who qualify and have the patience to build properly diversified portfolios, the 40/30/30 model offers a blueprint for navigating the next decade of investing.

The question isn't whether the traditional 60/40 model is broken. It is. The question is what you're going to do about it.

Ready to explore how a 40/30/30 strategy might work for your specific situation? Visit Mogul Strategies to learn more about our approach to blending traditional assets with innovative digital strategies for accredited investors.

Comments