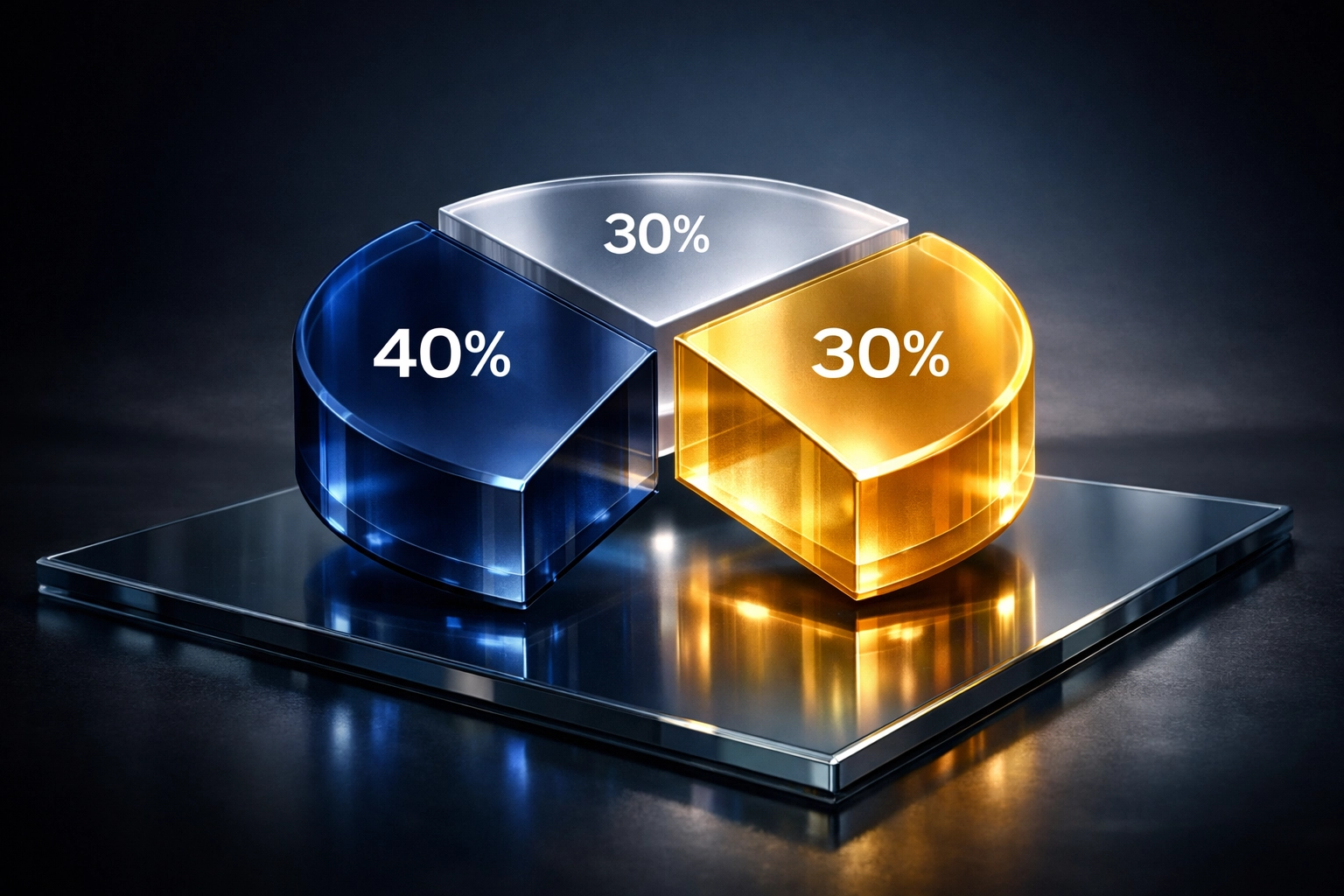

The Proven 40/30/30 Framework: How Institutional Investors Build Diversified Portfolios in 2026

- Technical Support

.png/v1/fill/w_320,h_320/file.jpg)

- Jan 30

- 5 min read

Let's be honest: if you're still running a 60/40 portfolio in 2026, you're playing yesterday's game with today's money. The investment landscape has shifted dramatically, and the smartest institutional investors have already moved on to something better.

Enter the 40/30/30 framework. It's not revolutionary in concept, but it's proving to be exactly what modern portfolios need to weather the storms we're seeing in today's markets.

What Exactly Is the 40/30/30 Framework?

The structure is straightforward:

40% in public equities (stocks)

30% in fixed income (bonds)

30% in alternative investments (private equity, real estate, hedge funds, digital assets)

That's it. Simple on the surface, but the implications for portfolio performance are significant.

This allocation represents a deliberate evolution from the traditional 60/40 stock-bond split that dominated institutional investing for decades. The key difference? That 30% alternatives sleeve changes everything about how your portfolio behaves during market stress.

Why the Traditional 60/40 Model Is Failing

Here's the uncomfortable truth about the 60/40 portfolio: it's been showing a correlation close to 1 with the equity market. In plain English? Your "diversified" portfolio moves almost identically to stocks. That's not diversification: that's concentration with extra steps.

Think about what happened during major market crises. In 2008. During the 2020 pandemic collapse. The 60/40 model was supposed to provide downside protection, but losses often exceeded 30%. The bonds didn't save you when you needed them most.

The problems compound in today's environment:

Volatile inflation makes traditional bond allocations less effective

Higher interest rates have reduced bond returns significantly

Geopolitical tensions create unpredictable market movements

Stock-bond correlations have shifted, undermining the fundamental premise of 60/40

When stocks and bonds move together during downturns, you're not diversified. You're just exposed in two different ways to the same underlying risk.

The Numbers Tell the Story

I'm not asking you to take my word for it. The data on 40/30/30 is compelling.

Research shows the 40/30/30 portfolio delivered a 40% improvement in its Sharpe ratio compared to traditional approaches. For those who want a quick refresher, the Sharpe ratio measures risk-adjusted returns: essentially, how much return you're getting for each unit of risk you're taking on.

A 40% improvement is substantial. That's not a marginal gain; it's a fundamental upgrade in portfolio efficiency.

J.P. Morgan's analysis found that adding just a 25% allocation to alternatives can boost 60/40 returns by 60 basis points. On a projected 7% return, that's an 8.5% improvement in performance. Over time, that compounds into serious money.

KKR's research went even further, finding that 40/30/30 outperformed 60/40 across every timeframe they studied. Not some timeframes. All of them.

How Alternatives Actually Improve Your Portfolio

Alternative investments aren't just about chasing higher returns. They serve specific functions within a well-constructed portfolio:

Reduced Correlation

The primary benefit is genuine diversification. When your alternatives don't move in lockstep with stocks and bonds, your overall portfolio becomes more stable. During equity market selloffs, uncorrelated assets can hold steady or even appreciate, reducing your drawdowns.

Patient Capital Advantages

Private market investments come with relative illiquidity: and that's actually a feature, not a bug. This structure enables patient, long-term strategic management. You're not forced to sell at the worst possible moment because there's no daily mark-to-market panic.

The result? More consistent income streams and the ability to capture illiquidity premiums that public market investors can't access.

Built-In Inflation Protection

Many alternative asset classes have inflation adjustment mechanisms baked into their structures. Infrastructure investments often have contracts that adjust with inflation. Real estate typically sees rents increase alongside consumer prices. These natural hedges protect purchasing power in ways that traditional bonds simply can't match in an inflationary environment.

Not All Alternatives Are Created Equal

Here's where things get nuanced. You can't just throw 30% at random alternatives and expect magic to happen.

The key is understanding what role each alternative investment plays in your portfolio. Generally, alternatives fall into three functional categories:

Downside protection – Assets that hold up or appreciate during market stress

Uncorrelated return generation – Investments that march to their own drummer regardless of market conditions

Upside capture – Higher-risk alternatives that amplify gains during favorable conditions

A thoughtful alternatives allocation includes elements from each category, balanced according to your specific objectives and risk tolerance.

Institutional-Grade Implementation

For institutional and accredited investors, implementing 40/30/30 requires active management and real-time responsiveness to market conditions. This isn't a set-it-and-forget-it strategy.

The alternatives sleeve might include:

Private equity for long-term growth and illiquidity premiums

Real estate syndication for income and inflation protection

Hedge fund strategies for risk mitigation and uncorrelated returns

Digital assets like Bitcoin for asymmetric upside potential (more on this in upcoming posts)

The specific mix depends on your investment horizon, liquidity needs, and return objectives. What works for a pension fund with 30-year liabilities won't necessarily work for a family office with different priorities.

The Democratization of Alternatives

Here's something interesting: institutions have allocated over 40% to alternatives for decades. This isn't new for the Yale endowment or major pension funds. What's changed is accessibility.

Less than a decade ago, entering private markets required $500,000 or more. Today, millions of investors can participate in strategies that were previously reserved for the largest institutional allocators.

That said, access alone isn't enough. You need expertise to navigate these markets effectively. The complexity of alternatives: from manager selection to due diligence to portfolio construction: requires specialized knowledge that goes beyond traditional stock-and-bond investing.

Building for a Stagflationary World

We're operating in an environment where traditional diversification assumptions no longer hold. The correlation between stocks and bonds has shifted. Inflation remains a persistent concern. Growth is uncertain.

In this context, the 40/30/30 framework offers something valuable: a structure designed for uncertainty rather than optimized for conditions that no longer exist.

The institutional investors who are outperforming aren't doing so through brilliant market timing or concentrated bets on individual stocks. They're doing it through thoughtful asset allocation that acknowledges the limits of traditional approaches.

What Comes Next

The 40/30/30 framework is a starting point, not a destination. Within that structure, there's enormous room for customization based on your specific situation, objectives, and views on different asset classes.

In upcoming posts, we'll dive deeper into specific components of the alternatives allocation: including institutional-grade approaches to digital assets, private equity opportunities, and hedge fund risk mitigation strategies.

At Mogul Strategies, we specialize in blending traditional assets with innovative digital strategies to build portfolios that can perform across market environments. The 40/30/30 framework provides the foundation; the execution is where real value gets created.

The question isn't whether you should move beyond 60/40. The data has settled that debate. The question is how to implement a better approach in a way that aligns with your specific goals.

That's a conversation worth having.

Comments